Personal finance

Invest tax free as soon as you can for as long as you can

“The first rule of compounding: Never interrupt it unnecessarily.” – Charlie Munger

The Quick Take

- Take advantage of your annual tax-free investment allowance as early as possible in the new tax year

- This means that your investment can benefit from tax-free growth 365 days sooner

- Allowing your tax-free investment to grow for as long as possible can be life-changing

- And choose a fund that allows you to remain invested for as long as possible

Perhaps you missed the February deadline to invest tax free? The good news is that you don't need to wait until the end of a tax year before putting your savings to work. By investing as early as possible in this new tax year (which started 1 March 2024), you can reap the full rewards of tax-free growth sooner. Here are some pointers to help you make the most of your tax-free investment.

1. IF YOU CAN, STAY THE COURSE

The late, legendary Charlie Munger said that one should never interrupt compounding unnecessarily. This is because your investment can grow exponentially the longer you remain invested.

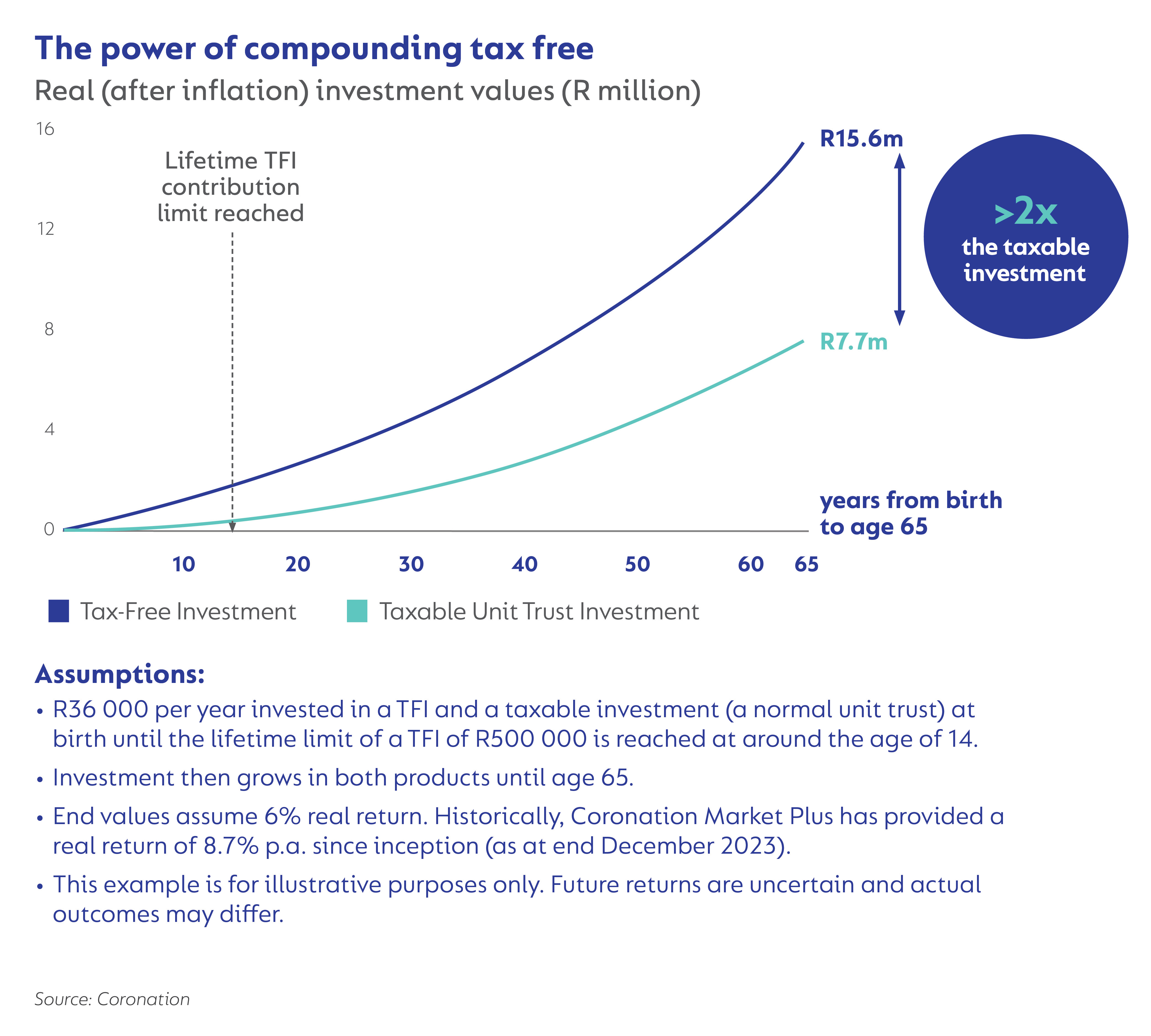

The same goes for a tax-free investment. When you harness the life-changing effect of the higher compound growth in a tax-free investment compared to that of a taxable investment option over time, you can double the value of your investment in real terms. See the illustrative example below.

