Investment views

Corohub exclusive: Built to last

The strength of a proven process in local and global markets

The Quick Take

- After a challenging period, our global equity fund has outperformed its benchmark global equity index in two consecutive calendar years

- This outperformance, despite the index’s own strong performance, was the result of taking an independent valuation-centric view, supported by a tried and tested approach that we have been fine-tuning over more than 30 years in local and global markets

- When looking to take advantage of where the biggest disconnect between price and value is (i.e., taking the long view), you need to be comfortable waiting for that view to come through

- The current volatile market environment is another opportunity where this approach acts as our compass as opportunities arise

The first decade of Coronation Global Equity Select, our developed markets-focused global equity strategy, was no walk in the park. The 10 years leading up to the end of 2024 were characterised by several extraordinary events (Covid, war and conflict, extreme monetary policy, tech revolutions, etc.) and narrow markets, especially in 2023 and 2024.

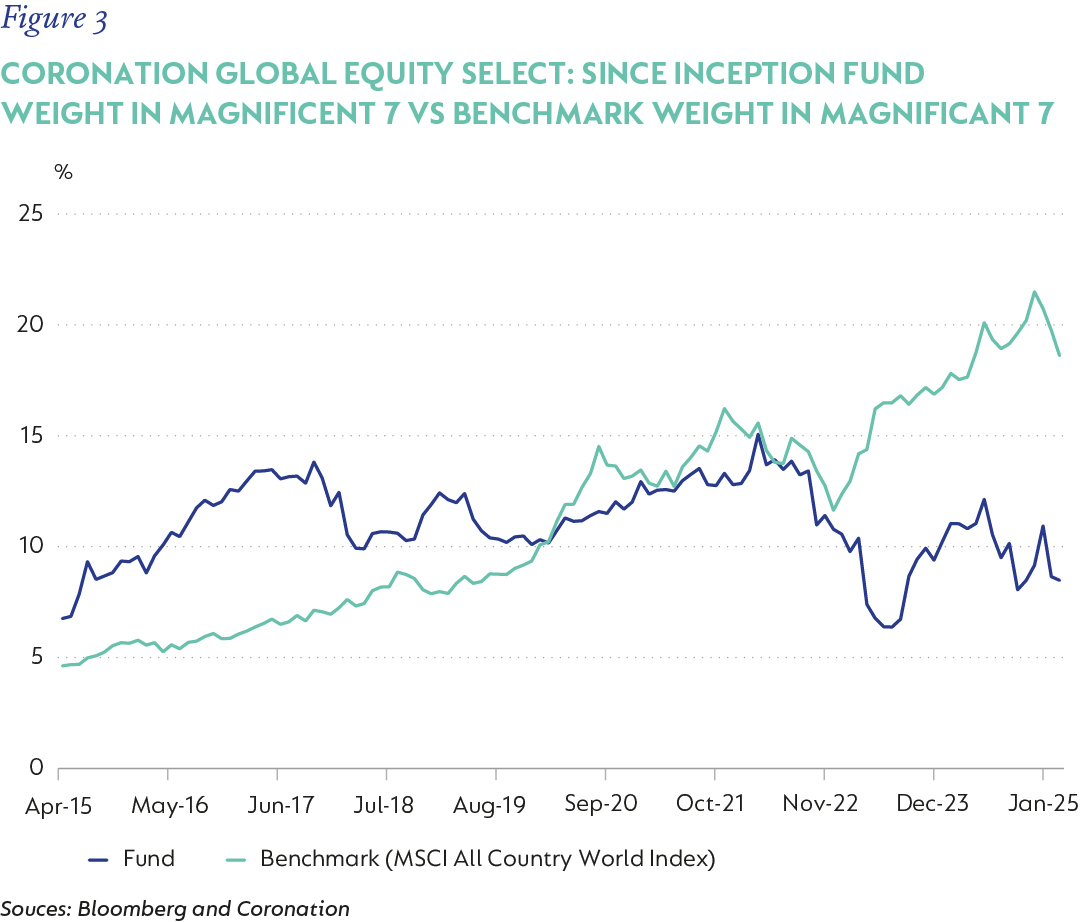

A handful of US tech-focused shares, dubbed the Magnificent Seven (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla), accounted for more than 90% of the S&P 500 Index’s total return in 2023 and more than 50% in 2024. With contributions this skewed, consensus firmly became that the US, and specifically US big tech, was the only game n town. And everything else lagged. This level of concentration in global markets challenged even the most disciplined active long-term investors, especially those with a valuation underpin like Coronation.

