PERFORMANCE AND FUND POSITIONING

The Fund returned 5.3% in the first quarter of 2024, 2.9% ahead of the 2.4% return for the index (MSCI Emerging Markets (Net) Total Return Index). Over one year, the Fund outperformed the index by 0.9%, and over the past two years, the Fund has now outperformed the index by 4.3% p.a. We are encouraged by this significant improvement in relative performance, but there is still more to be done in getting the longer-term numbers up, and we are working hard to achieve this. In this regard, and given how cheap so many emerging markets stocks are in our view, we continue to find numerous attractive new ideas. Since inception close to 16 years ago, the Fund has generated outperformance of 0.5% p.a. Our objective is and always has been, to generate 3%+ p.a. outperformance (gross of fees) over all meaningful periods, and we continue to believe that this is very achievable. At the time of writing, despite the recent outperformance, the shares within the Fund still offer an aggregate weighted average upside of 65% in the currency of listing, which is well above the long-term average of around 40%.

The biggest contributor to outperformance (alpha) in the period was Latin American digital bank Nu Holdings (Nu), which returned 43% in the quarter and provided 1.1% alpha. We have held Nu in the Fund for almost two years, having purchased it during the big sell-off in its share price that occurred in Q2 of 2022 (at an average price of around $5 a share). This was about six months after its much-hyped initial public offering (IPO) when it peaked at $12 a share.

There were multiple reasons behind the sell-off that created the buying opportunity at the time. Interest rates were rising around the world in response to inflation spiking, Brazil was hiking rates aggressively, and, most significantly, Nu was still losing money, having yet to turn a quarterly profit. When the company expressed doubts about their ability to manage credit losses in a higher rate environment, it was unsurprising that the share sold off so heavily. We were (and still are) big believers in the long-term opportunity for Nu while also holding other names in the country's digital banking/payments industry (we featured Stone, another performance contributor, in our prior quarterly commentary). We bought a modest position (1.5%) into the Fund in the initial weeks, and as our conviction increased in subsequent months, we bought more.

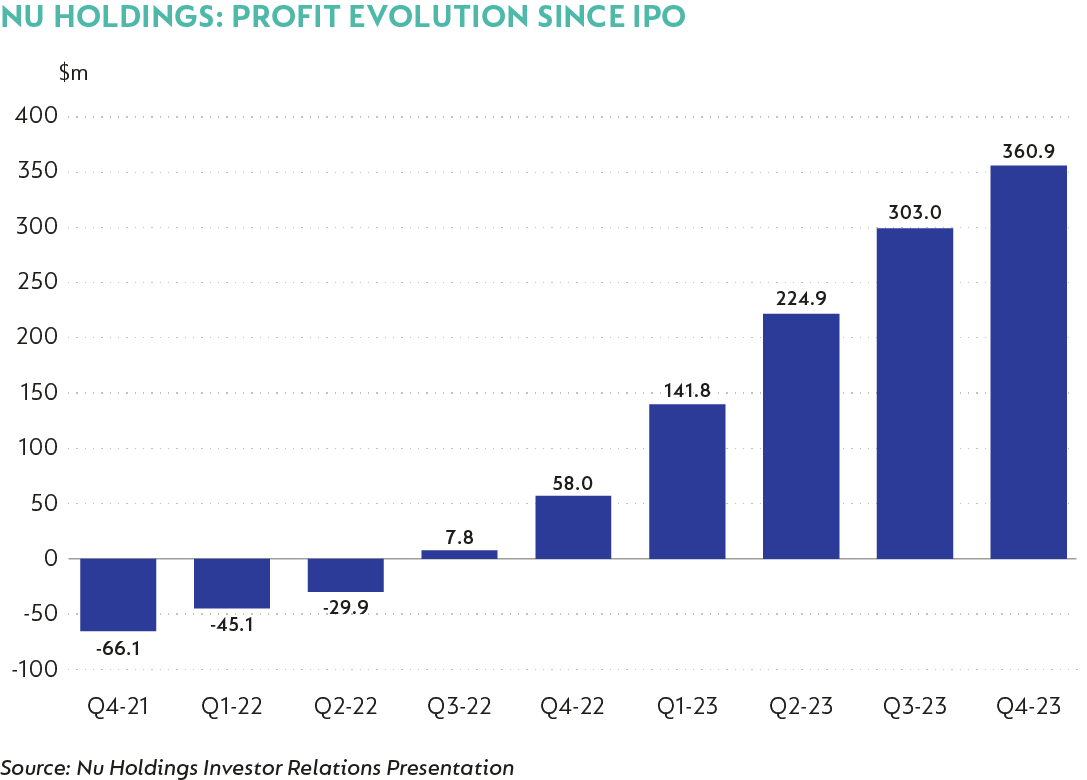

Having managed the worst of the cycle fairly well, Nu now seems to be firing on all cylinders, and, as a result, the share price is back to testing the highs that it reached in the immediate aftermath of its IPO. The simplest explanation for this turnaround is the sustained profitability of Nu. The graph below shows its profit evolution since going public, with the company making a profit of $360m in the last quarter of 2023 and over $1bn for the year as a whole. This was scarcely conceivable at the time of our initial investment.

