THE LATE 2021 ‘WORRY LIST’

‘Climbing the wall of worry’ is a market cliché acknowledging the fact that despite numerous potential problems appearing on the horizon, enough optimism may persist for asset prices to continue to rise. We all know that long-term investing is a future-facing endeavour, meaning that investors should expect to be continuously challenged by uncertainty. It’s useful to remember that this is a feature of the system, not a bug. If you cannot find a way to embrace uncertainty, you are highly unlikely to be an efficient investor; in this case, your investments often won’t bring you much joy, to paraphrase tidying and organising guru Marie Kondo.

A related observation is that, due to the human brain’s bandwidth limitations, the collective narrative typically only has capacity to worry about a few things at a time. In financial markets, it’s rare for more than two or three main story arcs to dominate the headlines in any given quarter. This narrow focus creates opportunities for investors who are prepared to do the hard work of conducting their own independent and proprietary research.

Not only is the real world infinitely more complex and interconnected than what can be accommodated in the news cycle, but the fact that nearly everyone is busy parsing information about the same risks often leads to the market overestimating the actual downside caused by the unfolding events, especially when measured over longer time horizons.

The topics that are currently driving market sentiment and on which we provide our views in this Corospondent include:

- The health of the global economy, which is slowing down after the rapid post-lockdown recovery period, while governments and central bankers grapple with setting the appropriate pace of withdrawing the extraordinary fiscal and monetary support unleashed since the pandemic started.

- Increasing concern about the potential for a lengthy period of stubbornly high inflation, which becomes more likely the longer current inflation rates remain elevated.

- The prospects for investors in China, who were recently buffeted by a leftwards shift in government policy, a tighter regulatory environment and growing concerns about the health of the property market.

The above are unpacked in detail by Marie Antelme, Suhail Suleman and Nishan Maharaj in their respective articles.

NASPERS/PROSUS AND THE LOCAL EQUITY MARKET

Over the past 20 years, an investment in the FTSE/JSE All Share Index performed very well, increasing capital invested in September 2001 by a factor of nearly 15. Over the same period, JSE heavyweight Naspers outperformed the Index by an order of magnitude, growing by 186 times. Astounding wealth has been created for investors and the company is arguably the defining South African public investment market success story of the democratic era.

However, more recent outcomes were not as rosy. In response to the Chinese authorities’ assertive policy and regulatory actions referred to above, Naspers declined by c.15% year to date (at the nadir, it was down 25%, but the share price staged a strong recovery in recent weeks). The sheer size of Naspers and related company Prosus makes the outlook for these shares hugely significant to most investors. The good news is that we still have high conviction in this investment case, as Marc Talpert explains here.

RETURN EXPECTATIONS

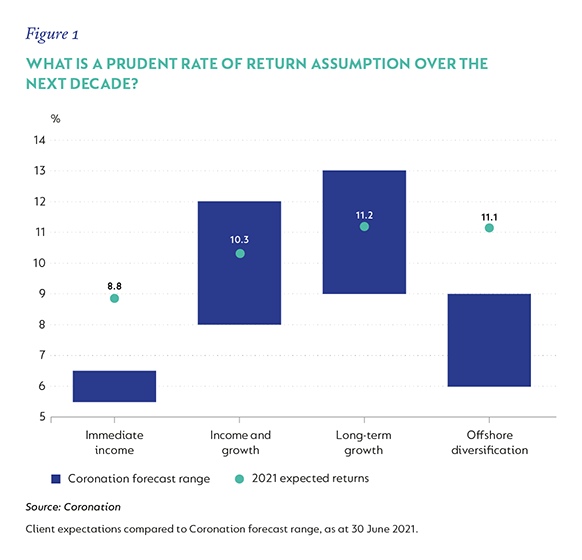

We would like to thank the many thousands of clients who participated in our annual client survey during July. While the primary purpose of the exercise is to get your input on the areas where our service to you can be improved, we also ask a few investment-related questions. The most important of these is about better understanding your long-term return expectations. It helps us to calibrate your expectations (the wisdom of the crowd) with the output of our research effort, which we express in a forecast return range over the next decade for the various key investor needs.

The good news from this year’s survey is that your and our expectations for returns from domestic general equity and multi-asset class funds are aligned. Our detailed research confirms that valuation levels in the domestic market are still relatively undemanding, meaning that a return expectation of inflation plus 4% to 7% p.a. from multi-asset class funds such as Balanced Defensive, Capital Plus and Balanced Plus is achievable over the next decade.

Of some concern is that your collective expectations are around 2% p.a. higher than ours for immediate income (from funds such as Coronation Strategic Income) and from international funds (such as Coronation Global Optimum Growth or Global Managed). For these fund categories, client expectations are closely aligned to the outcomes produced by these strategies over the past decade. However, when we take into account elevated developed market valuation levels (especially in the US) and the likelihood of lower-for-longer short-term interest rates, we reach somewhat less optimistic conclusions for these two investor needs.

RECOGNITION

At the recent European Pensions Awards held in London, Coronation received the European Pensions Emerging Markets Award, recognising our industry-leading performance and world-class client experience in this strategy. We launched our global emerging markets (GEM) equity strategy in 2008, which represents our view of the best investment opportunities available in this market segment. In 2020, the strategy ranked eighth out of 104 GEM all-cap strategies, and first out of 21 GEM all-cap core strategies, according to the investment platform eVestment.

NEW ONLINE INVESTOR SERVICE LAUNCHING IN NOVEMBER

I am also excited to share that we will be introducing a refreshed online investor service during November. Our aim is to make your client experience more pleasant, getting more things done more quickly and from more places. We will communicate the details to you in the coming weeks.

Thanks again for your ongoing support.

As always, I invite you to get in touch via clientservice@coronation.com if there is any aspect of our service to you that requires attention.

South Africa - Personal

South Africa - Personal