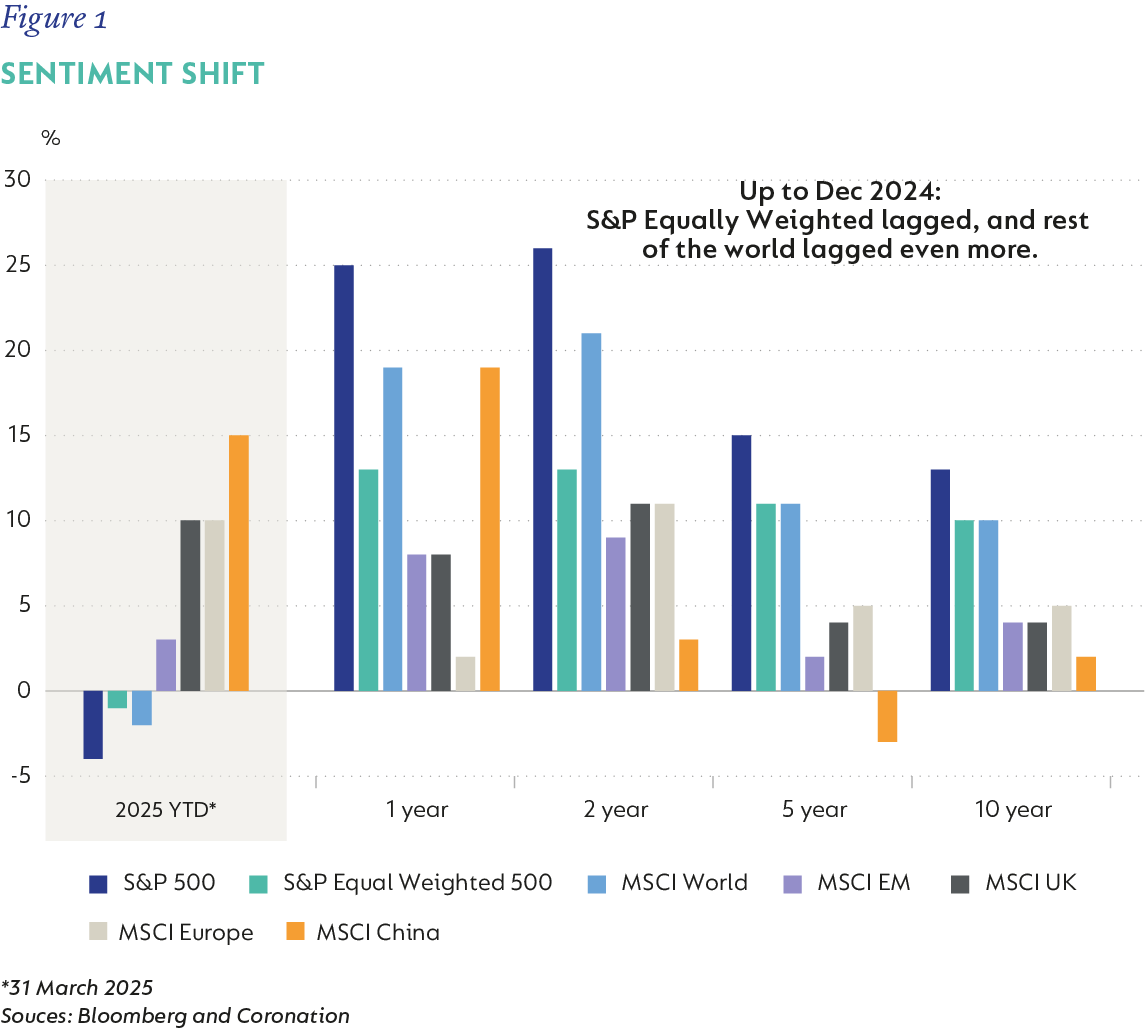

The momentum, however, quickly unraveled early in 2025 (Figure 1) as investor sentiment started to shift away from these shares on valuation concerns, and as market returns broadened out.

By mid-April, all seven shares had entered negative territory for the year.

GOING AGAINST THE GRAIN

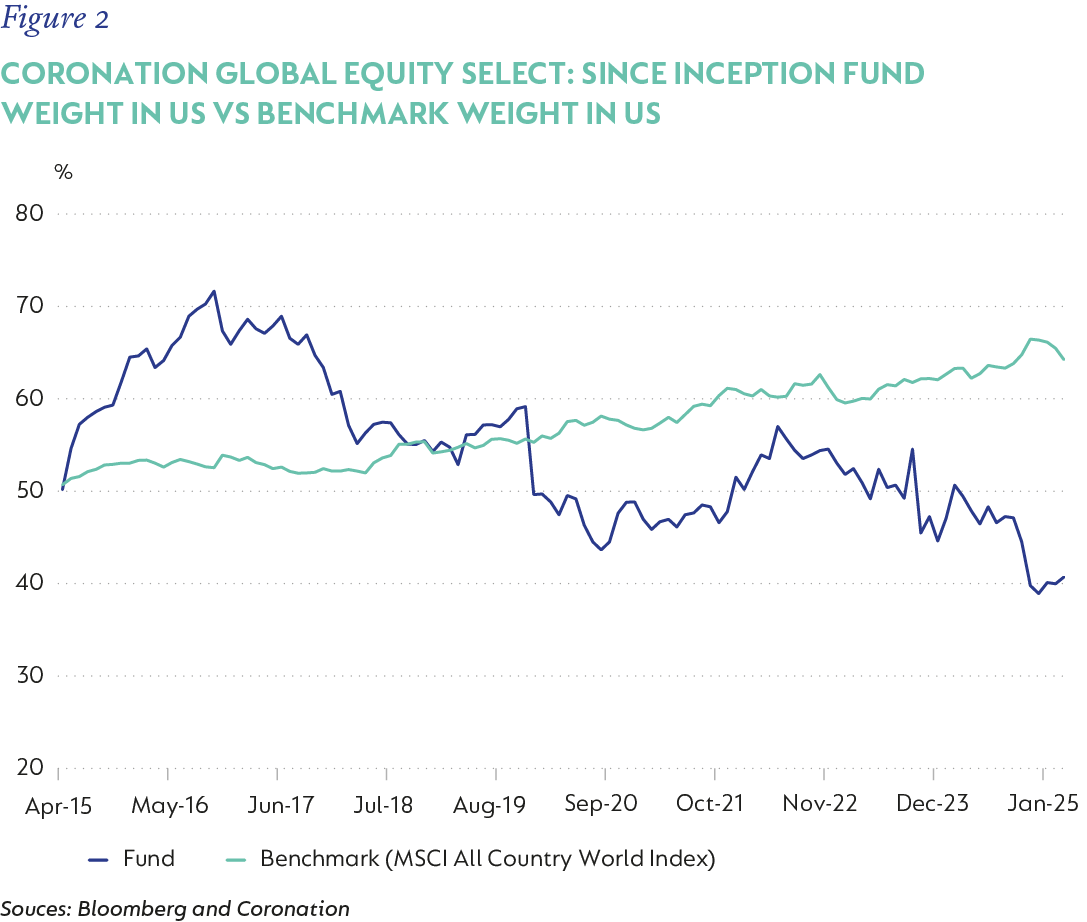

The extreme focus on a small number of large technology shares within a single country for an extended period created compelling stock-picking opportunities for investors willing to take the long view. Relying on a tried and tested approach that dates back more than three decades, we adjusted our global equity portfolio to be underweight the US (45% of Fund vs a benchmark weight of 67% at the time) with underweight exposure to big tech (as illustrated in Figure 2 and 3 below). This view resulted in a meaningful drag on performance in 2023 and 2024.

Throughout this period of underperformance, we stuck to our knitting: being valuation-focused and taking a longer-term view when assessing the prospects of a business. As we wrote in the July 2022 Corospondent: “Whilst this might seem obvious, in stressed market environments the time horizon of many market participants dramatically shortens, and the potential of businesses with longer-dated payoff profiles gets overlooked, which in our view, provides patient long-term investors with exceptional opportunities.”

