Personal finance

Coronation Global Optimum Growth

For investors with a long time horizon and a global outlook.

The Quick Take

- Coronation Global Optimum Growth is a popular core holding for many South African investors’ long-term savings outside of retirement

- For the past 24 years, the strategy has generated very compelling real returns in rand and in dollar

- Its unconstrained mandate and aggressive allocation works best over a long time horizon

- It is flexible enough to take advantage of non-equity opportunities and use protection strategies when appropriate

Coronation Global Optimum Growth is a popular holding in many South African investors’ portfolios. As a core investment for their long-term savings outside of retirement, the Strategy* has generated significant value over its 24-year track record. Below we explain some of the key traits of this rather unique mandate that is available to investors in US dollars or in rand through a feeder fund.

AN UNCONSTRAINED MANDATE THAT WORKS BEST OVER A LONG TIME HORIZON

The Strategy’s mandate is not constrained by any specific benchmark, asset class, geography, market segment or the limits applicable to retirement savers (through Regulation 28). This absolute freedom allows the portfolio to change its core holdings and strategic portfolio positioning as market conditions change, but also requires alignment with its investors in terms of their time horizon.

As such, the Strategy’s recommended time horizon is 10 years or more; intentionally longer than the classic recommended holding period of five years or more for many of the growth-oriented funds available to South African investors.

THINK OF IT AS AN AGGRESSIVE GLOBAL ALLOCATION PORTFOLIO…

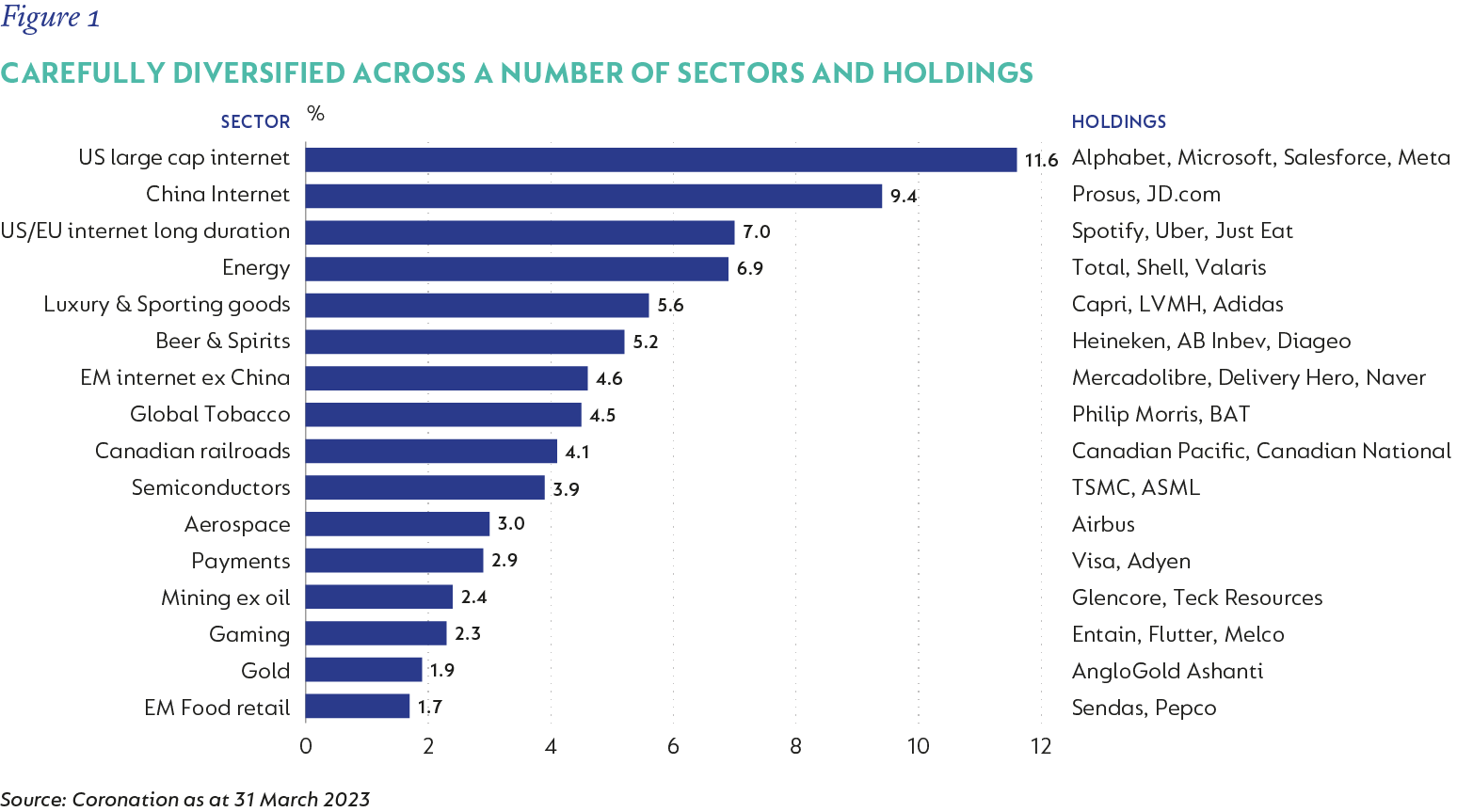

While the feeder fund** is one of the longest running funds included in the ASISA Worldwide - Multi-Asset - Flexible category, we much prefer investors to think of it as an aggressive global allocation portfolio. This reflects the reality that the bulk of its assets will be allocated to international equities over time, carefully diversified across a number of countries, economic sectors and holdings.

…WITH THE FLEXIBILITY TO TAKE ADVANTAGE OF OPPORTUNITIES BEYOND EQUITIES

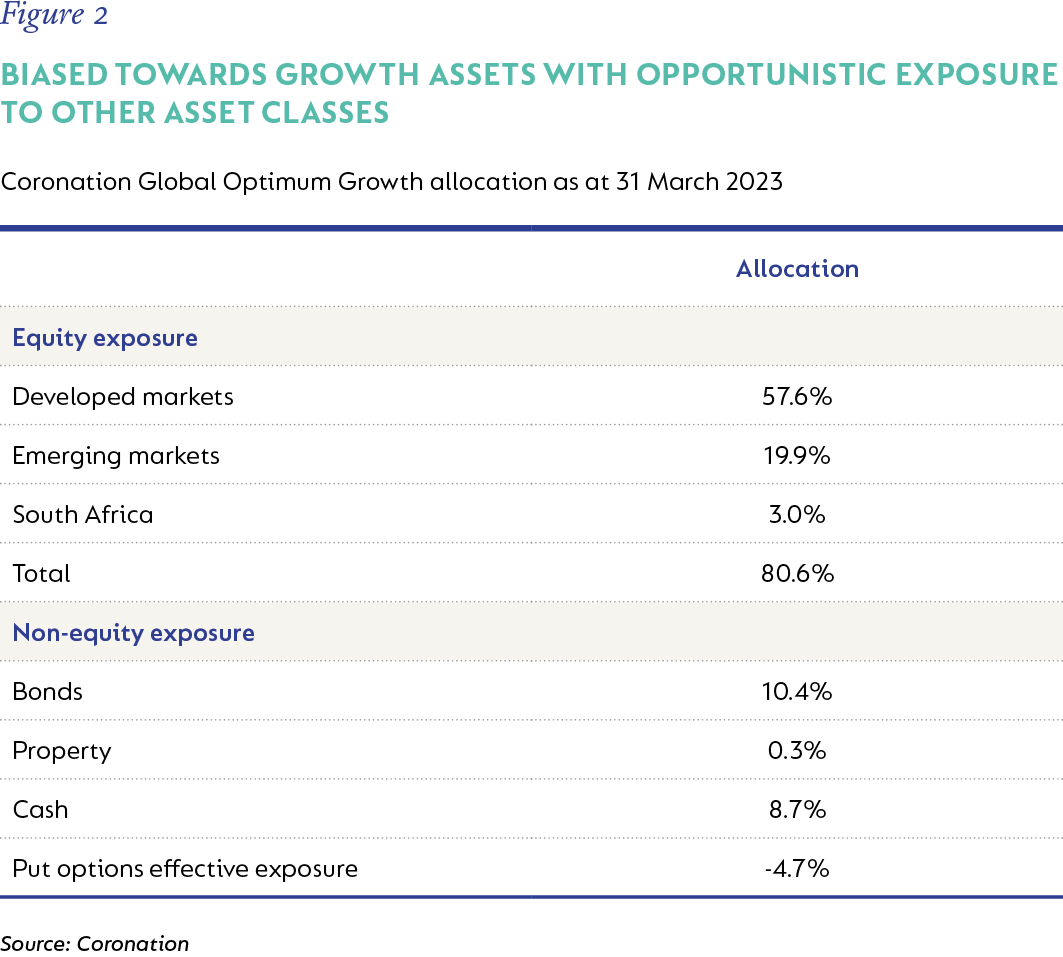

To make the Strategy more appropriate as a long-term holding in investor portfolios, its mandate allows for the flexibility to take advantage of non-equity opportunities as is clear from the table below.

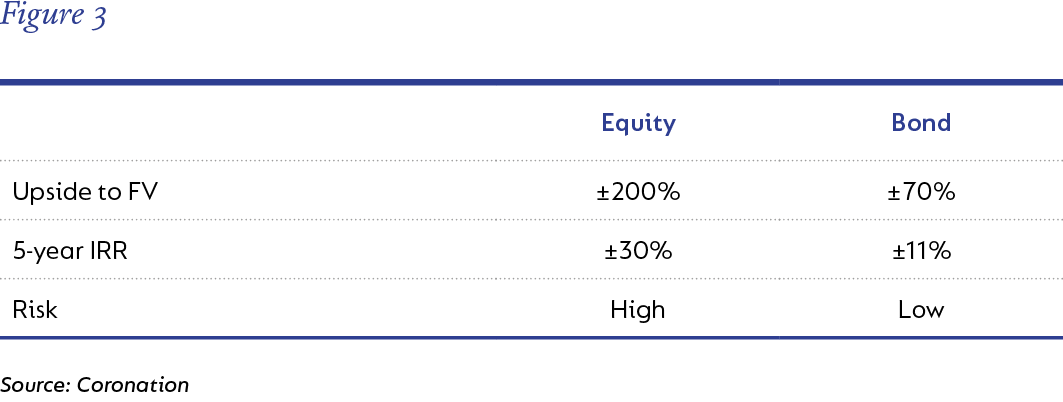

A recent example of a non-equity opportunity is a holding in Delivery Hero convertible bonds. We have owned and continue to like the equity of the business, with our current estimates of fair value indicating north of 200% upside. But thanks to the depth of our research effort, we were also able to identify an additional attractive investment opportunity within the business’s capital structure, being that of its convertible bonds. While these bonds have de-rated to 60% of par, our view is that the business is sufficiently liquid to repay these bonds in full. Delivery Hero’s liquidity position is improving as the underlying business is rapidly moving towards profitability and positive free cash flow. As such, we believe investors are likely to achieve a low-risk return of 11% p.a. in euros until 2027 – a very attractive proposition in our view.

Given the portfolio’s bias towards equities, we will also use protection as a portfolio construction tool at times where it makes sense. As such, the level of effective equity varies over time as a result of hedging strategies (such as puts), depending on our outlook and valuation levels for the shares held in the portfolio.

These strategies have proven very effective in the past, with puts contributing 3% to portfolio return in March 2020 amid the Covid market selloff. Today, a meaningful portion of the equity exposure is protected through a 5% effective exposure to put options (See Figure 2).

STRUCTURALLY HIGHER EXPOSURE TO EMERGING MARKETS A KEY DIFFERENTIATOR

One of the portfolio’s key differentiating factors is a structurally higher through-the-cycle allocation to emerging markets compared to that of other global allocation funds available to South African investors. While the Strategy’s formal benchmark (a composite of 35% developed market equities, 35% emerging markets equities and 30% global bonds) allows for an equal split between developed and emerging market equities, the allocation decision will always be an outcome of where we happen to find the most attractive risk-adjusted investment opportunities from a valuation perspective.

FOCUSED ON CAPTURING THE EQUITY RISK PREMIUM IN RAND TERMS OR IN DOLLARS OVER THE LONG TERM

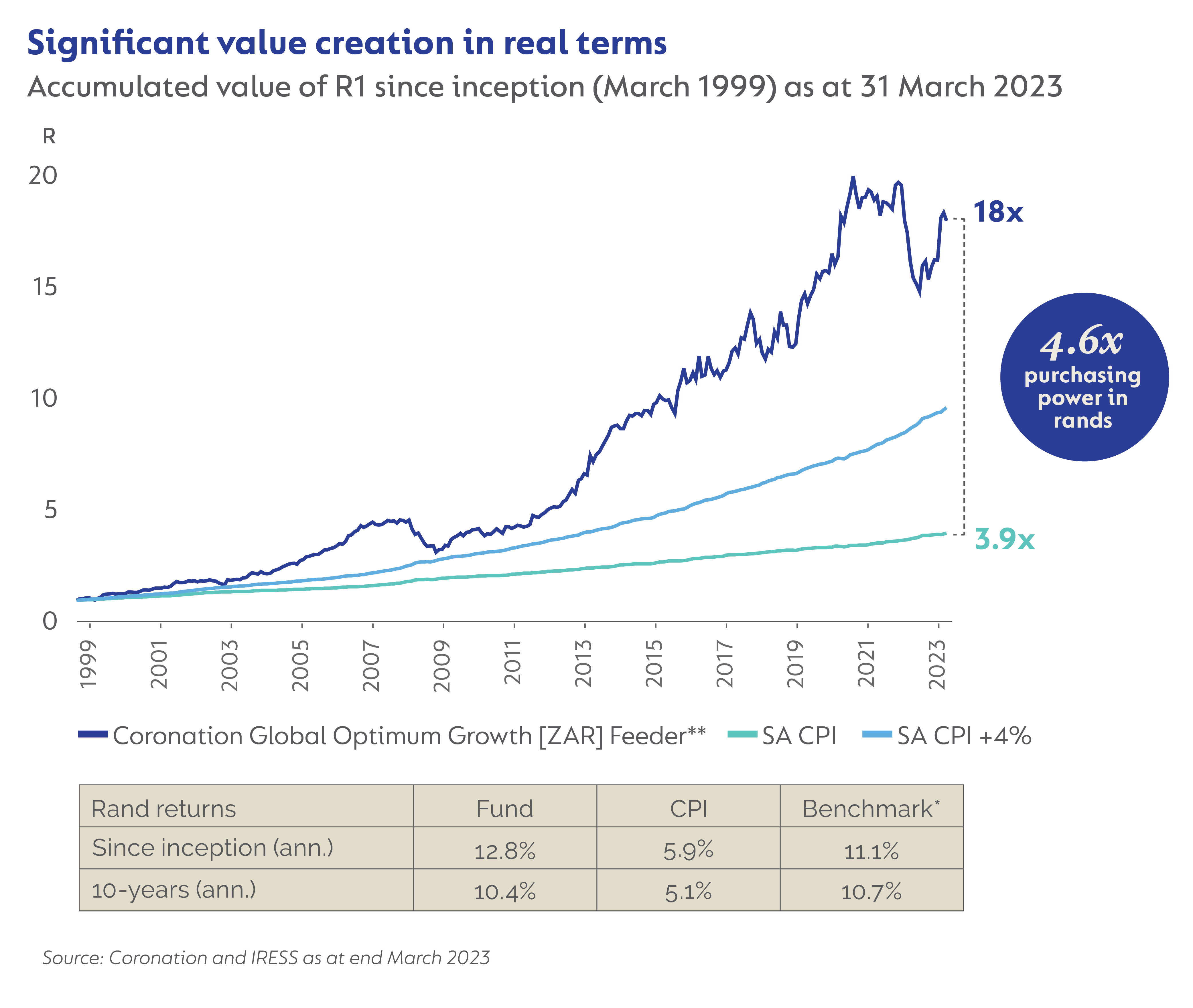

Since its inception in March 1999 to the end of March this year, the Strategy has delivered a real return of around 7% per annum in rand terms, which when translated into US dollars equates to a real return of 6% per annum. Over long periods of time, we expect the outcome in real terms to continue to be very similar for investors, regardless of the measurement currency used (rand or dollars).

Furthermore, a real return of around 6%-7% per year achieved over a long period of time fully captures the equity risk premium without being fully invested in the market.

AN OPTIMISING VEHICLE FOR YOUR LONG-TERM SAVINGS

As is clear from the above, investors with a global outlook and discretionary money to invest (in rand or in US dollars) for a long period of time, needn’t look any further than Coronation Global Optimum Growth. Its mandate is completely unconstrained and designed to find the best investment opportunities wherever they may be. Our aim remains to match or exceed the market’s return at a somewhat lower level of risk, as we have delivered over the past 24 years.

To read more about investing offshore, read our latest Coronation Investment Guide.

*Strategy refers to the Coronation Global Optimum Growth Strategy. The long-term track record for this Strategy is represented by the Coronation Global Optimum Growth ZAR Feeder Fund, which is the oldest fund managed according to the Strategy. The dollar-denominated version is a new fund with the same investment strategy deployed historically in the management of the rand-denominated Coronation Global Optimum Growth [ZAR] Feeder Fund.

***Please note that our full range of rand-denominated international funds is temporarily closed to new investments via the South African Unit Trust product. Read more here.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal