Personal finance

Investment forces of nature

“Birds fly by exploiting the laws of physics, rather than defying them.” – Steven Pinker

Sir Isaac Newton, one of history’s greatest scientific minds, spent years trying to turn lead into gold through alchemy. He was fighting against a fundamental law of nature – one he could not change. Lead and gold are, after all, two different atomic elements, but the discovery of elements and an understanding of the makeup of their atomic structures were still centuries away.

Wealth creation works in much the same way. Just like the consistent and powerful laws that govern the natural world, there are fundamental forces that shape how money grows. And real wealth comes from working with these forces, not against them.

1) THE FORCE OF COMPOUND GROWTH

A single piece of paper folded in half 46 times would reach the moon. One more fold gets you back to Earth. And while the answer is less than what you may intuitively have thought, it’s a great demonstration of the true power of compounding.

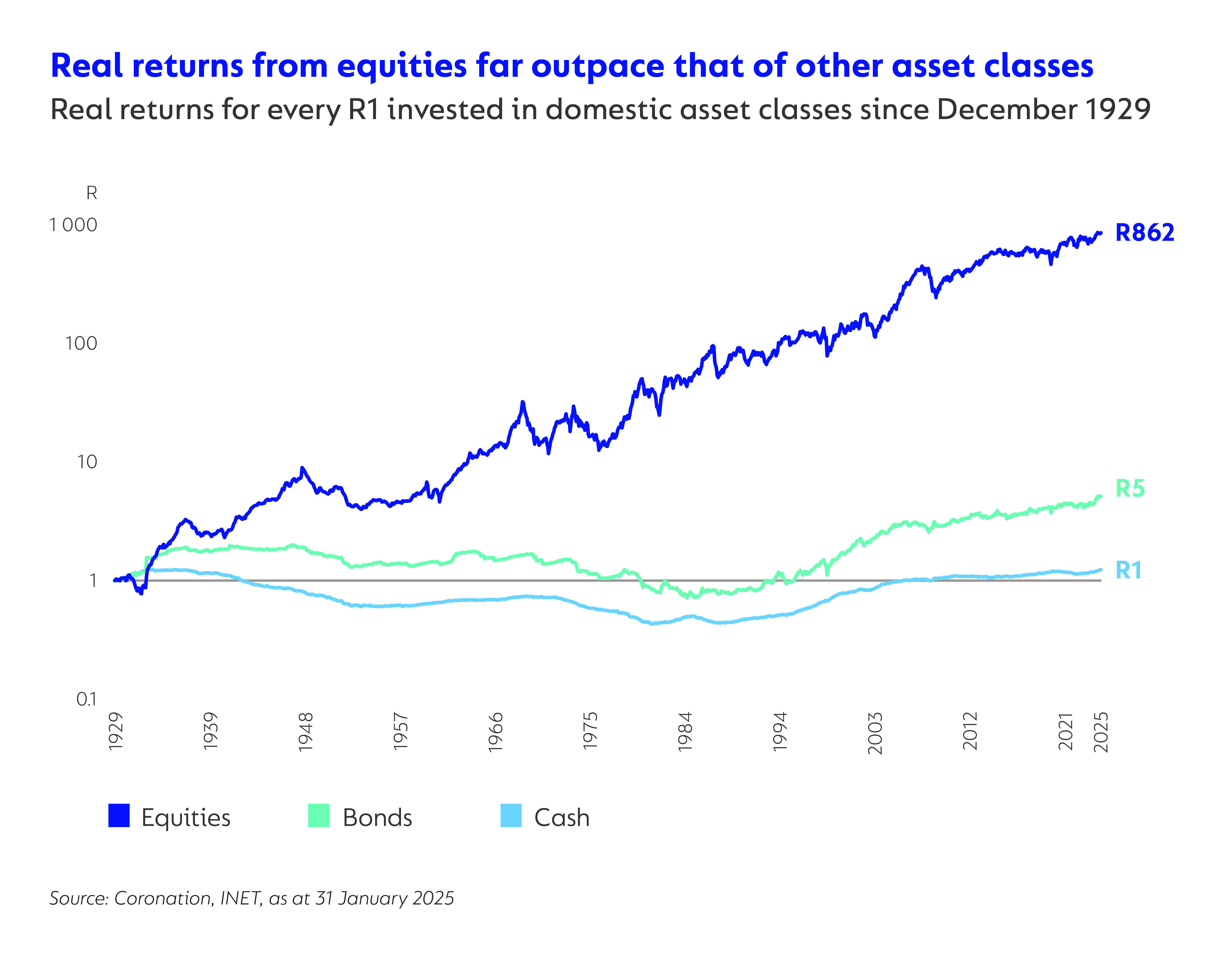

To harness this force in wealth creation, we believe that investors need to invest in enough equities; the asset class that’s the driving force behind inflation-beating returns over the long term in any portfolio. By investing in carefully selected businesses, you get to participate in their future profit. Owning the right amount of (i.e., enough!) equities throughout your investment journey, both before and after retirement, allows you to take full advantage of compound growth. And remember, this growth comes from time in the market, not trying to time the market. Compounding only works if you give it enough time.

2) THE FORCE OF UNCERTAINTY

As humans, we have an innate desire for certainty. We believe we can forecast the future ourselves or believe in experts who claim that they can. But if the past decade has shown us anything, it is that the future is impossible to predict. Uncertainty is part of investing, which means we must prepare for it.

At Coronation, we are great believers in diversification across asset classes, geographies, and industries. We go to great lengths to build resilient portfolios that can handle unexpected market or instrument-specific events. Diversification and the power of compounding are the only free lunches you get in the world of investing.

3) THE FORCE OF LOSS

You must have heard that the first rule of investing is not to lose money, right? The reason for this comes down to simple maths. It's harder to make a rand back than it is to lose one. If you give someone R5 and they lose one rand, they take a 20% loss. To make that rand back, they have got to achieve a 25% return.

At Coronation, we take a disciplined approach to investing, making sure your money is working for you while managing risk carefully. When we invest in businesses, we focus on their true value and ensure there is a margin of safety between what we pay for it and what our research indicates it’s worth, so you are not overpaying for assets. We believe that staying patient, diversifying investments, and sticking to solid fundamentals are the best ways to protect your money from permanent losses and help you achieve long-term financial success.

4) THE FORCE OF NATURAL SELECTION

The fourth force of nature in investments is derived from evolutionary biology—"nature finds the flaw". Markets do the same thing. It is, therefore, crucial to beware of weak businesses, management, and balance sheets. This does not mean that weaker businesses can never be a good investment, but rather that we will demand a large margin of safety to protect against potential value traps.

At Coronation, we believe in incorporating a second layer of protection when buying cheap assets. Not only do we demand a large margin of safety, but we also carefully manage position sizes so that the entire portfolio doesn’t get undermined in the event of these assets proving to be value traps.

5) THE FORCE OF FUNDAMENTALS ASSERTING OVER THE LONG TERM

While Newton lost the battle against the laws that determine the make-up of matter in his alchemical pursuits, he achieved success in uncovering the fundamental law that governs the behaviour of matter through his discovery of gravity. And just like gravity always wins, in investing fundamentals always prevail over the long term.

At Coronation, we believe investors should be cautious when coming across arguments that ignore long-term fundamentals. For example, in bear markets, many people will acknowledge that out-favour assets are cheap but will argue against holding them in their portfolios on the basis that undervalued assets will not deliver good returns in future. Equally, in bull markets, many people will acknowledge that in-favour assets may be expensive but also justify why markets will continue overpricing these assets, ignoring the fact that these assets could deliver poor returns in future.

Remember, the underlying fundamentals are like gravity. The true value of assets will eventually become apparent.

CONCLUSION

Having navigated markets for over three decades on our investors’ behalf, we’ve learnt the importance of leveraging (not defying) these laws of nature in investing.

We remain disciplined in how we build our portfolios by seeking great businesses with strong fundamentals and by preparing for uncertainty and risk through diversification and appropriate position sizing.

South Africa - Personal

South Africa - Personal