IN LAST QUARTER’S Corospondent we wrote about the low-return environment of the last five years and how it has led to a significant gap between expected returns and the actual results experienced by investors. The underwhelming period endured by some investors has left many questioning the risk-return payoff inherent in financial markets, and none more so than those drawing an income in retirement who rely on investment returns to sustain prudent drawdown rates.

THE INCONSISTENCY OF INFLATION-BEATING RETURNS

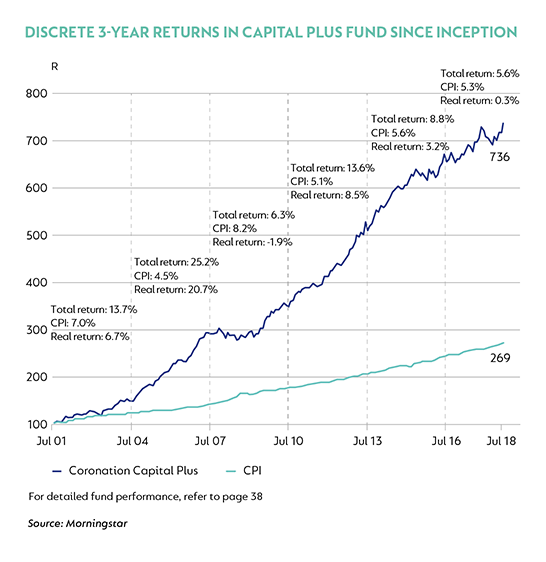

The need to sustain a growing income in retirement over multiple decades requires a return in excess of inflation – an obvious statement that requires little explanation. What is less intuitive is the fact that real returns do not materialise in a uniform fashion. Consider the graph below, which compares the value of R100 invested in one of our flagship post-retirement funds, the Coronation Capital Plus Fund, with the inflation-adjusted value of the R100 since inception of the fund.

For detailed fund performance, refer here

Since its launch 17 years ago, the fund managed to beat inflation by 6.6% per annum, resulting in a near tripling of purchasing power. However, by simply dividing the history into discrete three-year periods (the minimum recommended investment horizon), one can better observe the investor journey over time. For instance, an extremely strong three-year period from mid-2004 to mid-2007 resulted in real returns of more than 20% per annum – leaving many investors with lofty return expectations. That period was followed by three years characterised by the global financial crisis, which ultimately resulted in negative real returns and reversing investor sentiment completely – only to be followed by another strong three-year period.

It is useful to view the muted real returns of recent years in the context of longer history. In pursuit of beating inflation over time, one can expect to experience episodes of disappointing returns, but can take comfort from the fact that better times lie ahead.

HEADWINDS HAVE TURNED INTO TAILWINDS

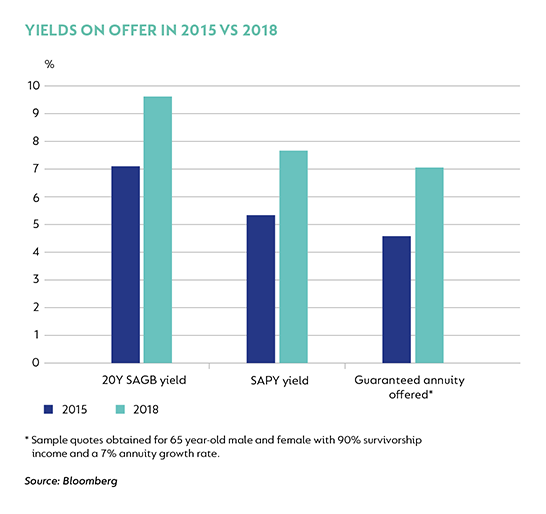

Multi-asset portfolios such as those managed for post-retire-ment investors have various sources of returns that are driven by different factors, including the yields offered on bonds and property. These yields proved to be a substantial headwind to reaching one’s inflation-beating targets over the most recent period of displeasing returns.

More recently, we have seen a significant shift in yields to the point where they provide for tailwinds in reaching the real return objectives for post-retirement portfolios. Comparing the current yields on South African government bonds (SAGB) and the South African Listed Property Index (SAPY) to what they were in 2015 shows how meaningful that shift has been.

Many investors assess the feasibility of living annuities based on the performance of the underlying funds over the recent past (looking backward). In contrast, guaranteed annuities are assessed on the income offered to the investor by the life office, which is informed by the future expected returns from markets such as the yields offered on long-dated bonds and property (looking forward).

The backward-looking nature of living annuities versus the forward-looking nature of guaranteed annuities could lead to investors moving assets into guaranteed annuities without appreciating the fact that they will benefit from the same drivers in their living annuity in years to come.

HARNESSING THE POWER OF GROWTH ASSETS IN RETIREMENT

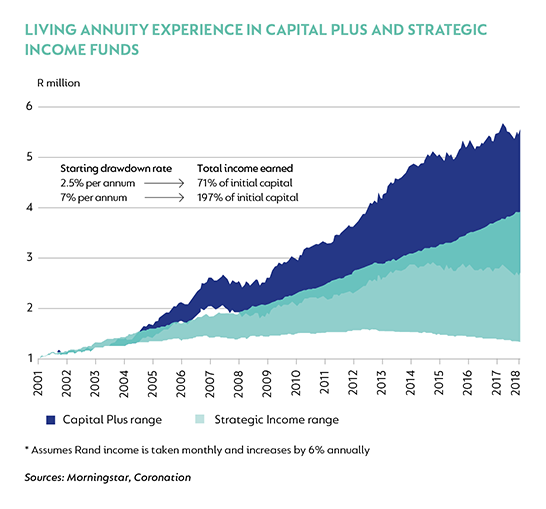

In last quarter’s article, we discussed our analysis of industry flows and highlighted the de-risking trends that result from investors switching out of funds with growth asset exposure to funds with little exposure to such assets. This trend is particularly strong in post-retirement portfolios. It is worthwhile reminding investors that thoughtful exposure to growth assets (in the form of equities and property) remains a crucial ingredient to a successful income drawdown plan. Take the following example using two of Coronation’s funds which both launched in 2001. The Coronation Strategic Income Fund is aimed at investors with immediate income needs and, as a result, does not have any exposure to equities.

The Coronation Capital Plus Fund is aimed at investors in retirement with long-term drawdown needs and holds the optimal exposure to growth assets for that purpose – typically ranging between 40% and 70% of the portfolio.

The graph above shows the value of R1 million invested in either fund for a range of starting drawdown rates between 2.5% and 7% per annum. The benefit of reasonable exposure to growth assets for income-drawing investors becomes clear in the fullness of time.

SCRUTINY IS GOOD, BUT AVOID IMPULSIVE ACTIONS

Periods of low returns typically result in greater scrutiny of investment portfolios – something that should be encouraged. Investors need to ensure that their investment portfolios are still fit for purpose and that they are getting value for fees.

Although it may be sensible for some to take action, we encourage investors to avoid impulsive decisions based on the very recent past. There is good reason to expect better investment outcomes in years to come. We would hate for you to miss it.

South Africa - Personal

South Africa - Personal