2. CHOOSE A GROWTH-ORIENTED FUND THAT WILL HELP YOU STAY INVESTED

One of the benefits of a tax-free investment is that there are no geographical or asset class constraints to your underlying investment fund. This means you could give your money the best opportunity to grow over time by considering a growth-oriented multi-asset fund. Multi-asset funds make it easier to remain invested as they offer a less volatile experience than an equity-only fund. These funds also simplify investing as you leave the asset allocation decision-making to the investment professionals.

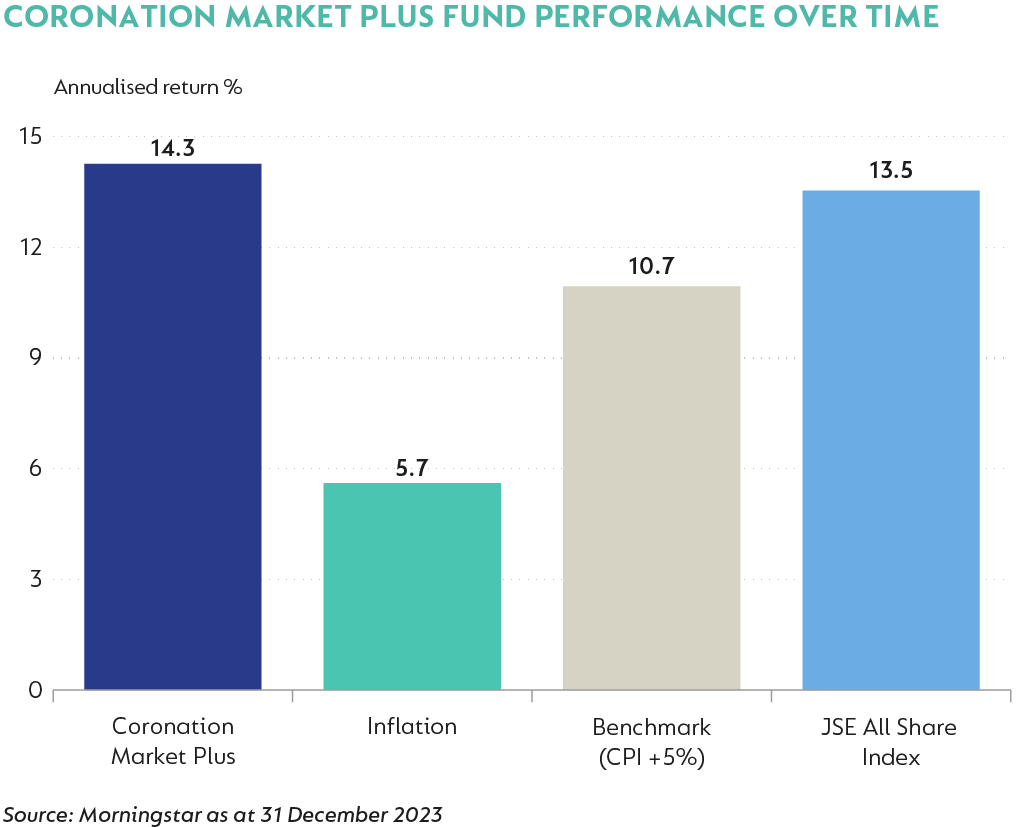

Since its inception in 2001, the growth-oriented multi-asset Coronation Market Plus has met the long-term capital needs of investors. As shown in the diagram below, the Fund has delivered an annualised return of 14.3%, which is well ahead of inflation at 5.7% per year. Worth noting is that, over this period, despite never being fully invested in equities, the Fund has outperformed the JSE All Share Index’s performance of 13.5%. (All performance figures quoted are as of 31 December 2023). This means that investors enjoyed equity-like returns but with significantly less volatility.

3. IF YOU DON’T HAVE A TAX-FREE INVESTMENT, START YOUR JOURNEY WITH CORONATION TODAY

Prioritise taking advantage of your annual tax-free investment allowance as soon as possible this new tax year. Doing this allows the taxes you save to remain invested for a year longer. And the longer you stay invested, the more you give yourself the chance to reap the benefits of compound growth over a lifetime.

SO WHY CHOOSE CORONATION?

- There are no initial or admin costs attached to opening a tax-free investment with Coronation.

- You can start investing with us from as little as R250 via a monthly debit order or make lump-sum investments from R5 000 to R36 000 per year.

- You can switch* your fund choice at any time without incurring capital gains tax or any other costs.

To select the funds that suit your needs, speak to your financial adviser if you have one, or go to our tax-free investment page today.

Coronation is an authorised financial services provider.

*While this is the ordinary course of business, switching fees or exit penalties may apply under limited circumstances.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal