Optimum Growth

Measured in rands, the fund declined 0.4% in the second quarter of 2021 (Q2-21), compared with a benchmark return of 2.7%, which resulted in 3.1% underperformance for the period. This underperformance is disappointing, yet we believe that the collection of assets held by the fund offers compelling long-term risk-adjusted returns with which to deliver on its goal of compounding capital well ahead of inflation.

While we are by no means happy with the short-term underperformance of the Fund over the past year, something to bear in mind is that c.90% of the Funds’ investments are offshore, and the rand’s 17% appreciation over this period has been a headwind. It should be further acknowledged that the past year has particularly benefitted economically sensitive businesses, as actual macroeconomic numbers have materially outperformed expectations in the depth of despair last year. With this, economically sensitive businesses’ actual earnings performance has also been significantly ahead of expectations, driving the sharp outperformance of these types of stocks.

The Fund has, and continues to own, far less of these sorts of businesses, which are often lower quality as well. Macro is inherently difficult to predict, as the last 12 months has shown. Thus, we prefer to invest in businesses that benefit from structural tailwinds, led by excellent management teams who ultimately determine the business's long-term success, as opposed to hard-to-predict macroeconomic factors that businesses cannot control. Valuation, however, has always been our guiding principle in determining whether to deploy your Fund’s capital into these sorts of businesses.

We remain confident that the Fund is well-positioned to achieve outperformance over the long term with these key principles in mind. Over the past five years, the Fund has generated a rand return of 11.3% per annum (p.a.), over 10 years a return of 15.9% p.a. and, since inception over 20 years ago, 14.1% p.a. (2.6% annualised net-of-fees outperformance).

It appears that our expectation of a disjointed normalisation experience is playing out across different geographies as varying degrees of vaccine coverage are achieved, which continues to create complexity for many businesses that operate across geographies. Emerging variants of Covid-19 are also contributing to increasing uncertainty, and short-term visibility remains low. During the quarter, the largest positive contributors were Alphabet (+13.3%, 0.3% positive impact), Facebook (+14.0%, 0.3% positive impact), Heineken (+14.1%, 0.3% positive impact) and Mercari (+13.1%, 0.2% positive impact). The largest negative contributors were New Oriental Education (-45.3%, 0.7% negative impact), Naspers (-15.0%, 0.7% negative impact) and Tencent Music Entertainment (-27.6%, 0.5% negative impact).

New Oriental Education is a business focused on after-school tutoring of Chinese students. The share came under considerable pressure due to potential regulations that could impact the after-school tutoring industry. These regulations could come in the form of restrictions as to when after-school tutoring is allowed, which, if implemented, would materially impact the future growth of New Oriental. Against this backdrop, we conducted extensive expert calls to obtain insight into the potential regulations. From this work, we are more comfortable that even though new regulations will be instituted, they will most likely be less draconian than feared. Thus, the negative share price movement appears to be overdone. However, we are cognizant of the risk inherent in this view, and therefore the position has been sized accordingly at 1.2% of the Fund, notwithstanding the significant potential upside on offer.

The Fund ended the quarter with 79.4% net equity exposure, roughly 2% higher than at the end of March 2021 as we found compelling equity opportunities.

Our negative view on global bonds remained unchanged as a large portion of developed market sovereign bonds offer negative yields to maturity, with the follow-on effect that most corporate bonds also offer yields that do not compensate for the risk undertaken. We did, however, buy South African (SA) bonds in the quarter, which now represent 1.6% of the Fund. Our view on the SA fiscal situation has improved somewhat due to record current account surpluses, driven by buoyant commodity markets, a commitment to structural reform as evidenced by the change in regulations toward private power generation, and the acceptance of a private partner for SAA, coupled with a commitment towards austerity regarding the public sector wage bill. Considering this backdrop, we feel the current yields on offer for SA government bonds are compelling enough to have exposure.

The Fund also has c.2.2% invested in global property: largely Vonovia (German residential). Lastly, the Fund has a physical gold position of 3.2%, a 0.82% holding in AngloGold Ashanti, and a 0.74% holding in Barrick Gold Corp, the largest gold miner globally. The gold price is down approximately 9% in USD year to date, but we continue to hold the position for its diversifying properties in what we characterise as a low visibility world with inflation risks. The balance of the Fund is invested in cash, largely offshore. As has been the case for many years, the bulk of the Fund (over 90%) is invested offshore with very little exposure to SA.

