Personal finance

Corolab Investment Guide: Long-term investing

Compounding maximum capital growth over the long term in a tax-efficient manner

Overview

People invest for the long term for different reasons. When you have time on your side, taking advantage of two things can maximise your outcome:

- investing in a fund with a proven track record in delivering maximum capital growth; and

- doing so in a tax-efficient manner.

The impact of compounding maximum capital growth in a tax-efficient manner over the long term is significant.

This edition illustrates the key drivers behind long-term investing, and how to pair the most appropriate growth-oriented multi-asset class fund with a suitable tax-efficient product to achieve two examples of long-term investment goals.

What are your long-term investment goals?

The most likely (and significant) reason people invest for the long term, is to build up capital for their retirement, which could be multiple decades from now.

Those who are fortunate enough to have access to discretionary savings (in other words, savings in excess of what they are already committing to their retirement pot) may be investing for an additional long-term goal, such as a child’s education, towards having greater financial freedom later in life, or towards creating generational wealth.

Whatever significant long-term goal you aim to invest towards, it is worth remembering that you can achieve maximum capital growth tax-efficiently. Let’s start with how to maximise capital growth over the long term.

How to invest towards your long-term goals

When investing for a long-term goal, your single biggest aim is to achieve inflation-beating returns that will grow your real wealth over time. Inflation is the most significant risk to long-term investors as it steadily erodes purchasing power, meaning that the same amount of money will buy less in the future than it does today.

1. Back the asset class that is best positioned to deliver compelling real returns over long periods of time

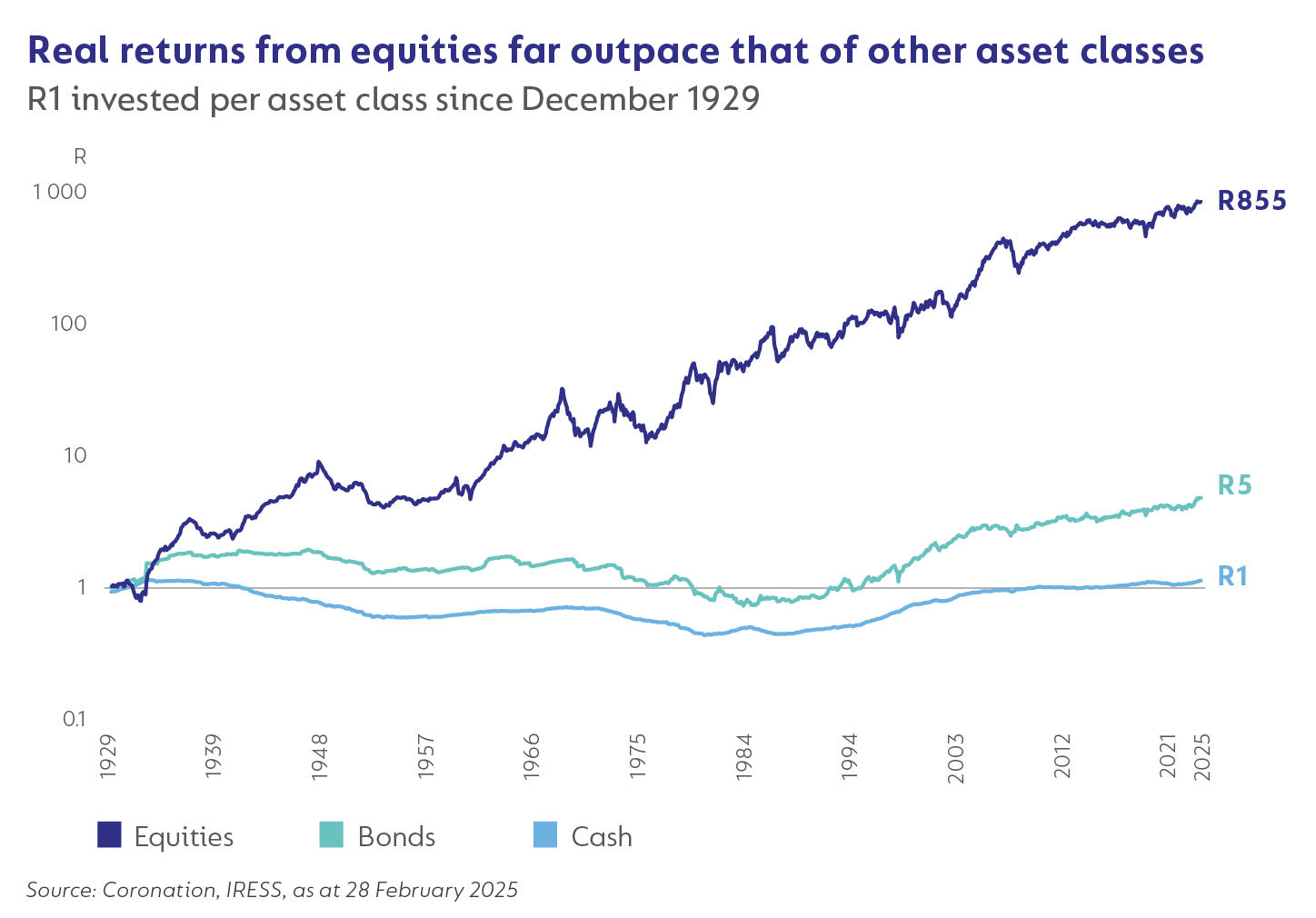

As the graph below shows, equities are the asset class best positioned to combat inflation over time. Their ability to generate real returns far outpaces that of other asset classes such as bonds and cash.

Based on data from 1929, South African equities have delivered 7.8% per annum (p.a.) real, whereas local bonds returned 1.9% p.a. real over the same period. Cash has barely kept pace with inflation, yielding real returns of 0.3% p.a. over this extended time period.

Thus, equities are essential for those aiming to build a portfolio that outpaces inflation and creates substantial wealth. They offer long-term growth potential that few other asset classes can match. By prioritising equity exposure over long periods of time, investors position themselves to achieve meaningful, inflation-beating returns.

2. Think in decades not years

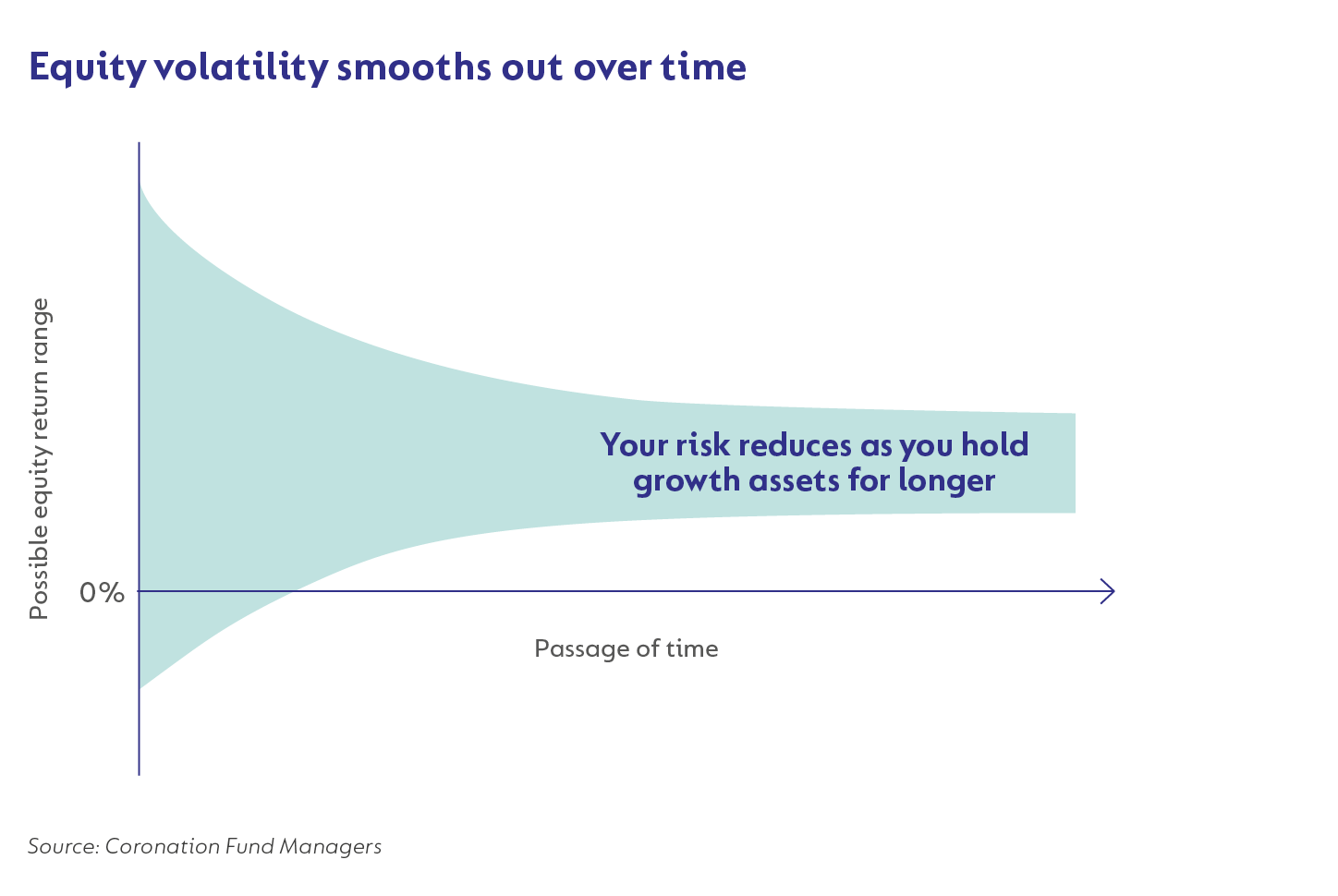

Equity returns are volatile in the short term. But to understand the difference in real outcomes that having sufficient equity exposure can make (as shown in the graph on page 3), requires thinking in decades, not years.

