Personal finance

Investing Offshore

Are you following the right strategy in the context of your overall portfolio?

Overview

South African investors understand the benefits of having international exposure. Yet, many investors allow their decision-making about the level of exposure to international asset classes to be informed by prevailing economic sentiment or the performance of a particular currency, asset class or investment fund.

Making isolated decisions (based on sentiment) about a single component of your long-term investment strategy is, however, not a prudent approach. Instead, having international exposure is a strategic component of any long-term investment portfolio, regardless of the point in the cycle, and one that needs to make sense in the context of your overall portfolio, as well as your individual needs.

This edition unpacks how best to think about your investment portfolio’s international allocation, explains what the appropriate allocation size is for different types of investors, and demonstrates how you can achieve your specific offshore needs by investing with Coronation.

Beware of the sentiment trap

Having international exposure as part of your overall long-term investment portfolio, can provide many benefits.

But when you allow sentiment to drive your investment decisions, it can increase the risk of making irrational choices which may result in missing out on long-term gains (due to poor timing) or exposing you to certain risks as detailed below.

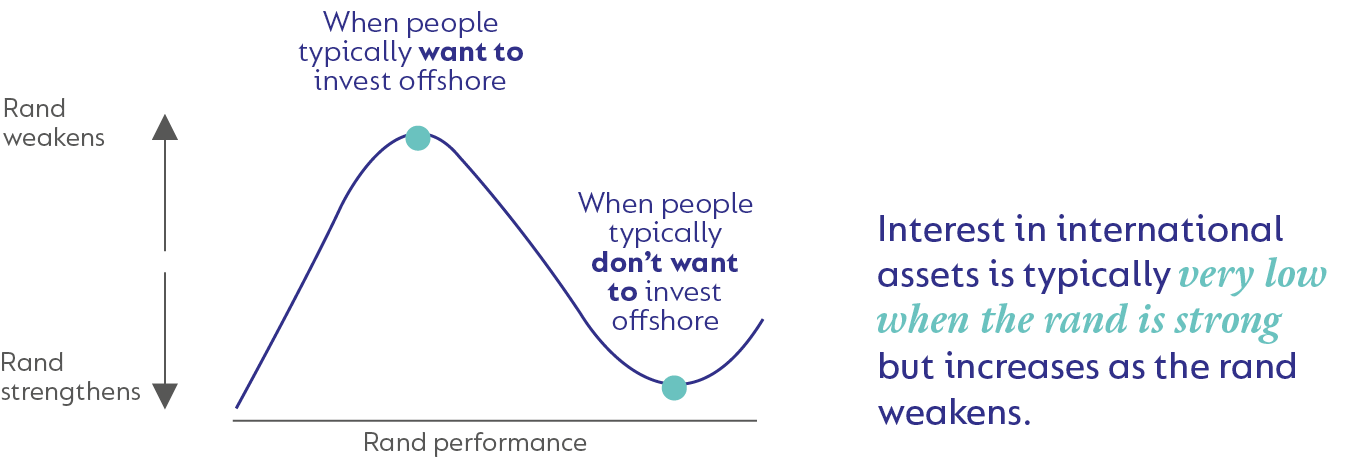

One of the best examples of sentiment-driven investing is how South African investors react to short-term currency moves. The performance of the rand has a long history of significantly impacting how investors perceive international investments. Interest in international assets is typically low when the rand is strong but increases as the rand weakens. This becomes value-destructive when investors inadvertently replace cheap assets with expensive assets (buying low and selling high) purely based on current sentiment.

In summary, it is important for investors to approach their level of offshore exposure rationally, and with strategic, not temporary, reasons in mind.

Strategic reasons to allocate internationally

In a fundamentally unforecastable world, one of the best ways to structure your overall investment portfolio is to diversify your exposure across multiple economic-, jurisdictional-, currency-, industry-, and company-specific risks.

For South African investors, the ability to diversify into international markets means that you can reduce your overall risk, but also increase the potential for overall return.

Listen to this short audio note by our CIO Karl Leinberger on the value of diversification.

DIVERSIFICATION TO REDUCE OVERALL RISK

By allocating money internationally, you add another asset class/set of asset classes to your overall investment portfolio that behaves differently to that of your local asset class mix, especially when factoring in the impact of the local currency.

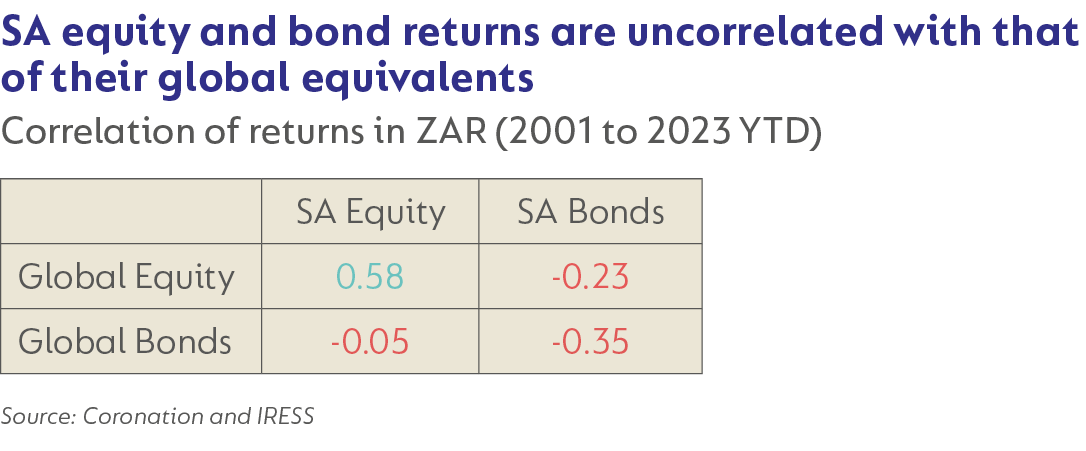

The following table demonstrates the value of introducing global assets to your South African portfolio. By assessing the correlation between asset classes, we are able to get an idea of how they behave over time. The lower the correlation, the more diversification benefits you can expect when combining the assets.

South African equities and bonds have a low correlation with their global equivalents, and an even lower correlation between asset classes – e.g. South African equities have a low correlation of 0.58 with global equities and -0.05 with global bonds.

DIVERSIFICATION TO ENHANCE RETURNS

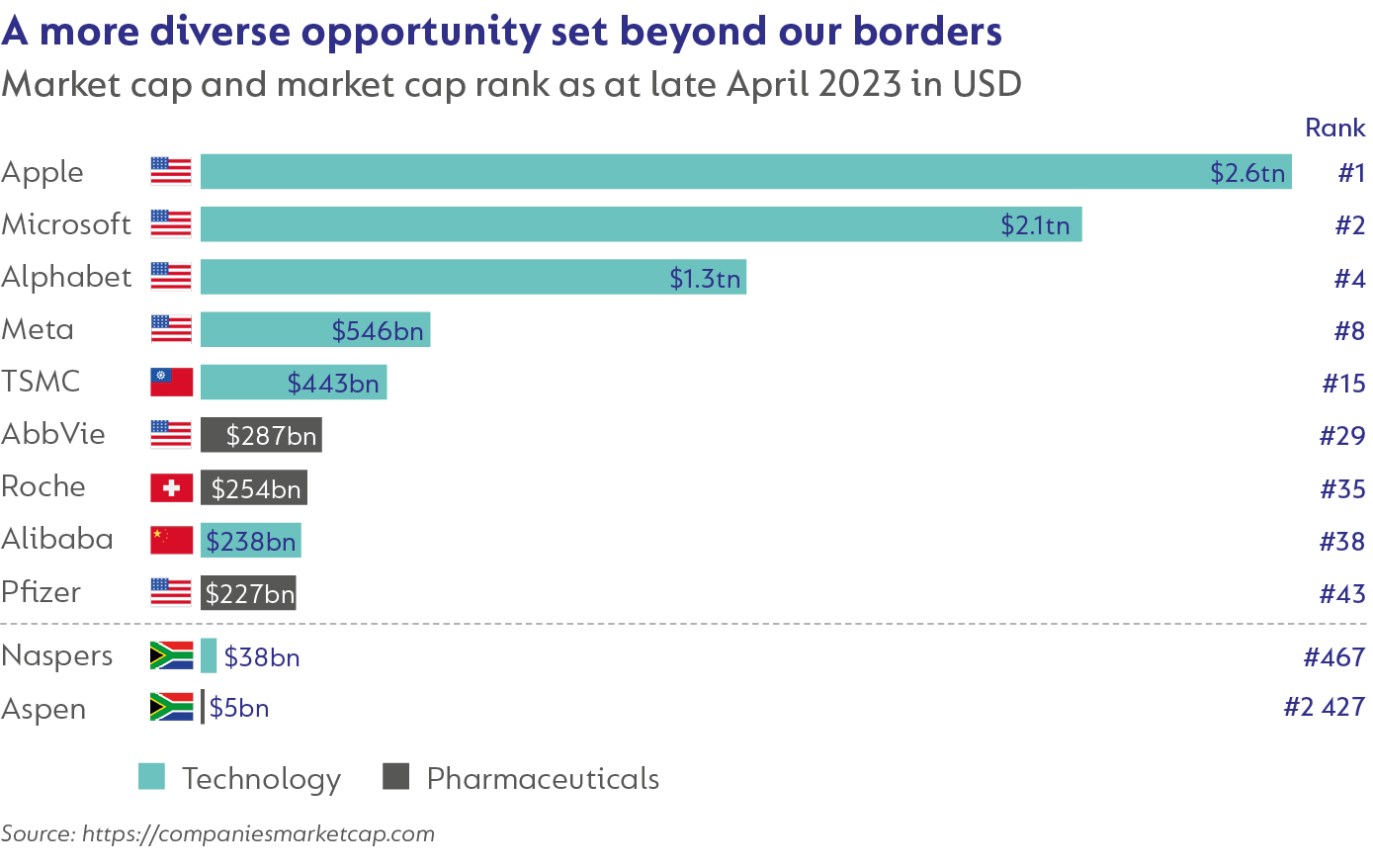

By opening up your investment portfolio’s universe, you gain access to opportunities in industries that may not have a strong presence in the local market (e.g. information technology, biotechnology, electronics, or pharmaceuticals) as well as to a much wider opportunity set of quality businesses with attractive earnings prospects within those industries.

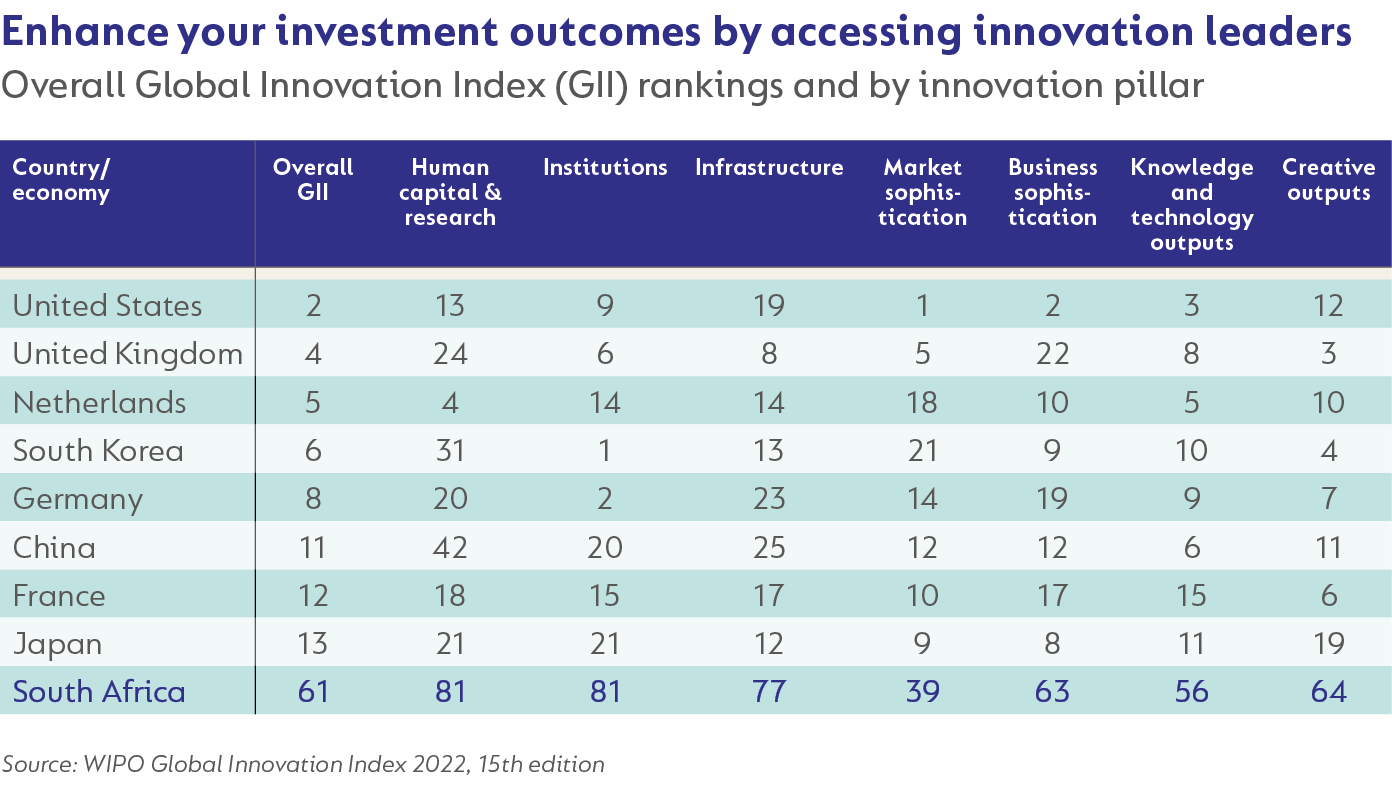

Furthermore, by diversifying your investment portfolio to include international assets, you gain access to growth regions that benefit from mega-drivers, such as innovation, industrialisation, urbanisation, digital advances and growing consumerism. The table below shows some of the most innovative countries in the world. By adding global diversification to your portfolio, you are able to enhance your investment outcomes through access to companies that are industry leaders, have access to the latest technology and research, and benefit from supportive government policies and institutions that promote innovation.

MAPPING THESE BETTER RISK-ADJUSTED RETURNS

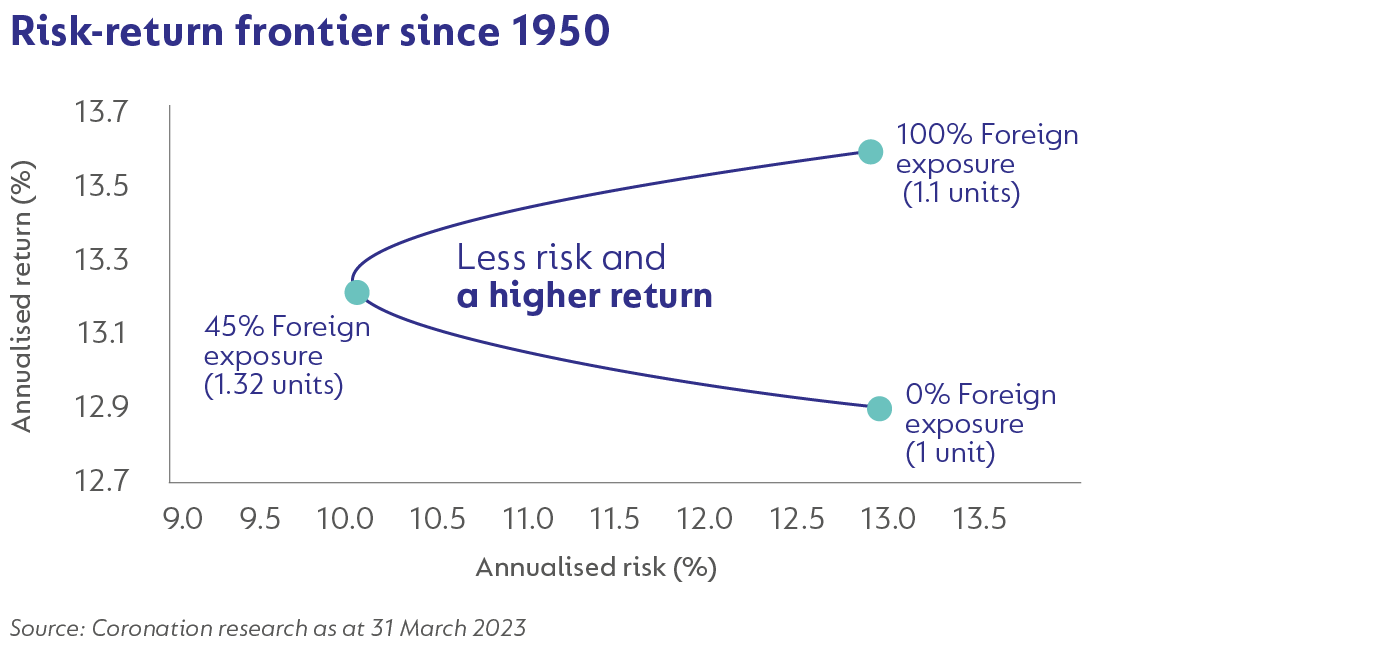

As detailed above, the following graph demonstrates that investors who include meaningful international exposure in their overall long-term investment portfolios can expect better risk-adjusted outcomes.

At 0% international exposure, investors get compensated with 1 unit of return for every unit of risk taken. But by having international exposure of 45%, the investor’s return increases and their risk decreases, meaning that they can achieve 1.32 units of return for every unit of risk taken.

A HEDGE FOR YOUR FUTURE SHOPPING BASKET

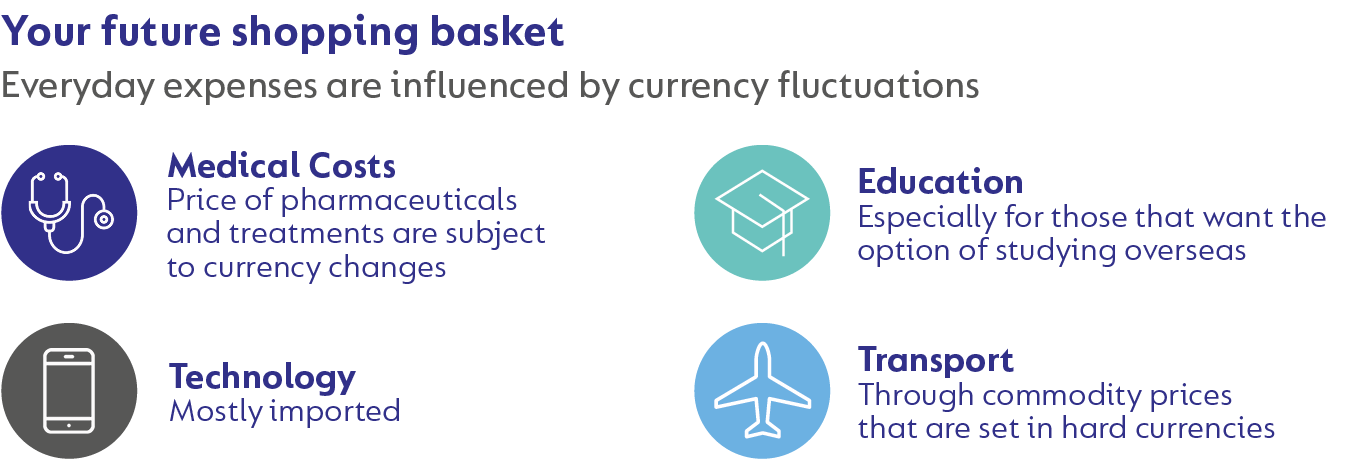

Many items in the South African consumer’s shopping basket (from fuel to food to healthcare) are largely priced in foreign currencies as the inputs are either commodities (with prices struck in global markets), or heavily reliant on imported content. Having adequate international exposure within your overall investment portfolio acts as a hedge against the long-term change in price of this part of your future shopping basket.

Episodes of currency weakness will more than likely remain a strong driver of price increases into the future. Having more than the minimum offshore exposure recommended for retirement savers may also be warranted for those planning for future liabilities in hard currency. This would include expenses such as overseas travel (for leisure purposes or visiting family members living abroad) or business opportunities, investing for a next generation’s education, or emigration.

How much international exposure is appropriate?

The amount of international exposure that you should have as part of your long-term investment portfolio depends on how much you have to invest.

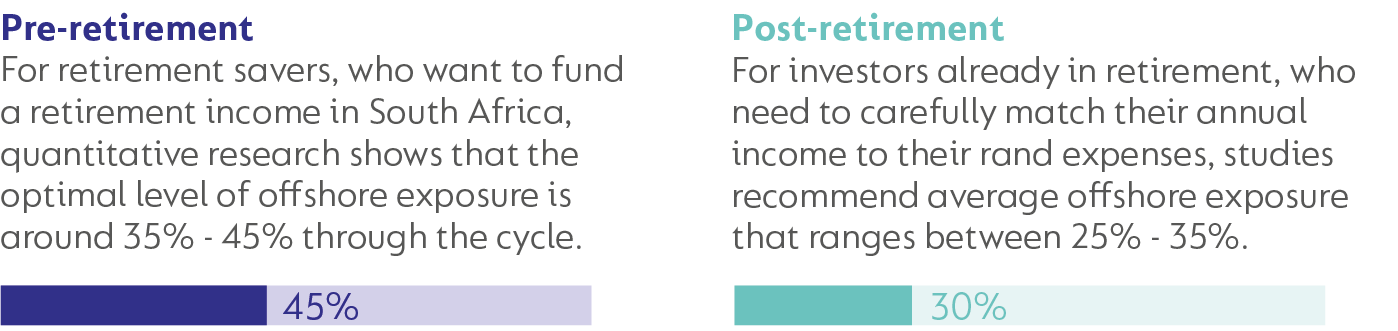

If you only have the budget to save for retirement, the following guidelines apply:

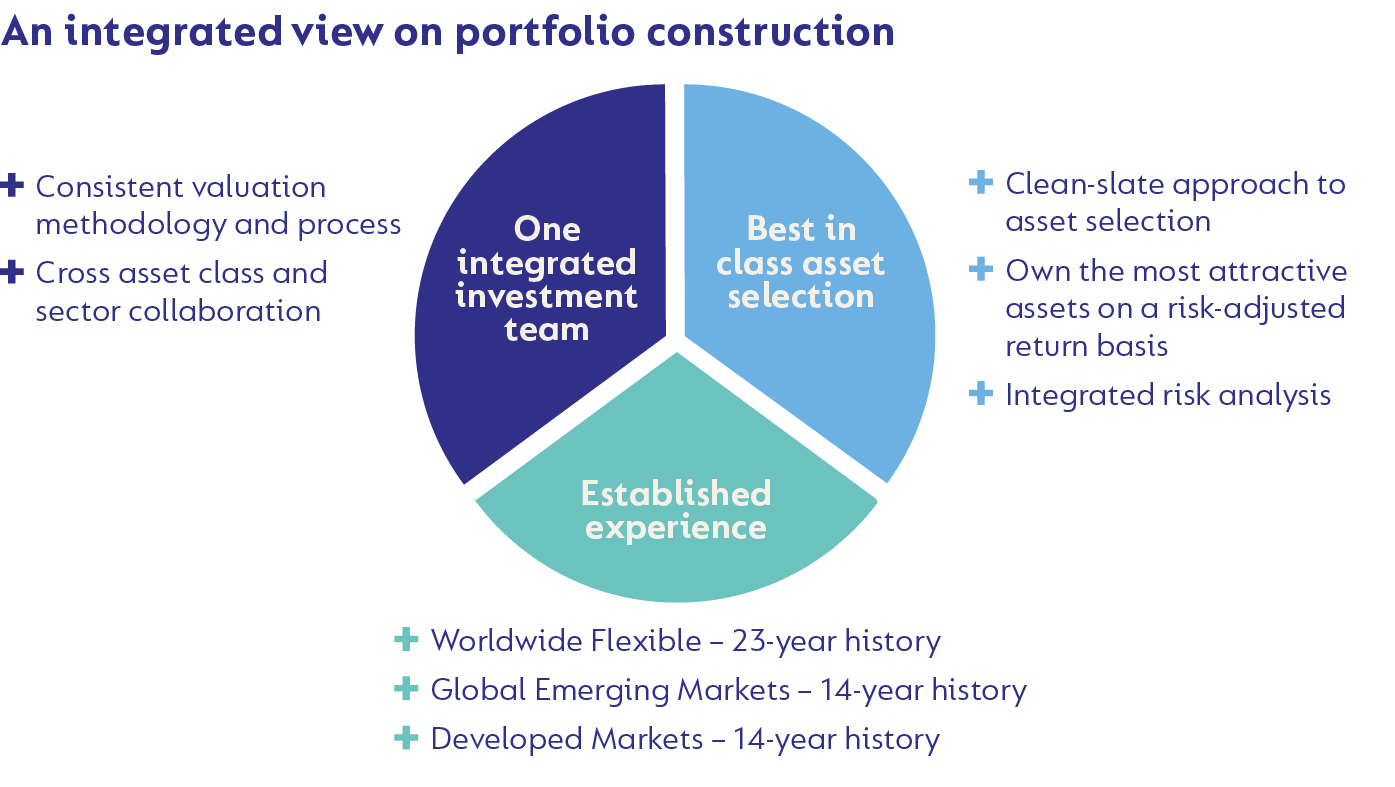

Typically, these investors would consider investing in a Regulation 28-compliant (Reg 28) multi-asset fund in which the international allocation decision is made on your behalf. At Coronation, we offer two Reg 28-compliant multi-asset funds that are aimed at the different stages of investors’ retirement journeys - Coronation Balanced Plus and Coronation Capital Plus. These funds are managed with an integrated view on portfolio construction across all asset classes to ensure that:

- the offshore allocation makes sense within context of the overall portfolio; and

- any associated unintended consequences are addressed through holistic risk management

WHAT IF I WANT MORE THAN 45% OFFSHORE?

Investors who can justify a larger international allocation include those who:

- spend regularly in foreign currency;

- are considered high net worth in a global context;

- need to consider offshore bequests because multiple generations live on different continents; and/or

- do not need to draw a significant domestic income from their savings.

At Coronation, we offer solutions to investors with larger international budgets. Read more in How to invest your rands offshore with Coronation

How we invest in global markets vs how we invest locally is no different

For close to 30 years, we have been applying the same long-term focused and valuation-driven methodology and process regardless of the geography of the markets in which we invest.

Furthermore, we operate as a single integrated investment team, with roughly the same number of SA-focused and global analysts who continuously collaborate across asset classes and sectors. We believe this team-based approach to investing, rather than relying on specialist silos, drives better outcomes for our investors.

DEMONSTRATING OUR ABILITY TO INVEST ACROSS GLOBAL MARKETS

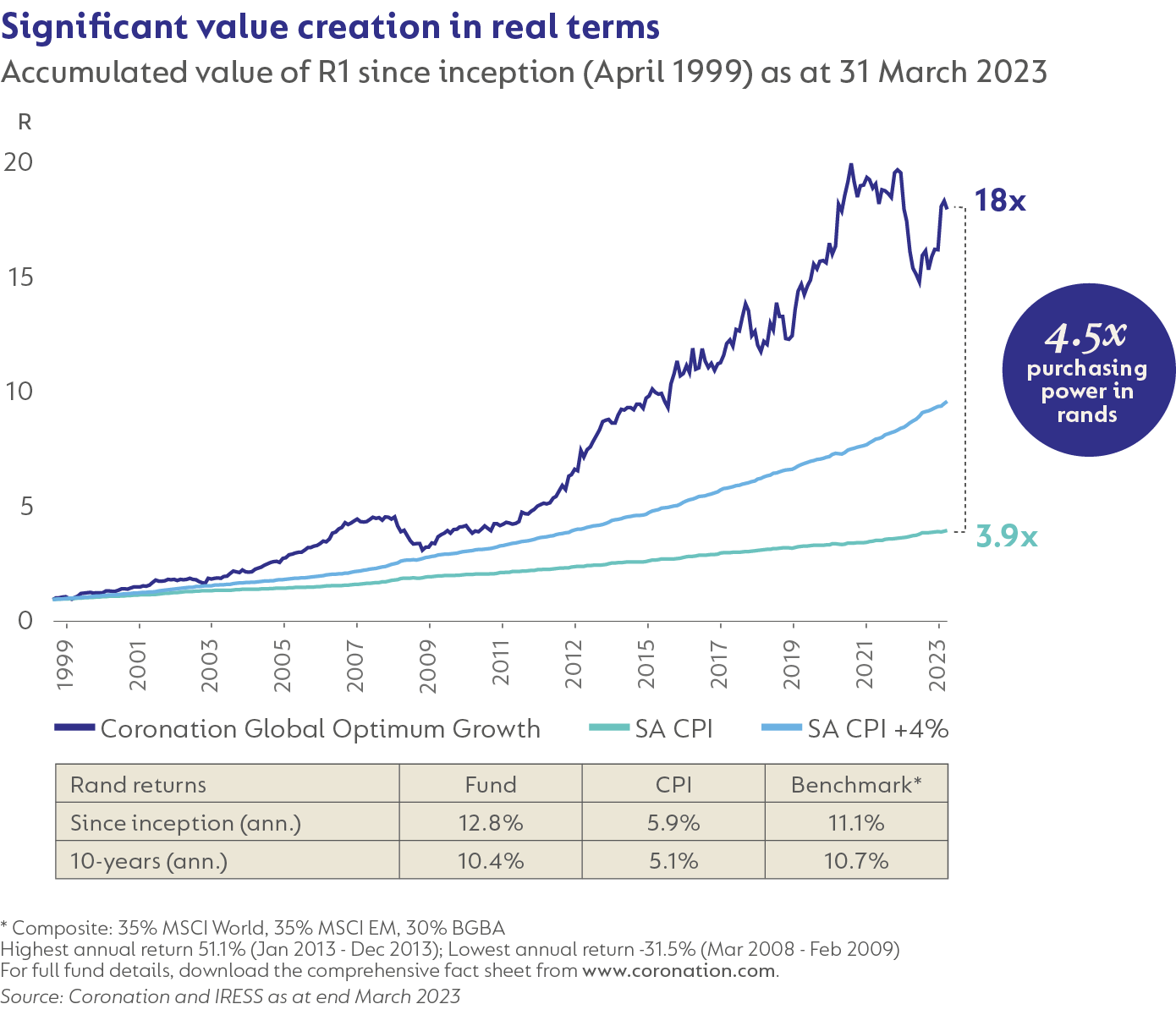

Our proven capabilities to allocate across markets and asset classes have generated significant value for investors over the long term, as demonstrated by the track record of the Coronation Global Optimum Growth Fund. The Fund is an unconstrained global portfolio that allocates to our best ideas across asset classes in developed and emerging markets. Key highlights for the rand-denominated feeder fund as at end March 2023 include:

- outperformed inflation by 7% p.a. over the past 20 years; and

- ranked second in its ASISA category over 20 years.

As demonstrated in the graph below, for every R1 invested at inception in March 1999, you would have R18 today compared to R3.90 needed to keep up with inflation – resulting in a 4.5 times increase in purchasing power over that period (or a 3.5 times increase in purchasing power in USD terms over that same period).

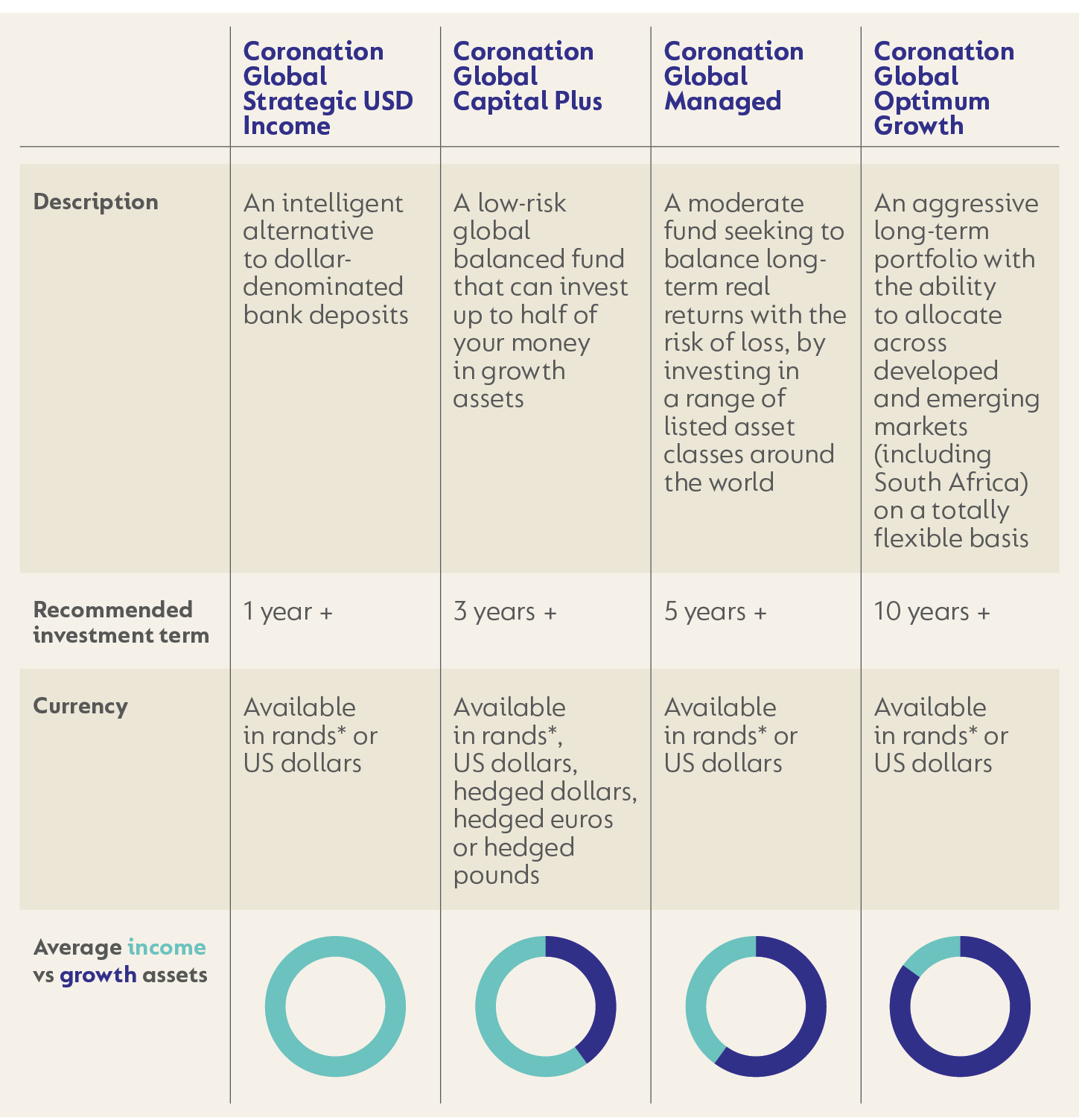

We also offer two other international multi-asset portfolios aimed at meeting specific investor needs, each with an investment track record of more than 10 years - Coronation Global Managed and Coronation Global Capital Plus.

All of our international funds are available as rand feeder funds** or denominated in US dollars.

How to invest your rands offshore with us

By living, working and owning a home in South Africa, you already have significant country-specific risk, arguing for additional international exposure.

Investors who require more international exposure than what is achievable by way of their retirement savings can therefore use their discretionary (or non-retirement savings) to invest in a fund incorporated in another country (i.e. externalising your rands), most often in the EU. In this case, the laws of the country of incorporation govern your investment. Coronation offers a range of funds incorporated in Ireland with the same underlying market exposure as our rand-denominated international funds**, but with the added benefit of jurisdictional diversification. We recently reduced the minimum investment amount required to open an offshore investment account with Coronation from $15 000/£15 000/€15 000 to $500/£500/€500.

We also offer rand-denominated feeder funds** that allocate all or most assets to international investments, while remaining easy to use and access, as the funds are established in South Africa. While these funds provide full economic diversification, they still operate under the laws of South Africa and therefore do not diversify jurisdictional risk (e.g. exchange controls, which limit the amount an asset manager can invest outside of SA on behalf of clients).

* Please note that our full range of rand-denominated international funds is temporarily closed to new investments via the South African Unit Trust product. Read more here.

AN ESTABLISHED INTERNATIONAL FUND RANGE

To give you access to the best global opportunities, we offer a range of multi-asset class solutions (as per the table below) that are designed to meet specific investor needs. We also offer three equity-only portfolios in the form of the developed market-focused global equity fund (Coronation Global Equity Select), a global equity fund of funds (Coronation Global Opportunities Equity) or our global emerging markets funds.

* Temporarily closed to new investments via the South African Unit Trust product. Read more here.

Read more about the funds mentioned in this table

FAQ's

HOW TO ACCESS OUR INTERNATIONAL FUNDS

Our rand-denominated international funds** are available directly from Coronation, or as investment options on the product platforms of most of the prominent linked investment product companies in South Africa. Our foreign-domiciled funds can also be accessed directly, or through the offshore fund platforms offered by both domestic and foreign institutions including Allan Gray, Capital International, Canaccord, Cidel, Discovery, Glacier by Sanlam, Ninety One, INN8, Momentum, and Old Mutual International.

HOW TO CHOOSE BETWEEN A RAND-DENOMINATED** & FOREIGN CURRENCY-DENOMINATED FUND

Our rand-denominated** and foreign-domiciled international funds are invested in the same assets. The suitability of fund structure is best determined by an investor’s financial and tax planning considerations. Factors such as the investor’s status (natural person or trust), family needs (e.g. children on different continents) and the purpose of their investment (e.g. whether they want to draw an income) should influence this decision. Offshore investment is still subject to exchange controls set by government and administered by the South African Reserve Bank. When investors elect to invest in our foreign-domiciled international funds, they use their individual allowance of up to R11 million a year. Investors in our rand-denominated international funds** utilise Coronation’s foreign investment allowance, which is currently set at 45% of the management company’s assets.

DECIDING ON THE RIGHT CURRENCY CHOICE

Deciding on the optimal currency allocation within a portfolio is integral to establishing the fair value of assets and optimising returns over time. Our long-term, growth-oriented foreign-domiciled funds therefore invest in a basket of currencies, despite the fact that returns are reported in US dollars. However, where funds have short-term capital preservation targets, which can only be expressed in a certain currency, the currency decision is often more appropriately made by the client. For this reason, we have introduced hedged currency classes for the Coronation Global Capital Plus Fund. This enables investors to choose the reference currency that we will use in managing the risk of short-term capital loss. (See table above for details.)

**Please note that our full range of rand-denominated international funds is temporarily closed to new investments via the South African Unit Trust product. Read more here.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal