Investment views

Even in a weak economy, private education can thrive

The Quick Take

- The public education system is under massive pressure, creating significant opportunities for private players

- Quality businesses doing great work have risen over the years and are providing a compelling alternative where the State is underdelivering

- SA-listed education groups are solid operators that deliver quality education and are well-positioned to capitalise on the sector’s growth opportunities

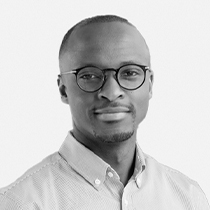

South Africa (SA)’s private education industry (schooling and tertiary) is an attractive space with good fundamentals and above-average growth prospects. Its listed education groups (ADvTECH, Curro, STADIO) deliver quality education and are defensive businesses with annuity revenues and reasonable returns when campuses are mature[1]. These groups benefit from powerful secular trends – strong demand for quality education; a public sector that is unable to invest sufficiently to meet demand; and a private sector that is taking market share. They have, therefore, mostly shown good growth in their business fundamentals over multiple years, including the Covid period. Figure 1 clearly illustrates their solid compound annual growth rate (CAGR) in enrolments. In our view, they continue to be well positioned to deliver above-average performance despite a weak economic environment, supported by market share gains resulting from State players that are under pressure and weaker/subscale private players that are strategically disadvantaged and vulnerable to prolonged macroeconomic weakness. This supports our enthusiasm for listed education players that should continue to do well as the power of their competitive and strategic advantages comes to bear.

CHALLENGES OF THE TIMES

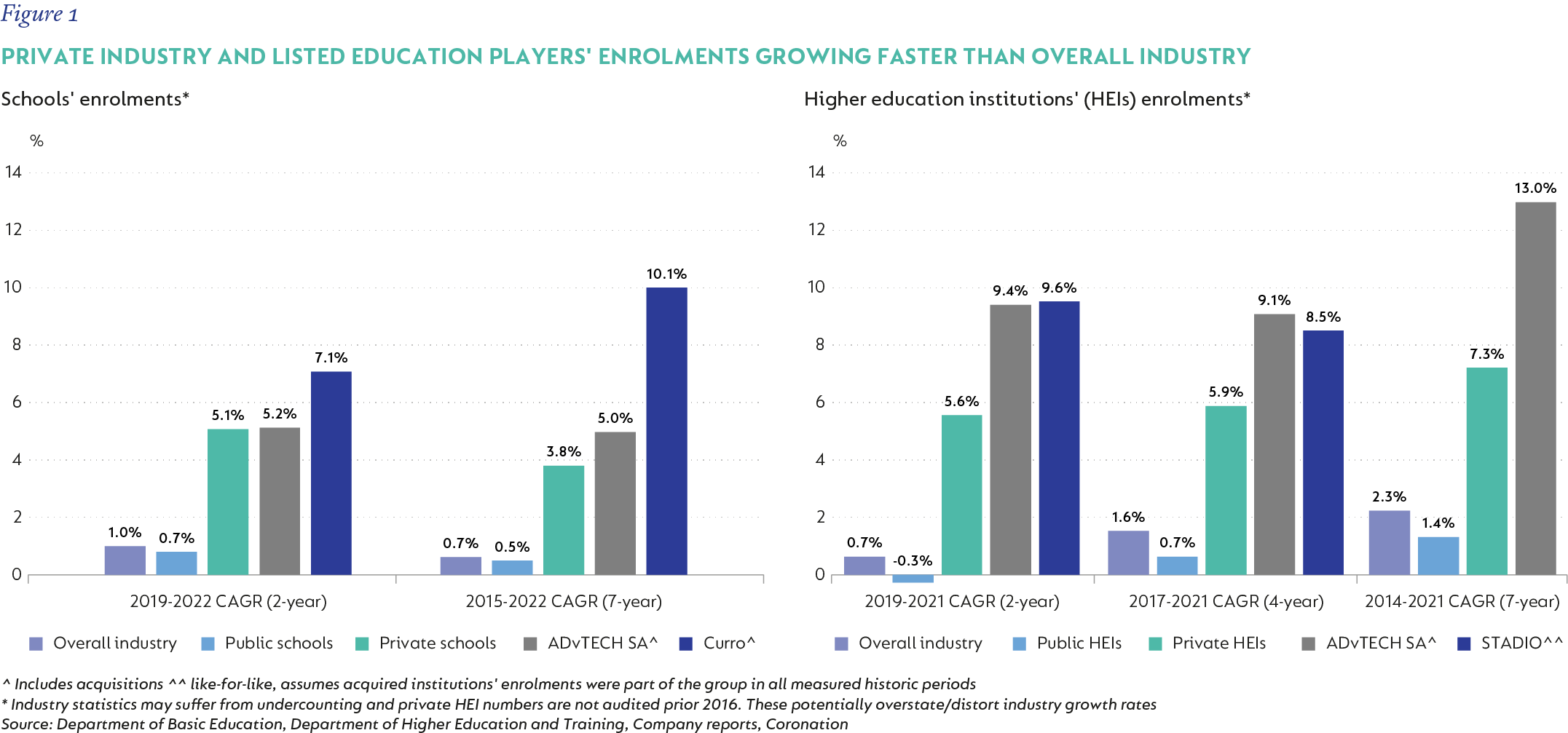

A persistently weak macro and consumer environment and an uncertain long-term economic outlook mean chronic affordability pressures and a genuine consumer need for value. As such, superior performance belongs to those who can deliver a quality education at competitive fees, while investing in quality, people, capacity, and technology. The listed education players are better positioned in this regard. Their scale allows them to a) run efficient cost structures (e.g. centralised costs, shared services, better utilisation of academic staff) to better control costs and limit fee increases; and b) invest meaningfully but efficiently (e.g. in research and development, technology, facilities management, expensive talent) in order to sustain and improve their offerings, while still making attractive profits. Figure 2 illustrates earnings before interest and tax (EBIT) for the three listed education providers. This contrasts with public schools and public tertiary institutions as well as lesser-resourced, subscale private players that are not able to achieve similar levels of investment and/or cost efficiency.

