The world is in an unprecedented crisis. We now have mandatory lockdowns in many countries, global travel has been banned and social distancing has become the norm. These actions will no doubt lead to a deep global recession. The depth of the recession is likely to be severe, but we cannot know the duration. This uncertainty will weigh on investors’ expectations of when a recovery might start. Investors have tried to find parallels with other global crises, such as wars and the 2008 Global Financial Crisis, but there is no easy comparison. We have never had such a long period of mandated economic inactivity.

Policymakers, led by the US Federal Reserve Board and the European Central Bank, have responded with aggressive monetary stimulus that has provided much-needed liquidity to panicked markets. Economies that can afford it have also introduced extraordinary fiscal measures. It is too early to say whether these measures will be successful or not, but the speed and co-ordination of global policy actions provide a small level of comfort.

Despite these measures, the economic implications of forced lockdowns are enormous. Do companies that are forced to close still pay rentals to landlords? Do they pay interest on loans to banks, or rates and taxes to local authorities? Do they continue to pay employees and for how long? The answers will be different depending on the country and the company, but it has created huge uncertainty in the minds of investors of how to value banks and property companies, for example.

Against this backdrop, the Balanced Defensive and Capital Plus delivered disappointing performance of -5.8% and -9.3%, respectively over the last year. We have not been able to protect capital, as most asset classes (except for cash) have delivered deeply negative returns. Going into this crisis, the funds were reasonably conservatively positioned, with Balanced Defensive at a 44% weighting in risk assets compared to a maximum weighting of 50%, and Capital Plus at a 57% weighting compared to a maximum of 70%. We were also below our maximum 30% offshore exposure in both funds, with Balanced Defensive at 22% and Capital Plus at 26%. This was because we felt that:

- Global equity markets were expensive after a number of years of strong multiple re-rating. In February, we felt that the market was being too complacent about rising Covid-19 risks, so we bought some put options on the S&P 500 Index.

- Global bond markets were yielding negligible to negative real returns.

- We were cautious on the earnings prospects of our domestic South African equity counters in a constrained growth environment. Within local equity exposure, the bulk of our holdings sat in the global rand hedge shares such as Naspers/Prosus and British American Tobacco/Reinet. We also protected some of our overall local equity exposure by owning domestic put options.

- We have been concerned about the ability of South African property companies to defend and grow their distributable earnings. Consequently, we had a very small exposure to the sector, which was mainly focused on those counters with defensive balance sheets.

- Local fixed income bonds were offering us attractive real returns, with our carve-out yielding more than 9%. With long-term inflation expected to remain in the 4% to 5% range, this yield met our inflation plus 3% to 4% return hurdle. The lower risk asset and offshore weighting was made up with the allocation to domestic fixed income.

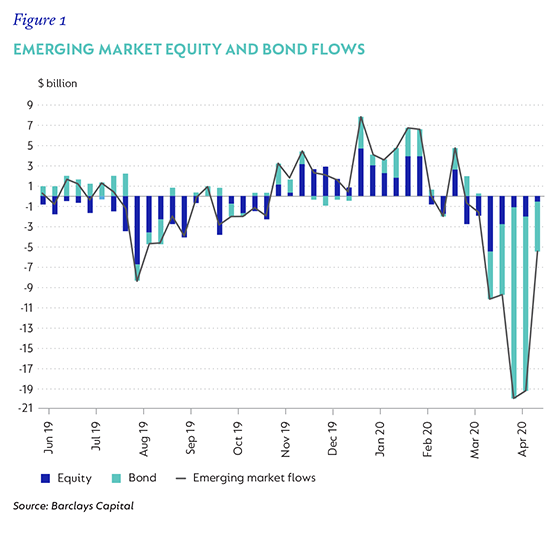

Unfortunately, this positioning was not nearly cautious enough and did not provide the capital protection or the stability in returns that we expected. Extreme global risk aversion led to a scramble for safe-haven assets and punished not just traditional risk assets but also led to wholesale outflows from emerging market bond funds (Figure 1). Foreign and local investors used relatively liquid South African fixed income assets as a source of funding. The volatility in the local bond market can be demonstrated by the 10-year SAGB yield swinging from 9.5% at the beginning of March to a high of almost 13% on 24 March. Our fixed income selection, which includes inflation-linked bonds (ILBs) and floating credit, performed far better than the ALBI, but was still negative for the quarter.

Within equities, our selection was also defensive. The two largest holdings, Naspers and British American Tobacco, held up well, as did the food retailers. However, the banks were very weak and detracted from returns. Overall, the equity portion delivered -18.3% and 19.4% for Capital Plus and Balanced Defensive, respectively, over the past year, compared to the -24.5% of the FTSE/JSE Capped Shareholder Weighted All Shar Index (Capped SWIX) benchmark.

HOW ARE WE POSITIONED NOW AND WHAT CHANGES HAVE WE MADE?

- We have increased our South African fixed income allocation. With the repricing in yields and by adding to our exposure, our fixed income allocation is now sitting at a yield close to 11%, which we think is extremely attractive when compared to a return from cash of c. 4.25% expected at the end of this year. We also do not expect a material increase in inflation over the next year or two, as the economy will be very weak. We acknowledge that domestic fundamentals have deteriorated with the Covid-19 crisis, but virtually every country in the world is facing a similar situation. Lower growth will contribute to an increased government debt burden and a widening fiscal deficit. We think local bonds have more than priced in these risks. Spreads look attractive versus South African cash, and real yields look compelling when compared to emerging market and developed market peers. We have a balanced mix of exposure across government and corporate nominal bonds and ILBs.

- We have removed our S&P 500 Index put position and, in the case of Capital Plus, some of our domestic equity put positioning as markets fell away. Other than these moves, there has been no increase in our global or local equity exposure yet. We will remain true to our investment style of adding to holdings where we see compelling long-term value. Once the contagion is contained, global equities could start to look past the short-term economic hit, especially with the support from large quantitative easing programmes, fiscal stimulus and low oil prices. Within local equities, equity selection will be critical. Many domestic companies will see their earnings bases severely re-set, with the Covid-19-related restriction of economic activity and the slump in global trade. After struggling with a muted economy for many years, the ability to cut costs and capital expenditure even further is simply not there or will materially hamper their recovery prospects. After rebasing our internal fair values, as well as our earnings and dividend expectations for the Covid-19 shock, our current basket of South African equity holdings gives us an upside to fair value of north of 60%. This is still very much skewed to the global rand hedge shares and, if valuations are compelling, we will recycle some of this into domestic companies.

- Global bonds remain terribly unattractive and, while property stocks have suffered an enormous derating, we have not added in this uncertain climate yet. As mentioned earlier, the knock-on effects of enforced lockdowns on landlords are still unclear and one of the consequences is far lower or no dividends for a period of time.

Social distancing measures, if enforced, should lead to a slowing in Covid-19 infection rates over the next month or so. It is hoped that they will spread the burden on the healthcare system and give more time for a combination of herd immunity to build, and for medical treatment, and finally, a vaccine to be developed. At some point, a slow return to normality (although there are still likely to be some social distancing measures in place) will start. Markets are forward looking and will anticipate a recovery. Investors should not wait for good news to be clear. By then the markets will have rallied already. Many companies’ share prices have reacted as though the current crisis is permanent and trade far below our assessment of fair value. There may well be more short-term pain, but trying to time the exact bottom is impossible.

In conclusion, the lack of capital protection from the funds over the last year was deeply unsatisfactory, coming mainly from the adverse events over the last month. The fixed income component performance was especially disappointing. Our expectation from this point is for asset prices to normalise, which will allow the funds to recover materially. It has been a volatile time in markets, but attractive valuations and yields cannot be ignored. We remain committed to only adding assets to our clients’ portfolios that we believe offer a sufficient margin of safety and are adequately priced for the underlying risk.

South Africa - Personal

South Africa - Personal