Investment views

Mondi

A global leader in sustainable packaging

The Quick Take

- Mondi is a key global player in sustainable packaging and is positioned to reap the rewards when the economic cycle turns

- Its vertically integrated business model, capacity expansion and strategic investments see it poised to capitalise on the packaging-intensive growing ecommerce market

- We believe it is undervalued and that, over time, our clients’ portfolios will benefit from this holding

Established in 1967, Mondi has its roots in South Africa and has grown into a global leader in paper and packaging. It operates in more than 30 countries across Europe, North America, and Africa, and employs over 22 000 people. From its origins in printing paper, Mondi pivoted to sustainable paper packaging, which now accounts for 85% of revenue, serving the consumer, retail, industrial, and agriculture sectors, as well as building and construction end markets. We believe Mondi offers compelling risk-adjusted upside, with the market underestimating its earnings power and strategic positioning.

MARKET LEADERSHIP

Mondi occupies important leadership positions across the three divisions it operates (Figure 1). In its packaging divisions, Mondi operates at scale, targeting less commoditised products with higher barriers to entry.

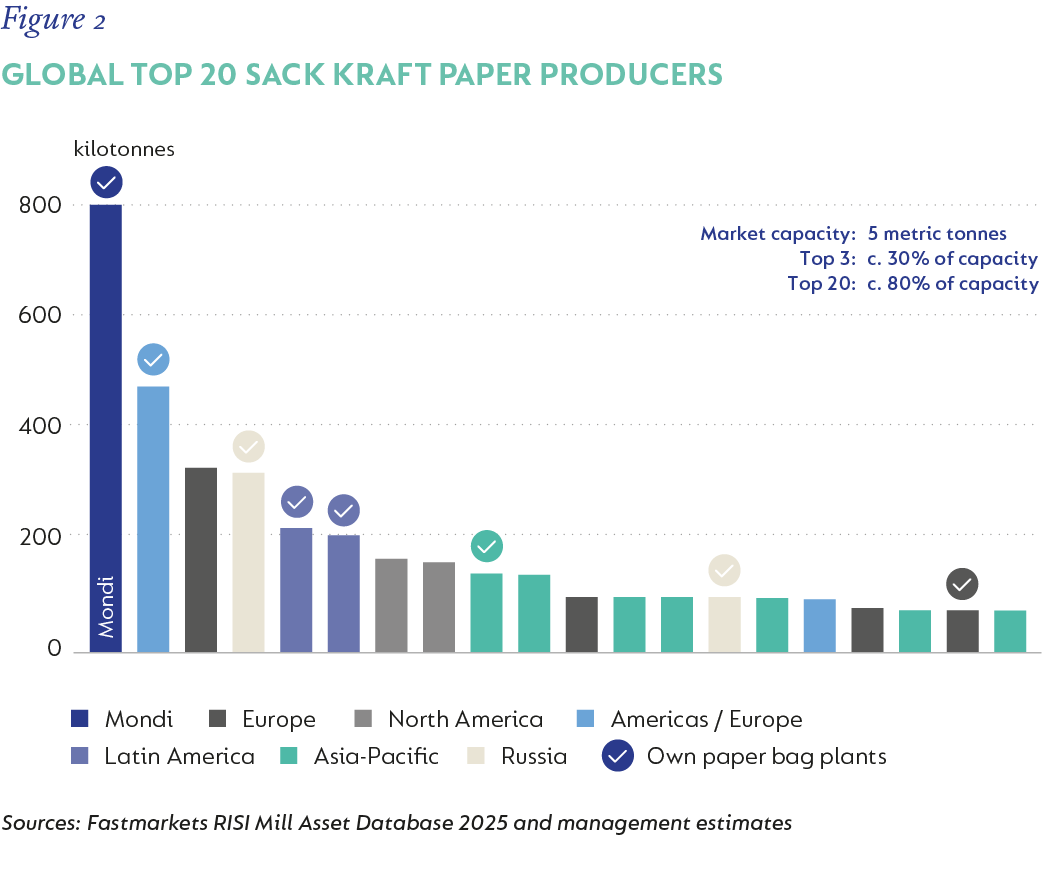

Its largest division, Flexible Packaging, accounts for 55% of earnings and is the number one kraft paper (brown packing paper) producer globally, with a 16% market share. Virgin kraft paper, made from softwood fibre, offers high strength, elasticity, and tear resistance, making it ideal for use in paper bags, sacks, and paper-based consumer products. Significantly, Mondi uses approximately 90% of its own kraft paper to produce end products such as sack kraft bags, where it is also the global leader, roughly four times larger than its closest competitor.

In Europe, Mondi is the number one specialty kraft paper producer, with the widest range of specialty paper grades, a key attraction for customers seeking security of supply, innovation, and global reach.

Barriers to entry are high, due to limited access to high-quality fibre sources and the need for end-market integration. Approximately 95% of producers are already vertically integrated. The business benefits from sticky long-term customer relationships around whom the converting plants are conveniently located. Demand is growing while limited new capacity is expected, resulting in healthy industry operating rates above 90%. Mondi is the scale player in this attractive market (Figure 2).

The Corrugated Packaging division accounts for 30% of earnings and is the leading virgin containerboard producer in Europe and the top corrugated box producer in emerging Europe. While 80% of the European containerboard market is recycled containerboard, this segment has low barriers to entry and is currently in overcapacity. Mondi has low direct exposure to recycled containerboard, producing only 20% of its containerboard output there and consuming more internally than it produces.

The bulk (80%) of Mondi’s containerboard production is in virgin grades, where barriers in terms of capital expenditure (capex) and fibre access are higher. While there are some common end uses with recycled containerboard, virgin has some specialised applications requiring strength, moisture resistance, and hygiene, e.g., food, pharmaceuticals, luxury, and heavy goods packaging. With limited new capacity, the supply-demand outlook is more favourable for virgin containerboard.

Mondi’s smallest division is the Uncoated Fine Paper business, which is the market leader in South Africa and occupies second place across Europe. In both markets, they own low-cost mills and are able to earn a return in what is a challenging market with volumes in structural decline.

MOATS

Mondi has some important economic moats that enable the business to maintain its competitive advantage, protect market share, and help generate attractive returns.

- It is a low-cost operator running large-scale, efficient, and well-invested paper mills.

- Approximately 75%-80% of Mondi’s production capacity sits in the lowest half of the industry cost curve. This enables Mondi to remain profitable throughout the business cycle while still delivering products at competitive pricing.

- It operates under a culture of continuous improvement, investing in its asset base to eke out efficiency gains and further widen this moat.

It also enjoys the benefits of operating a vertically integrated business model. Operations stretch across the value chain, from ownership of forests in South Africa to pulp mills built alongside their paper-making machines, which ultimately feed their box-making plants located close to end markets and customers.

Why is this an important moat? Vertical integration enables Mondi to be 90% energy self-sufficient, generating biomass energy from pulp production and reducing reliance on more expensive fossil fuels. Ownership of box plants located near their customers secures a captive route to market and enables their mills to run at higher, more efficient operating rates. Importantly, management continues to invest in deepening this moat.

WHY WE BELIEVE MONDI IS UNDERVALUED

At the heart of the investment case is our assessment that Mondi’s earnings base today does not reflect the true potential of the business. Three factors account for earnings being lower than our assessment of sustainable earnings. These include:

- The cyclical downturn in demand across their markets.

- The structural growth potential is still to be captured in the business.

- Acquisitions and new expansion projects that are not yet contributing to earnings.

CYCLICAL LOWS FOR DEMAND AND MARGINS

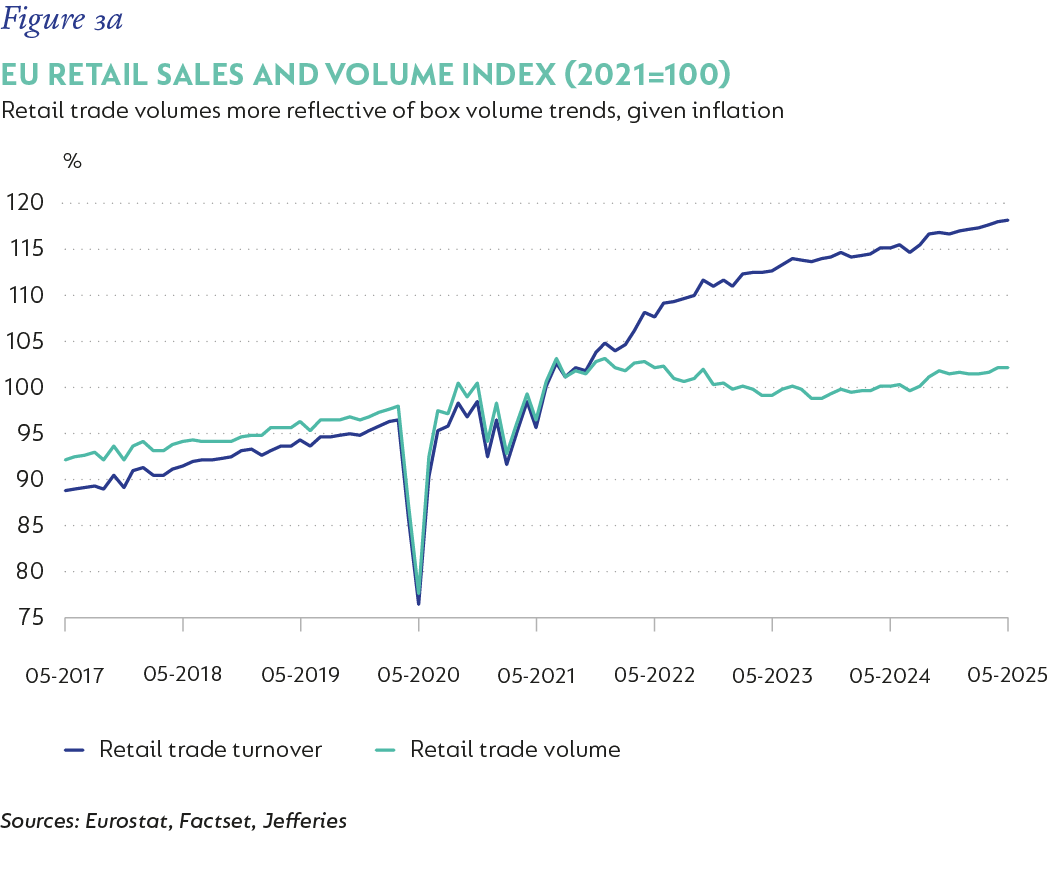

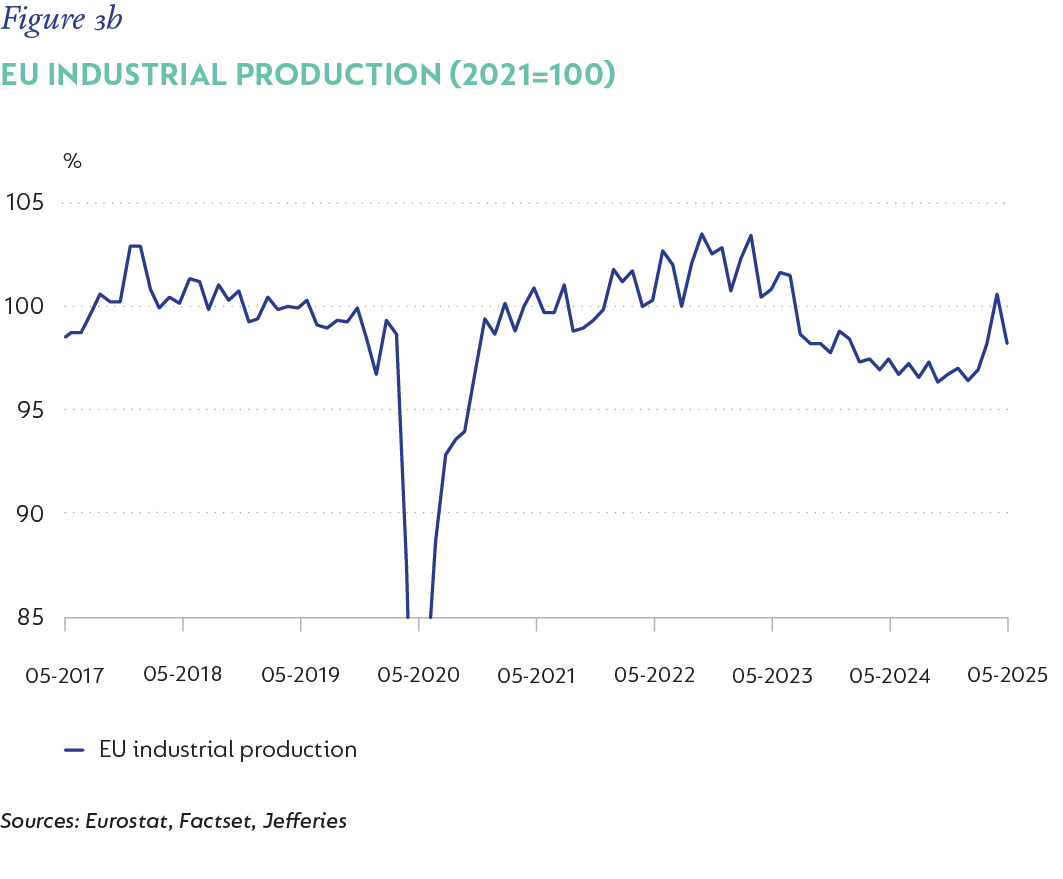

Mondi operates in a cyclical industry, impacted by the consumer and industrial demand cycles. The combination of high inflation and rising interest rates dampened both retail and industrial demand post-Covid. In Europe, retail sales volumes have been flat since 2022, while industrial production is yet to recover (Figures 3a and 3b). European box volumes fell 5% in 2023, while sack kraft volumes are still below pre-Covid levels. More recently, escalating trade tensions following President Trump’s “Liberation Day” tariffs have heightened uncertainty in the market, limiting the appetite for businesses to invest, hire, and grow. A perfect storm for demand.

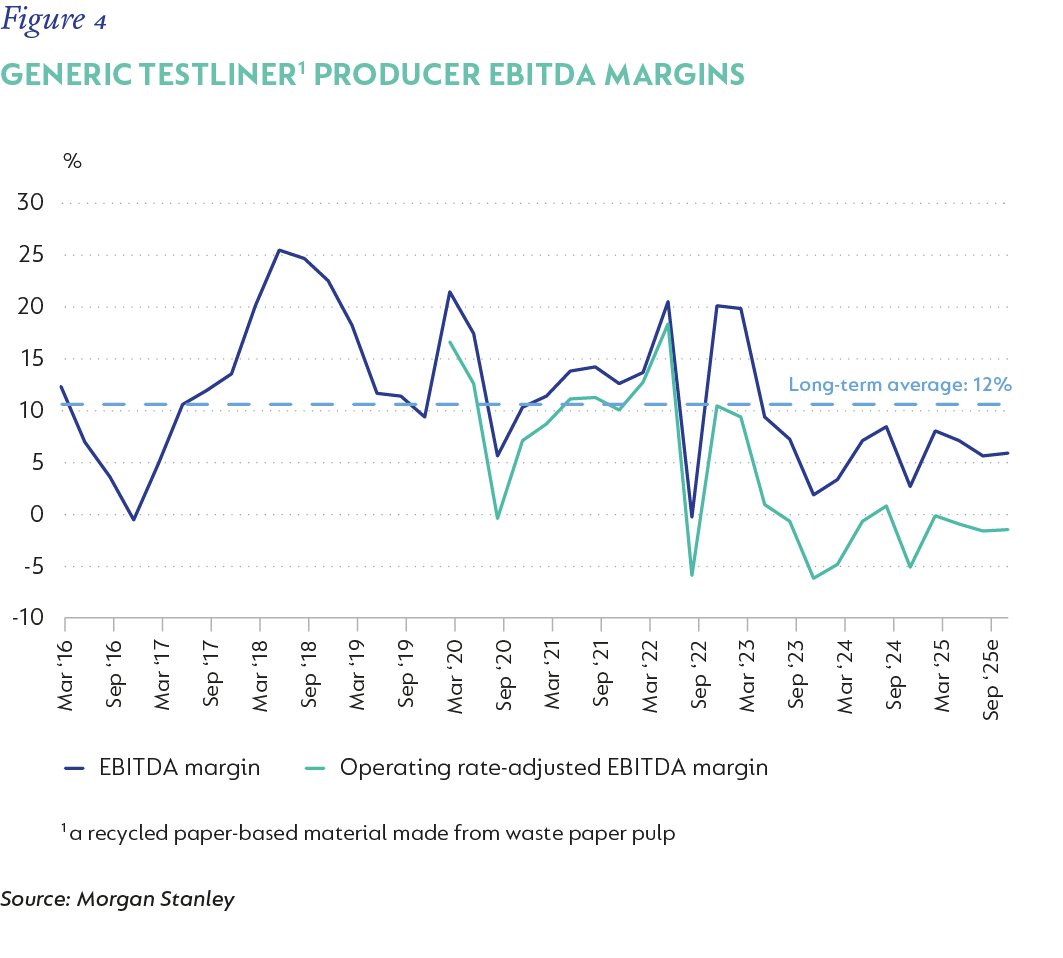

In this cyclical downturn, selling prices declined faster than input costs, resulting in a squeeze of industry margins to very low levels across most packaging grades. An example is the European recycled containerboard (20% of Corrugated Division volumes), where the downcycle was amplified by additional capacity entering the market, creating oversupply and resulting in low industry operating rates. Estimated recycled containerboard industry earnings before interest, tax, depreciation and amortisation (EBITDA) margins are down to mid-single digit levels versus the long-term average of 12% (Figure 4). Adjusting for lower operating rates, the recycled containerboard industry is hardly profitable on average, and an estimated 30% of that market is deeply loss making, an unsustainable position in the long term.

Easing inflation and lower interest rates are improving consumer affordability and supporting a recovery in industrial activity. 2024 saw a 4% recovery in box shipments and a small pick-up in sack kraft volumes, while the first half of 2025 has seen moderate price increases returning to packaging markets. It is still early days, but ultimately, as the cycle turns, industry margins should recover to more sustainable levels.