The key drivers of this evolution in profitability are quite simple – Nu have kept costs per customer flat while revenues per customer have steadily increased. With Nu having doubled the number of customers it serves since it went public (to close to 100m customers at the end of 2023), absolute profits have come through strongly. Revenues have evolved far quicker than costs, and, hence, efficiencies (the cost-to-income ratio) have improved to best-in-class levels.

These are still the early days of Nu's journey. They believe they can increase their average revenue per customer from around $11 currently to $15 within the next few years. They are also very early in their journey in Mexico and Colombia, the former offering a similar market opportunity to Brazil, where they already bank half the adult population.

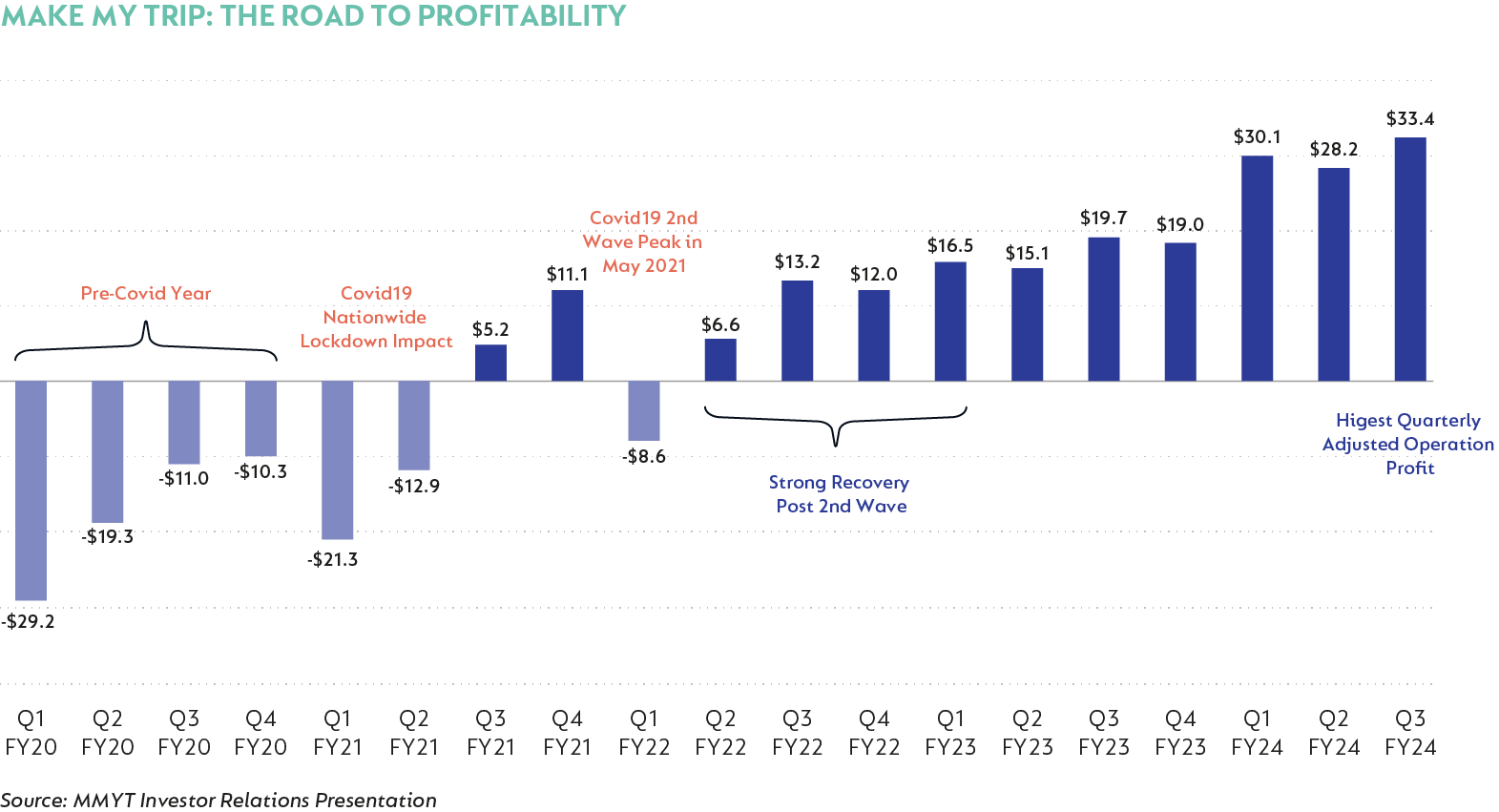

The next largest contributor to relative performance was Make My Trip (MMYT), an Indian Online Travel Agency (OTA). MMYT returned 51% in the quarter, contributing 0.7% to alpha. Over the last year, MMYT has returned almost 190%. Having lagged the broader Indian market, the share has finally taken flight. MMYT has benefited from the quick normalisation of travel within India post-pandemic. Furthermore, as the middle class grows, the proportion of the population that can afford to travel increases significantly. Their first-mover advantage and detailed local knowledge mean the international OTAs (Expedia, Booking.com) are largely irrelevant in India. MMYT has multiple brands to cover all potential travel situations, from air ticketing and hotels (the traditional travel case) to foreign exchange services and rail travel. During the pandemic, the company was forced to take a knife to costs and, as a result, has become sustainably profitable ahead of schedule.

