Personal finance

Investing in income funds

Understanding your chosen fund’s risk and return targets is key.

The Quick Take

- Income funds form part of a well-diversified portfolio; with the degree of exposure determined by your risk appetite

- There are many options to choose from, which means that investors and their chosen fund/s' objectives need to be aligned

- Coronation Strategic Income suits investors who prefer a conservatively-managed income portfolio with less interest rate sensitivity than a bond fund

- We take a measured approach to risk in order to outperform cash through the cycle and deliver positive performance over 12 month periods

Income funds have an essential role to play in an investor’s toolkit. However, fixed income assets still face their own set of risks. And investors have their work cut out to choose the most appropriate fund from a much greater set of options today.

We discuss fixed income assets and their risks in an accompanying article in this edition of Corospondent, while this article focuses on how we balance the risk and return objectives of our flagship income fund, Coronation Strategic Income.

MANY OPTIONS AND INCREASINGLY VARYING INVESTOR OUTCOMES

Income funds sit somewhere between a money market fund and a bond fund on the risk-return spectrum. Managed income funds housed in the ASISA - Multi-Asset - Income category were the most popular type of fund amongst domestic investors over the past decade. These portfolios can invest in a wide variety of assets, such as cash, bonds, listed property and even equities, with the primary objective of maximising income on behalf of investors. The category allows for a high level of flexibility, allowing portfolios to invest as much as 45% offshore, 10% in equity and 25% in listed property.

Increasing demand in this space has resulted in a wider variety of available fund options (with increasingly varying investor outcomes, both in terms of risk and return). As a result, the category now comprises a significantly less homogenous set of options compared to a decade ago, with differing risk and return profiles.

WHERE DOES CORONATION STRATEGIC INCOME FIT IN?

The Coronation Strategic Income Fund is a multi-asset class income fund with explicit risk and return objectives. These are closer to the classic definition of an income fund, aiming to meet the needs of an investor seeking a conservatively managed fund (with a strong capital preservation and risk management focus) that aims to outperform cash (or traditional money market funds) by 2% through the cycle, while aiming to produce positive returns over all 12-month periods (Figure 1).

The Fund is therefore suited to investors who can stomach more volatility than a money market fund, with a time horizon of between 12 and 36 months, but who require significantly less interest rate sensitivity than a bond fund. As such, the Fund’s interest rate sensitivity (or duration) is less than two years.

In order to meet its clear set of objectives, the Fund combines disciplined portfolio construction with a limit on more volatile asset classes. These guardrails include:

- No more than 10% can be invested in listed property;

- No more than 10% effective exposure to offshore bonds/cash; and

- Typically no equity exposure.

DISCIPLINED PROCESS

To meet our investors’ return objective of cash plus 2% over the medium term, we need to put some of the Fund’s capital into riskier asset classes. However, as part of our disciplined portfolio construction process, we never aim to increase our income funds’ risk profile or performance by increasing the possibility of investor downside.

This means that we won’t attempt to deliver more than cash plus 2% if we believe it will put our capital preservation commitment at risk or result in us underperforming cash. To achieve this, we use quantitative modelling to arrive at a blend of assets that allows us to meet our risk/return target with a high degree of certainty.

The need to put capital at risk through the portfolio positioning decisions also means that the Fund will not have a linear return series like that of a money market fund. Over short measurement periods, capital at risk can fluctuate. For example, rising interest rate environments make it more challenging to provide cash plus 2% (as has been the case since November 2021), while when rates are falling, it becomes easier to achieve this goal. However, we are confident that we can consistently deliver cash plus 2% through the cycle.

TAKING CONSIDERED RISK

As a demonstration of our considered approach to risk-taking, we discuss two current examples of how we are allocating within the bond space below.

1) SA government bonds still warrant a (smaller) holding

Despite attractive valuations, the risks underlying the investment case for South African government bonds (SAGBs) have increased considerably (also discussed in more detail in this quarter’s Bond Outlook).

The increase in risk stems primarily from:

- The country’s deteriorating fiscal outlook (read more about default risk);

- Inflation remaining above the midpoint of the SARB’s target band (read more about inflation risk); and

- The prospect of higher rates for longer in SA and worldwide (read more about interest rate risk).

Taken together, this will weigh on government’s ability to borrow in the bond market and, in turn, quite heavily on bond yields.

However, we have seen some adjustment in the valuation of bonds relative to other emerging market countries. The current administration has some levers that it could pull over the next couple of years to fund the government debt, meaning that there is some runway before hitting the point of a possible default.

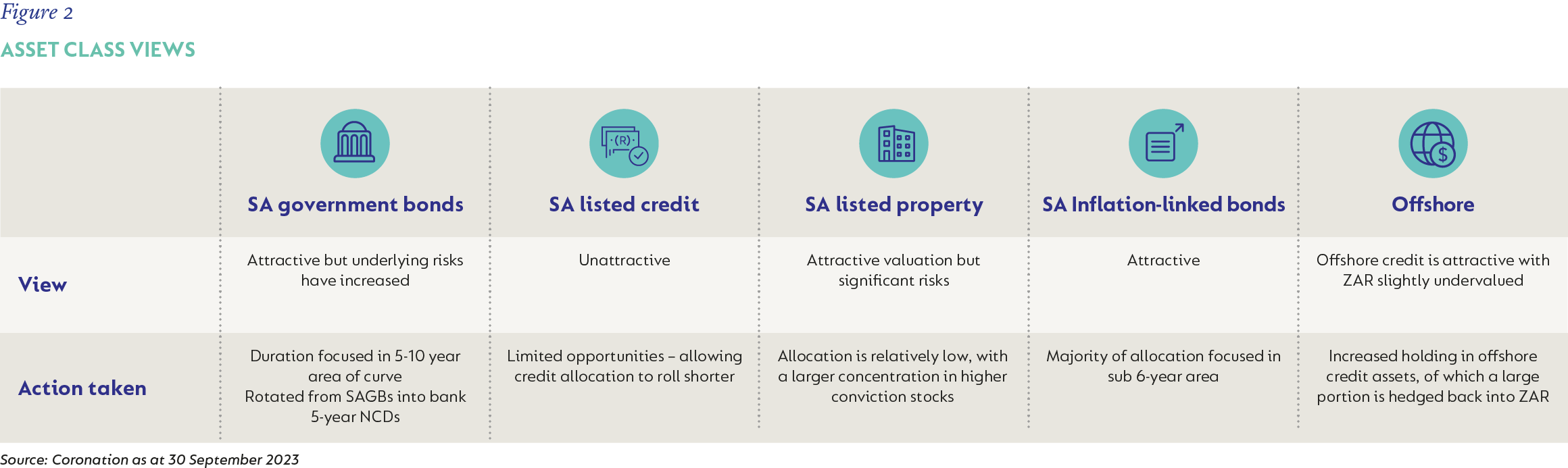

But in an acknowledgement of the risks that are inherent in the bond market, we have reduced our holdings in SAGBs from a high of 20% a year ago to about 14.2% today, and have rotated most of that into five-year negotiable certificates of deposit where we are seeing attractive value, as well as improving the Fund’s liquidity profile and diversification (see Figure 2 below).

2) Finding better alternatives to SA-listed corporate credit

For several years, we have viewed SA-listed credit as unattractive and continue to hold this view. In an improving economy (which typically coincides with a rising interest rate environment), the spread on good quality corporate credit tends to narrow, creating the opportunity to achieve capital gains and buy good quality credit at spreads that enable us to achieve our cash plus return target.

However, despite the poor fundamental backdrop in SA, credit spreads have continued to tighten this year as net supply has dwindled. We believe this compression in both yields and term premiums indicates a market that is hungry for yield at any cost and not what one would expect in a poor economic environment (read more about credit risk).

The compression in bank credit spreads has also been quite dramatic, and although banks remain well capitalised and very far from failure, we feel current pricing to be too optimistic.

Given their tight valuations, we consider current domestic credit spreads unattractive and see better alternatives in which to utilise our credit budget offshore, where the current pricing of global interest rates and credit markets offers investors an attractive, risk-adjusted opportunity.

