Investment views

A year of reckoning

Nothing short of decisive action will do.

The Quick Take

- Last year was one of ongoing market volatility and increased geopolitical polarisation

- SA significantly lagged its emerging market peers on structural challenges and policy inertia, but bonds delivered respectable returns

- Private sector participation is key to restoring SA’s productivity and investability

- All eyes are on an increasingly dovish Fed and the extent of its policy rate reduction

The Covid crisis of 2020 ushered in a new era of uncertainty and volatility that has continued to roil financial markets. This continued unabated as 2023 commenced with banking crises in the US and EU, followed by growing concerns about the implications of higher interest rates for longer. This was compounded by intensifying geopolitical tensions, with the ongoing conflicts in Ukraine and the Middle East adding to the list of potentially catastrophic, destabilising global events. The last quarter of the year saw a de-escalation of market uneasiness as the Federal Reserve Board (the Fed) pivoted towards a more dovish rate outlook. South Africa (SA) experienced much of the same during the course of the year, but with continued power outages impeding growth and further policy missteps leading to reduced confidence in the current administration.

The performance numbers as at year-end hide the tremendous uncertainty and uneasiness that most investors felt throughout the year. Dollar index declines (3% in 2023) spurred stronger emerging market performance, with many of SA’s peers gaining well over 5% against the dollar. SA, due to its many problems, significantly lagged its peer group’s currency performance, with the rand down 7% versus the US dollar. This was also reflected in the marginal widening of SA’s credit spread relative to both emerging and developed markets. Despite a rollercoaster of a year in global bond markets, 10-year bonds in both the US and SA settled only 30 to 40 basis points (bps) wider from where they started in 2023. Over the last year, the FTSE World Government Bond Index returned 5.2% in US dollars, with the local FTSE/JSE All Bond Index (ALBI) returning 9.7% in rands (2% in US$). This was a strong performance by local bonds, as cash and inflation-linked bonds (ILBs) only returned 7.8% and 7.1%, respectively, over the same period. Despite local bond yields still ending the year wider, it was the high starting yields on offer and relative outperformance of the bonds with a maturity of less than 12 years that bolstered the ALBI’s returns.

URGENT REFORM IS NEEDED IN SA

2024 is the year of the wood dragon in the Chinese zodiac and is meant to bring evolution, improvements, and abundance. It is the perfect time for rejuvenated beginnings and laying the foundation for long-term success. SA is in deep need of all these things as it continues to tread water near the abyss of despair and irrelevance. The country has three major problems that include:

- Electricity shortages: Underinvestment in both generation and transmission capacity has led to severe power shortages that have capped growth. Even if the system moved towards an acceptable level of performance, it would still cap growth in the 2%-2.5% range. Massive bailouts have also diverted funds away from productive spending and strained government finances.

- Logistic constraints: Underinvestment and incompetent management have seen a disastrous fall from grace in the internal transport and harbour networks. This has cost the country significant revenue due to lost exports and has also meant that it could not maximise the benefits of the recent commodity boom. In addition, further funds will need to be diverted to shore up Transnet’s balance sheet and return the network to an acceptable level of capacity.

- A frail implementation of the rule of law: This is both in the implementation of State-owned company governance controls and the policing of serious crime on the ground. The failure to ensure the prevalence of the rule of law in the country has led to reduced business and investor confidence as well as a significant loss of profits due to high levels of corruption and illegal enterprise. Once again, government finances are placed under further pressure due to the need for capital injections and lost tax revenue.

The electricity and logistic problems are a direct result of government’s inexperience in these industries and the solution would be for government to take a back seat by providing a platform for private sector investment into those industries, thus allowing the private sector to drive the reform. There is precedent for this littered across the globe. Even in the US, where the space programme was a crowning achievement by the State and was used to propel innovation in that economy, the private sector has now taken over to drive the next phase of evolution (SpaceX, Virgin Galactic and Blue Origin).

The repairing of the rule of law will take significant resources to rebuild credibility and competence in key institutions, weed out corrupt entities and arrest the growth of corrupt enterprise. The resources being drained by the electricity and logistic problems could be utilised to restore law and order, provided the private sector is enabled to participate here too. There are no quick or easy solutions to any of these issues, but there are solutions. They do, however, require swift action to ensure the country does not fall off the cliff.