Yet, it’s hard to stomach volatility. Over a rolling one-year period, you are on a rollercoaster ride. For every good year, there is a miserable one. And it’s only when you start lengthening the time horizon of your equity exposure, that the volatility becomes much more palatable.

As is clear from the visual below, the longer you remain invested in equities, the lower your risk of losing capital becomes.

3. Consider growth-oriented multi-asset class funds to stay the course

Most investors may prefer a less volatile experience to investing in a fund that only holds equities. Such an approach may allow them to stay the course while still achieving inflation-beating returns.

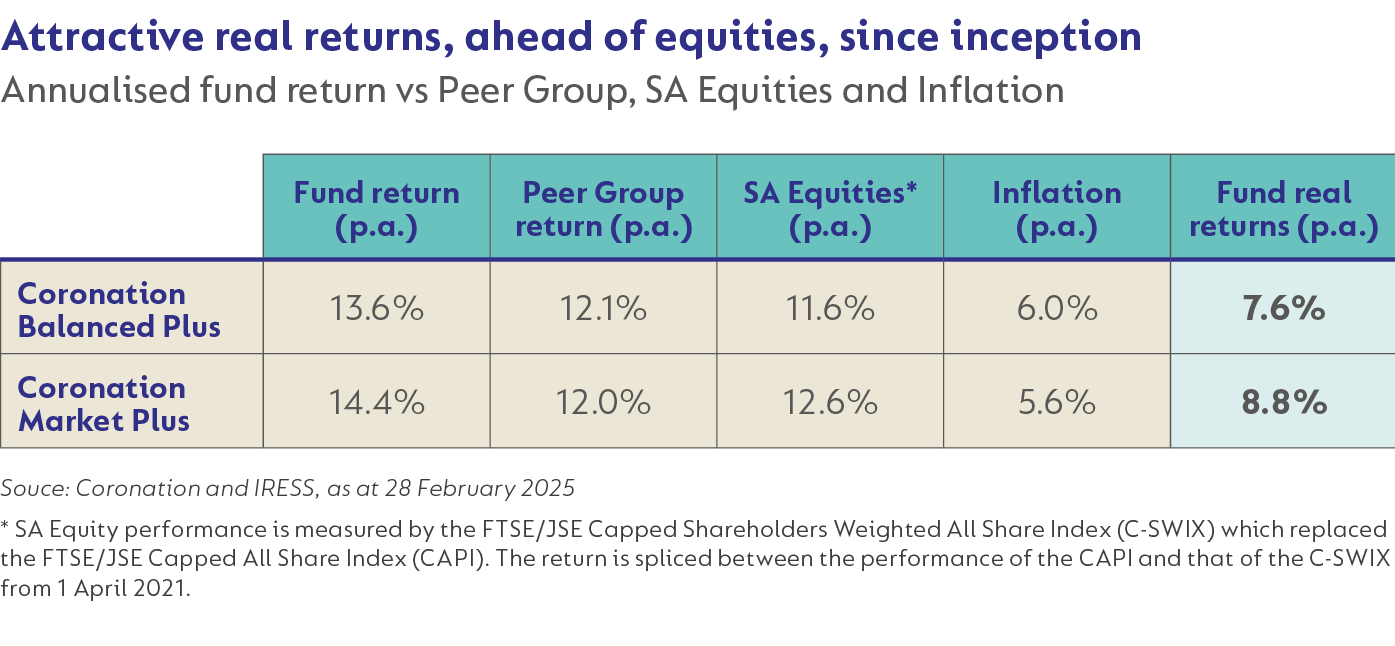

For example, Coronation’s popular growth-oriented multi-asset class funds aimed at retirement savers (Coronation Balanced Plus) or discretionary investors (Coronation Market Plus) have delivered attractive real returns since their respective launch dates, while managing to outperform equities over the same time period.

4. Back managers with strong track records in asset allocation

In a world where very little goes to plan, investors need to consider investing for the long term with good asset allocators that have demonstrable track records in taking bold and decisive actions as has been required in response to the many unimaginable events of the last 20+ years.

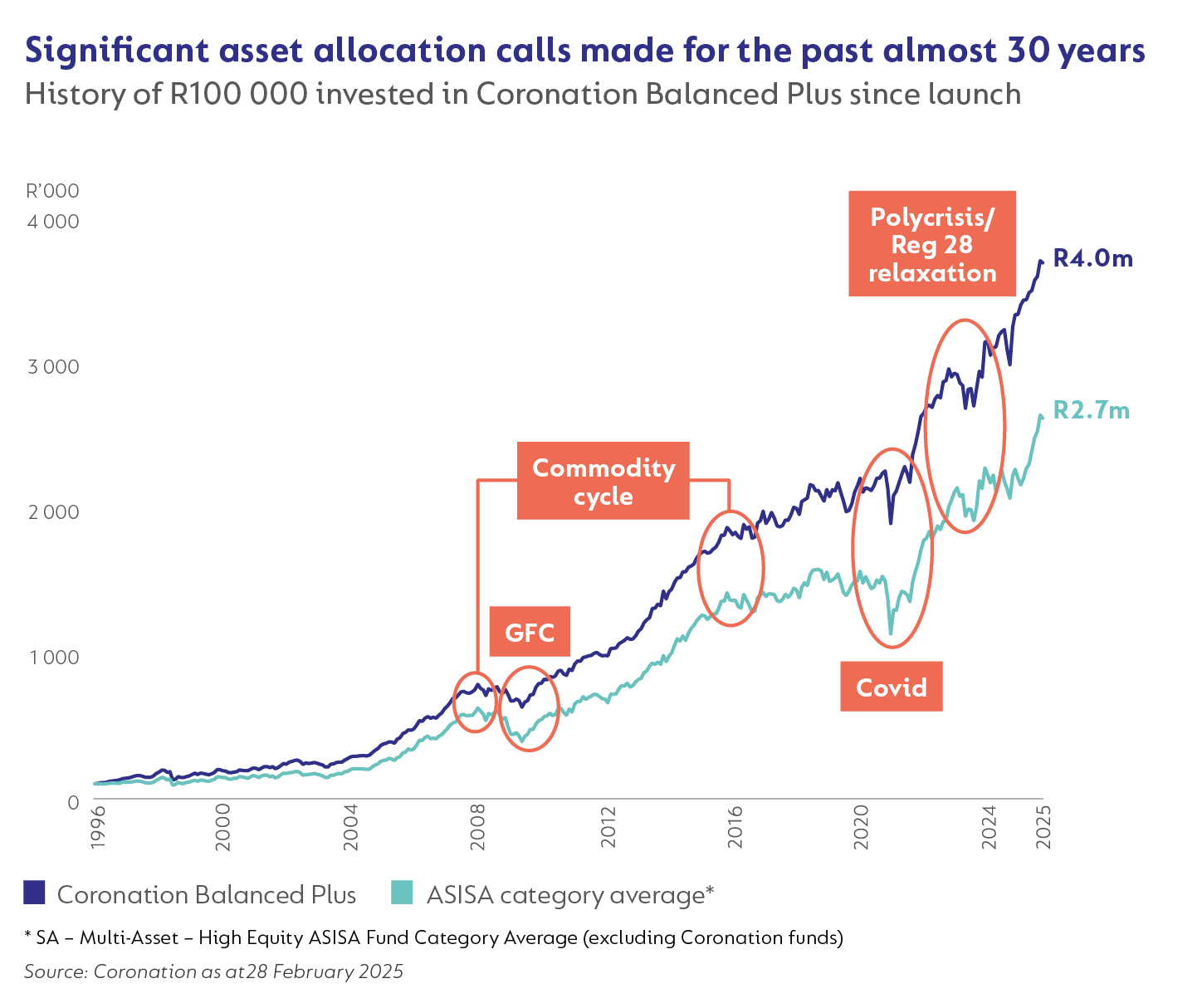

Delivering track records like those of Coronation Balanced Plus and Coronation Market Plus requires asset allocation across all geographies and asset classes throughout the cycle—a capability few managers have.

This core strength is best illustrated in the following key market moments of severe dislocation, during which we needed to make big allocation calls, subsequently leading to outperformance in our multi-asset class portfolios.

Key market moments |

The big allocation calls we made |

|---|---|

|

The commodity boom of 2007 |

With commodity prices flying in response to China’s infrastructure rollout, our long-term work on commodity prices indicated normal prices were well below spot. We significantly reduced portfolio exposure to commodities in response, contributing to outperformance in subsequent years. |

|

The commodity bust of 2015 |

When resource prices were in the proverbial hole following a slowdown in Chinese demand and the shale energy boom in the US, our long-term work indicated a strong disconnect between price and value, and we upweighted our commodities exposure in response. While this call contributed to underperformance initially, it contributed to significant alpha in 2016. |

|

The Global Financial Crisis of 2008 |

After markets endured one of the most severe bear markets in history, our long-term work on equity valuations indicated a large margin of safety, convincing us to increase our portfolios’ equity exposure to a full weighting by early 2009. |

|

The Covid pandemic of 2020 |

While our portfolios were not well positioned going into this unprecedented event (fairly full equity weighting and low exposure to the safe-haven assets of gold and USD cash), we leveraged our research process and spoke to as many experts as possible to understand how the pandemic would evolve and the impact of lockdowns on consumer behaviour and company results. We used this knowledge to update and refresh our models across the investment universe to refresh our valuation estimates. Cross-collaboration within the investment team unearthed the attractive opportunity presented by select equities, convincing us to increase equity exposure across our portfolios significantly by December 2020. |

|

The Polycrisis/Reg 28 Relaxation of 2022 |

A big derating in global assets in response to higher inflation and interest rates coincided with the relaxation of Regulation 28’s offshore limits. Our long-term work on valuations allowed us to step into the opportunity presented by offshore assets meaningfully and rapidly, moving our Balanced Plus Fund’s offshore allocation at the time from around 20% to 45%. |