We have been reducing the share price methodically over this period as it approaches our fair value. Besides valuation, we are also mindful that customers are very focused on price, and therefore, the first-mover advantage may not be as enduring as that of other internet businesses. The steady downward pressure on "take rates" (commission) for flights is a good indicator that pricing power is hard to maintain and may eventually feed through into hotel bookings.

Other material contributors to alpha were Airbus (0.6%), Bank Mandiri (0.5%) and ASML Holdings (0.5%). In the case of Airbus, the company now has a close to 60% share of new orders for narrowbody planes, well ahead of its only real competitor, Boeing. Airbus also benefited from the safety scares that engulfed Boeing since a maintenance-related issue in January.

The biggest detractor in the quarter was HDFC Bank, India's largest private sector lender and the second largest position in the Fund at the beginning of the year. The share returned -16% in the period, costing the Fund 0.9% alpha. HDFC now trades on around 15 times one year forward earnings, representing a slight discount to the no.2 private sector lender ICICI Bank, despite having a far superior franchise and execution track record. We are therefore confident in the long-term upside of the investment case from current levels.

Other material detractors for the quarter were PEPCO, which returned -32% for -0.8% alpha impact, and AIA, the pan-Asian insurer (-0.6% alpha). Also notable was Pinduoduo, which returned -20% and cost 0.5% alpha. PEPCO is particularly disappointing as it has given back all its gains it made in the fourth quarter. We continue to engage with management and undertake independent analysis with a view to establishing whether the operational issues are temporary or more indicative of long-term underlying problems with the business model. PEPCO now trades on 11 times our 2025 earnings forecasts.

AIA has been dragged down by negative sentiment towards China, and we have been adding to it as the valuation has become even more attractive in our view (only 40% of the business is China-dependent). In Pinduoduo's case, the main cause of the decline seems to be concerns about a huge increase in tariffs and other barriers to entry for its international ecommerce operation Temu, with US presidential hopeful Donald Trump proposing 60% tariffs on all Chinese goods. Temu's current exports into the US don't attract any taxes as they are below the parcel threshold at which customs duties kick in (average order value is $40 vs the $800 at which tariffs kick in). At the margin, this is negative for Pinduoduo, but Temu is only a part (20%) of the overall investment case, which is premised more on Pinduoduo's incredible execution in its home market. Finally, although it was the second largest position in the Fund, the underweight in TSMC cost the Fund 0.5%.

There were a number of new buys in the quarter. In China, we bought China Resources Beer and Anta Sports (2% combined weight, both having declined substantially over the past year and both bought on around 15 times 2024 earnings), as well as local Chinese car brand BYD. The Fund also bought a 2% position in SK Hynix, a strong no.2 in the semiconductor memory industry (DRAM and NAND). After a cyclically weak period for memory prices, the cycle seems to have turned strongly in their favour, with capacity shortages and rising selling prices. There is also potential for significant capacity shortages as manufacturers scramble to meet demand from NVIDIA and other AI players for high bandwidth memory, which uses much more of their scarce manufacturing capacity and, therefore, supports higher prices in the future. In spite of the very positive medium outlook for SK Hynix and the memory industry in general, it trades on only 11x forward earnings.

Finally, the last notable buy was Kazakhstan's Kaspi (1.7%). We are very familiar with the company as other Coronation strategies have owned it since it went public in late 2020, but the secondary listing in New York greatly improved investability for us, with low liquidity previously being a hurdle. Kaspi has established itself firmly as the leading in-store and ecommerce payment provider in the country, with a hard-to-fathom 90% share of the adult population as customers. Fully 60% of retail payments (by volume) go through its system. It offers everything for both consumers and merchants, including inter-party payments, bill payments, "Buy Now Pay Later (BNPL)", ecommerce, and regular online consumer banking. Despite offering reasonably predictable earnings growth of above 20% p.a. over the next five years (the market is very under-penetrated), it trades at only 10 times earnings and offers a 7% dividend yield.

We sold out of two of the Fund's Indian holdings (Apollo Hospitals and TVS Motors), both on valuation grounds in what appears to us to be a very expensive Indian market. We also sold out of Adidas, bearing in mind that we did buy a new position in Anta and, from an overall portfolio risk point of view, wanted to keep a limit on the Fund's overall Chinese sportswear exposure – China is a key driver for Adidas. After the controversy surrounding the aborted arrangement with Kanye West and a change in CEO, Adidas performed very strongly in 2023 with a 40% return. This provided us with a funding source for other more attractive risk-adjusted expected return ideas.

DisclaimerSA retail readersComprehensive fact sheet

South Africa - Personal

South Africa - Personal