The prolonged prevalence of these issues has meant that growth has remained lacklustre and government finances have remained strained. More recently, we have seen increased pricing pressures as a result of the higher cost of doing business in the SA. This unfortunately results in a grim outlook with longer term growth in the 1.5%-2% range, inflation uncomfortably around 5.5%, budget deficits of around 5%-6% of GDP and the debt to GDP ratio on the path to 90%.

Local bond yields have felt most of the pressure from the deteriorating fundamental backdrop as yields remain elevated, well above nominal GDP and with no sign of respite. This situation remains unsustainable and, although the SA government has some breathing room over the next three to five years due to levers that can be utilised to fund the country, these are only temporary reprieves. If crucial reforms are not enacted, then we will remain firmly on the path to financial obscurity.

VALUATION ANALYSIS

In the face of such a depressing context, it is hard to find a reason to own any asset in SA. However, at Coronation, we aim to divorce emotion from our investment decisions and focus on the valuation of assets. This helps us to understand whether the fundamental risk is sufficiently represented in the pricing of these assets.

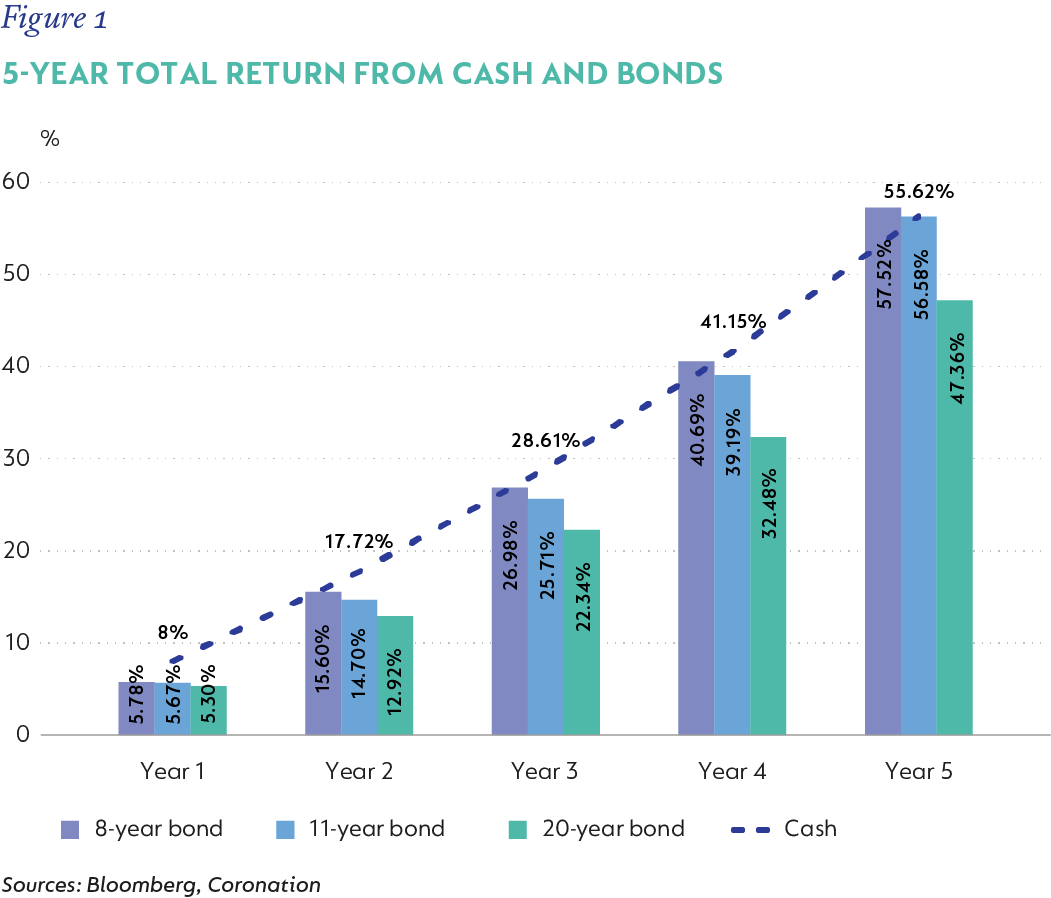

A further deterioration in fundamentals from here will result in a further widening of SA bond yields. In order to assess the protection that the valuation offers, we assume a 100bps widening in the 8-year, 11-year and 20-year bonds from current levels every year, for the next five years (end yields of 14%, 15% and 17%, respectively, assuming the benefit of rolldown). In addition, we assume that cash rates will widen 200bps to 10.25% by the end of the period.

