Personal finance

Two funds, two decades, double the index

A history of consistent alpha generation in local and global markets

The Quick Take

- Sterling track records of disciplined long-term investing

- Annualised alpha of >3% over two decades after all fees

- Meaningful long-term wealth creation for investors

- Supported by in-depth research across local and global asset classes

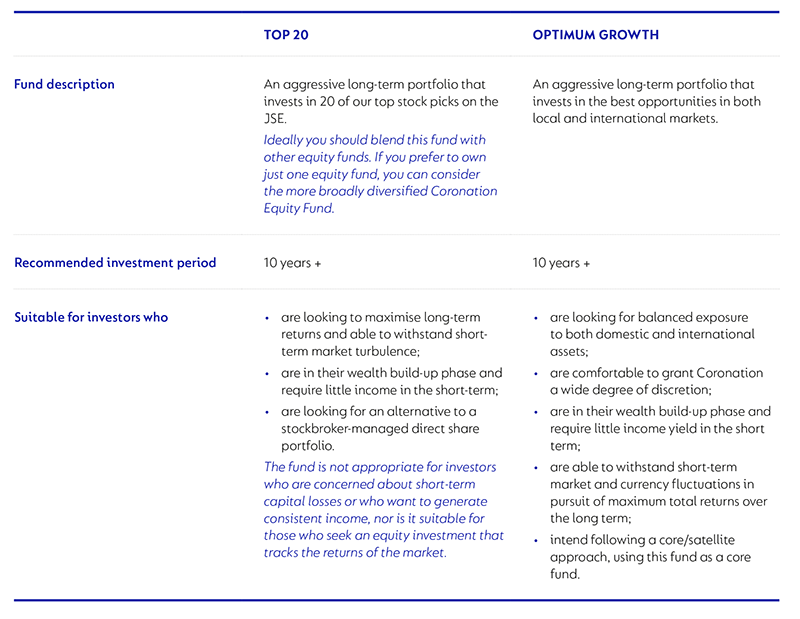

2020 marks a milestone anniversary for both the Coronation Top 20 and Coronation Optimum Growth funds. While the two funds are managed to meet very different investor needs – one to maximise returns within the borders of South Africa and the other by investing across the expanse of the globe – both have outperformed their benchmarks since their launch dates in 2000 and 1999 by 3.6% p.a. and 3.3% p.a., respectively. Over time, this alpha adds up, resulting in meaningful wealth creation for investors.

CORONATION TOP 20: 20 OF OUR BEST IDEAS ON THE JSE

Since its inception in 2000, Top 20 has offered its investors an actively managed and concentrated portfolio of what we believe to be the best opportunities on the JSE. The focused nature of this Fund has called for great discipline from its managers and, at times, true grit from its investors. Because we limit ourselves to no more than 20 investment ideas within the Fund, the potential to outperform the index through disciplined stock selection is greater, but with that comes lumpy returns over the shorter term.

Investing is a long game

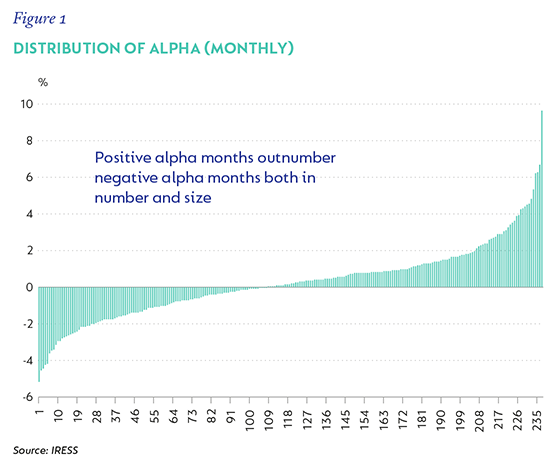

The investor’s reward for enduring many periods of short-term underperformance (as is clear from the distribution of negative and positive monthly alpha in Figure 1) is exceptional wealth creation in the long run.

