To invest without limits, consider an unconstrained mandate

What all investors want over time is a good return from their investment. If you are looking to invest money over and above what you are already saving for your retirement, your key consideration is maximising returns at the level of risk you are willing and able to take. To achieve this, you may want to consider an unconstrained multi-asset class fund.

What does unconstrained mean?

Unconstrained investing is an investment style that enables your fund manager to invest in the most attractive opportunities regardless of geography, asset class, industry or theme. In other words, they have the freedom to pursue the best possible returns on your behalf without having to adhere to any specific benchmark or regulatory limits.

As an example, most retirement portfolios in South Africa use equities as a key building block, given their status as the highest-returning asset class over long periods of time. But, because they have to adhere to Regulation 28 of the Pension Funds Act, these mandates cannot invest more than 75% in equities or allocate more than 30% to international assets. In an unconstrained mandate, the fund can go beyond these limits when the fund managers deem it appropriate to do so.

The benefits of an unconstrained approach include access to investment themes, companies and growth opportunities not available locally, as well as the freedom to diversify across asset classes and geographies compared to remaining fully invested in a single asset class or geography regardless of the quality of the available investment opportunities. This flexibility makes it an ideal long-term portfolio holding.

A 22-year track record in investing without any limits

At Coronation, we have a 22-year track record in truly open mandate investing through the Coronation Optimum Growth Fund. Since its inception in March 1999, its flexible mandate has enabled the Fund to produce a very competitive rand return of 14.5% per annum after fees (or 10% p.a. when measured in US dollars).

The Fund is managed on an absolute return basis, meaning that it aims to deliver competitive after-inflation (real) returns over the long term of at least inflation plus 5% per year. Given the current long run domestic inflation expectation of 5%-6%, Coronation Optimum Growth will target a return of at least 10% to 11% after fees over the next several years.

We also recently launched the Coronation Global Optimum Growth Fund for investors preferring to invest in US dollars. The new fund is managed in exactly the same way, by the same portfolio management team, as its existing rand-denominated sibling.

Finding the best opportunities through broad and deep research

We’ve invested significant resources to support our research on global opportunities, providing our clients with access to the best investment ideas beyond the South African universe. Coronation Optimum Growth can thus make use of the full opportunity set, supported by broad and deep expertise from a team of 18 investment analysts who cover global and emerging market stocks.

Exposure in many global equity and global balanced funds still tends to be dominated by developed market exposure (most prominently the US), given their dominance in global headline indices. As a result, the global investment industry commits less time and resources to researching opportunities in emerging market equities, making it easier to identify attractive opportunities through original, inhouse research.

At Coronation, our ability to take advantage of opportunities in emerging markets has benefited from our experience in managing South African mandates for the past 28 years and is backed by our expertise in managing specialist emerging market portfolios for the past 13 years.

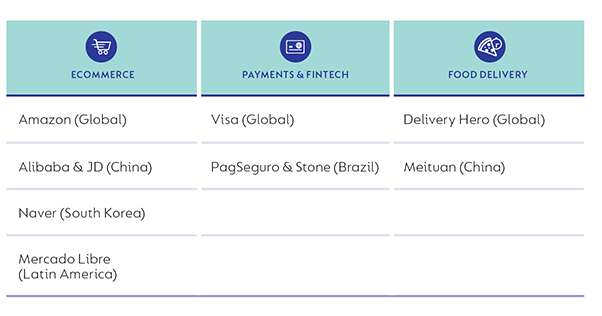

The output of our research process results in a well-diversified portfolio that includes attractive opportunities in global and regional ecommerce and fintech, food delivery in China; and across the rest of the world, luxury goods, aerospace and automotive providers, sportswear, pharmaceuticals, and even a North American railroad.

The constant interaction between our analysts also allows for an overlap in research responsibilities and the ability to identify the most attractively priced business in attractive industries across the developed and emerging market universes is clear from some of the Fund’s current holdings below.

So, if your retirement plan is in place and you have discretionary money to invest consider an unconstrained mandate where the sole focus is on finding the best opportunities, wherever they may be.

Coronation Optimum Growth gives you access to these opportunities. We believe that the Fund will continue to deliver on its inflation plus target to help investors meet their ultimate goal of a good return over time.

*Coronation Optimum Growth will, subject to final regulatory approvals, soon be converted to a feeder fund into its new offshore sibling and, as such, will also be renamed to Coronation Global Optimum Growth [ZAR] Feeder to reflect this change.

Coronation is an authorised financial services provider

South Africa - Personal

South Africa - Personal