As the outlook for the future remains uncertain and hard to predict, we take comfort in the fact that the Fund holds a collection of businesses that we feel are attractively priced and can operate in what we deem a highly complex and fast-changing environment. Also, because the Fund is a multi-asset flexible fund, we have access to additional tools to take advantage of dislocations in the market, with the continued increased equity exposure being an example.

Notable buys/increases in position sizes during the quarter were Delivery Hero and AUTO1.

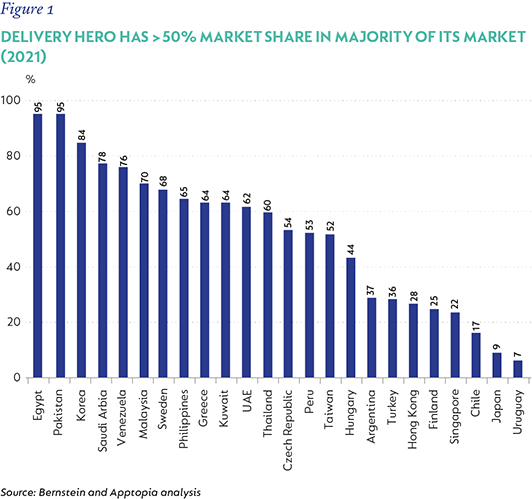

Delivery Hero is an online food delivery business with a leading market share position in markets that account for more than 95% of its gross transaction value, which makes it extremely well placed in a winner takes most or at least oligopolistic industry (Figure 1). 67% of their current gross transaction value comes from Asia, with Korea contributing 53% to the group’s gross transaction value. MENA then makes up 20%, with Saudi Arabia the key market. We feel there are material, secular tailwinds for food delivery, with the current penetration of home delivery of takeaway food in Delivery Hero’s markets only amounting to 32%, which should materially increase due to the consumer value proposition of home-delivered food. Notwithstanding the business being loss-making at a group level, we are encouraged by the positive economics of their more mature regions, which provides a pathway to future overall profitability. The business is attractive based on our long-term assessment of business value.

AUTO1 is the leading online used car platform in Europe, providing a significantly better consumer experience for buying and selling used cars. They also act as a key destination for a fragmented European dealer base from which to buy or sell cars. At 1%, online penetration of used car transactions is extremely low across Europe but is set to rise as an increasing number of consumers become accustomed and willing to purchase a used car online due to the materially improved experienced offered by AUTO1 (45% of European consumers are willing to purchase a used car online). They are a first mover, have pan-European exposure (important for the vehicle sourcing) and are founder-led (the founders continue to own 25% of the business). The economics of the business has been improving, and the company is already close to breakeven, notwithstanding heavy investments for growth. We are confident that the long-term economics of the business will be attractive, along with the immense future growth prospects.

Vaccines have continued to roll out across the world, and this should continue in the months ahead, with the hope that we are close to the end of the pandemic and its devasting effects. However, further uncertainty has been brought about due to emerging virus variants. Against this backdrop, we remain positive on the outlook for the fund, which has been built bottom-up, with a collection of attractively priced assets to provide diversification and achieve the best risk-adjusted returns going forward.

Global Emerging Markets

Measured in US dollars, the Fund returned 0.4% in Q2-21, lagging the 5.1% return of the benchmark MSCI Emerging Markets (Net) Total Return Index by 4.6%. This underperformance has reversed the positive start to the year, and the fund now lags the benchmark over the last year by just over 4%. Although this short-term underperformance is disappointing, we believe some drivers are shorter-term in nature and driven by stock-specific moves, which are discussed below. Over more meaningful long-term periods, the Fund is still well ahead of its benchmark, by 2.3% p.a. over three years, 0.8% p.a. over 10 years and by 2.0% p.a. since inception, just shy of 13 years ago.

The biggest positive contributor to relative performance (alpha) in the quarter was Sendas Distribuidora SA (Sendas). We spoke about Sendas in our last quarterly commentary, when it had been freshly spun out of its previous holding company CBD, with shareholders receiving an equal number of Sendas shares to their CBD shareholding. This was done to better realise value by separating the cash and carry operation of CBD (which became Sendas) from the supermarket, hypermarket and convenience store formats, which remain part of CBD. The cash and carry business was run separately from the other formats, so there were no real gains from having everything under the same roof other than saving a few central costs, which were dwarfed by the poor rating applied to the company as a whole. This transaction has proven to be a spectacular success, with the individual shares Sendas and CBD now (as at 30 June) trading at a combined share price of R$124 compared to a share price for CBD of R$71 at the beginning of the year and R$79 just before the spinoff at the beginning of March. The biggest pickup was in the much-maligned CBD, which has almost doubled in value since the separation (in local currency terms). As a result, we sold out of CBD completely as it reached our assessment of fair value. The Sendas position we retained returned 31.9% in the quarter, contributing 54 basis points (bps) to relative performance.

