Growth assets disappointed in the recent past. It is understandable that some investors may want to give up. But only looking backwards may lead you to the wrong conclusions.

RECENT OUTCOMES WERE WEAK

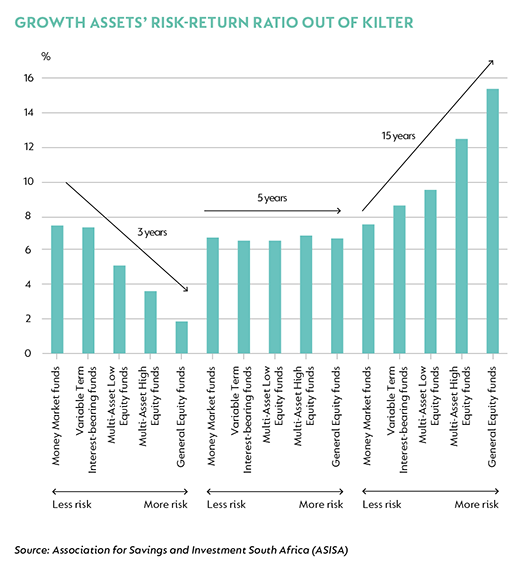

Recent experience has planted doubt in the minds of some investors as the risk-return trade-off did not hold. The truth is that over the five years to the end of May, you achieved no additional return when increasing risk incrementally. The graph below illustrates this point using some of the key unit trust categories along the risk spectrum. Regardless of whether you invested in a low-risk money market fund, a fully invested equity fund, or anything in between, your average return outcome would have been similar. The issue is amplified when you assess returns over three years. Over this period, investors were better off in money market funds than in equity funds – you experienced the risk, but not the return. This inevitably leads some investors to ask certain questions - Is it still worth exposing my portfolio to the risks associated with growth assets? Should I rather derisk my portfolio? Or put simply - Where did my return go?”

INSIGHTS FROM OUR INVESTOR SURVEY

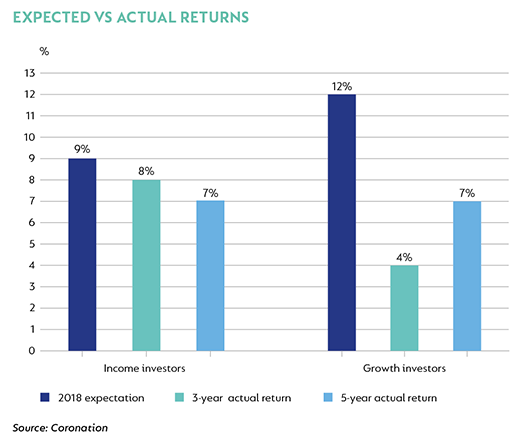

We recently concluded our second annual client survey in which we used the opportunity to ask investors a range of questions that could help us create better outcomes for clients. One of the areas that we focus on is the expectations gap: the difference between investors’ expected returns and their actual experienced returns. The results can be interpreted as a barometer for how comfortable investors are about their investment choices.

The graph below shows the gap in practice. On average, those investing for short-term income expect an annualised return of 9% compared to the actual outcome by the average flexible fixed interest fund of 8% and 7% per annum over three and five years respectively. In contrast, those investing for growth over the long term have endured a much more disappointing experience over the last few years. Our survey shows that the average long-term investor expects 12% per annum. Compare that to the average return of your typical balanced fund of only 4% and 7% per annum over three and five years respectively. Although one can argue that investor expectations are too optimistic and require moderation to be prudent (at the current 4.4% CPI rate, it implies a 7.6% per annum real return expectation, compared to 5% real return as the generally accepted reasonable expectation for a balanced fund), the reality is that the average balanced fund has only delivered a third of the expected return over the last three years.

Unfortunately, this expectation gap may be interpreted as justification for taking actions that could prove to be wealth destructive over time.

WEALTH DESTRUCTION IN ACTION

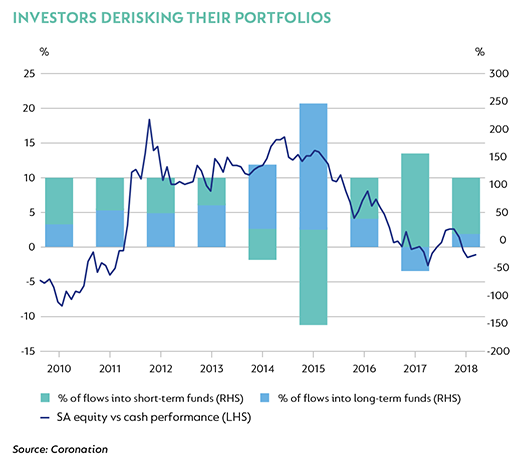

The need to act when expectations are not met is an understandable human response, but could result in several unintended consequences when ill conceived. Selling growth assets after periods of poor performance, or buying more growth assets after periods of exceptional performance often is to the detriment of growth investors over the long term. Our analysis of flow trends in the unit trust industry indicate that many investors are de-risking their portfolios – consider the graph below.

Leading up to 2015, investors displayed an increasing preference for long-term funds. As the graph shows, it also coincided with a period where the three-year return gap between equities and cash was compelling. In short, investors increased their exposure to equities after equities had significantly outperformed cash. Over the last three years, we have seen a reversal away from a strong preference to long-term funds to investors appearing to de-risk into short-term funds. This move has again happened at a time when equities had already underperformed cash.

MANY PATHS ARE POSSIBLE, BUT ONLY ONE ROAD IS TRAVELLED

Humans need organising narratives to cope with the complexities of life. We just do not have the bandwidth to engage in-depth with every issue that crosses our path. Often, our own experience plays an outsized role in the stories we use to shape our view of the world. This is especially true for subject matter we do not engage with regularly.

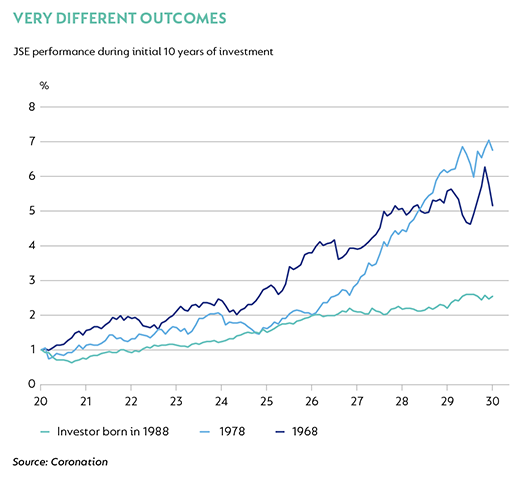

Take the difference in experience between three investors in the graph below. It shows the investment returns achieved during their 20s for investors turning 30, 40 and 50 respectively this year. We use 10 years as an evaluation period as a decade is the minimum timeframe that can be described as long term. When the two older investors became adults in the 1990s and 2000s, the local share market produced above-average returns as the global economy grew above trend, inflation was tamed and South Africa reaped the dividends of a normalising society post the advent of democracy. Our younger investor achieved a much more muted outcome, framed by the losses suffered during the global financial crisis in 2008 and the underperformance of the local economy ever since.

The danger of basing your decisions only on personal experience is that you are ignoring 99.9% of the available information. Our two older investors are likely to end up with unmet expectations if they continue to extrapolate the double-digit real returns achieved early in their lives, while our younger investor may end up investing too little if she becomes demotivated after achieving below-average return rates at the outset of her investment programme.

When we extend from the three observations highlighted above to the full historical record (of nearly 1 000 observations), we can say the following about local share investors with 10-year investment horizons:

- South African shares on average returned inflation +8% per annum since 1930.

- The average return since the advent of democracy in 1994 is actually higher at inflation +10%.

- Over the past 36 observations since July 2015, the return declined to inflation +5.6%.

- The return achieved exceeded inflation around 90% of the time since 1930, and 100% of the time since 1969.

- Longer-term returns tend to mean revert: lower return periods tend to be followed by higher return periods and vice versa.

There is therefore no doubt that the risk-return trade-off has held over time.

DO NOT LOOK BACK, YOU ARE NOT GOING THAT WAY

Starting in 2013, we have consistently cautioned investors through various platforms (including this publication) to expect more muted returns. At the time our view was driven by the lofty valuations of South African assets as well as our assessment of investor expectations on the back of extrapolated past returns. While this reminder provides cold comfort, the reality is that we are not surprised that investors have been underwhelmed by their return experience over the last three to five years. What is more important now is the view going forward, and in many ways it is more promising. Risk and reward are intrinsically linked, and we are concerned that investors are diluting their ability to participate in the trade-off due to the experience of the recent past. The reality of how markets work means that one’s expected return increases as past returns remain lower for longer. We hope that some of the articles featured in this issue of Corospondent gives you an idea of the opportunities that can result in improved returns going forward.

South Africa - Personal

South Africa - Personal