Personal finance

Equities and Endurance: The cornerstones for unlocking long-term investment success

“The single greatest edge an investor can have is a long-term orientation.” – Seth Klarman

The Quick Take

- Investing in equity markets can be uncomfortable in the short term

- But creating long-term wealth requires you to be a long-term participant in equities

- History shows that higher average returns, coupled with the power of compounding, lead to retirement changing outcomes

- Harnessing this force in wealth creation requires investors to have adequate exposure to equities throughout their investment journeys, and to give these assets enough time for the exponential power of compounding to take effect

The first half of 2025 was one of the more volatile periods in recent market history, reminding investors just how uncomfortable it can be to be invested in equity markets. And ironically, even rising markets don’t always equate to rising investor confidence.

As a result, the discomfort associated with equity investing this past year may have kept some on the sidelines, seeking safety in bonds or cash. Another contributing factor may have been doubt in equities’ ability to outperform the more conservative asset classes (called the equity risk premium).

From a financial planning perspective, the concern is that investors’ long-term portfolios may be too conservatively positioned – an approach that is likely to result in future disappointment.

IF YOU WANT TO CREATE LONG-TERM WEALTH, YOU NEED TO BE A LONG-TERM PARTICIPANT IN THE EQUITY MARKET

Dipping into equities only when headlines calm down and retreating at the first signs of volatility is a problematic approach, resulting in value destruction over time. Ultimately, you end up buying high and selling low, the exact opposite of what investing intends to achieve.

Long-term real returns are more easily earned by disciplined, long-term investors. This is because equity markets reward those who stay the course, rather than those who try to time the market or doubt its ability to outperform other asset classes in the long run.

