Global asset markets have had a torrid start to the year, with equities experiencing the worst first half of a year in over 50 years. In a rare, coordinated sell-off, where both core asset classes (equities and bonds) declined, investors have had few, if any, places to hide in 2022 so far. Indeed, the declines have been widespread, with REITs declining 20% (according to Morgan Stanley “the worst start to a year on record”) and gold down approximately 5%. Only short-dated USD cash and certain commodities delivered positive returns.

Considering this backdrop, and the fact that the Fund came into the year with an overweight position in equities, the portfolio’s returns have also suffered. Nevertheless, conservative fixed income positioning, select commodity exposure and a positive contribution from merger arbitrage positions resulted in the year-to-date return being within 1% of the benchmark.

While the severity and somewhat indiscriminate nature of the sell-off has been painful to endure, it has also resulted in widespread price dislocation. In equity markets, for instance, good businesses have been jettisoned alongside weak businesses, with little regard for differences between their long-term prospects. Across multiple industries and investment themes, our analysts are finding a range of opportunities that we consider to be very attractive today.

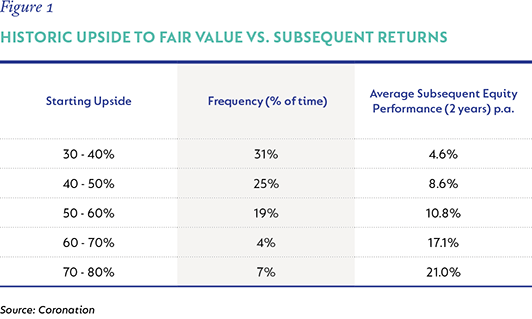

Long-time readers will know that we follow a valuation-driven investment research process. By assessing multiple factors (including the underlying earnings power of a business, the quality of management and key risks), we aim to determine a fair value (FV) - our estimate of what the business is really worth. When the price the stock is trading at in the market is well below our FV estimate, it often signals opportunity. Using these fair values for each stock, we can calculate a FV (and upside to FV) for the portfolio as a whole, which we have tracked over time. This is far more than a mere analytical exercise. As the table below shows, there is a strong positive correlation between the portfolio’s estimated upside, and subsequent equity returns. In previous periods where the upside to FV has been in the 60% to 80% range, subsequent equity returns (over the next two years) were approximately double the Fund’s average equity return. Today, the upside within the equity portfolio is again in the 60% to 80% range. And while there are no guarantees, this is one of the reasons for our optimism about the portfolio’s future prospects.

To highlight the broad range of opportunities our analysts see today, you can read the article by analysts Danie Pretorius and Chris Cheetham on selected examples from different corners of the market - spanning multiple industries and style factors - where we believe the long-term fundamentals of the businesses are not reflected in the valuation.

At quarter-end, the Fund was positioned as follows:

- 64.2% in equity, excluding commodity equity exposure of 5.0%

- 10.1% in commodity-related assets, split equally between gold (the metal) and diversified miners

- 8.0% in investment-grade fixed income

- 7.7% in high yield fixed income

- 4.7% in listed infrastructure assets

- 2.3% in property

- 2.8% in merger arbitrage situations

There’s a saying in markets that you can have good news and you can have good prices, just not at the same time. While many of the news headlines today are bleak, much of this is already reflected in asset prices. Our assessment of what most businesses in the portfolio are worth is largely unchanged, but with market prices materially lower, the portfolio’s price-to-value gap has widened significantly, implying much higher expected future returns.

Please note that the commentary is for the retail class of the Fund. View the Global Managed Fund page

Disclaimer

South Africa - Personal

South Africa - Personal