STATE OF PLAY IN SCHOOLING

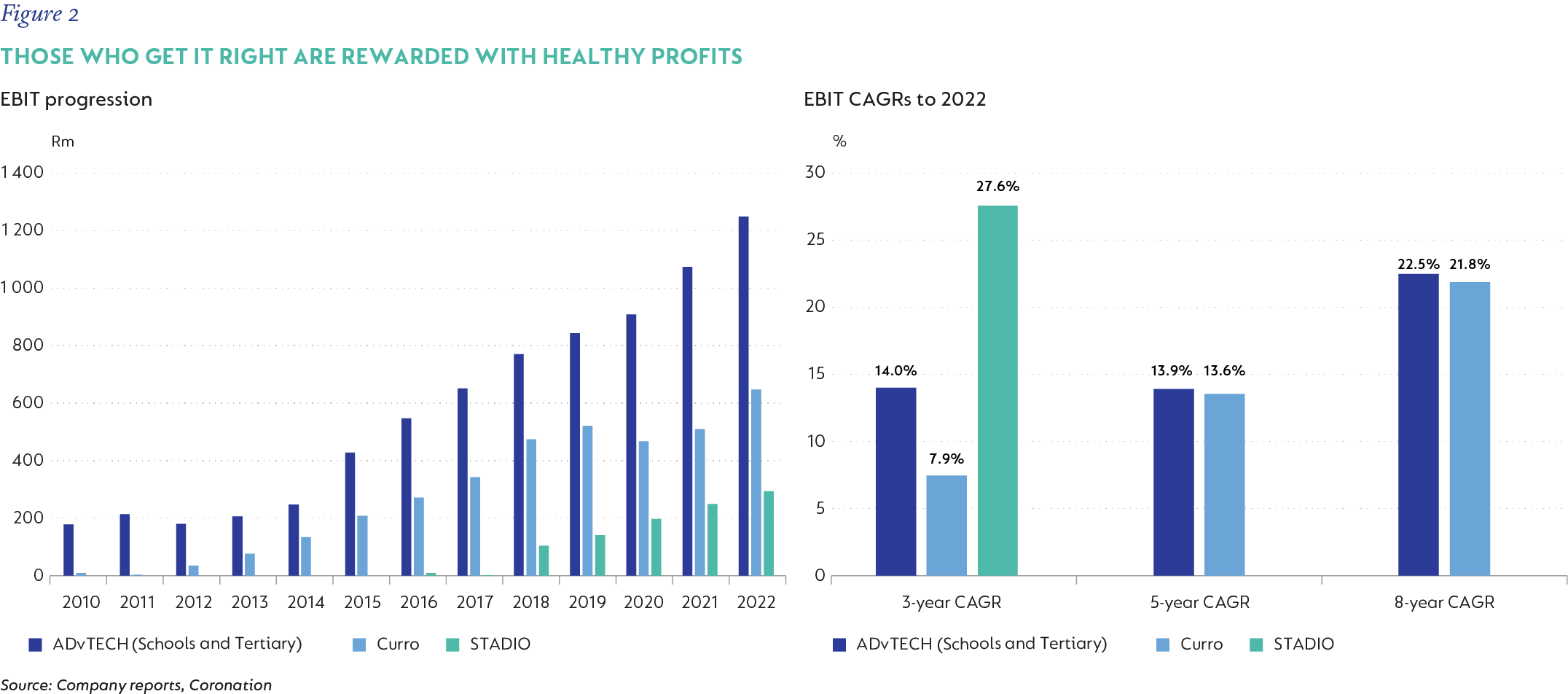

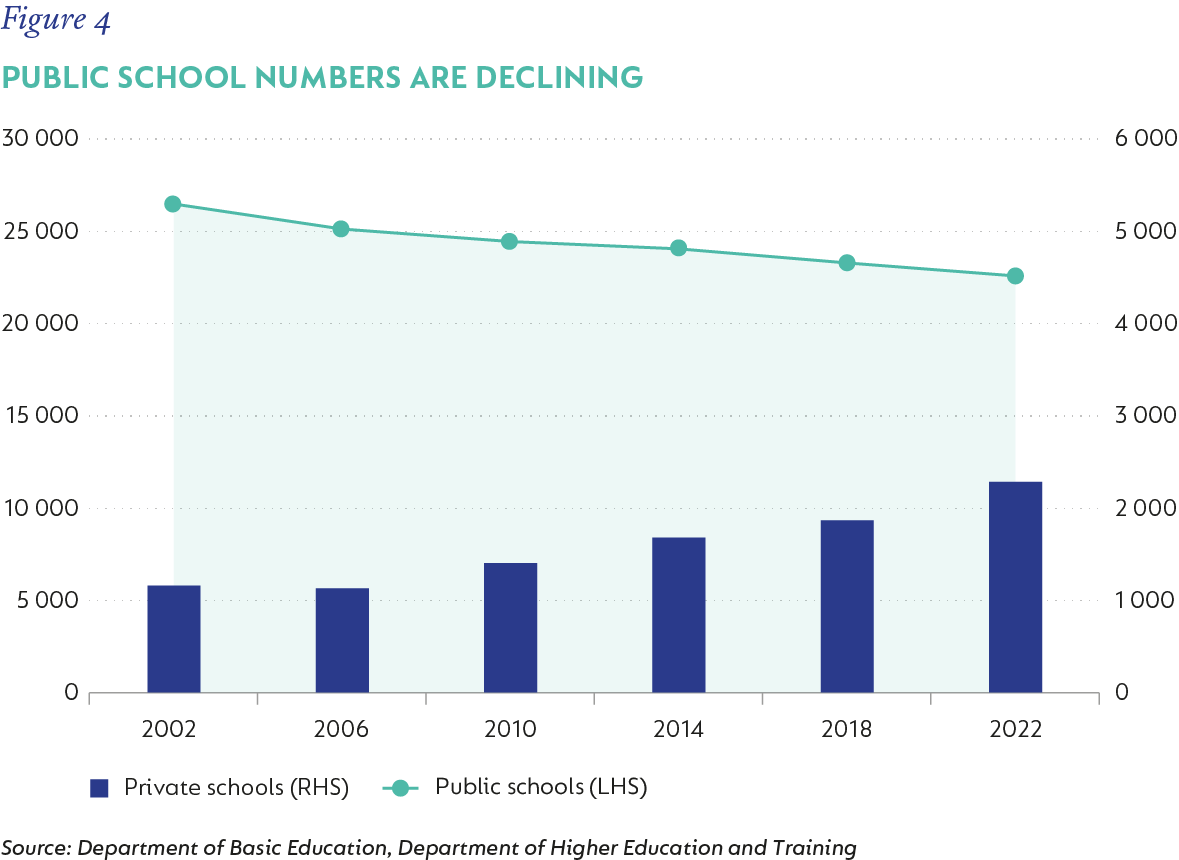

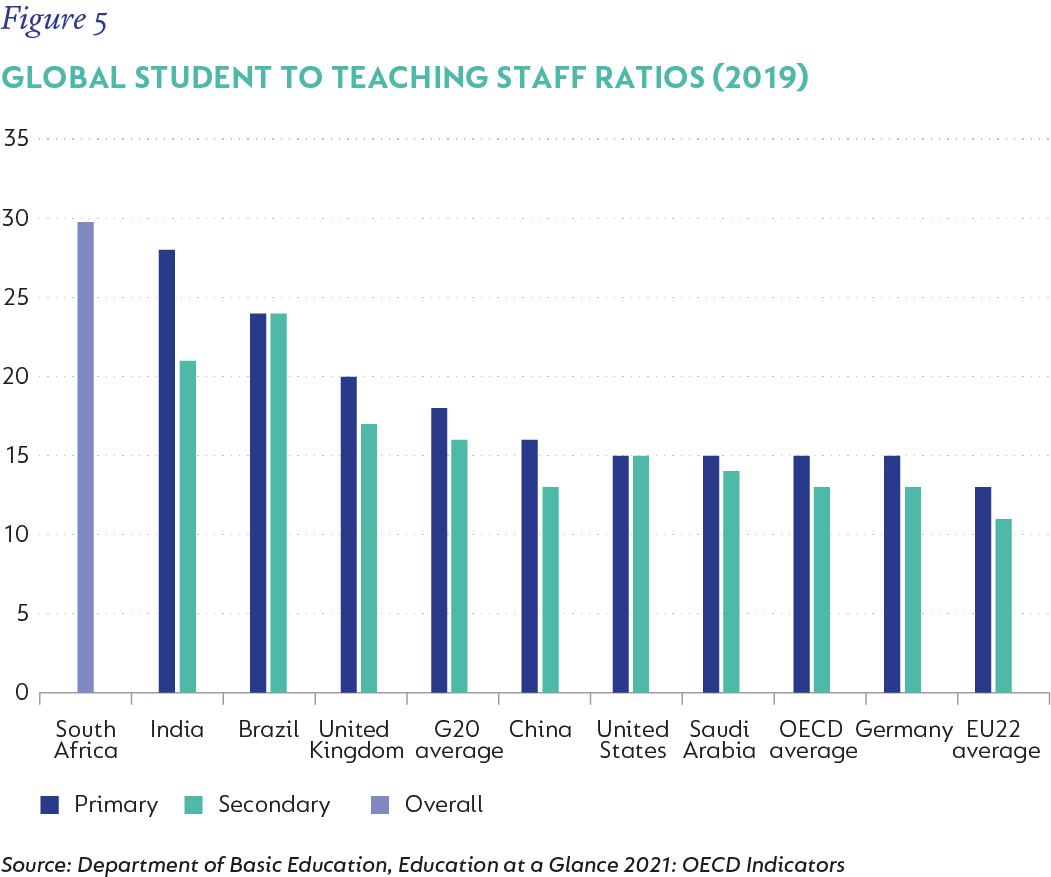

It is no secret that SA’s basic education system is severely challenged and that, while our public schooling system has pockets of excellence, by and large, it is significantly underdelivering. Public enrolments have grown over time (Figure 3) but the number of public schools has declined (Figure 4). Further, student-to-teaching staff ratios are stagnant and stubbornly high, both absolutely and when compared to a basket of global counterparts (Figure 5), and public education outcomes are worryingly weak. All this is despite what should be strong spending on education by government, given that education spend as a share of both government expenditure and GDP is high and compares well globally.