THE OPPORTUNITY IN LOSS-MAKING, LONG DURATION SHARES

Between 2020 and 2022, the growth share cycle saw a significant shift from the initial pandemic-driven gains to a correction as inflation rose and interest rates increased, impacting the valuations of these typically high-growth, high-valuation companies.

At the top of this market cycle (December 2021), we had a small allocation (<4%) to loss-making, long-duration shares (LMLD) in Coronation Global Equity Select. But in 2022, our research effort indicated that long-term investors were being given a generational opportunity to buy high-quality businesses with outstanding prospects at fractions of their underlying value.

At the time, it was a particularly brutal 12-month period for long-duration growth companies, with many names down 60%-70%. These share price drops came as interest rates started to normalise, signaling the end of the era of ‘cheap’ money. However, not all marked-down long-duration companies had the same fundamentals. While many were legitimately in precarious financial positions, our research showed that others represented an excellent opportunity.

BUILDING THE THESIS

Notwithstanding our view that this was a generational opportunity, we were very considered in purchasing these shares. We only bought the businesses where we had the most confidence in long-term fundamentals, and we limited our purchases to companies with strong balance sheets that could see them through an extended period of poor market sentiment. In addition, we carefully managed position sizing within our portfolios.

At the time, we wrote: “When trying to understand whether a long-duration growth business is structurally stronger today than before the Covid-19 pandemic, it is important for us to identify the problem the business is trying to solve. We ask ourselves whether the problem has sustainable consumer demand and if it can be solved in an economically profitable way. If the answers to both questions are yes, we set out to determine if we are buying this business at a reasonable or cheap price relative to its intrinsic value.”

At the first market trough in June 2022, we had increased portfolio exposure to a basket of LMLD businesses to 7% of Coronation Global Equity Select (from <4% mentioned earlier). Despite a reporting season which, in most cases, confirmed our investment views, prices fell a second time and troughed around the second market low in September 2022.

With greater conviction and lower prices, our weighting then increased to 14% of the portfolio.

THE AUTO-1 CASE STUDY

One of the LMLD shares that we believed was attractively valued and offered significant upside was Auto-1, a leading digitally enabled European automobile wholesaler transitioning from a growth-at-all-costs mindset to a focus on profitability. Three distinct stages marked the building of our position in Auto1:

- Our initial buying early in 2021 when the share price was falling;

- Ongoing buying in the second half of 2021 through to early 2023, into a rapidly falling share price to maintain the portfolio weight; and

- The period between late 2023 and early 2024, when the business saw multiple quarters of declining revenue and multiple downward revisions of forward-looking guidance.

TESTING THE INVESTMENT CASE

We continued to do further work and engaged with various stakeholders (industry experts, customers and competitors). Our research indicated that the market was attributing a negative value to the group’s retail division, Autohero. Assuming this division was worth nothing, investors were effectively only paying a low multiple (5x EV/EBITDA) for Auto1’s profitable merchant business, whose strong underlying performance was obscured by significant losses at Autohero. Recognising this attractive valuation, we chose to increase our position.

Fast-forward to Q1 2024, when clear evidence of improved execution emerged, with the company reporting notable progress across a set of key metrics. Most importantly, we saw significant improvements in profitability in both their merchant and Autohero businesses, which continued into Q2 2024. At the same time, revenue growth was starting to accelerate. This gave us further conviction behind the accelerated revenue growth and margin gains we were expecting, which subsequently transpired.

By end-March 2025, Auto-1 was one of the top contributors to alpha in Coronation Global Equity Select over one, three and five years.

LONG-TERM CONSISTENCY BEATS SHORT-TERM INTENSITY

Most of the LMLD shares in our global equity portfolio have now exited their loss-making status (today, they are just profitable long-duration growth shares), and their share prices have increased several times since the market lows in June-September 2022, even after the tariff-induced volatility in April 2025 (read more in our latest commentary).

Coronation has performed through multiple examples of dislocations in local and global markets thanks to our deep commitment to a tried and tested approach. The extreme moves we are currently experiencing are, yet again, a chance for disciplined long-term stock pickers to act with conviction and take advantage of the changed opportunity set thanks to deep fundamental bottom-up research. As we have learnt before, it is often in times like these that we can improve both the quality and expected upside within our portfolios.

South Africa - Personal

South Africa - Personal