See for real how investing tax free can boost your long-term returns

Published January 2021

The start of the new tax year kicks off from the beginning of March each year. While that may not sound like the most exciting diary entry, for those who share in the quest for tax-efficient investing, it is an opportune time to look at your options. Three products can help you maximise your tax benefits over the next 12 months:

- Retirement annuities (RAs)

- Endowments (for high-income earning individuals)

- Tax-free investments (TFIs)

Each product has a different function in an investment portfolio, so it is not a case of one being preferable to the other. But whether you are saving for retirement through a workplace retirement fund or an RA, also consider a TFI for its long-term benefits of tax-free compound growth. And the earlier you start investing in a TFI each new tax year, the more you can make of the potential growth benefits over the full 12 months.

As of the beginning of March, you can invest between R250 and R3 000 in a TFI via a monthly debit order, or a lump sum of up to R36 000 per tax year, and up to a maximum of R500 000 over your lifetime. The amount you save on tax remains invested, which can make a significant difference to the growth of your money over the long term. But how much of a difference?

THE BENEFITS OF INVESTING TAX FREE ARE COMPOUNDING EVERY DAY

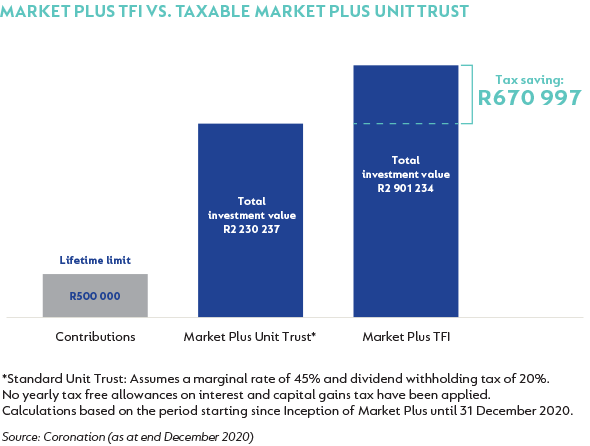

The graph below shows very clearly the benefits of investing in a TFI over the long term. It compares the same investment in the taxable Coronation Market Plus Fund versus the tax-free Coronation Market Plus Fund over the same time period.

Let’s assume that from the fund’s inception in July 2001, an investor was able to contribute the R36 000 annual limit until the lifetime limit of R500 000 was reached. And then assume this investment was left to compound until the end of December 2020. Simply by investing tax-efficiently, the investor would have R670 997 more capital in the TFI fund than the taxable fund. It’s a significant difference over time and could make the world of difference to an individual’s life at retirement or a child or grandchild’s education.

The sooner you invest your life-time allowance, the more you will reap the rewards of long-term investing and the power of compounding as long as you remain invested.

While you don’t get a tax break when contributing to a TFI, no tax is accrued while you are investing and all proceeds withdrawn from the investment are tax free. You have complete tax certainty and do not have to worry about facing a larger-than-expected tax rate when you withdraw funds from your investment in future.

NO SWITCHING COSTS

You can switch between funds or withdraw money as your circumstances change. Just be mindful that all amounts invested will count towards your annual and lifetime limits regardless of any withdrawals you make – you cannot ‘replace’ the money you withdraw with a new investment. So it’s best to consider a TFI as a long-term investment in order to take full advantage of the tax-free returns and proceeds.

South Africa - Personal

South Africa - Personal