PERFORMANCE

The Fund outperformed the benchmark MSCI Global Emerging Markets (Net) Return Index by 4.4% in the quarter to end September 2022, returning -7.2% compared to the index’s return of -11.6%. Over six months, the Fund is +0.9% ahead of the benchmark. Although this is a very short-term time period, we are pleased that after a tough 15 months (end-March 2021 to end-June 2022), the Fund’s performance has improved considerably. The impact of the difficult 15-month period remains visible in the three- and five-year relative returns, where the Fund has fallen behind the benchmark by varying margins. Since inception over 14 years ago in July 2008, the Fund performance is in line with the benchmark. It is worth noting that up until March 2021, the Fund had outperformed the benchmark by 2.4% p.a. and was comfortably ahead over three, five and 10 years at the time, highlighting again that the significant underperformance since then has been concentrated within a relatively short time period, in large part (but not solely) driven by Russia (60% of the underperformance over the past year).

As a reminder, we have written down the Fund’s Russian exposure to zero, so there is now only upside optionality in this regard. Foreigners are not yet able to trade on the Moscow Exchange, but one can observe what Russian stocks are being valued at by local participants on the Moscow Exchange. Using current Moscow Exchange spot prices for the Fund’s Russian holdings and for the exchange rate, these stocks would be a material 12% of the total value of the Fund today. One can argue that until foreigners can participate, these are not real prices – as a counter, however, the trading volumes are reasonably high in most stocks, so one has reference market prices that are being set by willing buyers and sellers, with good volumes behind the transactions. This 12% of total Fund value is of course theoretical until we can actually trade in Russian stocks and repatriate the proceeds. We still have no indication as to when this might happen. Three of the Fund’s Russian holdings that are not domiciled in Russia and have listings in the US and UK (Yandex, X5 and TCS) are exploring listings on alternative exchanges (typically on the Hong Kong Exchange) and this eventuality over the medium term could result in value being realised. For the rest of the Fund’s holdings that are Russian domiciled and listed (with Magnit being the biggest position by far), one would likely need a resolution to the war before value could potentially be realised. From an operational point of view, the sanctions have had little impact on Magnit’s business – it grew its revenue organically by 19.7% in the three months from 1 April to 30 June 2022, with like-for-like (LFL) sales growing 13.1% during this period (compared to the 12.0% LFL sales in the January to March 2022 period). The LFL performance in the April to June period was in fact the company’s best performance in this regard over the past five years. July and August have then seen a further acceleration on the April to June LFL sales performance.

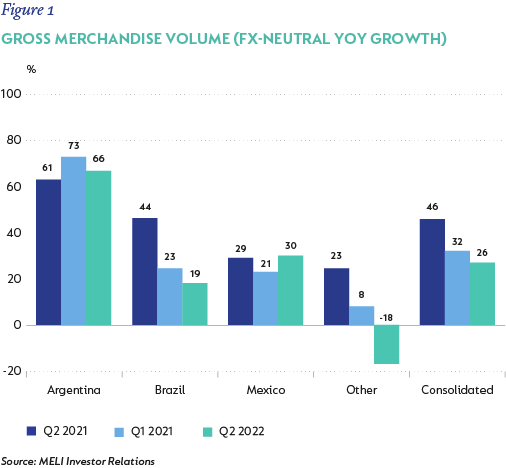

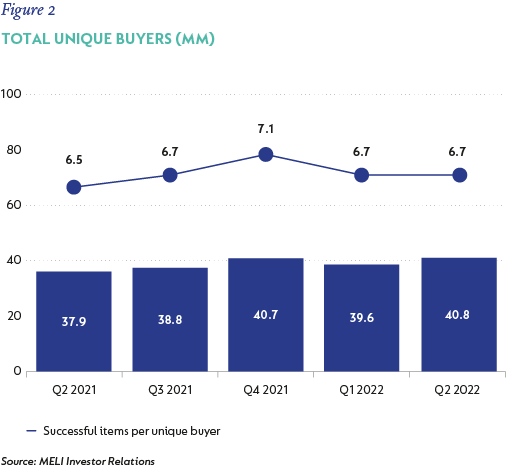

The biggest contributor to relative return in the quarter under review was pan-Latam ecommerce and fintech group Mercado Libre (MELI). After selling off heavily in the second quarter as part of the rout in global technology stocks, MELI returned close to 75% over the subsequent two months from the bottom in mid-June to the peak in mid-August. We added significantly to MELI during the sell-off (as we did to a few other high-conviction technology-related/loss-making stocks that sold off heavily) and therefore benefited from this rebound. The realised return for the Fund from MELI was +31% in the quarter and it contributed 1.4% to relative return. The primary driver of MELI’s quick share price recovery was the exceptional operational and financial results release for the second quarter. Many ecommerce-related operations across the world have struggled to deliver strong growth as their comparison periods (the base) from 2020 and 2021 included abnormal pandemic “super volumes”. This was not the case with MELI, which saw gross merchandise volume (GMV) grow 26% year on year (yoy), including 19% growth for the largest market Brazil. This is after they also had an exceptional pandemic period.

Importantly, the operational results were not driven by heavy promotions to sustain volumes. Operating profit rose 51% yoy, mostly driven by GP margin improvement and MELI’s fintech platform, which saw net revenues more than double (+113%). At the start of the year, MELI was only a 1.4% position in the Fund given its far less attractive valuation than is the case today. Over the past several months, we have been adding to the position as the stock declines (now down 40% YTD even after the recent rebound), resulting in the 3.9% position in the Fund today.

The next largest contributor was Petrobras, the partly state-owned Brazilian oil company. Petrobras returned 28% in the quarter and contributed +0.8% to relative return. Most of this return was due to dividends – Petrobras paid around $3.20 in gross dividends per ADR during the quarter on an opening ADR price of $11.60. This equates to an astonishing dividend yield of 27% in one quarter alone as oil prices were very high in the first half of the year and Petrobras was able to pay out these super profits as dividends. The realised return from dividends in the Fund would have been a bit lower due to various withholding taxes, but the overarching point - that the share is incredibly cheap at current oil prices - remains relevant. Petrobras trades on 3x earnings and, due to limited large scale required capital expenditure, converts all of this into free cash flow, which equates to a 33% forward dividend yield. Investors place such a low valuation on this asset due to a combination of expected declines in the oil price and the prospect of left winger Lula da Silva returning to the presidency after the second round of elections due on the last Sunday of this month (October). While both of these do pose a risk to Petrobras, we believe they are more than compensated for in the current share price. Due to the limited capital investment programme at Petrobras - the company spent the last decade developing one of the biggest oil finds in recent history - Petrobras is still highly cash generative, even at $70 a barrel, which we believe is below a ‘normal’/sustainable oil price due to significant underinvestment in developing new oil fields around the world since the Global Financial Crisis. Oil fields have reducing yields over time, and with many developing nations having seen their output fall (Venezuela, Nigeria, Iran), a glut of oil that suppresses prices is unlikely to occur on a sustained basis. With respect to the potential return of Mr. da Silva, it is worth noting that his first stint in the presidency (2003-2010) was fairly centrist in nature and the congressional elections returned a slight majority for allies of the incumbent (pro-business) president, who will limit the potential for damaging intervention at Petrobras. The above all said, political risk does exist, and this reality results in the position size being limited (2.2% of Fund currently) in spite of the very cheap valuation. Other Brazilian assets also featured within the top 10 contributors. Cash and carry operator Sendas returned 19% for a +0.7% relative return contribution, while there were also +0.3% contributions from each of Nu Holdings (a digital bank) and XP Inc (broad financial services company).

Outside of Latin America, the Fund benefited from its holding in Coupang, a Korean ecommerce retailer. This is a smaller position (2% of Fund) than MELI, but returned a similar amount (+31%) and contributed +0.7% of relative return. A large part of this positive return is the effective reversal of the share price decline seen in the previous quarter; however, the positive contribution in the third quarter far exceeded the negative impact in the second quarter (i.e., the two-quarter impact was strongly net positive) as we had bought a large part of the position at the share price lows in May/June. Coupang went public in early 2021, with the share price peaking shortly thereafter at around $ 50. We did work on Coupang pre the IPO and concluded that as much as we liked the business, it was far too expensive. It was the 70% decline in the share price since then (from $ 50 to $ 17 today) that brought it into buying range for us. Coupang (the #1 ecommerce operator in South Korea) is one of many such stocks (that we would simplistically describe as loss-making long duration stocks) that were very expensive a year ago in our view, but that have now become attractively valued given the share price declines of 60% to 80% in these stocks. In aggregate, these stocks (which would include MELI, Coupang, Delivery Hero (food delivery in 80 countries, mainly EM), SEA (SE Asia gaming and ecommerce), Nu Holdings (Brazilian digital bank), Make my Trip (India online travel) and Zomato (India food delivery) have gone from being 3% of Fund in aggregate a year ago to 14% of Fund today. In fact, we did not own many of these (Coupang, SEA, Nu Holdings, Make My Trip, Zomato) at all 1 year ago. In contrast today, given the collapse in their share prices, we believe these stocks present some of the most attractive opportunities in emerging markets.

Of the large emerging market constituents, China performed the worst during the quarter, with the China portion of the benchmark returning -22.5%. There are a multitude of reasons for this, such as the continued “zero-Covid” strategy being pursued by the government at all costs, the turmoil in the property market (and knock-on impact on the banking system) and the increased restrictions being placed on technology transfers to China by the US. Having been the standout emerging market for much of the last decade, the country has seen its equity market derate significantly relative to other countries. The Fund’s exposure to China is primarily within the technology sector - either directly through large fund holdings like JD.com or indirectly via Naspers and Prosus, which continue to trade at a discount to the look-through value of the Tencent stake owned by Prosus. We wrote extensively in the prior quarter about the narrowing of this discount, which continues to apply as Prosus buys back shares using cash resources and the sale of Tencent shares. We believe that Prosus should be trading at a premium to the value of the Tencent stake since the other assets it owns (Delivery Hero, OLX, PayU and iFood, to name just a few) have real and identifiable market value – on aggregate, these assets make up roughly 30% of our own fair value for Prosus. For so long as Prosus is buying back shares, the value accretion to shareholders is significant, especially since Tencent is also buying back shares and therefore Prosus’ stake in Tencent is not declining at the current rate of share repurchases by both parties. The Fund did well on a relative basis from being less exposed to China than the benchmark (the “country allocation”) and, importantly, did even better from stock selection, with the stocks held in the Fund outperforming on a relative basis. This is what one would expect from an investment style focused on bottom-up stock selection. As an example, not owning Tencent directly added 0.6% to relative returns and owning a large (average 7% weight) exposure to Naspers/Prosus cost only -0.5% relative return. The only significant detractor (>0.2% impact) from China was JD.com, which returned -22% in the quarter and cost -0.6% of relative performance. This was fully offset by not owning Meituan Dianping and having only a small position in Alibaba, both of which are material index weights and did very poorly in the period under review.

FUND POSITIONING

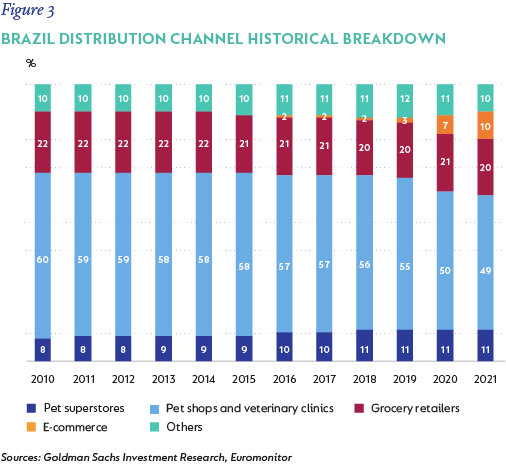

There were several new buys in the quarter (none of which were individually greater than a 1% position at quarter-end). An interesting new buy in Brazil was Pet Center Comercio “Petz” (0.8% position), a specialist retailer focused on the pet care industry in that country, which is the fourth largest pet care market globally. The company is focused on the premium segment of the industry, which is less exposed to competition from ecommerce and supermarkets, who focus on mass market products. The pet care industry is highly fragmented, with small pet shops accounting for half of the retail market compared to 25% and under in developed countries like the United Kingdom and USA, where small shops are only 6% of the market. In Brazil, these small shops have been consistently losing share to other formats, including pet superstores, which is Petz’s offering.