DELIVERING WHAT IT SAYS ON THE TIN

As we have demonstrated above, allocating to instruments or fixed income asset classes with a higher expected return than cash requires careful analysis of the prevailing market environment and the inherent risks of a particular asset class, and then dynamically (or actively) adjusting exposure when the return profile of these asset classes changes (as indicated in Figure 2).

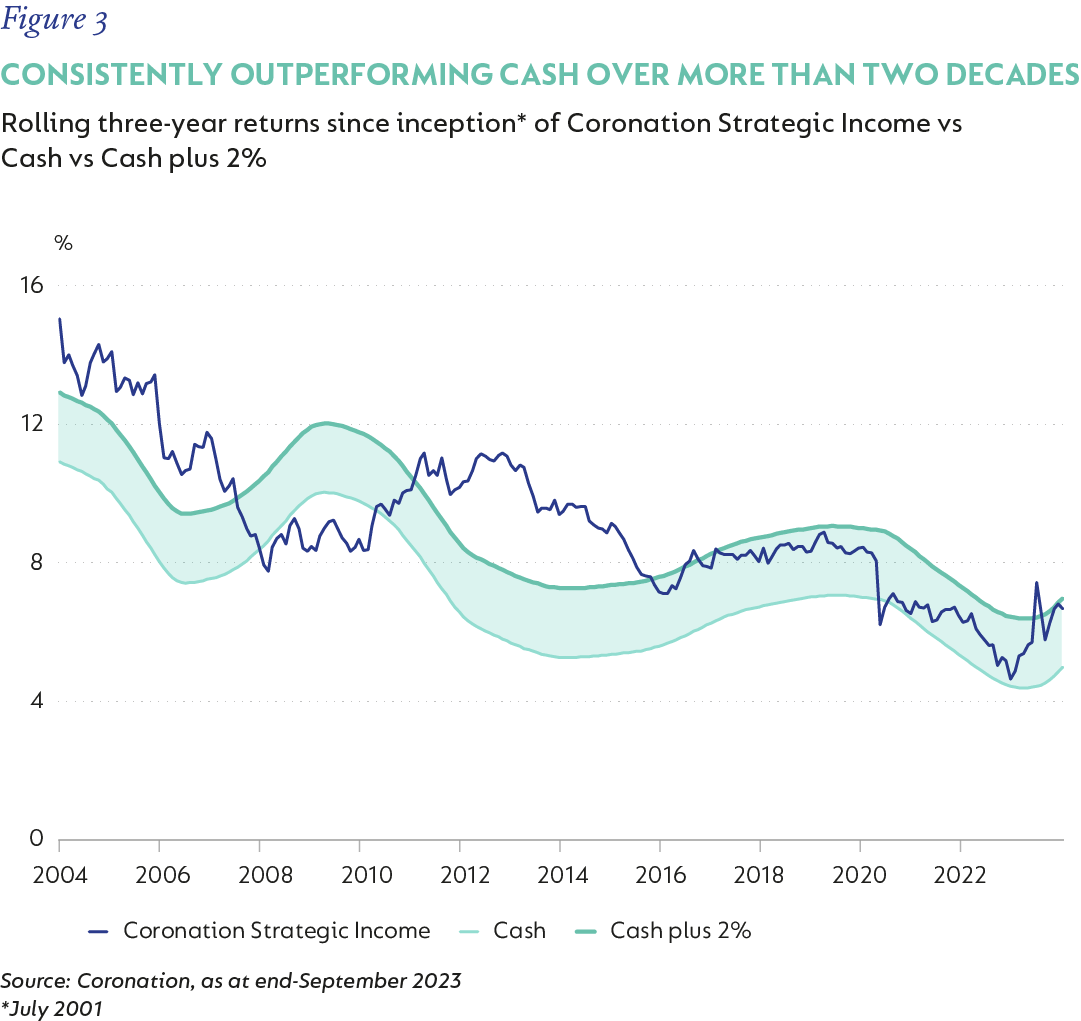

The success of this approach has resulted in a track record of outperforming cash by 2.2% p.a. since inception over its more than 20-year history. Similarly, when measured over rolling three-year periods, the fund has consistently performed ahead of cash as shown in Figure 3.

Read more about Coronation Strategic Income or its USD equivalent in our Corolab Investment Guide.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal