The Fund returned 2.9% during the first quarter of 2025, which was in line with the return of the benchmark MSCI Global Emerging Markets (Net) Total Return Index. Over the past three years, the Fund has now returned 2.6% p.a., comfortably ahead of the 1.4% p.a. return of the benchmark. We remain committed to improving the five- and 10-year relative returns, both of which are below the market return. Since its inception in July 2008, the Fund has outperformed the benchmark by 0.2% p.a.

The sell-off in technology, and specifically semiconductor stocks, was the big theme in global markets in the quarter (and has continued post quarter-end), and with the Strategy being 4.5% underweight TSMC relative to its 10% benchmark weight, the -16% return from TSMC in the quarter ended up being the biggest contributor to the Fund's outperformance in Q1 (0.9% positive relative contribution). We have made the point a few times that whilst we believe that TSMC is a great company and its role in keeping the world going is indispensable (no one else can make the high-end chips that go into all the advanced electronics the world uses), a 5-6% position (as opposed to an 'overweight' 10-12% position) was appropriate given TSMC's valuation, other opportunities in Emerging Markets, and the geopolitical risk of having 95% of its production based in Taiwan (including almost all the high-end chips). Historically, TSMC's stellar share price performance has cost the Fund relative performance (-1.5% in 2024 as an example), but the sharp decline so far this year has now benefited the Fund on a relative basis. With TSMC at the time of writing down 30% YTD and trading on 13x this year's earnings, we have been slowly adding to the position.

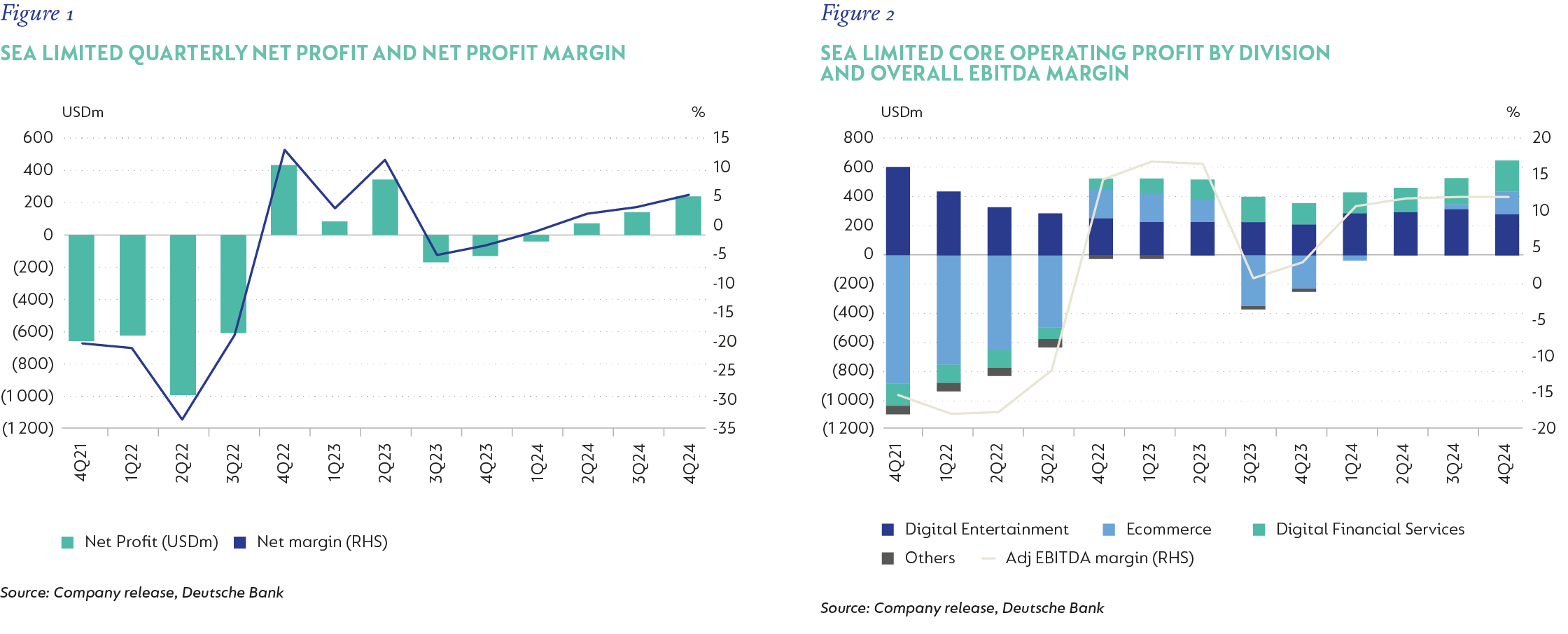

The second largest contributor to relative performance was SEA Limited (SEA), which returned 23% and provided 0.7% of outperformance. SEA reported great results for 2024, and this, together with raised guidance for 2025, was a big driver of the upward movement in the share price. For the year as a whole, revenue was up 29% on 2023, but in the fourth quarter of 2024, revenue growth had accelerated to 37% year on year (YoY).

Most pleasingly, having been in the "loss-making" categorisation of the Fund from the time it was first bought, SEA has now graduated into the profitable camp with all divisions making a positive EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation) contribution and net income being positive for the last three quarters as well as for 2024 as a whole. For 2025, SEA management has guided to around 20% growth in Gross Merchandise Value (GMV) in ecommerce, and after some time of heavy pressure in their Digital Entertainment (gaming) business (the cash cow that has funded all their other ventures), they have guided to double-digit revenue growth there. At the end of March, SEA was a 4% position in the Fund.

Other material positive contributors were MercadoLibre (MELI; 15% return, 0.6% positive contribution), JD.com (18% return, 0.5% contribution) and Tencent Music Entertainment (26% return, 0.5% contribution). In the case of MELI, the positive share price movement was a reversal of what we saw in the fourth quarter, with the Brazilian real strengthening (Brazil is its most important market) and Argentina continuing its stabilisation programme under the Milei government. In the fourth quarter, MELI saw revenue grow 37% YoY, with Brazil up 38% and Mexico up 43% (both YoY). Net income for the quarter was almost 4 times higher than that of the comparable quarter in 2023. MELI continues to grow its market share in a growing market despite its already large size. Its years of investment into growing its ecosystem of sellers as well as improving its logistics and fulfilment capabilities (getting packages to buyers) have seen its market share increase to 42%. SEA's competing Shopee operation has also grown its market share strongly in Brazil and is now the number two player, having overtaken Magazine Luiza.

The biggest detractor in the period was Alibaba, which the Fund does not own but is now, after a 55% upward move in the quarter, a 3.3% weight in the benchmark. This underweight cost the Fund 1.2% relative performance. There are a few reasons why we haven't owned Alibaba (the Fund sold out of Alibaba in mid-2022), but the short summary is that, firstly, the Fund already has positions in JD.com and Pinduoduo (both China ecommerce) and from a portfolio risk point of view, we wish to limit overall Fund exposure to any one sector in a single country. Secondly, Alibaba has bled ecommerce market share to JD.com and Pinduoduo, as well as the live streaming companies like ByteDance. Having been highly dominant with 90% market share a decade ago, Alibaba now has less than 40% share of a much larger market. Alibaba has derated massively over time as its growth slowed and it spent more and more on its cloud and other divisions. The decision not to own it has largely been correct. It is therefore important to understand what changed in such a short period of time to warrant a 55% move in the share price.

In our view, there are two main developments. Firstly, the Chinese government appears to be far more positively predisposed to Alibaba and the private sector in general. We have previously discussed the broader evolution in thinking by the government to the private sector as the Chinese economy has slowed, but in Alibaba's case the rehabilitation of the founder Jack Ma is a significant positive development – he appeared onstage with China's president at a high profile government event in mid-February, having become almost invisible since their financial services arm Ant Financial had its high profile initial public offering pulled by authorities in 2021. The second main development was the announcement by China-based DeepSeek that they had produced AI models on par with those of Open AI in the US at a fraction of the cost. This set off a scramble for AI investment in China, and in Alibaba's results release in February, it was announced that they would be spending RMB380bn (about $50bn) in capex on the cloud segment over the next few years. This announcement is largely what drove the increase in the share price. Although there is potentially significant opportunity in Alibaba, we are a bit more circumspect on the company's long-term moat in AI. China's state-owned entities have invested heavily in cloud infrastructure, as have private sector entities like Baidu and Tencent. It is therefore far from certain that the heavy spending announced on cloud capex will generate meaningful financial returns for shareholders. The deeper issues with market share losses to better operators in ecommerce remain unchanged. We therefore retain our existing exposures to China ecommerce via JD.com (4.1% of Fund) and Pinduoduo (1.7% of Fund).