As is clear from the graph and description of the big allocation calls we made above, investment markets are not static. New opportunities arise as companies, industries, countries, and asset classes develop and contract. Relative valuation levels between local, developed market and other emerging market assets, as well as between equities, bonds and cash, change over time. The emergence of new asset classes, or a deepening of an existing asset class through new listings and more activity, adds to one’s investable universe. Regulations restricting or enhancing the freedom to invest in foreign markets also change.

Multi-asset portfolios can therefore enhance investors’ eventual outcomes by making good strategic and tactical asset allocation decisions in response to this dynamic environment.

Adding a tax-efficiency layer to your long-term goals: two case studies

In this quest for maximum growth over the long term, investors can consider adding a tax-efficient layer to their long-term goals by housing their retirement savings within a retirement annuity (RA), or their discretionary savings in a tax-free investment (TFI) or endowment plan (in the case of higher-income individuals). Let’s look at two case studies that pair one of our growth-oriented multi-asset funds with a suitable tax-efficient investment account.

CASE STUDY 1: INVESTING FOR RETIREMENT BY WAY OF A RETIREMENT ANNUITY

If you are saving for retirement, we believe that Coronation Balanced Plus, our flagship pre-retirement fund, is the most suitable option for your retirement savings. The Fund offers investors the highest exposure to growth assets (up to 85%, with a maximum of 75% in equities) and offshore exposure (up to 45%) within Regulation 28 limits, allowing investors to maximise capital growth.

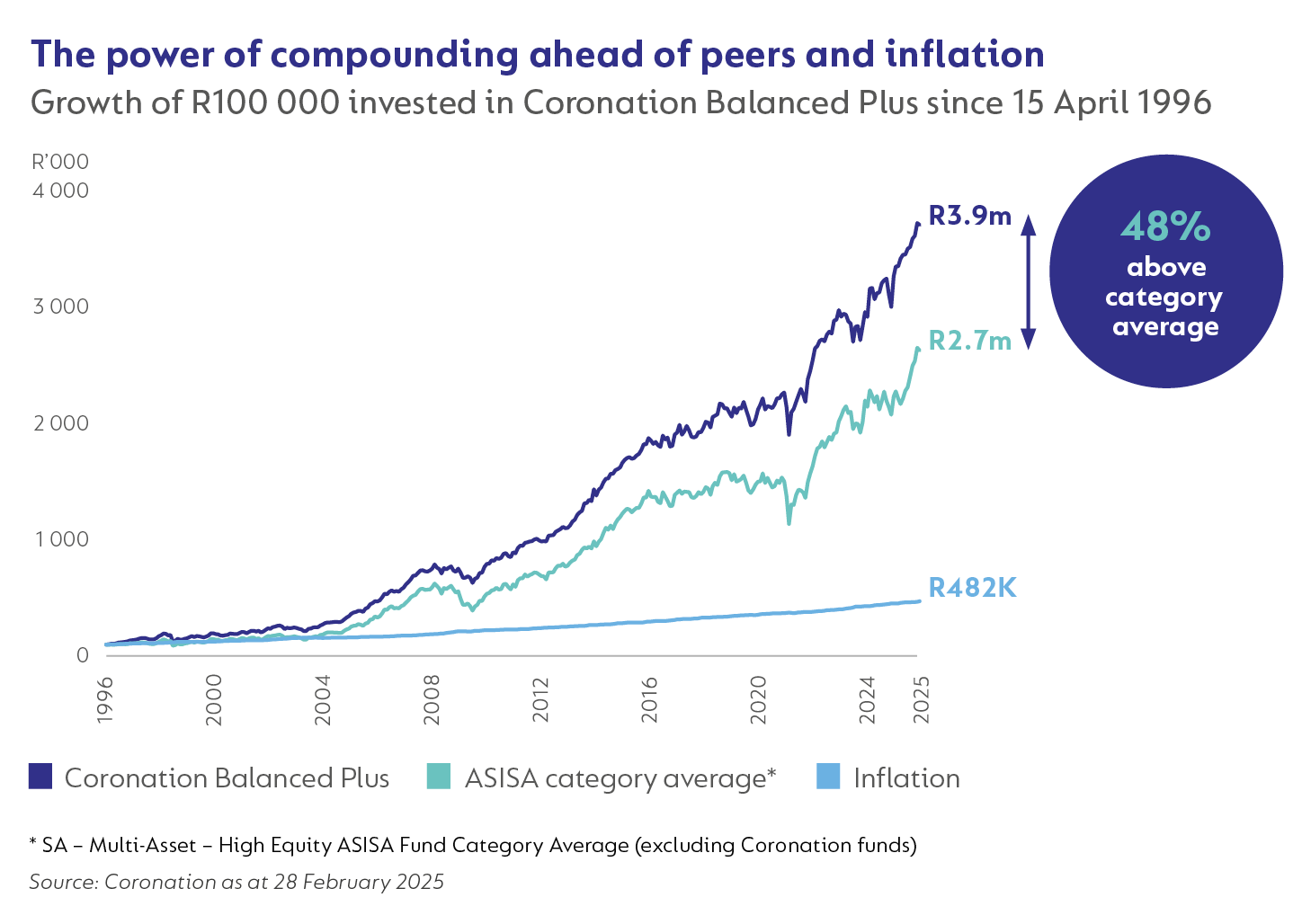

Coronation Balanced Plus has close to a 29-year track record in delivering inflation-beating returns ahead of its benchmark (ASISA category average). Since inception, the Fund also managed to outperform the local equity market, and doing so with much less exposure to equities.

This level of outperformance, compounded over time, can add significantly to your investment outcome. As is clear from the prior graph, an investment in the average high equity balanced fund almost 29 years ago would have grown your capital by 27 times (in nominal terms) as at end February 2025, whereas a similar investment in the Coronation Balanced Plus Fund, which has outperformed the category average by a seemingly small 1.5% p.a. after fees, would have grown your capital by just shy of 40 times over this same period.

Achieving tax-efficiency with a Retirement Annuity

The Coronation Retirement Annuity Fund is a personal retirement account that enables you to save tax-efficiently for retirement if you are self-employed or with which to supplement your existing occupational retirement savings if you are employed.

Your investment in a Retirement Annuity (RA) must comply with Regulation 28 of the Pension Funds Act. Investing in the Coronation Balanced Plus Fund (as discussed before) is the simplest way to achieve that using Coronation’s best investment views.

The key benefits of a Retirement Annuity include:

- Tax-efficiency: Your contributions are tax-deductible (up to certain limits) and your investment returns (interest and dividends) are not taxed while you remain invested

- Choice: You can choose from a range of Coronation unit trust funds, as long as your fund/selection of funds complies with Regulation 28 and you can switch between funds at any time.

- Flexibility: You can stop, reduce or restart contributions as your circumstances change

- Access: You can withdraw from your Retirement Lump Sum Component once per tax year, ideally limited to times of financial hardship ( read more about the benefits of resisting the urge to access your retirement savings on our website)

- Cost efficiency: Coronation charges no initial fees, switching fees, exit penalties* or administration fees.

* While this is the ordinary course of business, Coronation retains the right to charge a switching/exit fee under limited circumstances.

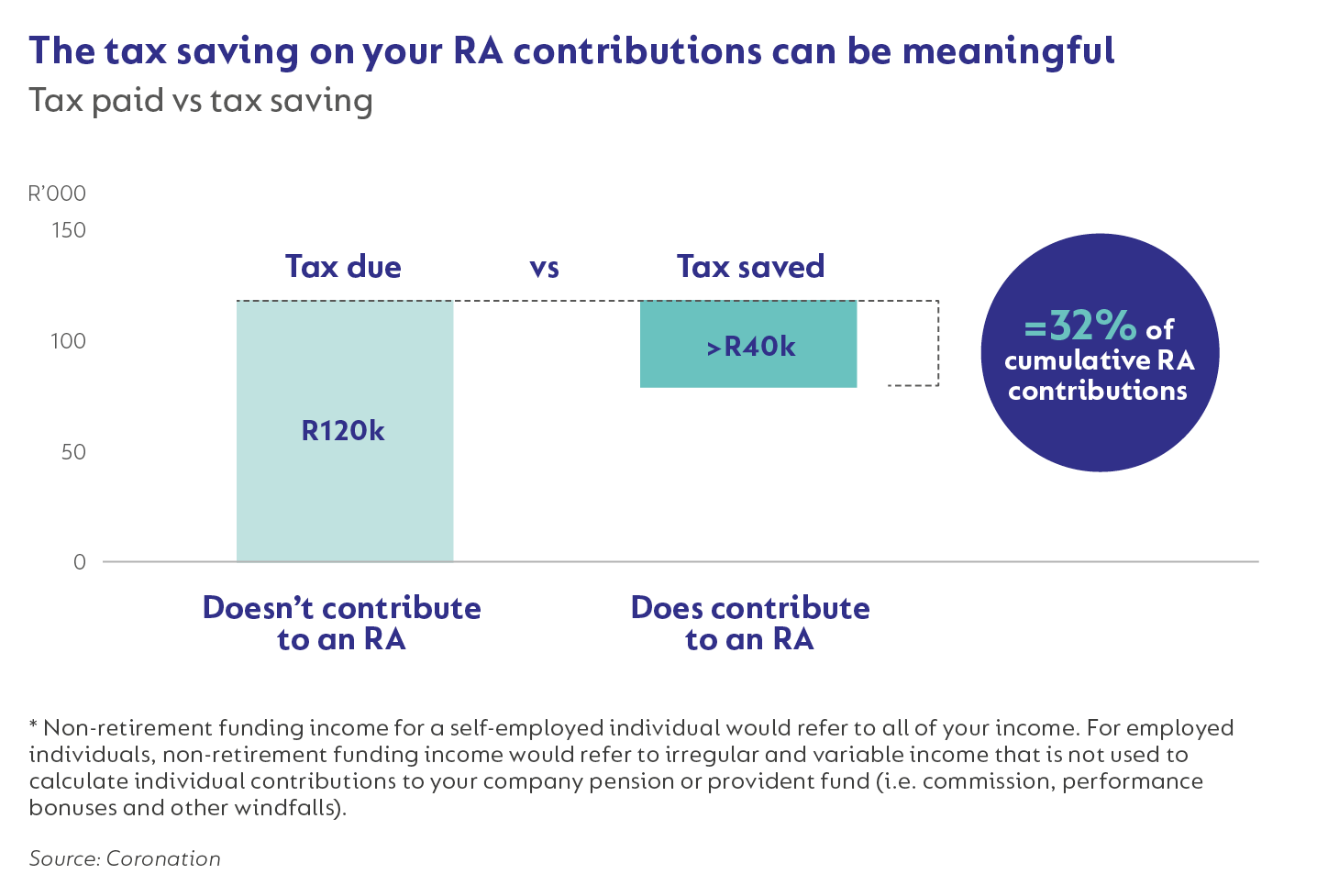

To demonstrate the tax saving enabled by contributing towards retirement within an RA, consider the following hypothetical example:

Investor A earns a non-retirement funding income* of R500 000 a year, but doesn’t contribute to an RA. As a result, Investor A pays roughly R120 000 in tax on that amount of income.

Now let’s assume Investor A did contribute the maximum allowable amount to an RA, which is 27.5% of R500 000 (or R137 500). This results in a tax saving of more than R40 000, which could ultimately fund 32% (tax saving as a % of annual RA contributions) of Investor A’s contributions in the following tax year.

CASE STUDY 2: INVESTING FOR A LONG-TERM GOAL WITH DISCRETIONARY SAVINGS

Maximising capital growth with Coronation Market Plus

If you are investing towards a long-term goal with discretionary savings, your options for achieving maximum capital growth are wide. Depending on the purpose of your investment, your investment fund doesn’t need to comply with Regulation 28. It could include anything from an equity-only fund that invests only in SA-listed assets (such as our concentrated Coronation Top 20 Fund) or a more diversified equity-only fund that invests in a combination of domestic and international equities (such as Coronation Equity). You can even consider utilising your discretionary savings in a fund predominantly investing in offshore asset classes (read more about these funds in our Corolab: Investing Offshore).

We believe Coronation Market Plus offers an optimal solution for those who prefer a complete long-term solution for their discretionary (non-retirement) savings from a single portfolio without deciding whether to invest in domestic or international markets. Since its inception in 2001, the Fund has met the needs of long-term investors seeking more aggressive exposure to equities than what can be achieved within typical retirement capital portfolios (i.e., more than 75% in equities). Over this period, Coronation Market Plus has delivered annualised returns well ahead of inflation and the average balanced fund. What is particularly pleasing is that, over this period, the Fund has also managed to outperform the JSE All Share despite never being fully invested in equities.

Achieving tax efficiency with a Tax-Free Investment

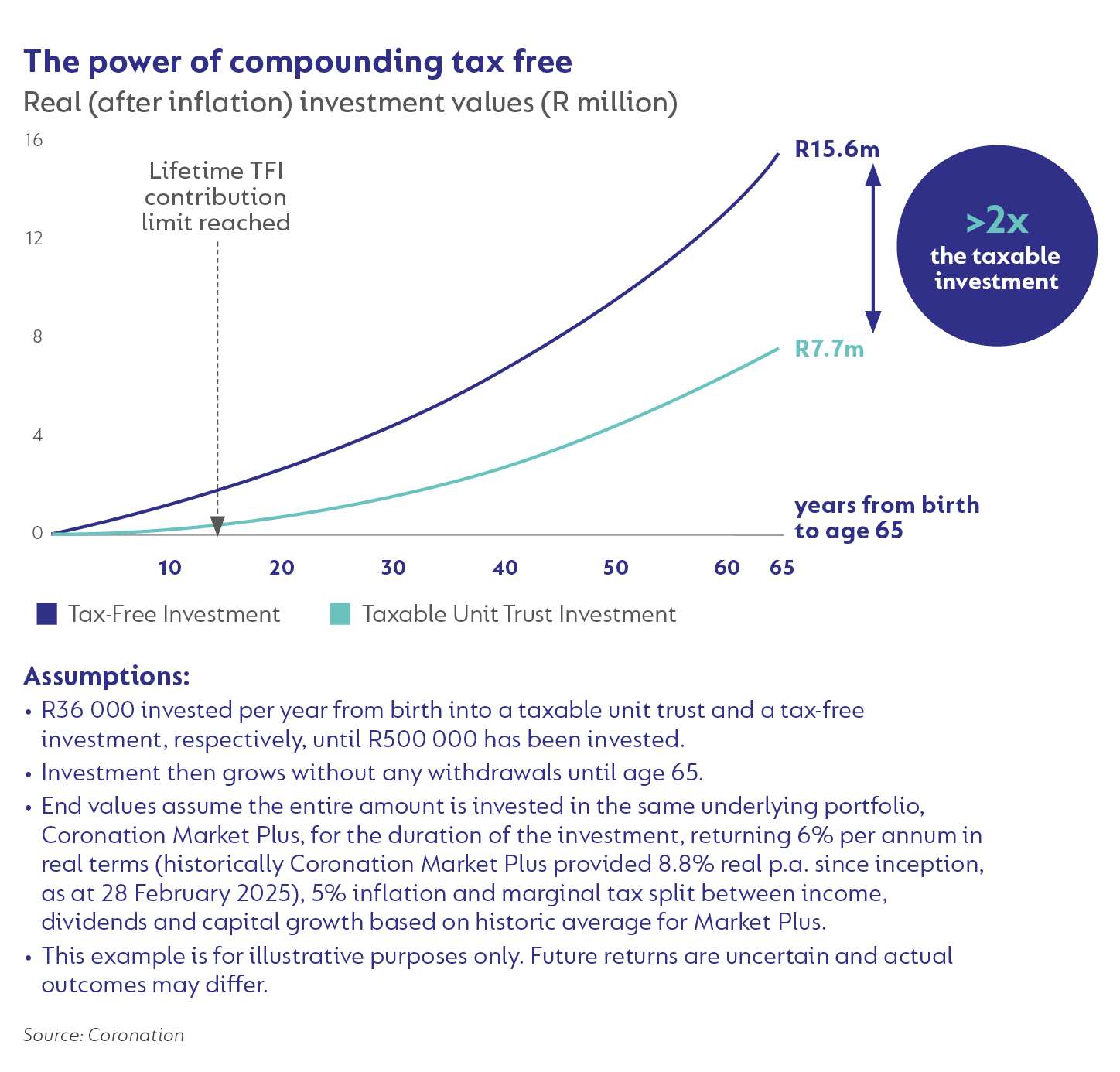

If you want to make your discretionary long-term investment work harder, you could consider housing your chosen fund, such as Coronation Market Plus in the Coronation Tax-Free Investment (TFI) account.

When you invest in a TFI, you don’t pay local tax on your investment returns - both while you’re invested and when your investment pays out. The taxes you save remain invested to grow, which can make a significant difference over the long term.

The following illustrative example highlights the long-term benefits of tax-free compounding in a fund such as Coronation Market Plus. Investing the maximum annual allowance (R36 000) in a TFI for your child from birth until reaching the lifetime limit of R500 000, and then leaving it to compound over time, can result in an investment worth R15.6 million in today’s money by the time your child turns 65. This hypothetical (very patient) tax-free investment beneficiary would, therefore, never have to contribute to retirement while working, effectively freeing up 10% to 15% of annual income that would typically have been required to fund retirement income if you start contributing in your early 20s.

A higher-income option

High-income individuals who have already hit the investment ceiling in their TFI could consider an endowment as another tax-efficient investment option.

The appeal of endowments lies in the flat tax rates that apply to income and capital gains. Income is taxed at 30% (compared with a marginal individual tax rate that can be as high as 45%), while capital gains are taxed at 12% (compared with an effective rate of 18% for individuals in the highest income tax bracket). Investors’ underlying fund options are not restricted by any regulation. As such, you can invest in any of our long-term growth-oriented funds.

Conclusion

The conclusion is as simple as it is compelling: Invest in growth-oriented multi-asset funds with long track records of delivering inflation-beating returns for your long-term goals.

Choosing a multi-asset fund such as Coronation Balanced Plus (for savers who need to adhere to retirement limits within the context of an RA) or Coronation Market Plus (for discretionary savers who can seek more flexibility in terms of equity exposure than a Regulation 28-compliant fund) are most likely to help you achieve the best outcomes while enabling you to stay the course.

When you pair these track records with a tax-efficient product, the power of compounding will most likely do extraordinary things for you.

South Africa - Personal

South Africa - Personal