We are attracted to the defensive nature of the business, with 85% of sales from essential products, and the very compelling store economics of 30%+ return on invested capital. The founder-led management team (we met with the founder CEO in recent months) has delivered operationally on a consistent basis and we believe the structural drivers will allow them to continue to gain share in a profitable way. Between store growth and maturation of existing stores, Petz is likely to be able to deliver annual earnings growth of around 15% for the next several years, in our view. We have followed the stock for several months waiting for an attractive entry point and this quarter provided such an opportunity with the forward earnings multiple having fallen to 25x, compared to 90x at the post-IPO peak.

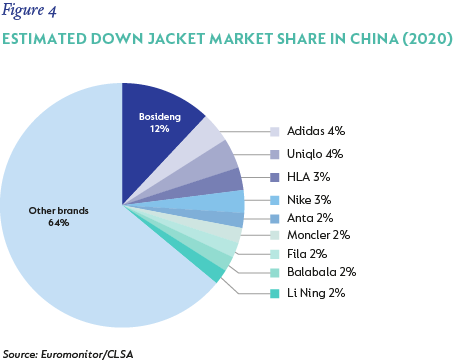

Another new buy worth highlighting is Bosideng International, a manufacturer and retailer of down jackets in China. This is another founder-led business and has transitioned from manufacturing into becoming a retailer. The company has the leading down jacket brand in China, with the majority of sales being via their own direct-to-consumer channel. We are attracted to the market opportunity that awaits Bosideng, with low penetration of the category and very low average selling price for jackets relative to other northern hemisphere middle income and developed countries. Although Bosideng has the largest market share, in absolute terms they still have only 12% share and their domestic peers are a fraction of their size.

We expect strong (mid-teens percentage) revenue and profit growth with high cash conversion and most earnings paid out as dividends since growth is not capital intensive. With 15% of its market cap in cash, Bosideng has ample room to improve returns to shareholders even further. Bosideng trades on 13x forward earnings (ex-cash) and pays a 5% dividend yield.

In terms of sales, we sold the small remaining positions in Oil & Natural Gas Corporation (India), Longi Green Energy and Nvidia. In all three cases the reason for selling was due to a re-evaluation of the risk-reward trade-off in the names, rather than due to having reached our fair value and no longer offering sufficient margin of safety.

With the world having now opened up post Covid (China being the notable exception), we have started to travel extensively for research purposes. During the past quarter, three of the team members spent two weeks in Brazil and another two analysts spent a week in India, making it the second trip to India this year. One of the team members is currently in Poland, spending time on one of the Fund’s holdings (Pepco, a discount general merchandise retailer with 3 500 stores, the majority of which are in Eastern Europe) and another two of the team will be travelling to Saudi Arabia and broader Middle East later this month.

OUTLOOK

After peaking in mid-February 2021, the emerging markets asset class has returned -37% to end-September. This has been an exceptionally difficult time to be invested in emerging markets as the impact of rising interest rates, high inflation, the strong US dollar and heightened geopolitical tension have resulted in emerging markets underperforming the broader MSCI All Country World Index significantly. The big sell-off in emerging markets has created very attractive investment opportunities, in our view. Using our internal metric of upside to fair value, the Fund has amongst the most compelling upside it has had during its 14-year history, with 110% aggregate/weighted-average upside in the portfolio, compared to a level of typically around 45%.

Please note that the commentary is for the retail class of the Fund. View the Global Emerging Markets Fund

Disclaimer

South Africa - Personal

South Africa - Personal