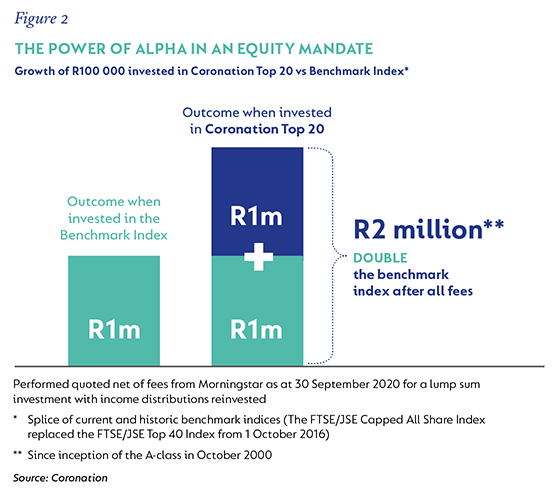

In rand and cents terms, the Fund’s annualised alpha of 3.6% means that R100 000 invested at launch 20 years ago would have grown to more than R2 million as at the end of September 2020 – after all fees. This is double the return of a similar investment in the benchmark index (Figure 2).

A long-term track record enabled by an incredible research effort, investment philosophy and support from our clients

According to Neville Chester, a manager of Top 20 since 2007, the success of the Fund is a direct result of leveraging the in-depth, proprietary research of Coronation’s investment team. “It’s their application of our intensive, long-term focused approach that has been crucial in consistently identifying undervalued ideas for the Fund over the past 20 years.”

However, staying the course in a fund such as Top 20 requires clients to embrace our investment approach and be willing to back the Fund through periods of short-term volatility and underperformance. “This support has been a key factor in making the Fund the success that it is today.”

CORONATION OPTIMUM GROWTH: A BLEND OF OUR BEST IDEAS FROM ACROSS THE GLOBE

In 1999, we pioneered the uniquely flexible worldwide multi-asset mandate by launching Optimum Growth. Its founding purpose, and still its driving force today, is to provide investors with a long-term portfolio of the best investment ideas we can find around the world, while aiming to deliver healthy long-term real returns.

The Fund is unconstrained, so it can invest anywhere in the world and across all available listed asset classes. Its fund managers decide on the optimal allocation between both growth and income as well as domestic and foreign assets. Optimum Growth’s investors therefore benefit from our full global research effort, comprising 70 investment professionals, across all the investable asset classes.

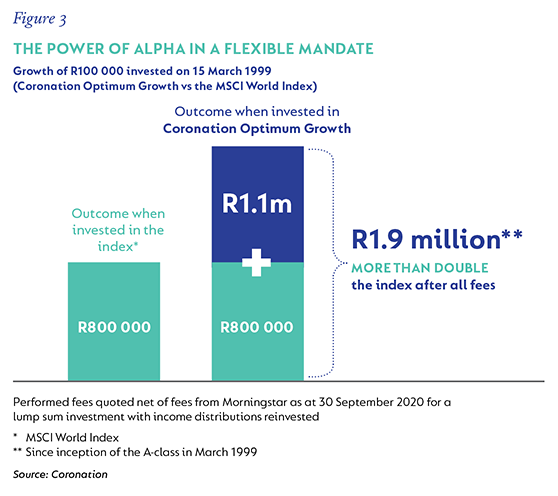

As with Top 20, the long-term reward for staying invested in the Fund has been exceptional. It has outperformed global equities (as measured by the MSCI World Index) by 4.6% p.a. since inception, resulting in a current investment value more than double that of an investment in the index (Figure 3). And given the benefit of wider diversification in a fund such as Optimum Growth, we delivered this performance with significantly less volatility than that of the index.

Can we repeat these outcomes for investors over the next two decades?

According to Gavin Joubert, a manager of Optimum Growth since 2005, the Fund benefits from ideas being generated by a team of 18 investment professionals who provide detailed coverage of global developed and global emerging market stocks. “Besides being a well-resourced and experienced team by global standards, our knowledge of global stocks has continued to increase year after year, which places Optimum Growth in a strong position to continue to deliver attractive risk-adjusted returns for its investors.”

Regarding Coronation Top 20, Chester adds that the same factors that have driven the remarkable performance of the Fund remain in place at Coronation. “Today, we are as excited as we have ever been about the opportunities that are available in the market and that we are currently taking advantage of in the [Top 20] Fund.”

South Africa - Personal

South Africa - Personal