There were a few other material positive contributors during the quarter. First of these was Momo.com, the leading Taiwanese e-commerce retailer, which almost doubled and contributed 0.4% to alpha. Additionally, the 18% return from global brewer Heineken contributed 0.3% to alpha, whilst the 40% return from Brazilian education stock YDUQS contributed 0.2% to alpha.

The largest negative impact on relative performance came from the decline in the combined Naspers/Prosus position. We hold these stocks in preference to holding Chinese internet firm Tencent as they trade at a significant discount to their look-through value. The Fund holds a large (average 9.0% position in the quarter) position in Naspers & Prosus, and the 12.3% aggregate negative return from these positions had a 1.5% negative impact on relative performance. This was partially offset by not owning Tencent directly as it is the second-largest stock in the benchmark (over 5% weight at quarter-end). With Tencent returning -3.9% in the quarter, this zero Tencent weight contributed a positive 0.5% to relative performance. The correct way to look at the overall impact is to combine the two, and in this case, the combined impact was therefore -1%. This was a direct reversal of the situation that occurred in the first quarter and was caused by the discount to which Naspers and Prosus trade relative to Tencent widening once more. Prosus, which was originally spun out of Naspers to narrow the discount, has announced a scheme to purchase Naspers shares by means of a tender offer. This tender offer is aimed at addressing the discount. Coronation is currently engaged in discussions with Naspers and Prosus in this regard.

The second-largest detractor was the Chinese after school tuition (AST) provider New Oriental Education (EDU). We added to the existing EDU position late in the last quarter after a 25% share price decline so that it had reached a 2.5% position by March quarter-end. Unfortunately, the regulatory news that led to the original share price decline continued to develop negatively, and the share declined substantially further during the latest quarter, costing the Fund 1.4%. EDU is now 55% below the levels it traded at in mid-March.

What initially started as a crackdown on payment practices and lax business registration, which we expected to benefit EDU at the expense of less scrupulous operators, morphed into a full-blown review of the tuition industry. There has been much speculation in the press on what this will look like, with the country's president opining that schools should shoulder the majority of the burden in educating children, rather than children relying on AST. There has also been an indication that younger children (K-9 years) should not experience so much pressure so early in their school career as there is already enough pressure later on when the school-leaving “gaokao” exam is taken. The range of outcomes for AST providers is being speculated to include total bans for younger students, a ban on the marketing of AST services and restrictions on offering classes during weekends and/or school holidays.

With this range of outcomes, it is not surprising that the share price of EDU and other players have reacted so negatively. It is impossible to know the final outcome with any degree of certainty; however, we have spent a lot of time talking to industry experts and ultimately assessing what each potential regulatory change could do to the earnings power of the listed players and compared this to their current share prices. Each business is slightly different. Some are more online-focused (rather than offline/ face-to-face), and some are more exposed to K-9 versus years 10 through to 12. Each also has a different cost structure and the flexibility to adjust this cost structure varies between them.

Overall, we believe that EDU’s share price already reflects a fairly dire outcome. The risk/reward is attractive in our view and thus we have kept the position around 2.3% of the Fund. However, we are cognisant of the overall exposure to the sector given the wide range of potential outcomes, and we therefore sold out completely from TAL, one of EDU’s competitors. TAL, which has higher K-9 exposure, was trading at a higher starting rating, with a lower upside to fair value, and therefore we believed it had more potential to derate significantly in a worst-case outcome.

The next most significant negative contributor was Tencent Music Entertainment (TME). This was also a stock that declined late in the previous quarter and returned a further -24.5% in the latest quarter. This position cost -0.9% of relative performance. Operationally, TME is doing well, despite a challenging base in the first quarter of 2020 when China was mostly locked down, which was good for their business. Revenue in the first quarter (Q1-21) was up 24% year on year, with operating profit up 12% and accompanied by great cash generation. The company even bought back roughly $200m of stock, a rarity among Chinese businesses.

The reason for the share price decline is antitrust related. Like most dominant firms in China, TME has attracted attention from Chinese regulators. The first issue relates to exclusive content, which in our view is manageable as only a small part of TME’s business today is exclusive. The second is speculation that two previous acquisitions (Kuwo and Kugou) may not have been properly approved by the authorities prior to their acquisitions being consummated. The potential remedies ranged from a fine to a forced unwind of these deals. Our research suggests the “nuclear” option of a forced unwind has roughly been reflected in the halving of the share price since it peaked in March. The forced sale of Kuwo and/or Kugou would, of course, result in corresponding proceeds to TME and would still leave QQ Music (the original music app before the acquisitions) having around 35% market share, which is the approximate market share held by Spotify (the Global #1 and #1 in most countries) in most of its markets.

The last material detractor was JD.com (JD), which returned -5.5% in the quarter and cost the Strategy -0.5% alpha. JD is the second-largest e-commerce retailer in China, with 500m customers reported at the end of March compared to 387m in the comparable period a year ago, with management aiming to gain a further 100m in the year ahead. Customer growth has been driven by greater assortment and improvements in fulfilment. Their incredible logistics arm employs 200,000 people and has more than 1,000 warehouses, giving them almost complete geographical coverage of this massive country - all within their own control. More than 90% of orders are delivered either the same day or the next day. Customer loyalty is most evident when looking at purchase frequency and spend, which have increased four-fold and five-fold respectively since 2015.

JD has been effective in incubating new business units, with the most notable being JD Logistics (described above) and JD Health (an online health platform). Both have been separately listed successfully, with the holding company retaining 64% ownership in JD Logistics and 69% ownership in JD Health. This dynamic is important to consider when thinking about the implied valuation for the core retail business. The entire group has a market value of $118bn but the market value of their listed stakes ($50bn), together with the most recently reported net cash ($19bn), means the market values the retail arm at only around $50bn. The core retail business should generate $135bn in revenue this year at a 4% EBIT margin. We believe this margin is well below normal, which could potentially be high single digits. If you apply a conservative 6% EBIT margin and the statutory 25% tax rate, the core retail business trades on less than nine times earnings for this year. Even at the current 4% margins, the multiple is only 12 times earnings for a company growing topline at 20% p.a. This analysis ignores other balance sheet investments that they have, namely, JD Technology (fintech and cloud) and JD Property, which is increasingly housing their physical logistics assets off balance sheet by bringing in capital partners.

A final point worth considering is that the increased scrutiny of the technology sector in China could potentially benefit JD’s retail business. They have historically been hurt by ‘pick one’ tactics, whereby a brand that sells on multiple platforms is penalised on Alibaba’s platforms. These tactics have resulted in JD having an inferior assortment for some key categories, such as fashion and beauty products. With the banning of these tactics by the regulators, merchants have been free to sell all products on all platforms, which should further improve the customer value proposition. The share is down around 25% from its peak in mid-February this year and offers around 100% upside to fair value, in our view. This is extremely attractive in both absolute and relative terms, and JD is thus a 7.1% position in the Fund.

There were two new buys in the quarter, Delivery Hero (1.5% of the Fund) and Anglo American (1.0% of the Fund). Anglo American was purchased for both valuation and diversification reasons. The Fund has little commodity exposure at a time where demand is generally more than supply and prices are rising as a result of this mismatch. Unlike the 2007 period, where miners were trading at high ratings (multiples) on unsustainably high earnings, ratings today are generally quite reasonable, even if spot commodity prices are at the higher end of their normal range. In the case of Anglo American, the company trades at around 6.5 times 12-month forward earnings and offers a 7% dividend yield. Importantly, it trades at less than 11 times earnings if its key commodities were to return to our assessment of normal prices. In previous commodity booms (most notoriously in the run-up to 2007), miners blew all their profits on massive expansion projects that ultimately caused prices to tank, or they bought each other out at astronomical valuations only to see share prices fall later in tandem with commodity prices. This time around, behaviour has been more disciplined, so it is less likely this mistake will be repeated. From an environmental, social and governance perspective, Anglo American L has no direct oil exposure and have spun out their coal assets to shareholders, leaving shareholders with platinum group metals, iron ore, diamonds and copper making up more than 90% of profits.

The other new buy, Delivery Hero, is a food delivery business, covered in detail in the Optimum Growth commentary above.

Portfolio managers

Gavin Joubert, Marc Talpert and Suhail Suleman

South Africa - Personal

South Africa - Personal