The power of compounding through equities

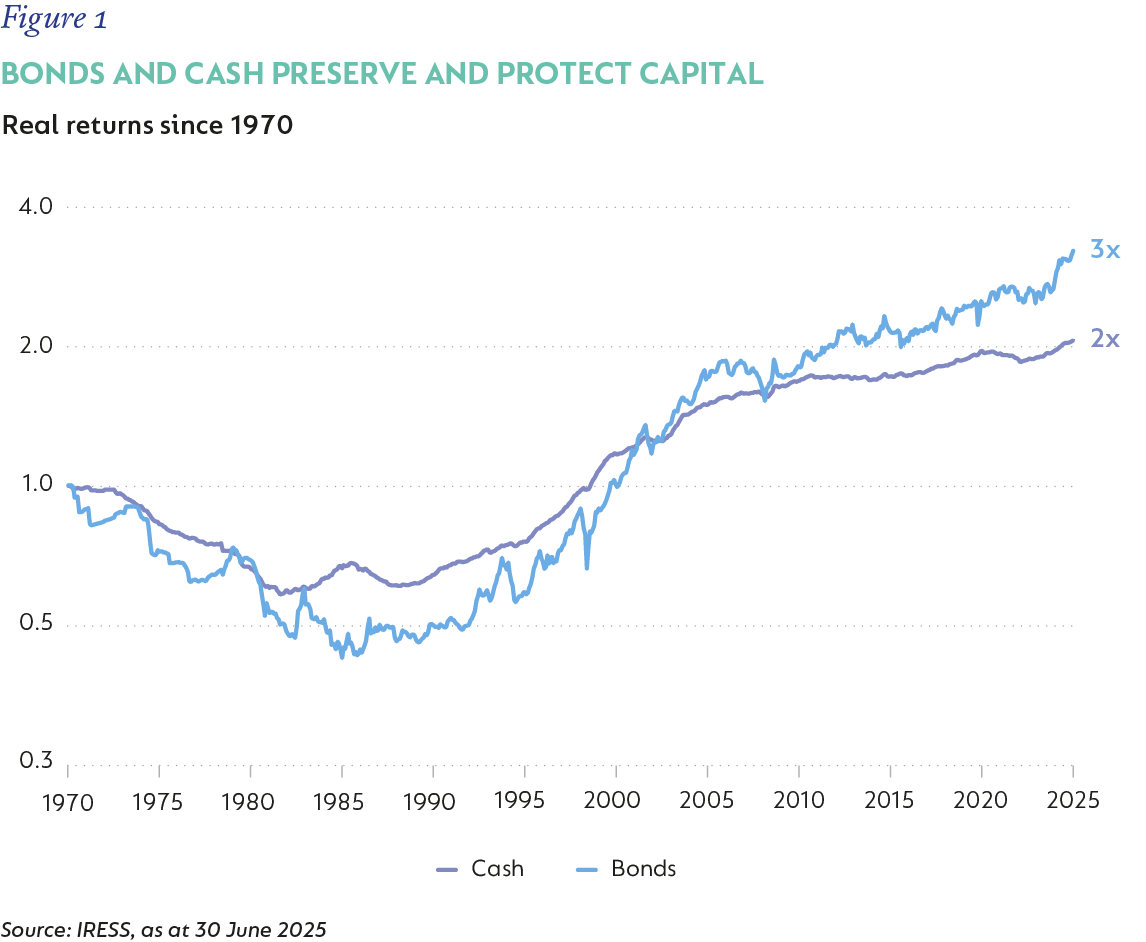

Consider the real returns delivered by bonds and cash since 1970 as illustrated in Figure 1 below. (While this may sound like a very long period, remember that it is not too different from the multi-decade horizon of the average investor who starts investing for his/her retirement at the age of 25 or 30 years.)

As is clear from the graph, bonds and cash managed to preserve and protect capital from inflation over the stipulated horizon. For every R1 invested in cash in 1970, your money is now worth R2 in real terms, whilst every R1 invested in bonds in 1970 is now worth R3 in real terms.

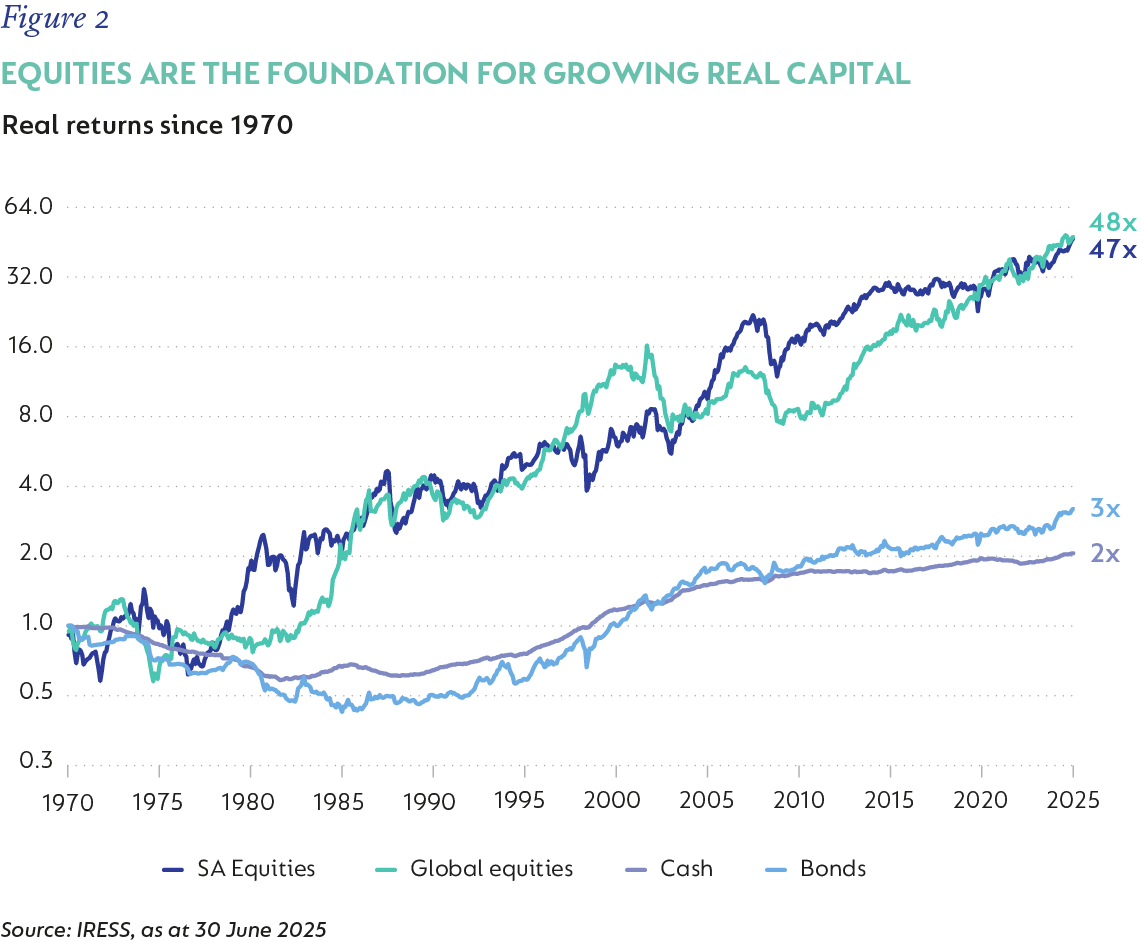

However, for those who want to meaningfully grow their real capital over time, the most efficient asset class is equities, both local and foreign. Higher average returns coupled with the power of compounding allowed equities to deliver 45 and 46 times the original capital invested (Figure 2), respectively – an extraordinary, retirement-changing outcome reserved only for those willing and able to remain invested.

BUT OUR BEHAVIOURAL BIASES MAKE IT HARD TO REMAIN INVESTED IN EQUITIES

The harsh reality is that investors often miss out on this wealth-creation opportunity shown above because of behavioural biases, including but not limited to:

- anchoring to past performance (of a fund or asset class or region),

- loss aversion, or

- preferring asset classes that produce stable returns (think of the lower volatility associated with cash and bonds) over asset classes with lumpy returns (think equities).

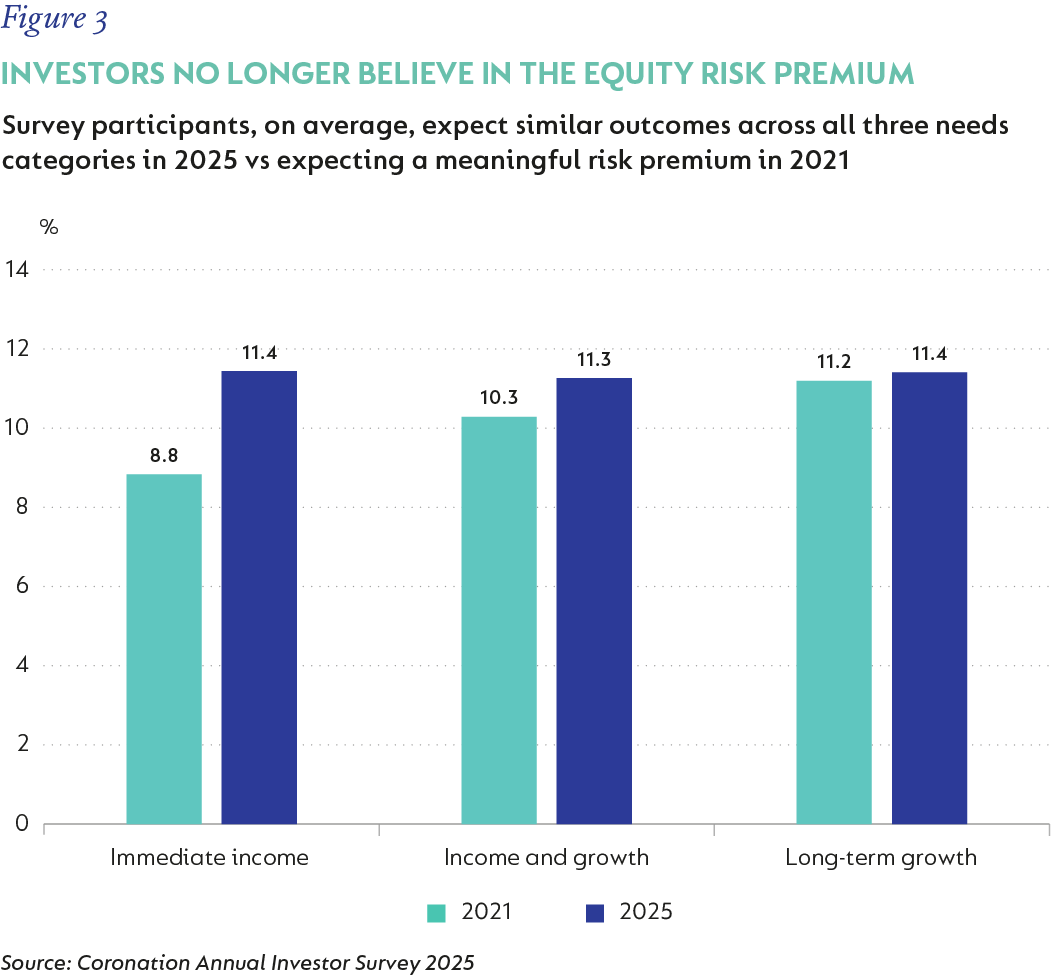

In the long run, this results in dire investment outcomes. And our 2025 investor survey once again showed a reversal in investors’ belief in the equity risk premium (mentioned at the start). This year, survey participants expected, on average, only a 0.3% annual return premium from a long-term growth-oriented fund such as Coronation Balanced Plus (that can invest up to 75% in equities) when compared to an immediate income fund such as Coronation Strategic Income (where growth asset exposure is limited to 10%). This is a significant reduction in expectations when compared to the previous year’s survey, where participants expected, on average, an annual return premium of 2%. This is a concerning signal if these projections are informing long-term investment decisions.

A SHARED COMMITMENT TO BEING PATIENT

We understand the discomfort associated with investing in equities as an individual investor. But harnessing this force in wealth creation requires investors to have adequate exposure to equities throughout their investment journeys (both before and after retirement), and to give these assets enough time for the exponential power of compounding to take effect.

And there is certainly merit in supporting the equities of businesses that grow shareholder wealth over time, demonstrated by the exceptional value uplift produced by our long-term growth-oriented funds (those with an equity bias or holding only equities) with multi-decade track records.

View the Coronation Balanced Plus comprehensive fact sheet

Often our views of business with the ability to grow shareholder wealth require patience, as has been the case following the broad global equity market sell-off in 2022 and again in 2024 when global markets were exceptionally narrow (predominantly led by a handful of US tech stocks). At the respective times, we took advantage of the breadth of mispriced opportunities (we covered these views in detail in our April 2022 Corospondent, here and here) and of the outsized opportunity for stock pickers to outperform through differentiated portfolio positioning (as discussed in our March 2024 commentaries, here).

Today, we are encouraged by the fact that these views have now meaningfully contributed to performance across our global growth-oriented portfolios, and in turn are also benefiting our domestic multi-asset funds with exposure to offshore equities.

View the comprehensive fact sheets for Coronation Global Optimum Growth and Coronation Global Managed.

PATIENT YET READY TO ACT

The most recent tariff-induced sell-off in April created yet another compelling opportunity for us to invest in what we believe to be high-quality, winning businesses: those with attractive economics, large addressable profit pools, excellent management teams that are not only good operators but also very good capital allocators, and importantly, businesses that are on the right side of technological change. As such, we remain constructive on the outlook for our domestic and global growth-oriented funds.

However, investing with a long-term mindset does not imply complacency toward the elevated risks shaping the landscape for the second half of 2025. Volatility is expected to remain high, and as always, uncertainty is likely to cloud the global outlook.

That is precisely why we remain anchored in our clear, valuation-driven approach – guided by deep research resulting in fundamental conviction, rather than market sentiment – and our commitment to building portfolios on your behalf that are well diversified and invest in appropriate levels of equity needed to meet your respective long-term needs.

In a world full of immense uncertainty, staying the course can be incredibly difficult. But our track record proves that consistent, long-term investment in equities through various cycles reward those who are willing to partner with us and invest for the long haul.

South Africa - Personal

South Africa - Personal