In the five years leading up to 2020, the sideways shuffle of the JSE meant that local balanced funds struggled to meet their long-term annualised real return expectations of 5% to 6%. Despite a strong recovery since April 2020 , we continue to believe that a number of valuation tailwinds in the underlying asset classes place these funds in a much better position to deliver on their real return expectations going forward. Here’s why we are optimistic:

South African equities – still plenty of opportunity

South African (SA) equities, a key building block of Regulation 28-compliant balanced funds, saw an impressive 30%-plus rally since the onset of the Covid-19 pandemic. This is in sharp contrast to the preceding five-year period, during which the asset class experienced a grindingly flat market. While the opportunity set may not be as big as it was 18 months ago, there are still many attractively priced shares for the following reasons:

1. The SA equity market is cheap

Over the past few years, negative news flow has translated into low share prices, so much so that many domestic share prices are still more than 50% lower than their all-time highs reached several years ago. As a result, the JSE is awash with shares trading on low earnings multiples and high dividend yields.

The upside to fair value from the SA equity holdings across our funds is historically significant - a good indicator of the potential currently being offered by the local equity market.

Also, the adage “follow the money” is particularly apt now. Between 2019 and 2021, there were 50 company buyouts on the JSE, with owners taking them private because they felt their shares offered more value than the market was willing to pay for them.

(Read more about our constructive SA equity outlook here.)

2. There’s a considerable breadth of value

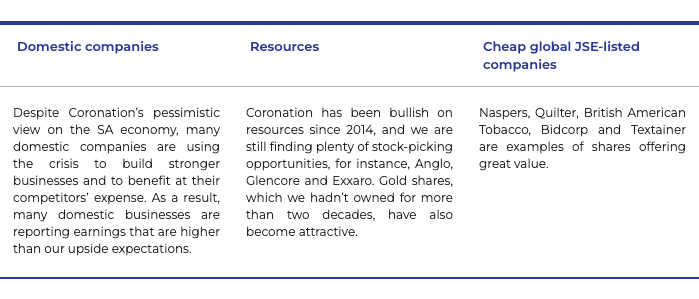

Outstanding value can be seen across the market, not just in isolated pockets. We group the stocks that offer the most attractive value in three buckets:

3. Our bullishness is not based on an optimistic view of the SA economy

We remain concerned about the many structural impediments that are likely to lead to the same anemic future economic growth path as experienced in the several years before the pandemic. However, a significant amount of pessimistic sentiment and bad news is already priced in. This has resulted in very low market prices that offer a significant margin of safety. We believe well-managed companies will continue growing despite a tough environment.

Local bonds – it’s all about the price

We also think that local bonds are attractive. Today, we are seeing yields of anywhere between 9.5% and 10.5%, depending on where you are looking on the yield curve (compared to a yield of around 2% from a US 10-year bond). On their own, these yields get you very close to the real return target of a typical balanced fund.

However, our positive view does not mean that we are naïve about the risks of a debt trap. We were worried about our country’ levels of indebtedness even before Covid-19 and continue to watch fiscal developments closely. As a valuation-driven investor, it is not our job to avoid certain assets classes simply because of the risks, but rather to assess risk in the context of the price you pay for the asset. In our view, current bond yields are sufficiently compensating investors for the risk, and we think there is a lot of protection in the back half of the yield curve, which is where our fixed income and multi asset class funds are invested.

Global equities – opportunity for stock picking

Towards the end of 2021, we were concerned about global equities, due to high valuations and elevated levels of exuberance. However, the recent selloff in January has left us a little more optimistic about the prospects of the asset class in general and specifically the opportunities being presented to stock pickers as a result of dramatic price declines in some parts of the market. Although global market prices remain elevated at index-level, we are finding very attractive stock picking opportunities.

Not the time to be in cash

With the market volatility in the last few weeks of January reminding investors just how quickly things can and do change in financial markets, now is not the time to be sitting in cash. We continue to believe that investing in an actively-managed and well-diversified portfolio of assets such as the Coronation Balanced Plus Fund remains an appropriate choice for most long-term investors. And, given the valuation tailwinds available in domestic assets (equities and bonds) and selected global equities, we believe that long-term real returns in the 5% - 6% p.a. range remain achievable by investors in balanced funds.

Coronation is an authorised financial services provider.

Disclaimer

South Africa - Personal

South Africa - Personal