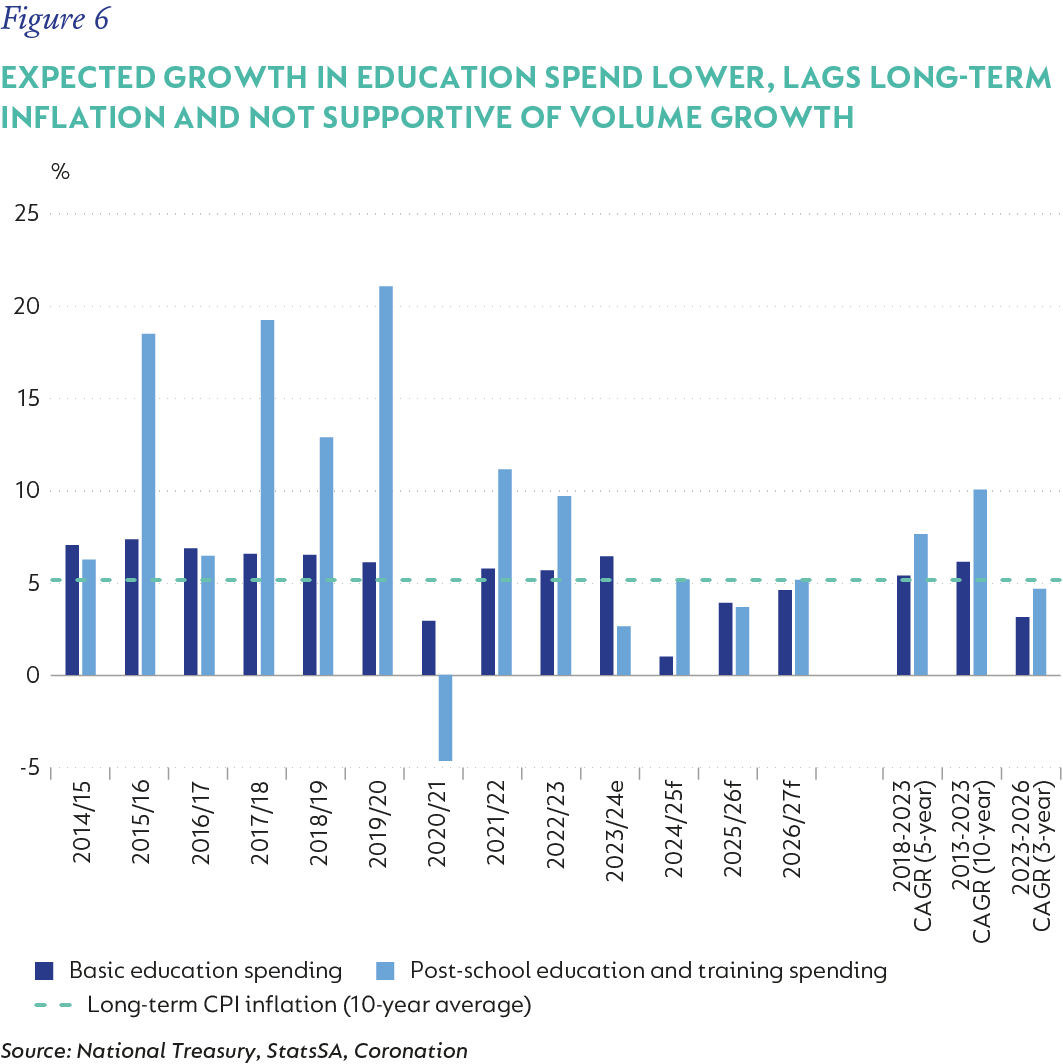

With the above in mind, combined with the reality of finite/diminishing resources, it is clear that the State’s challenges are immense. Figure 6 clearly illustrates the marked slowdown in expectations for spending growth in basic education, which now lags long-term inflation. In our view, headwinds in public education are intensifying. Added to that, fee-paying public schools face long-term pressure on fees as they need to pass higher-than-ideal fee increases to fund a growing number of parents requiring financial assistance/exemption; necessary internal investments; and above-inflation cost pressures. These undermine the long-term competitiveness of the segment and we expect it to lose share to private schooling.

In private schooling, we have an industry with a few scale players and a plethora of standalone private players, many of which are not-for-profit and subscale. Economic realities constraining affordability combined with the continued need to invest in operations and absorb above-inflation cost growth mean operators with limited buffers/resources are likely to face growing challenges. These threaten their long-term competitiveness. The listed education players are well positioned to outcompete in this space and gain market share.

STATE OF PLAY IN TERTIARY

The SA tertiary education sector is a tight market where demand for quality tertiary education exceeds supply, i.e. our State universities are broadly full. Over the last decade, we have seen listed education players grow sizable and solid tertiary businesses, bringing capacity, innovation and quality offerings at the right price to the industry and delivering solid enrolment growth (Figure 1 above). Going forward, growth prospects for strong private tertiary players remain positive in our view, with the key drivers being strong demand combined with an at-capacity public system facing several difficulties, which include a constrained ability to fund growth; an outsized financial dependence on a State funder that is under increasing financial pressure (Figure 6 above); a volatile public tertiary institution environment; and weaker execution by some State universities. Together, these imply a public system that is unable to fully service market growth and rising risks in universities’ financial models. Conditions are ripe for competent private players to play an increasing role in the SA tertiary education sector.

CONCLUSION

Given our optimistic views on SA private education, we have long been a significant owner of ADvTECH, our preferred listed player. ADvTECH is a high-quality education group that is well-managed and has a strong emphasis on quality and value. We like their scale and diversification across schooling and tertiary education. While it has done well historically, we think its best days are ahead of it. We also have smaller positions in STADIO and Curro. These are promising businesses that hold a lot of long-term potential but come with higher execution risk. We like STADIO’s distance- and online learning focus, are pleased with their execution so far, and expect strong future growth. Curro has had a more challenging evolution, but it is a substantial business with significant advantages and the building blocks to become a formidable player. Execution risk is higher than one would like but its lower valuation in recent years – on a still attractive earnings and cashflow outlook – has provided a reasonable margin of safety for the patient investor. ADvTECH, STADIO and Curro are all good examples of businesses we expect to thrive despite a weak economy, consistent with our view that the strong will get stronger in these tough times.

[1] High utilisation of capacity when campuses are fully developed

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal