Investment views

Addendum 2: Stress testing worst-case scenarios

- assessing asset class performance in weak state regimes

SRI LANKA

An extended period of poor macroeconomic management including a restrictive trade regime, a weak investment climate, a loose and unguarded monetary policy, an administered exchange rate, and erratic fiscal governance finally culminated in Sri Lanka losing market access in 2020. But, even then, the government of the time persisted in prolonging the inevitable for another two years – at great cost to the economy – before an external debt suspension was announced. This was trailed a few months later with the removal of President Nandasena Gotabaya Rajapaksa in 2022 following mass public unrest. The crisis continues and a debt restructuring has yet to be finally concluded.

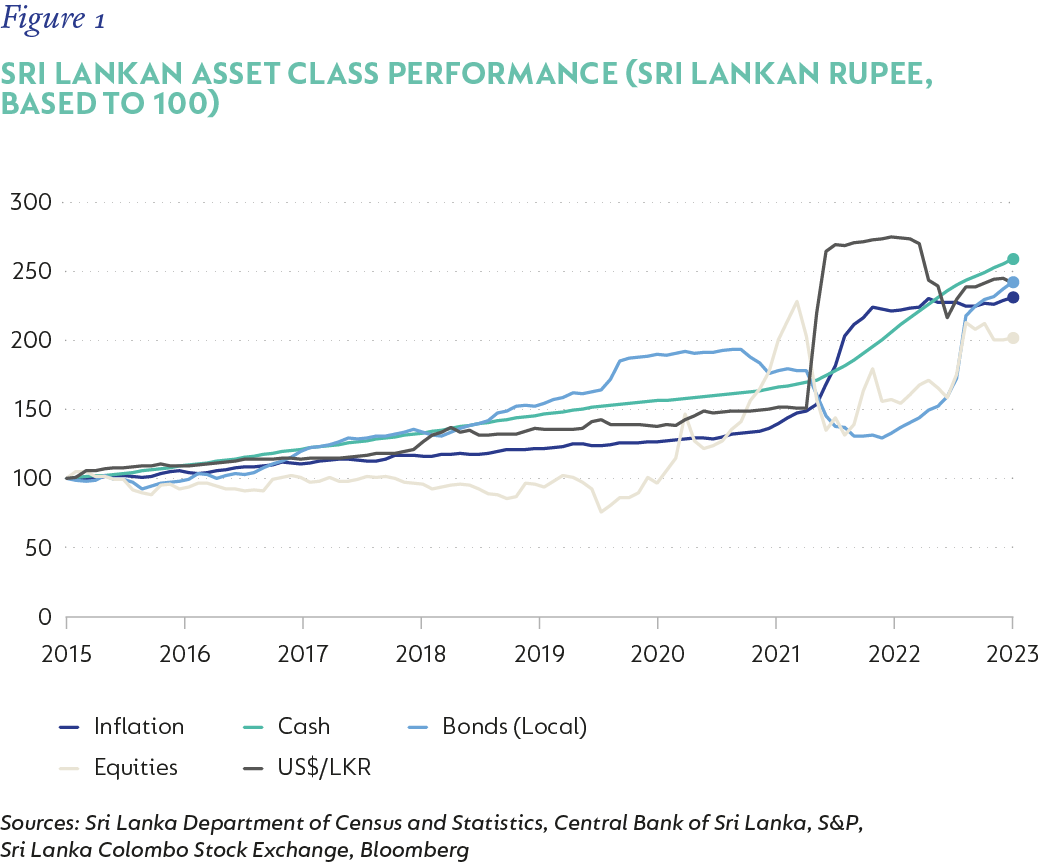

Figure 1 below provides some insight into the nature of the crisis and how it impacted pricing and valuations. There are several key observations to bear in mind:

- The starting base is very important. Depending on where one assumes the initial point of departure is, will make a material difference to the relative outcomes over a cumulative long-term holding period.

- However, choosing a starting point between late 2015 and late 2020 (or similarly, rotating allocations at this point) almost inevitably favours an equity holding as the asset class that best preserves value from both internal and external currency standpoints. As such, the argument that an equity allocation would have proven the best preservation strategy within the Sri Lankan context remains intact. Indeed, if extending the starting point further back (this loses ‘local bonds’ as an asset class), equity retains its foremost ranking over the long term and still comes out relatively well on a real basis.

- That said, the favourable return profile provided by ‘cash’ in this case study is noteworthy. From 2009 to 2021, the average real rate provided by cash was a defensible 3.5%. Given the consistency with which Sri Lanka provided such a good pick-up, a wholesome long-term outcome is understandable. Yet it’s also very important to recognise that having a starting point anytime between late 2017 and mid-2022 would have resulted in a negative real return from cash. So, even with high cash rates, real value preservation was lost over this period while invested in cash.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal