Investment views

Opportunities across the spectrum

A polycrisis has sent global markets sharply down; and there is opportunity to be found.

The Quick Take

- A polycrisis has dealt a 50-year blow to global equity markets, leaving investors with few places of refuge

- The sell-off has been indiscriminate, resulting in widespread opportunity

- Our valuations-based approach has enabled us to find value across the equity spectrum

- Much of the bad news is priced in and we are optimistic about the return potential of our developed market portfolios

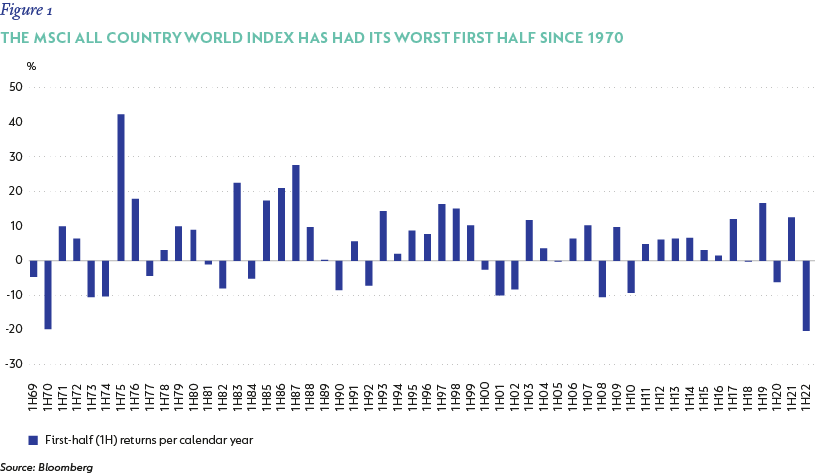

GLOBAL EQUITY MARKETS have suffered their worst start to a year in over half a century, falling by 20.2% in the first six months of 2022 (Figure 1). There are several reasons for this sell-off – Russia’s invasion of Ukraine and China’s ongoing lockdowns in pursuit of ‘Zero-Covid’ has exacerbated supply chain constraints; resulting inflation has prompted central banks to raise interest rates and withdraw liquidity from the market; and fears that the economy could tip into recession has dampened the market’s animal spirits.

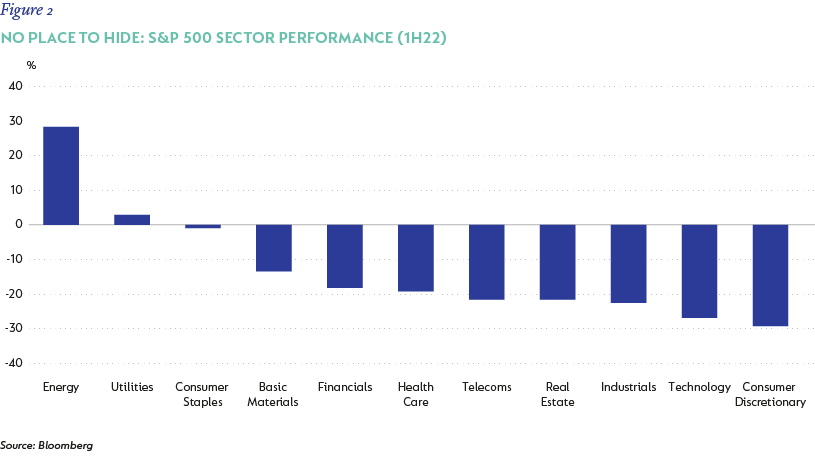

Equity investors have had few places to hide so far this year. For instance, with the exception of energy stocks that rallied on the back of higher oil prices, and a modest gain from utilities, all sectors in the S&P 500 Index declined meaningfully (Figure 2).

AS ALWAYS, THERE IS OPPORTUNITY IN CRISIS

While the severity and somewhat indiscriminate nature of the sell-off has been painful to endure, it has also resulted in widespread price dislocation. In equity markets, for instance, good businesses have been jettisoned alongside weak businesses, with little regard for differences between their long-term prospects. Across multiple industries and investment themes, our analysts are finding a range of opportunities that we consider to be very attractive today.

To highlight the broad range of opportunities our analysts see today, we have selected a few examples from different corners of the market – spanning multiple industries and style factors – where we believe the long-term fundamentals of the businesses are not reflected in the valuation.

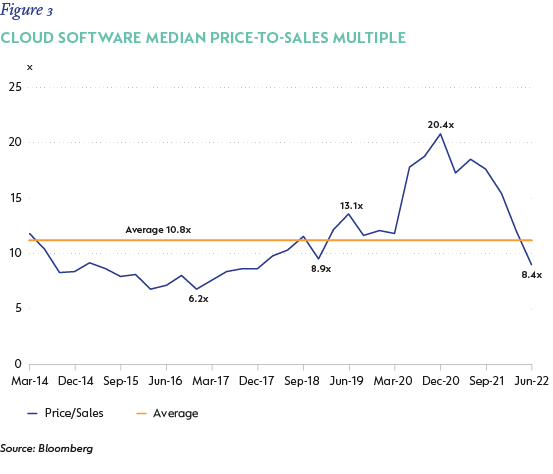

(SOME) HIGH GROWTH STOCKS ARE NO LONGER EXPENSIVE

Software has long been an industry where the leaders have enjoyed high growth, high margins, and exceptional returns on invested capital. Large parts of the sector have transitioned from a licensed, on-premises model to a subscription-based (software-as-a-service) model, with even better economics accruing to the winners (for instance, through higher customer retention and lifetime value). This insight has not been lost on the market, and the sector justifiably seldom appears “cheap” on shorter-term metrics. However, valuations became detached from reality, in our view, as the market, fueled by low interest rates, demonstrated a near insatiable appetite for growth stocks during the pandemic with little regard for the price paid. This changed dramatically in 2022 as rising interest rates have led to a repricing of growth, with the sector selling off sharply and indiscriminately (Figure 3). This has enabled us to purchase two new names that have been on our watchlist for some time, Adobe and Coupa.

Adobe is the leading software provider for creative professionals. Its products such as Photoshop, Illustrator and Premiere Pro are market leading, industry standard tools that are essential for users to do their jobs effectively. Adobe thus boasts sticky customer relationships with a high degree of recurring revenue. It is a high-quality compounder that is well placed to benefit from continued growth in the creation and consumption of content, the growing use of technology in effective marketing solutions and the continued digitisation of paper processes. These positive attributes, coupled with a history of innovation, have enabled Adobe to deliver top-tier revenue growth (22% five-year historic compound annual growth rate), margins (37% at the operating level, and rising), cash generation (over 100%) and returns on invested capital (close to 40%). We believe Adobe has sold off on macro concerns, rather than for any stock-specific reasons, and expect double-digit annual returns from this quality asset going forward.

Coupa is a cloud-based expense management platform for enterprises. It enables customers to monitor spend in real time, to set and check adherence to expense policies and guidelines, and to automate mundane procurement and payment-related functions. Coupa’s popular procurement tool connects customers with a broad range of suppliers, allows them to set spend policies, shop around, see supplier inventory balances, track purchases, and compare spend data to benchmarks to identify inefficiencies. Coupa estimates that it saves its customers 3% - 5% of the total amount spent through its platform. This is a significant benefit, and our detailed work and checks with both software experts and users confirm that its solutions are highly rated and deliver substantial savings to customers. To build on this solid foundation, Coupa is investing both organically and inorganically to expand its capabilities in related areas, such as payments and supply chain solutions. The opportunity set is large, and we believe Coupa is well positioned to capture a sizable portion of it. While this investment is strategically sensible, it comes at the expense of current profitability, which remains well below normal in our view. We forecast continued strong revenue growth (above 20%) and see significant upside to FV based on conservative normal margin assumptions.

The stock has fallen by more than 80% from its peak as concerns mount that “back-office” IT spend could be the first to be cut, should we enter a recession. We think this risk is real, but fully reflected in the current valuation.

(SOME) CONSUMER CYCLICALS ALREADY ANTICIPATE A RECESSION

Capri Holdings is the owner of three iconic, founder-led luxury brands in Michael Kors, Jimmy Choo, and Versace. The latter two were acquired in 2017 and 2018, respectively, and added true luxury cachet alongside Kors’ more accessible positioning.

Versace is a highly regarded fashion brand, known for its innovative and glamourous designs. While celebrities regularly donned its bold creations at red carpet events around the world, the brand was historically severely undermonetised due to a narrow focus on haute couture and bespoke runway items. This has changed under Capri’s ownership, with Versace growing its ready-to-wear ranges and devoting more resources to new menswear, footwear, and high margin leather accessories ranges, as well as developing ecommerce capabilities. Capri plans to more than double Versace’s revenue base over the medium term while expanding operating margins well above 20%. Based on our research, the brand is in excellent shape with strong pricing power, and the aforementioned targets are very achievable. Early evidence of profitable growth leaves us excited about what lies ahead for Versace.

Known for its handbags, Michael Kors operates in the affordable luxury segment. The group was historically over-exposed to department store sales and discount outlets, where they had limited control over pricing and, by implication, brand perception. However, both Kors and key competitor Coach have successfully begun to elevate their brand profiles through narrower distribution, focusing on a smaller number of higher priced items and reducing promotional intensity.

In our view, the resilience of Kors and the significant growth potential of Versace and Choo is being totally overlooked by the market, with Capri Holdings being valued on 6 - 7 times earnings. Management clearly agrees, with a new $1bn share repurchase programme and the company buying back $300m of stock (5% of the market capitalisation) in the last quarter alone. We believe Capri offers tremendous value for long-term investors.

(SOME) STEADY COMPOUNDERS ARE PRICED FOR DISRUPTION

Payment processors benefit from a long-term structural shift from cash to electronic payment methods (e.g. cards). This global trend has multiple drivers, including growth in ecommerce, reduction in friction (e.g. tap-to-pay), behavioural changes (e.g. hygiene preferences post Covid) and government incentives. Despite ongoing innovation from challengers, we believe the resilience of a number of incumbents in the payments ecosystem is underappreciated. Similarly, the revenue streams of the payment companies are principally a function of nominal payment volumes, providing a natural hedge in an inflationary environment.

For instance, Visa’s position as the dominant card network allows them to be an enabler of innovation, rather than being disrupted. New market entrants have in many cases found that partnering with Visa is the most effective route to get to scale. Similarly, Visa (as well as MasterCard) remains an indispensable partner for retailers – even Amazon walked away from a high-profile threat to stop accepting Visa cards in the UK. This strong incumbent position affords Visa the resources and credibility to invest in new product lines, like Visa Direct and B2B payments. We estimate Visa can grow earnings by 15% p.a. over the next five years; the current 23 times price-to-earnings (P/E) multiple does not sufficiently capture this growth.

Similarly, a number of merchant acquirers (who accept payments on behalf of merchants and connect to various payment schemes, such as Visa) have seen their shares derate on fears of disruption. Fiserv, which is the second largest acquirer in the US, has in our view been mischaracterised by the market as a stodgy incumbent, weighed down by old technology and overexposure to banks, destined to lose market share. We think this narrative is far too simplistic (and frankly wrong). More than 20% of Fiserv’s merchant revenue is from its software-led Clover POS platform, targeting smaller merchants in the restaurant and retail verticals, which is growing at 30% p.a.; similarly, its new Carat platform aimed at enterprise omnichannel retail is growing at 20%. Fiserv is also the leading provider of core banking software, a slower growing but incredibly stable business, that creates meaningful opportunity to cross sell merchant services in partnership with their banking customers. We think Fiserv can grow revenue at a high single-digit rate and earnings by mid-teens over the next five years, leaving the stock grossly mispriced on 13 times P/E.

EVEN (SOME) LONG-DURATION, LOSS-MAKING BUSINESSES OFFER ATTRACTIVE RISK VS REWARD TRADE-OFFS

It has been a particularly brutal year for long-duration growth companies, with many names down 60% - 70%. Many nascent businesses with unproven business models were beneficiaries of the ultra-low-rate environment, where the prospect of future riches – however speculative – was chased to extreme levels. With valuations in many instances detached from reality, a reset was necessary. The subsequent sell-off has been swift but also indiscriminate. With access to cheap capital suddenly limited, many of these early-stage companies now need to pivot from growth at any price, to generating sustainable profits and cash flows. Some of these businesses are likely to fall short of their lofty aspirations, but some will succeed. While the range of potential outcomes is wide, we see an opportunity for long-term investors to identify disruptive companies with attractive, sustainable business models that offer the potential for outsized gains; we have started to build a modest position in this segment via a basket of winners across industries including ecommerce and food delivery.

There’s a saying in markets that you can have good news and you can have good prices, just not at the same time. While many of the news headlines today are bleak, much of this is already reflected in asset prices. Our assessment of what most businesses are worth is largely unchanged, but with market prices materially lower, the price-to-value gap has widened significantly, implying much higher expected future returns. +

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal