2017 WAS NOT a year that ended with a whimper. The final quarter may go down in history as a period in which, to paraphrase then-UK prime minister Harold Macmillan’s message to the apartheid government in SA in 1960, the winds of change again started blowing through our continent. The national discourse was enriched with the publication of a number of books, such as Adriaan Basson and Pieter du Toit’s Enemy of the People, Crispian Olver’s How to Steal a City: The Battle for Nelson Mandela Bay and Jacques Pauw’s runaway bestseller The President’s Keepers. These books, through brave and uncompromising reporting, gave further insight into how our public institutions have been hollowed out as a result of a misguided descent into cynical transactional politics.

In December, the ANC took the first tentative corrective steps by selecting Cyril Ramaphosa as leader, indicating some support for the anticorruption message that underpinned his campaign. At the time of writing, more green shoots are emerging, as news broke of potential prosecutorial action against the Gupta family.

In this issue we feature a guest column by independent political analyst Steven Friedman who gives insight into the changing political landscape. Marie Antelme, our economist, explains that the economic situation remains dire, with urgent need for sensible and confidence-restoring actions. We can unfortunately still expect a tough budget for taxpayers as a result of a highly constrained fiscal situation. Peter Leger, head of our Global Frontiers team, reminds us that political change in Angola and Zimbabwe also brings some hope of renewal elsewhere in our neighbourhood.

We dedicate this edition of Corospondent to those who have contributed to an environment where it again seems possible for our society to be run in the interest of the many rather than the few.

LESSONS LEARNED

The past quarter also brought some stark reminders of how a lack of commitment to the highest ethical standards can quickly lead private sector actors astray too. This was already evident with the number of global first-league businesses implicated in SA’s state capture. However, the collapse in the value of Steinhoff in early December as a result of accounting irregularities and probable fraud was the most impactful example from the perspective of long-term investors. While the final chapters in this story are yet to be written, we include a detailed review of recent events at the company, as well as an explanation of why we decided in 2014 to invest in its shares. You can read more in CIO Karl Leinberger’s article here.

STRONG INVESTMENT RETURNS

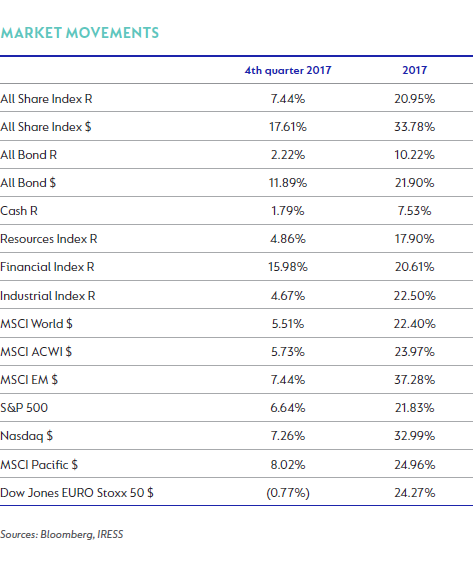

The past year delivered a good performance for most of our investors despite all the noise dominating the headlines. Our local long-term growth funds all achieved double-digit returns, exceeding their long-run real return targets and outperforming most competitors. Our general equity funds have matched rather than exceeded benchmark returns. Nearly 40% of the FTSE/JSE All Share Index return was produced by Naspers, which now makes up an incredible one fifth of the market index. Even though we still see value in the share, it is just not prudent to accept the index level of concentration risk in one share in most of our funds. This ‘forced underweight’ effect was especially significant for investors in our more conservative funds (Balanced Defensive and Capital Plus) where we limit a single share’s exposure to a maximum of around 3% of portfolio. While rand returns in our international funds were impacted by the currency strengthening by more than 10% in December, performance across the range was in line with or better than these funds’ benchmarks. Dollar returns ranged between 7% for the conservative Global Capital Plus Fund and 39% for the specialist Global Emerging Markets Fund. You can read more about specific fund performance and positioning in the fact sheets and commentaries available here

As announced in last quarter’s Corospondent, we recently introduced a new format for your investor statements, which now include additional useful information. It should also be easier to understand. If you have any feedback on how we can further improve the information we provide to you, please do not hesitate to get in touch with us via clientservice@coronation.com. In the coming weeks, we will also enhance our fact sheet disclosure by including the performance of the average fund in the respective peer groups, in addition to the funds’ investable benchmarks.

South Africa - Personal

South Africa - Personal