The Turkish hard discount retailer BIM returned -19% in the quarter and cost 0.6% of performance. Most of this move took place in mid-March when Turkey's flawed democratic credentials were worsened by the arrest of the country's leading opposition politician, the Istanbul mayor, who was about to be nominated by his party as their next candidate to take on the current president, Recep Tayyip Erdogan. The charges against the mayor are widely believed to be false and aimed at keeping him from challenging the incumbent, who has led the country in some form or another for over 20 years. The stock market and currency both fell sharply, but subsequently recovered some of their losses.

We do not believe these negative political developments materially alter the long-term value of BIM. Historically, periods of currency weakness and high inflation have benefited this business as its value proposition becomes even more compelling in times of hardship. Our main concern has always been that unorthodox monetary policy destroys the value of the currency, since we seek market-beating returns in dollars from the investments in the Fund, and from this perspective, the monetary authorities have stuck to high interest rates to bring down inflation and protect the currency.

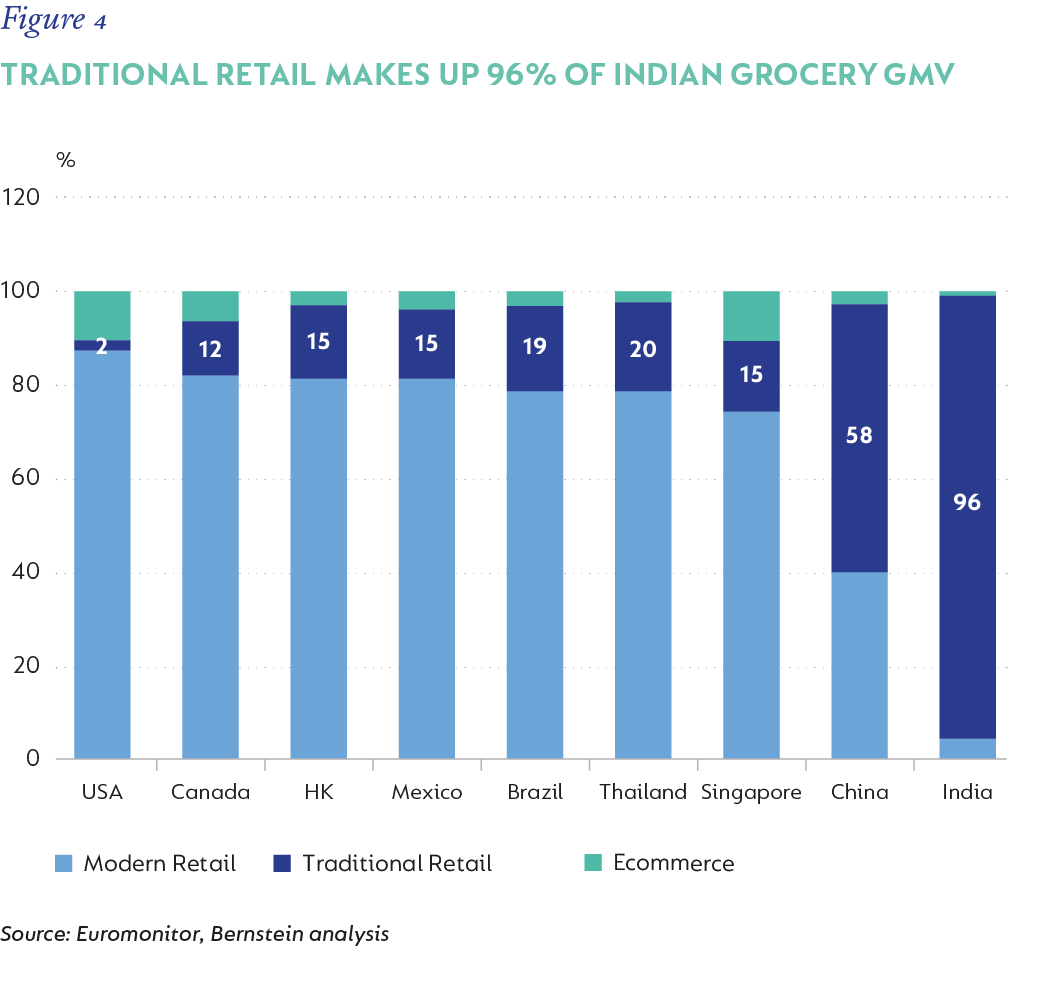

This ended up being a reasonably busy quarter in terms of new buys and sells. This is to be expected in a volatile market, where opportunities are constantly evolving. In India, the Fund bought the two leading food delivery companies, which effectively operate as a duopoly: Zomato (a previous holding that was sold) and Swiggy, a new listing that is part-owned by Prosus. These two businesses are now collectively 1.2% of Fund. Our thinking on the opportunity for these two stocks has evolved over time as we have come to appreciate that their addressable market is much wider than just food delivery. India is the third largest grocery market in the world, and 95% of it is informal, with small "kirana" stores (unbranded traditional convenience) dominating the sector. Less than 1% of sales are via ecommerce. The market opportunity here for Zomato and Swiggy is unparalleled, and they offer better selection and prices already, with the potential to take a significant portion of this market online.

With continued good execution, there is no reason why quick commerce cannot get to 5% market share within the next five years (from 0.3% in 2024), which implies one percentage point in annual market share gains in an overall market that is also growing strongly. Zomato and Swiggy are in a strong position to capture a large share of this, and together with their lead in food delivery, we believe they offer compelling long-term upside.

Partly as a hedge against heightened volatility and strained geopolitics (Russia/Ukraine, the Middle East, US tariffs, China/Taiwan) we bought AngloGold back into the Fund (having previously owned it for a long period) and the purchases, together with strong share price performance, meant this was a 1.7% position by quarter end. Gold mining stocks are often very frustrating investments – one doesn't always get the full benefit of higher gold prices feeding through to stock returns, but we believe AngloGold has ample self-help opportunities and the position brings some valuable diversification to an investment portfolio given that AngloGold's earnings are geared towards changes in gold prices (the cost of digging the gold out of the ground doesn't change significantly in the short term, but earnings can swing wildly up or down with gold price moves). At spot gold prices of around $3 100 an ounce, AngloGold is trading on 6x forward earnings and offers a 5% dividend yield. Even at a gold price of $2 500, AngloGold is still attractive.

Other new buys included New Oriental Education (0.9% at quarter end), Galaxy Entertainment (Macau gaming; 0.7% at quarter end) and TBC Bank in Georgia (0.6% at quarter end). To fund the buys several names were sold with the most material sales to zero being ICICI Bank in India (1.4% at the start of the period, got closer to fair value), Samsung Electronics (1.1%, due to concerns over execution) and Yum China (1.0%, close to fair value).

We remain very positive about the long-term prospects for the Fund, with the upside at 90% at the time of writing in early April and the potential return (IRR) of 22% p.a., which are well above the long-term averages.

ASSESSING THE IMPACT OF TARIFFS ON FUND HOLDINGS

At the time of publication, there is extreme market volatility driven by the ever-changing situation regarding the "reciprocal" tariffs the US has proposed to implement against the rest of the world. These were then delayed for 90 days, except for China, but the new standard 10% rate remains across the board for other countries. We can take no definitive long-term view on where these tariffs end up, but for now, it does look like China will be more affected than anyone else out of the major exporters to the US. Tariffs are unlikely to deliver on their stated goal of returning large-scale manufacturing to the US, particularly of low-value-added consumer goods. The economics of producing these goods in the US, where labour costs in manufacturing are 4- 20x higher than in emerging markets, means that such goods will always be far more expensive to produce in the US than elsewhere. For China, because it is more affected, we have carefully assessed the impact of tariffs on each of the Chinese holdings in the Fund. China's exports to the US make up less than 3% of its GDP. This is meaningful but manageable. There is very little direct exposure to US trade within the Chinese holdings in the Fund, most of which are fully domestic operations, with the few stocks with large non-China exposure mostly exporting to, or operating in, the rest of Asia and/or Europe.

South Africa - Personal

South Africa - Personal