STRUCTURAL GROWTH IS NOT REFLECTED IN EARNINGS

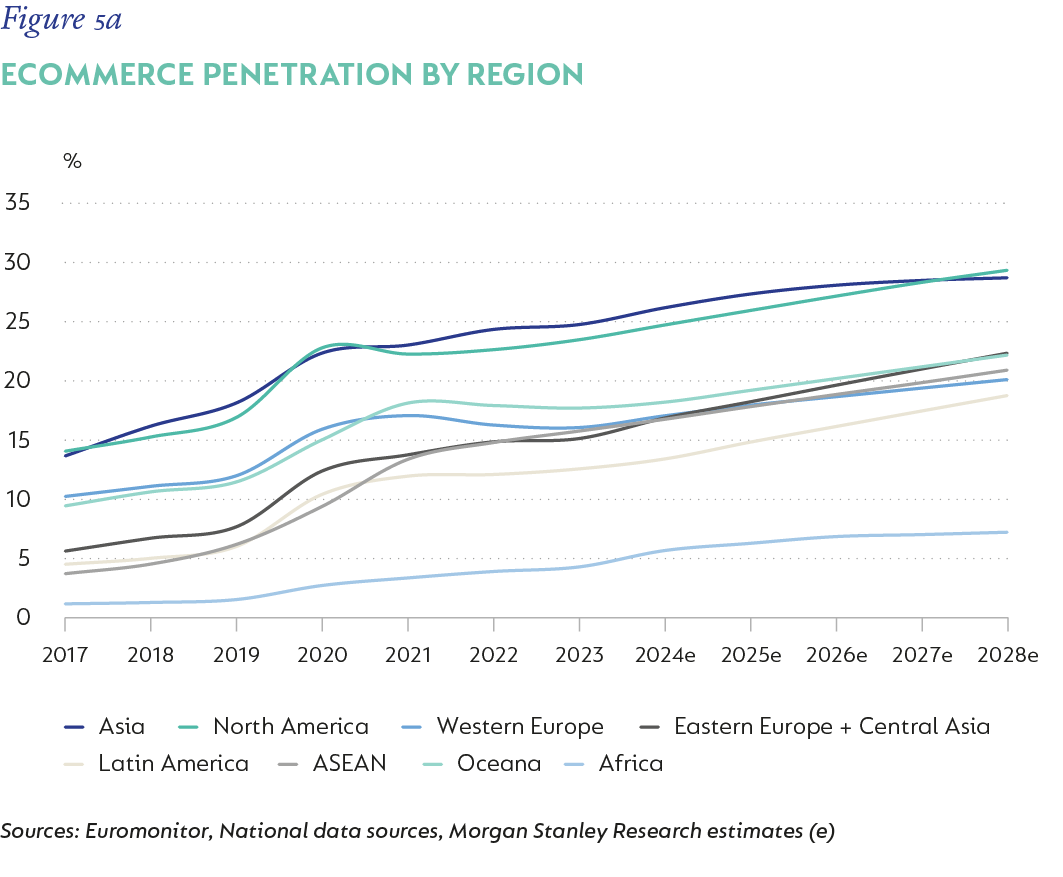

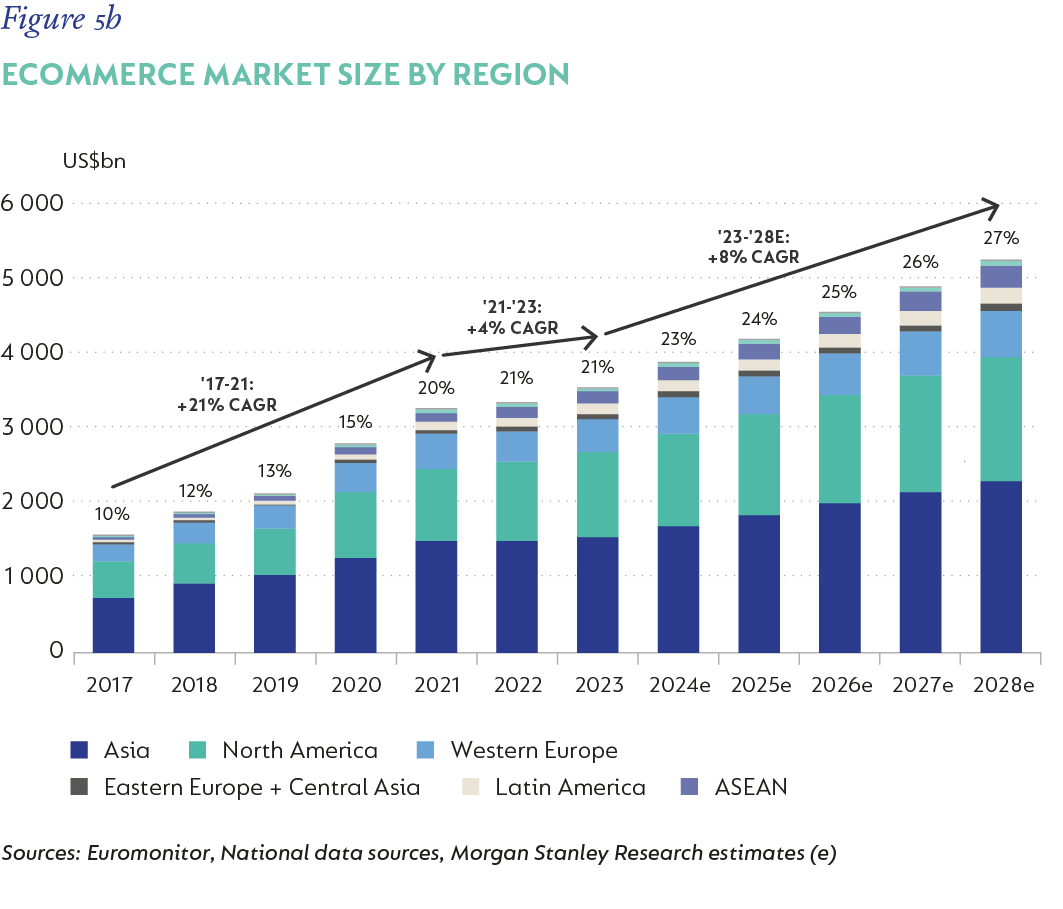

The paper packaging market benefits from some long-term structural growth drivers. Ecommerce has been growing strongly at the expense of brick-and-mortar retailing, and this trend is likely to continue (Figures 5a and 5b). The rise of food delivery services is yet another channel that is taking off within the ecommerce space. Online retailing makes use of more packaging in the delivery process and is a key demand driver for corrugated boxes and mailing envelopes. The potential market size for ecommerce packaging is large, particularly in emerging markets where penetration levels are still very low.

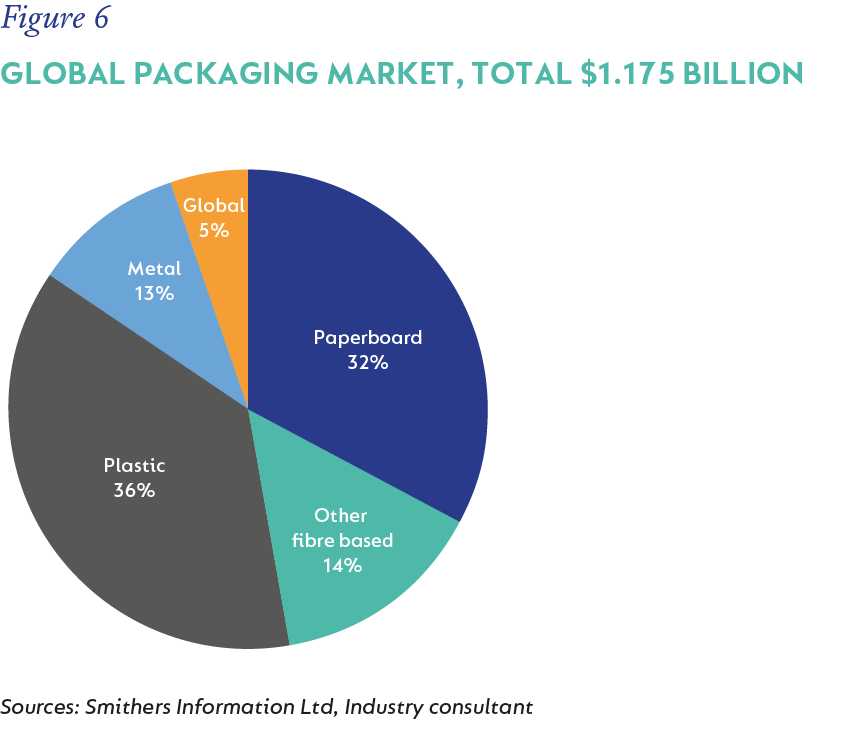

The global drive towards sustainability is at the heart of shifting consumer preferences away from single-use plastics towards sustainable paper packaging. From food, beverages, clothing, and general merchandise to industrial and agricultural packaging, global FMCG and industrial players are evolving their product supply chains towards sustainable packaging with paper at the centre of this transition. Regulations seeking to drive this shift are being enacted. Examples include the Packaging and Packaging Waste Regulations (PPWR) adopted by the European Council in December 2024. Plastic packaging accounts for 36% of the total global packaging market, estimated at US$1.175 billion in 2023 (Figure 6). Clearly, not all plastics will shift to paper, but the total addressable market is significant.

PARTNER OF CHOICE

Mondi has positioned its business to benefit from these structural tailwinds by partnering with clients to develop sustainable, paper-based solutions. It is a one-stop shop, combining corrugated kraft papers with coatings, plastics, and barrier technologies to achieve strength, flexibility, display, and moisture-proof qualities as needed. For example, in the ecommerce space, Mondi has developed a protective mailer envelope in collaboration with Amazon by making use of Mondi’s kraft paper and corrugated capabilities. In the pet food space, Mondi developed the flexi-bag, leveraging the strength and flexibility characteristics of their sack kraft paper to replace plastic-based bags.

