Investment views

The biggest risk is taking none

Are long-term investors positioned for the future?

- SARB’s Covid-19 policy response has shifted the outlook for asset classes

- Money market and income funds have lost their shine

- Current equity valuations trump history in a low-interest environment

- Risk assets are better positioned to achieve long-term growth

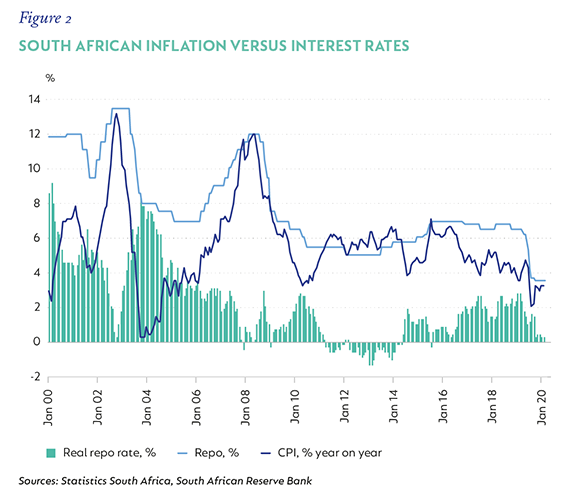

CASH, AS THE OLD saying goes, is king. And in a local equity market where we have had a paucity of returns, cash and cash-plus funds have certainly been reigning, both in terms of returns and inflows. South Africa, one of the last few countries that has a truly independent central bank, has maintained, up until now, positive real interest rates. The South African Reserve Bank (SARB) believed that, due to South Africa’s loose fiscal policy, it needed to offset this by running a very tight monetary policy. This has meant that, on a pre-tax basis, cash investors could have achieved a return ahead of the official inflation rate.

The various cash-plus and income funds could then use some duration and opportune credit selection to add an additional 0.5% to 1.0% over and above this. For the five years up until the end of 2020, the average money market fund returned 7.1%, the average cash plus fund 8.0% and tactical income funds 7.5%. This compares to an average domestic equity fund return of 3.2% over the equivalent period and 4.4% for the average high-equity balanced fund.

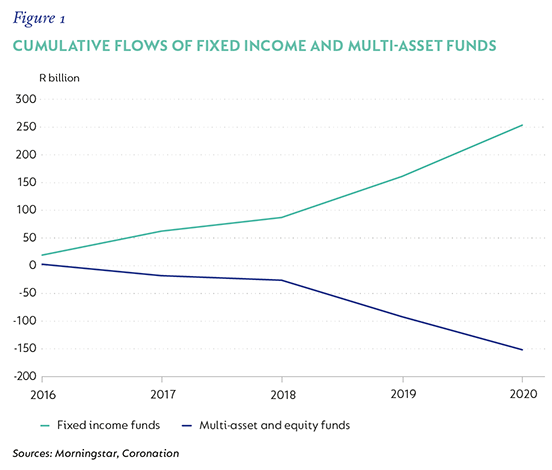

Given the lower risk profile and lower volatility of returns, it is no wonder that money market and income funds have attracted the lion’s share of flows. For the past five years, R252 billion has flowed into these funds, while equity funds and multi-asset funds with exposure to growth assets have experienced outflows of R150 billion (Figure 1). What has been surprising, however, is how this trend has continued in 2020, even though the forward-looking opportunities are now very different.

LOWER EXPECTED RETURNS

A money market fund return profile is very different from that of an equity fund. Where the return for equities can never be guaranteed and upside in any given year is effectively unlimited, in a money market fund you have a very good idea of what you are going to earn over the next 12 months. On the day you invest you can easily obtain the 12-month yield, and, barring any surprise interest rate moves, that is exactly what you’ll earn. Further, as policy rates are adjusted by only 0.25%-0.5% at a time, potential interest rate moves are also unlikely to result in a significantly different return. And, given the low duration in money market and income funds, a decline in rates triggers little to no capital gains.

Today, given the poor state of the local economy, the potential return from money market funds and income funds is significantly different from those achieved historically. In 2020, the SARB aggressively cut interest rates to their lowest levels in 50 years. And with rolling lockdowns continuing to weigh on the economy, rates are unlikely to increase in the short term. The SARB has felt comfortable cutting rates given that official inflation is solidly positioned in the Bank’s target range of 3%-6% and they have more confidence in the fiscal prudence of the current government (Figure 2).

This has all been good news for borrowers, but, of course, very bad news for savers. With the Johannesburg Interbank Average Rate offering a yield of 3.6% at the moment, the average money market fund is going to struggle to offer investors a meaningful return. This yield is at or below official inflation (which tends to be below actual inflation), meaning that real returns will also be far worse than they have been over the past five years.

A further challenge to income funds being able to return a yield ahead of this rate is the fact that credit spreads for good quality corporates have tightened significantly over the past few years. In fact, today a good quality corporate can borrow term money at a cheaper rate than the South African government is able to, meaning the funds can actually earn a negative spread over the risk-free rate for lending to a quality company.

WHERE TO FROM HERE?

This leads to the debate as to what the alternatives for investors are. In 2020, despite the immense impact of the lockdown on the economy, South African equities managed to return 7.0% for the year and proved once again how difficult it is to time equity markets based on macroeconomic factors. And, this was despite the fact that many South African companies saw their share prices declining significantly (the more South African-biased FTSE/JSE Capped Shareholder Weighted All Share Index was up only 0.6%).

Over the next several years, given the very cheap relative levels of the market, we expect equity markets to continue to deliver solid returns. While there is never guaranteed certainty in equity market returns, the balance of probabilities is firmly in favour of equities being able to beat the return that a money market fund is going to be able to achieve in the foreseeable future.

Similarly, a multi-asset fund that can allocate between equities, longer dated bonds, property and alternative assets, all of which offer meaningful return prospects, stands a far better chance of delivering a much more meaningful return than a money market fund.

In behavioural finance, it is a well-known fact that investors tend to allocate money to funds that have performed well, and away from those that have underperformed, even though there are very strong rational reasons for why they should be doing the exact opposite. Today there is a clear inflection point, and we know, with a high degree of certainty, that the potential returns from money market and income funds will be significantly lower than those achieved for the last decade.

At the same time, over the same period, equity markets have derated to the point where the dividend yields alone of most domestic equities are in excess of money market rates, and there is potential for capital appreciation over and above that. For any investor with a long-term investment horizon, allocating funds to the safety of cash is likely to be locking in significant underperformance relative to equity and multi-asset alternatives. The implications of taxation, with capital gains and dividends taxed at a lower effective rate than interest income, will only further increase this differential. +

South Africa - Personal

South Africa - Personal