2018 WAS A bruising year for us, with many of our funds underperforming the already anaemic market benchmarks. I used my December break, away from the mania that is financial markets, to reflect on: lessons learned, the defining positions in our funds and how this most recent cycle compares to previous cycles I have lived through in my 19 years at Coronation.

RECENT UNDERPERFORMANCE IN THE LONG-TERM CONTEXT

We have been here before – painful periods of underperformance have been a regular feature of our long-term track record.

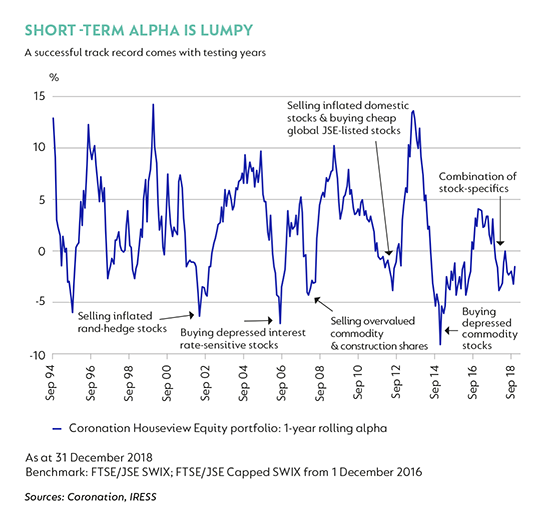

Our last period of acute underperformance serves as an excellent case study in this analysis. Three years ago, in the late stages of the commodity bear market, in a piece to clients on long-term investing, I made the following comment: “The graphs … show how misleading short-term alpha is. Notwithstanding consistent and compelling delivery on a long-term, cumulative basis, our portfolios have underperformed the market in one out of three years. However, in every one of those periods, the portfolio actions that caused short-term pain (buying dramatically undervalued assets that were falling, while selling overvalued assets that were rising) were the very same actions that delivered compelling results when the cycle (subsequently) turned.”

In the three years since, this argument has been strongly vindicated. Commodity stocks were widely loathed at the time and our overweight position had, until that point, been very costly. In the article, I referred to Anglo American moving from $10 to $70 through the bull market, only to collapse to an absurdly low $3.50 at the time of writing. A week after writing, the cycle turned (if only we had known then that we were at the bottom of the market!). Anglo is up an eye-watering seven times in the three years since.

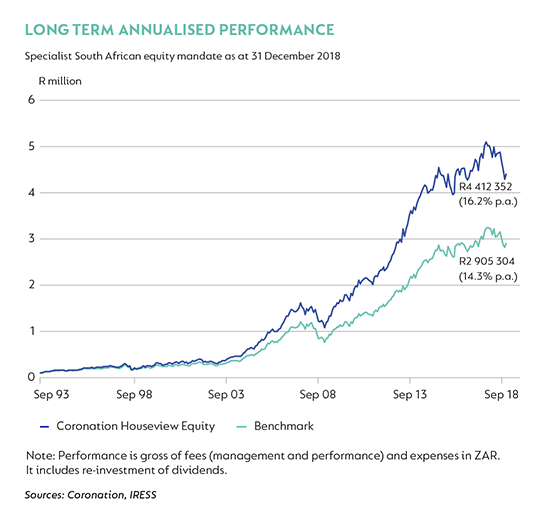

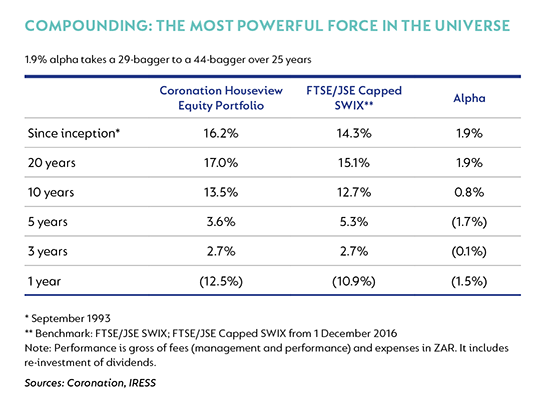

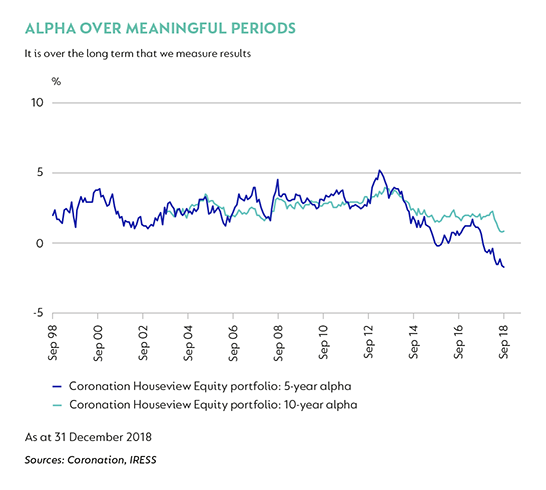

The article included an analysis of alpha in our flagship house-view equity fund over the full period of our history as an investment firm. This has been updated appropriately in the accompanying graphs and merits the following observations:

- Short-term alpha. Although it does not feel like it, the data show this cycle to have been fairly mild compared to some of the seven other downcycles we have lived through over the years.

- Long-term alpha. Our long-term track record remains compelling in what has been a very challenging 25-year period in which to manage retirement capital – characterised by notable events such as the transition to democracy, emerging markets crises, currency collapses, the Global Financial Crisis (GCF) and more recently, Nenegate – to name but a few.

- Medium-term alpha. The graphs show quite neatly how this cycle has differed from previous ones, in that our five-year alpha turned negative in 2018 for the first time in our 25-year history. Although five years falls short of a full business and investment cycle, it is an important and closely watched performance metric.

WHY HAS THIS PARTICULAR PERFORMANCE CYCLE BEEN SO TOUGH?

Previous periods of Coronation underperformance were largely due to a single cycle playing itself out (examples include the currency blowout in 2001, the interest rate cycle in 2006, the commodity cycles in 2008/2016 and the GFC in 2008/2009).

This time around, things are a little different, with a combination of several meaningful but unrelated positions in out-of-favour asset classes and stocks all detracting in the same period (despite very different fundamentals).

Key detractors include:

- Asset classes: overweights in local equities, emerging market equities and high-quality property stocks.

- Stock-specifics: large positions in British American Tobacco (BAT), Northam Platinum, MTN, Intu, Hammerson, Anheuser Busch Inbev (ABI) and Quilter.

NOTHING HAS CHANGED

We strongly believe that nothing has changed for us. The same investment philosophy and process that have delivered through many performance cycles for two and a half decades remain unchanged.

It is a process that has delivered an exemplary long-term track record across multiple asset classes and geographies (local equities, fixed income, asset allocation funds, emerging market equities and frontier markets).

The same people, working harder than ever, are managing your money and doing the hard yards in our research effort (albeit with a few more scars on our backs!). We remain intellectually curious, relentlessly searching for a deeper understanding of the world in which we invest your capital. For example, during the course of last year we had more than 35 calls with various stakeholders in the tobacco industry to try to better understand an industry undergoing dramatic change.

Finally, we remain flexible and determined not to fall into the trap of being stubborn. In this industry, if you do not have the humility to know that you live in an uncertain and unforecastable world, you will fail. We have an internal culture of championing minority views and challenging groupthink. Where we think we have made a mistake, we have either sold or reduced position sizes. Where we do not believe this to have been the case, we have either held our position or bought more at lower prices.

KEEPING THE FAITH

We are perplexed by the prices at which some stocks currently trade. The value we are finding in certain stocks is simply astounding.

Our view is that changes in market structure have driven a dislocation in the pricing of stocks. Anything with a whiff of value has been slaughtered – and with no apparent valuation floor. Much of this is likely a consequence of the global megatrend: out of value managers into high-quality (or Growth at a Reasonable Price’) managers, into quant funds and, finally, away from active to passive funds. Although this is currently a source of great frustration, it is also an opportunity for the patient, long-term investor, given the fact that the fundamentals always ultimately assert themselves.

The performance cycle is part and parcel of managing money for the long term. Investing is fundamentally a non-linear activity and, in order to secure long-term gain, one needs to be prepared to endure short-term pain.

Although there are many investors who endeavour to deliver steady results in what is a random, inefficient and volatile market, I believe this to be an impossible task over long periods of time and analogous to the efforts of Isaac Newton, one of the great minds of all time, who expended an enormous amount of energy practising alchemy before ultimately failing. History has shown, over and over again, that cycles always turn and that the surest path to wealth creation lies in long-term investing. Only this time horizon gives one the mandate one needs to fully exploit the inevitable differences between price and value.

SOME GOOD NEWS – LOOKING FORWARD

At a time when many are running for the safety of cash, we are more sanguine about the future:

- After being very negative about the South African equity market for most of the last five years, we are now much more optimistic about future returns:

- We have taken advantage of depressed sentiment to significantly increase the quality of our equity portfolio (currently very high-quality stocks comprise an abnormally high 57% of the portfolio).

- We currently find an unusual confluence of value in the local market, both in the rand hedges (examples include British American Tobacco, Quilter and ABI) and in domestic stocks. There are many examples of high-quality, defensive stocks that have endured a tough operating environment over the last few years and have low earnings bases. Many of these should see strong earnings recoveries if the economy recovers at all from a very depressed base. Examples include Pick n Pay, Spar, Netcare, Famous Brands and Afrox.

- We believe that some of the high-quality domestic property stocks offer value, notwithstanding the likelihood of an Edcon bankruptcy at some stage this year.

- Many emerging markets are very cheap after a miserable few years. It has been many years since we have been able to buy high-quality businesses at the undemanding ratings currently available in many of these markets.

Although there are no guarantees in life, and low prices do not guarantee high future returns, they certainly provide fertile ground in the search for above-average, risk-adjusted returns.

I conclude with an apt quote from one of the great investors of our time, Seth Klarman:

“In investing, nothing is certain. The best investments we have ever made, that in retrospect seem like free money, seemed not at all that way when we made them. When the markets are dropping hard… and an investment you believe is attractive, even compelling, keeps falling in price, you aren't human if you aren't scared that you have made a gigantic mistake. The challenge is to perform the fundamental analysis, understand the downside as well as the upside, remain rational when others become emotional, and don't take advice from Mr. Market, who again and again is a wonderful creator of opportunities but whose advice should never, ever be followed.”

Disclaimer

South Africa - Personal

South Africa - Personal