“In the past, censorship worked by blocking the flow of information. In the twenty-first century, censorship works by flooding people with irrelevant information. In ancient times having power meant having access to data. Today having power means knowing what to ignore.” – Youval Noah Harari

Nearly everyone is by now aware of the central conceit in professional wrestling: this is scripted entertainment rather than a serious sport with unknown outcomes and real winners and losers. Yet, wrestling remains a big and successful business. WWE Inc., the most prominent promotor, is a multi-billion-dollar corporation that hosts more than 450 events a year and broadcasts in 28 languages, with the potential to reach more than 800 million homes around the world. Its share price tripled over the past five years. The key insight is that, in exchange for entertainment and escape, the audience is a willing participant in the lie. This complicity makes ever more extreme scripts possible and ensures that the whole edifice remains sustainable. If the fans revoke their consent, the system will collapse.

This phenomenon has become pervasive in our post-modern world. It sometimes feels like everything is now performance art. It is well advanced in politics, where President Vladimir Putin and ex-President Donald Trump rewrote the populist playbook, showing how to hack the media by flooding public discourse with disinformation through increasingly outrageous statements. This new style of propaganda aims to muddy the waters so that it becomes impossible to reach consensus based on the facts.

We see it in global markets too. In a world awash with liquidity, narrative-based ‘investment opportunities’ inspire an army of newly empowered retail investors using easily available leverage via their app-based, fee-free broking accounts to take a punt. Dogecoin, a meme-inspired crypto in-joke, traded 60 times higher in late-April 2021 compared to the start of the year. Multiple electric vehicle start-ups, with no revenue or product, are trading at prices consistent with double-digit global market share a few years out. Nearly 400 new equity listings were added to US markets in three months, in the strongest first quarter for deal-making since at least 1980. Three out of four of these were blank-cheque acquisition companies. We live in a world where there are many who are prepared to sell what people want to hear.

Being in on the joke does not protect you from negative consequences, though. Wrestlers still get injured and pervasive anabolic steroid use increases their risk of cardiovascular disease. Donald Trump became only the third one-term president since the Great Depression, as most Americans rejected his style of politics. High valuations supported by good stories but not by solid fundamentals will eventually lead to large losses, as illustrated by the dotcom bubble of the early 2000s.

At Coronation, we do not believe that the truth is unknowable. That is why we remain committed to improving our understanding of the fundamental drivers of value through deep and intensive proprietary research. Over time, this approach will continue to produce superior results.

Fee reductions for more conservative funds

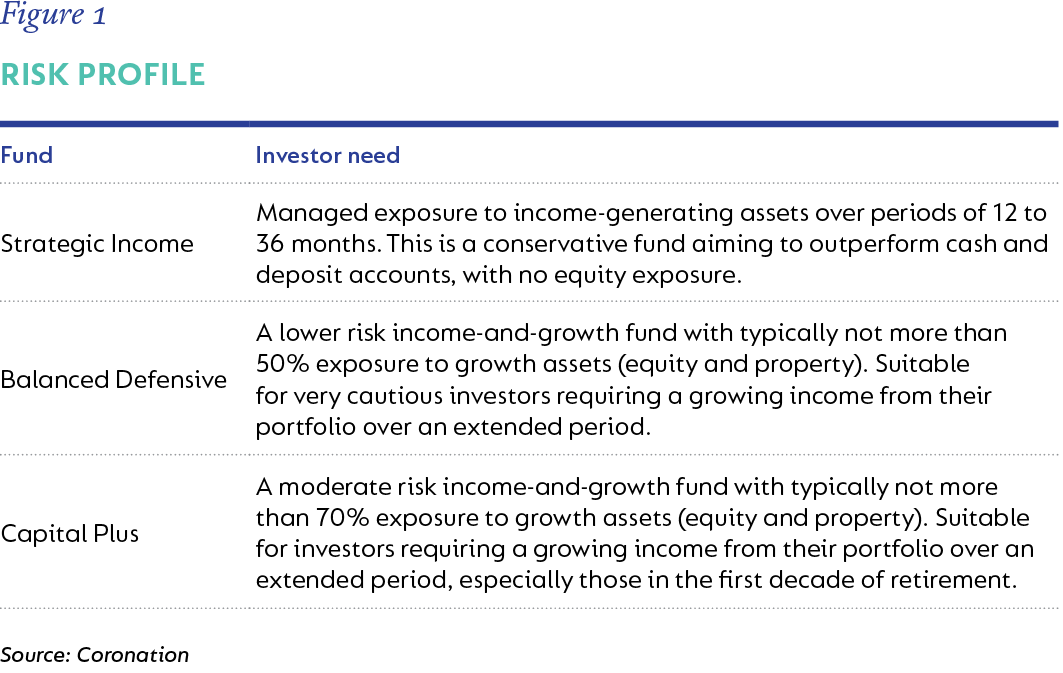

We have recently introduced management fee reductions for the Coronation Strategic Income, Coronation Balanced Defensive and Coronation Capital Plus funds. These changes are aimed at making it slightly easier for more conservative investors, often retirees who are dependent on their investment portfolio to meet their living expenses, to select the fund with the most appropriate risk profile for their needs, as summarised in Figure 1. More information on the new fees is available on our website and on the respective fund fact sheets.

In this edition

Bullish sentiment in global markets is built on the expectation of a post-Covid-19 economic boom due to a release of pent-up demand as lockdowns ease. The IMF recently upped its global growth forecast for 2021 from 5.2% to 6%. The key risks to this upbeat forecast are a stumble in vaccine rollouts and efficacy, possibly due to new virus variants; and increasing inflation concerns in response to an increase in the money supply, coupled with faster growth. Marie Antelme unpacks the latter in detail here. Locally, the outlook is more subdued, but as is evident from the economic and fund commentary in this edition, much of the froth evident in pockets of the global markets is not present in local financial markets, which still offer undemanding market prices.

In three examples of recent original research, our emerging markets team makes the investment case for emerging securities exchanges, Godwill Chahwahwa unpacks the opportunities created by crunching the numbers post a change in accounting standards, while Floris Steenkamp reports on a return of business confidence in Zimbabwe and the attractive opportunity presented by Zimplats.

Finally, we lead this edition with an extract from our third annual Stewardship Report, covering our environmental, social and governance activities during 2020. If you would like to read more on this topic, the full report is available here.

As always, I invite you to get in touch with us via clientservice@coronation.com if you require more information or if you are in any way unhappy with the quality of our delivery to you.+

South Africa - Personal

South Africa - Personal