In what was a torrid year for almost all asset classes, the fourth quarter (Q4-22) provided some respite, with both global equity (+9.8%) and global bond markets (+4.5%) advancing. Despite this recovery, the year still ended firmly in negative territory, with global equities down -18.4% and global bonds down over -16%. The Fund had a strong quarter, advancing over 9.8%.

FUND POSITIONING

Perhaps the most notable difference compared to a year ago is the opportunity set that has emerged in the fixed income space. For the last decade we have run out of ways to say that “we see no value in developed market government bonds” or “fixed income markets offer little in the way of return, while assuming a significant degree of risk”. And for much of this period we looked foolish as interest rates plumbed new lows (meaning prices hit new highs). That all changed last year as the high yield, investment-grade credit, emerging market debt, and developed market government debt markets all registered double-digit declines. This is not what investors seek from (supposedly safe) bonds!

The Fund’s conservative fixed income positioning, which resulted in an outperformance of over 10% when compared to the global fixed income benchmark, has given us a long-awaited opportunity to put capital to work in the fixed income space. Short-dated US Treasury Bills (T-Bills), with maturities of typically less than three months, and which yielded virtually nothing a year ago, have largely been sold to fund new investment grade credit and inflation-linked bond (ILB) positions.

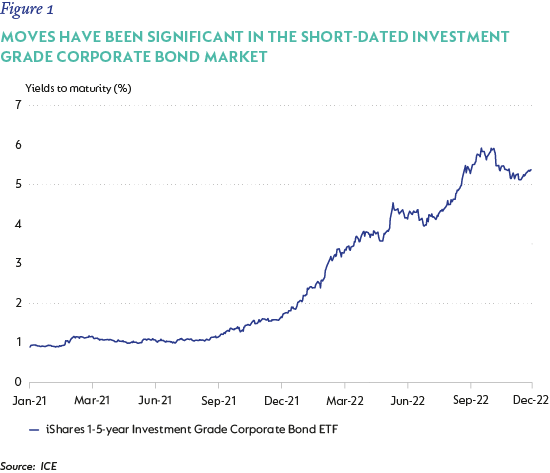

The chart below gives a sense of how significant the moves have been. For the iShares 1-5-year Investment Grade Corporate Bond ETF (a proxy for the short-dated investment grade corporate bond market) yields to maturity have moved from 1% in 2021 to over 5% currently.

The Fund’s exposure to ILBs has also increased, from virtually nothing last year, to over 7% today. These bonds work differently to typical fixed income instruments. Instead of locking in a nominal rate of return, ILBs allow investors to lock in a real return (i.e. a return over inflation). A simple example may clarify the mechanics of this type of bond: let’s say an investor buys a 10-year US Treasury bond with a yield to maturity of 4%. If that investor holds the bond to maturity[1], then his/her return is guaranteed to be 4%. Now if inflation over that period is 2.5% per annum then the investor will have earned 1.5% real (or 1.5% after inflation). If inflation surprised to the upside at say 5% per annum, then the investor would have earned less than inflation, or -1% real.

In contrast, if the same investor bought a 10-year ILB at a real yield of 1.5%, then no matter what inflation does, if held to maturity, the investor will be guaranteed a return of 1.5% over inflation. So, if inflation materialises at 2.5% per annum, then he would have been indifferent between owning the Treasury bond (with its fixed nominal coupon) and the ILB. Both real and nominal returns would be the same. But in the instance where inflation surprises to the upside, the holder of the ILB would earn inflation of 5% per annum plus the 1.5% real yield, given a nominal return of 6.5%, and be much better off.

While our base case is that inflation trends lower from currently very high levels, there is a risk that it proves stickier and more volatile than the market expects, in which case removing inflation risk and locking in real returns becomes particularly valuable. Furthermore, real yields have increased significantly, so ILBs are now more attractively priced than they have been for the last decade.

At quarter-end, the portfolio was positioned as follows:

- 3% effective equity

- 2% in real assets (listed infrastructure and property)

- 7% in high yield fixed income

- 4% in inflation-linked assets (including 4% in gold)

- 3% in investment-grade fixed income instruments

The remaining 2.1% is invested across a range of other assets.

While the Fund’s fixed income positioning has changed, and the return potential has increased, equities remain the most important building block for the portfolio. Indeed, regular readers will note that over the last year equity exposure has increased by approximately 6% to 72%. As outlined in commentaries throughout 2022, we are finding a broad range of opportunities.

In our Q2-22 commentary, we discussed Coupa Software and highlighted that some “high growth” stocks are no longer expensive. Coupa is a cloud-based software platform that offers an extensive suite of expense management solutions, including strategic sourcing, benchmarking, automating mundane procurement activities, streamlining processes and policies, and real-time supply chain visibility. Coupa is the software market’s undisputed business spend management leader and has a long runway for growth as companies continue to digitise their back-office processes.

Over the last year, the business experienced elongated sales cycles in a tough macro environment, however our conviction in its product superiority and customer proposition through its high return on investment remained intact. On 12 December 2022, Coupa’s Board entered into an agreement with a private equity firm, Thoma Bravo, to be taken private in the next six months. The enterprise value was determined to be $8 billion, an 8.7 times multiple of next year’s revenue, equating to a 77% premium to the pre-acquisition undisturbed share price. While the $81 takeout price is marginally below our fair value, we are satisfied with the offer, considering the swift return generated for our portfolios and the large opportunity set of high conviction ideas we currently have.

In the same commentary we also discussed “value” stock Capri, the owner of three iconic founder-led brands in Michael Kors, Jimmy Choo, and Versace. “In our view, the resilience of Kors and the significant growth potential of Versace and Choo is being totally overlooked by the market, with Capri Holdings being valued on 6-7 times earnings. Management clearly agrees, with a new $1bn share repurchase programme and the company buying back $300m of stock (5% of the market capitalisation) in the last quarter alone. We believe Capri offers tremendous value for long-term investors.” Capri was the top contributor to returns in Q4-22, advancing 49%.

Netflix was a positive contributor in Q4-22. This follows a strong period of outperformance, with the share almost doubling since its May 2022 lows. As a reminder, Netflix shares tumbled in the first half of 2022, driven by worse-than-expected results and subscriber declines after years of strong growth. We subsequently scrutinised the investment case intensely, which resulted in a lowering of our growth assumptions and fair value. Importantly, we did, however, conclude that our core investment thesis was largely unchanged and that the market had overly penalised Netflix based on two quarters of weak growth. Netflix remains the clear market leader in streaming, an industry with high barriers to entry, ample pricing power, and strong structural growth tailwinds. We stuck to our view, with our long-term focus being key in a skittish and volatile market.

Finally, we had discussed how not owning certain mega caps hurt returns relative to the market in 2021. It was notable that much of this reversed in 2022 and not owning Tesla (-65% for the year), Nvidia (-50%), and Apple (-26%) all contributed to the Fund’s relative returns.

OUTLOOK

As always, we have no insight into the direction of the market in the near term. We aim to focus on what we control, which is researching investment ideas across the capital structure, and responding to opportunities as and when they arise. In the fixed income space, we have increased duration, added investment-grade corporate credit, and bought ILBs. In the equity markets, we think certain stocks are heavily discounted and offer attractive returns for investors with a long-term time horizon. This is the primary determinant of our overweight position.

[1] and assuming coupons are re-invested at the same rate

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal