Personal finance

Your investment portfolio in retirement needs the best of these two objectives

How we take advantage of return opportunities while being conscious about risk

The Quick Take

- Investors nearing retirement need to be mindful of their change in investment objective

- Delivering on the now dual investment objective of capital growth and capital preservation requires a bespoke portfolio

- Coronation offers two funds aimed at investors in retirement that are constructed to take advantage of return opportunities while being mindful of risk

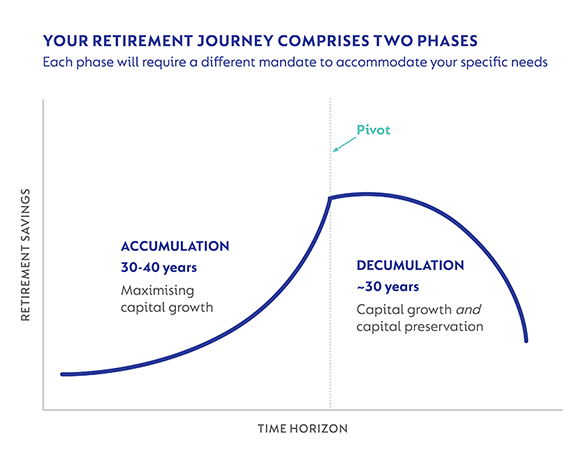

As you near retirement, your investment needs will reach an inflexion point. Chances are that you spent many decades investing and growing your retirement capital which soon needs to provide an income for the rest of your days. When you transition from the build-up phase (accumulation) to a period of decumulation (when you start drawing a regular income), your primary investment objective changes from maximising capital growth to a dual, and often more complex, one of capital growth and capital preservation. At Coronation, we offer two investment funds for living annuity investors that are designed to deliver on both needs simultaneously within a single portfolio.

YOUR POST-RETIREMENT FUND NEEDS TO STRIKE THIS BALANCE

Retirees’ investment portfolios need to meet both needs for the following reasons: Capital growth is required to help manage the risks of inflation (your investment returns need to be ahead of inflation to sustain your standard of living) and longevity (your capital needs to last for as long as you end up living). Your portfolio therefore needs appropriate exposure to risk assets (equities and listed property) to deliver inflation-beating returns over what could be a multi-decade investment time horizon.

At the same time, because you will now also start to withdraw from your built-up retirement savings by way of a regular income, your investment portfolio requires a strong focus on capital preservation. This is to help manage the potential negative impact that a market drawdown may have if and when these occur.

HOW WE BUILD BESPOKE INVESTMENT FUNDS THAT DELIVER ON BOTH NEEDS

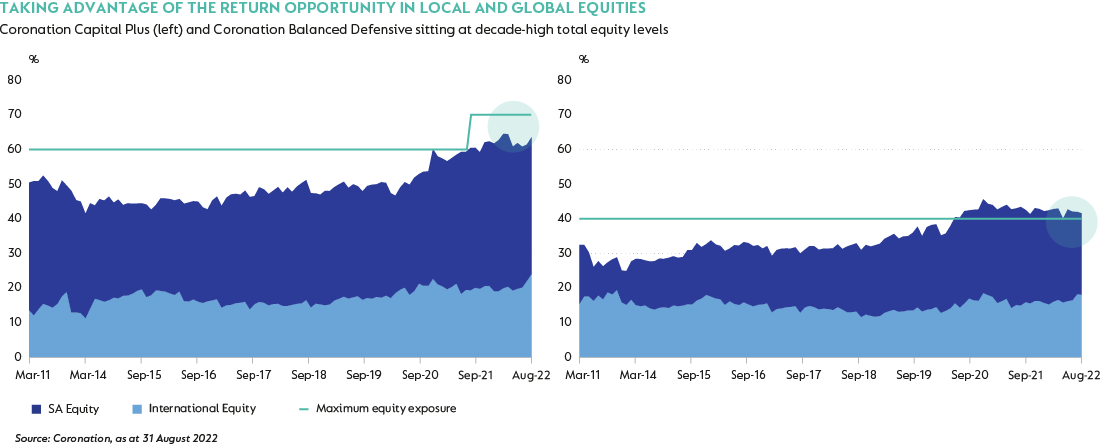

Coronation offers two bespoke Regulation 28-compliant multi-asset class funds with excellent track records in supporting the specific needs of retirees who wish to make annual income withdrawals over extended periods of time. The two funds – Coronation Capital Plus and Coronation Balanced Defensive – use various tools to deliver on their dual objectives of producing inflation-beating returns while also focusing on the need to protect capital.

ALWAYS MINDFUL ABOUT RISK

We address the protection of capital through the following key portfolio management principles:

Asset class limits

Each fund has a limit on risk asset exposure, within which we also cap on the amount of equities that can be held. For example, Coronation Capital Plus can invest up to 70% in risk assets in total, while Coronation Balanced Defensive’s total risk asset limit is capped at 50%.

Use of protection

We also actively manage the volatility within each fund’s risk asset exposures by investing in derivative instruments (when it is appropriate and cost effective) that offer protection during market drawdown events.

Diversification

By making use of the full spectrum of return drivers available to us in these funds, we build diversified portfolios that mitigate investors’ exposure to single-factor risk (e.g. when the outcome of our base investment case for a specific asset class, instrument or sector doesn't play out as we expected).

Considered instrument selection

Selecting instruments with the highest return potential is key to achieving inflation-beating returns. But given the funds’ need to balance their return objectives with a focus on capital protection, we are more mindful about qualities such as balance sheet health or cash returned through dividends than investing based on pure valuation metrics. We furthermore incorporate limits to individual share positions to prevent overexposure to a single instrument or type of risk.

Integration

We are well positioned to integrate global exposure into our post-retirement funds. The recently relaxed offshore limit under Regulation 28 allows added flexibility in our funds through which we can further improve the risk-adjusted outcomes for clients by accessing wider and deeper markets, where appropriate. However, from a risk management perspective, we will manage the offshore exposure actively (always mindful that our investor base’s liabilities are in rand), and in an integrated manner (to avoid any doubling up of risks across the domestic and global universes).

A great time to be allocating assets

While the first half of 2022 has been a tough environment in which to produce inflation-beating returns given that no asset class other than cash managed to deliver positive returns, we are very positive about the outlook for growth assets, in particular, going forward. This is reflected in both Coronation Capital Plus and Coronation Balanced Defensive having close to decade-high exposures in terms of their respective equity limits (as mentioned earlier).

However, building robust post-retirement portfolios require that we not only take advantage of attractive returns when they are on offer, but to also use diversification, instrument selection and protection to manage risk on behalf of our investors in these funds. Taken together, we believe the current environment is constructive for delivering on our respective targeted inflation-beating returns in Coronation Capital Plus and Coronation Balanced Defensive.

Disclaimers

SA retail readers

South Africa - Personal

South Africa - Personal