Within Mondi’s specialty kraft business, 15% of the products sold in 2024 did not exist five years ago but were developed by Mondi together with their customers. Mondi’s scale and breadth of product make it a partner of choice for businesses seeking to develop and bring to market new sustainable packaging solutions.

INVESTING FOR GROWTH

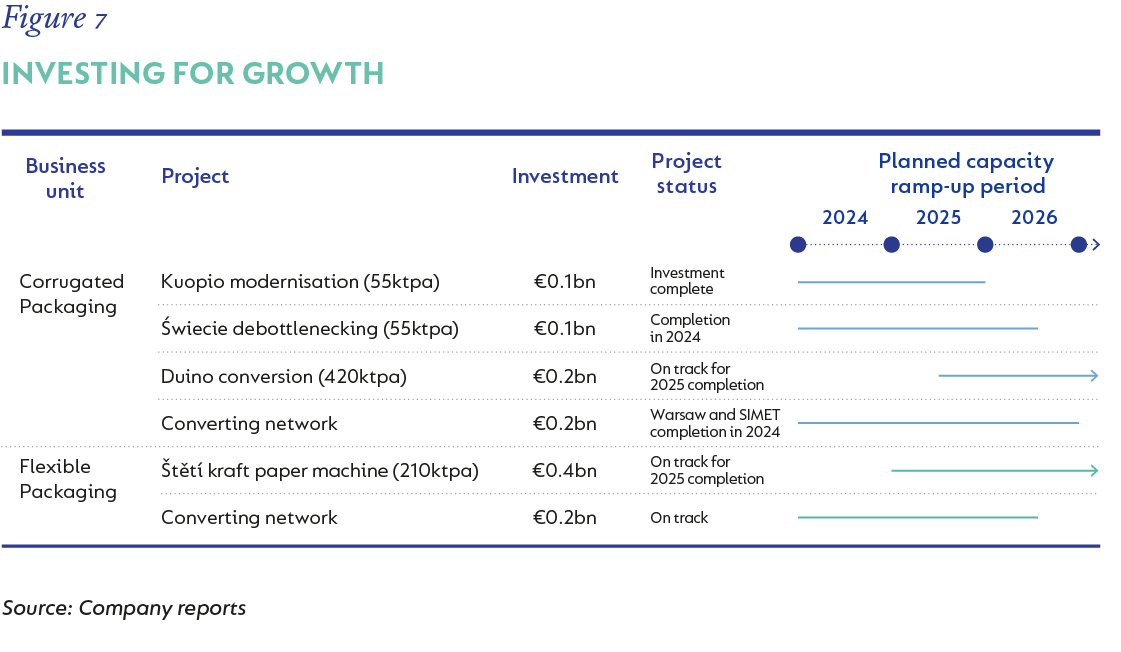

With strong growth opportunities available, Mondi has continued to invest in additional capacity. In 2023, they launched an investment programme totalling €1.2 billion, a significant sum representing nearly 20% of the current market capitalisation of the group. This programme involved building new paper mills, debottlenecking existing operations and adding downstream converting capacity to both the Containerboard and Flexible Packaging divisions. These projects were delivered on time and on budget and are now ramping up to full production (Figure 7). The current earnings base for Mondi does not yet reflect the benefits from this additional capacity.

“BEING GREEDY WHEN OTHERS ARE FEARFUL”

Under mid-cycle trading conditions, a business of this quality and growth potential, with the significant investment in capacity expansion, will generate earnings meaningfully higher than what was reported in 2024. The current downcycle in demand across Mondi’s markets, together with concerns about new recycled containerboard capacity, has weighed on the share price. In our view, this presents a compelling investment opportunity. While the timing of a demand recovery is uncertain, Mondi trades at around eight times our assessment of sustainable mid-cycle earnings – a very attractive multiple for a business enjoying scale, market leadership and a compelling growth outlook.

South Africa - Personal

South Africa - Personal