Figure 1 illustrates the results of our analysis for each of the instruments Even with such conservative assumptions, because of the high starting yields and the steepness of the yield curve, the 8-year and 11-year bonds outperform cash, assuming a 5-year holding period (coupons reinvested at prevailing cash rates). The 20-year bond lags due to the higher modified duration it carries and because the yield curve is pretty flat after the 12-year maturity date. Thus, if one assumes no permanent loss of capital in the next five years due to default/restructuring, sub 11-year bonds still provide an attractive opportunity relative to cash.

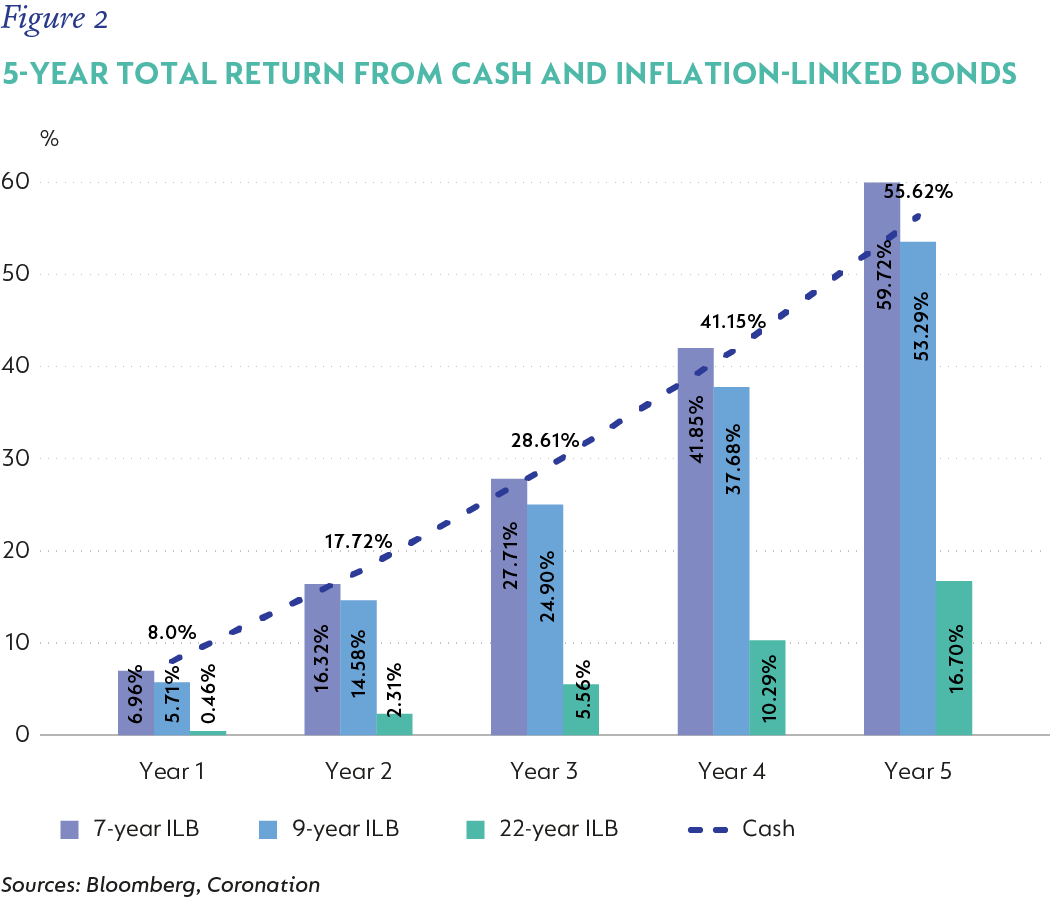

For completeness, we ran a similar exercise for ILBs (Figure 2). The key difference is that we only assume a 75bps per year sell-off (ending yields of 7.9%, 8%, and 8.6%) in each of the ILBs (this assumes inflation expectations worsen) and we also assume that inflation averages 6.5% over the period. The results are displayed in the graph below. The 7-year ILB still outperforms cash and even nominal bonds over the five-year holding period, given its high starting yield. Due to the higher duration that ILBs carry and because inflation breakevens are already above 6% for maturities longer than nine years, these bonds struggle to match cash and nominal returns.

The principal conclusions from the above exercise are that bonds with a maturity of less than 12 years encompass the highest risk premium and thus offer holders a significant cushion against further fundamental deterioration. In addition, 7-year ILBs offer a diversified opportunity for enhanced returns in the event that inflation continues to deteriorate as a result of further economic worsening.

THE GLOBAL BACKDROP

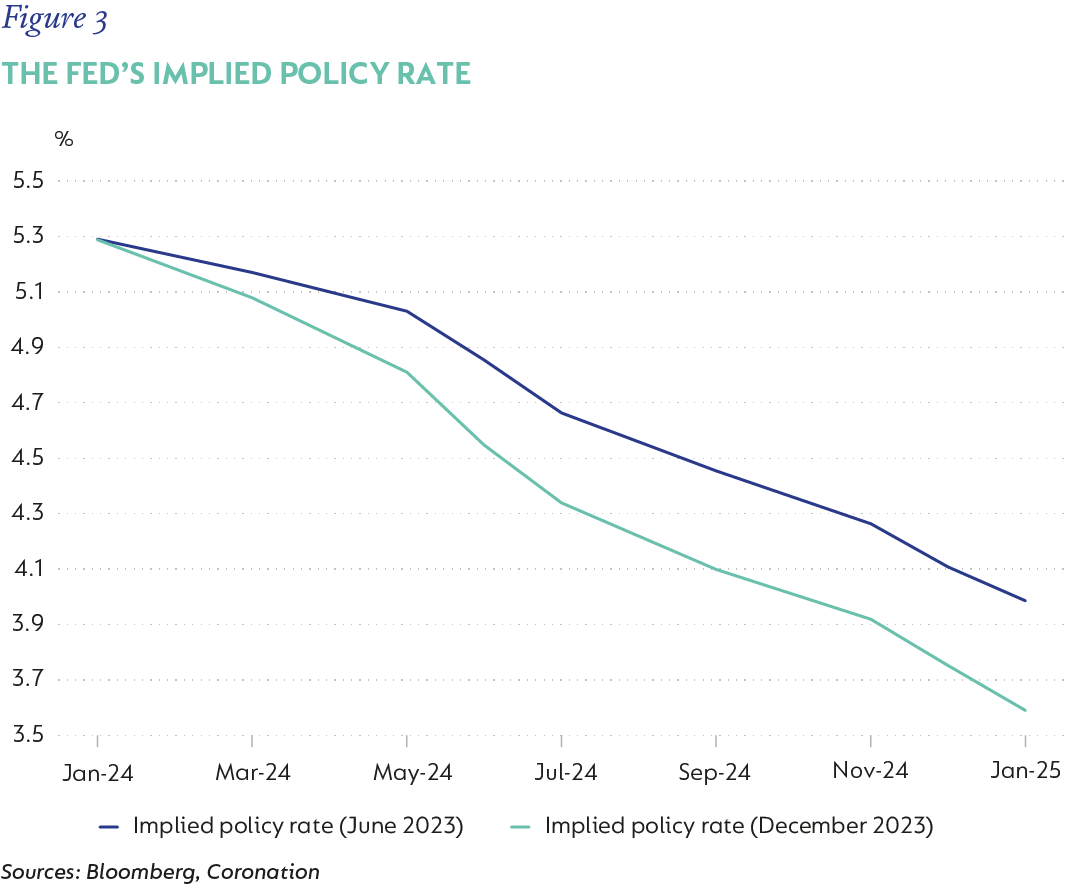

We would be remiss in not acknowledging that the SA bond market is but a tiny cog in a much larger, macro bond landscape. Therefore, major changes in global bond valuations will have a significant impact on local bond performance. The current path of US monetary policy will dictate the path of US bond yields and, hence, have a significant impact on local bond yields as has already been the case in the last quarter. Figure 3 shows that Fed policy rate expectations have already turned quite dovish, with the market expecting almost seven rate cuts, up from the expectation of four, six months ago.

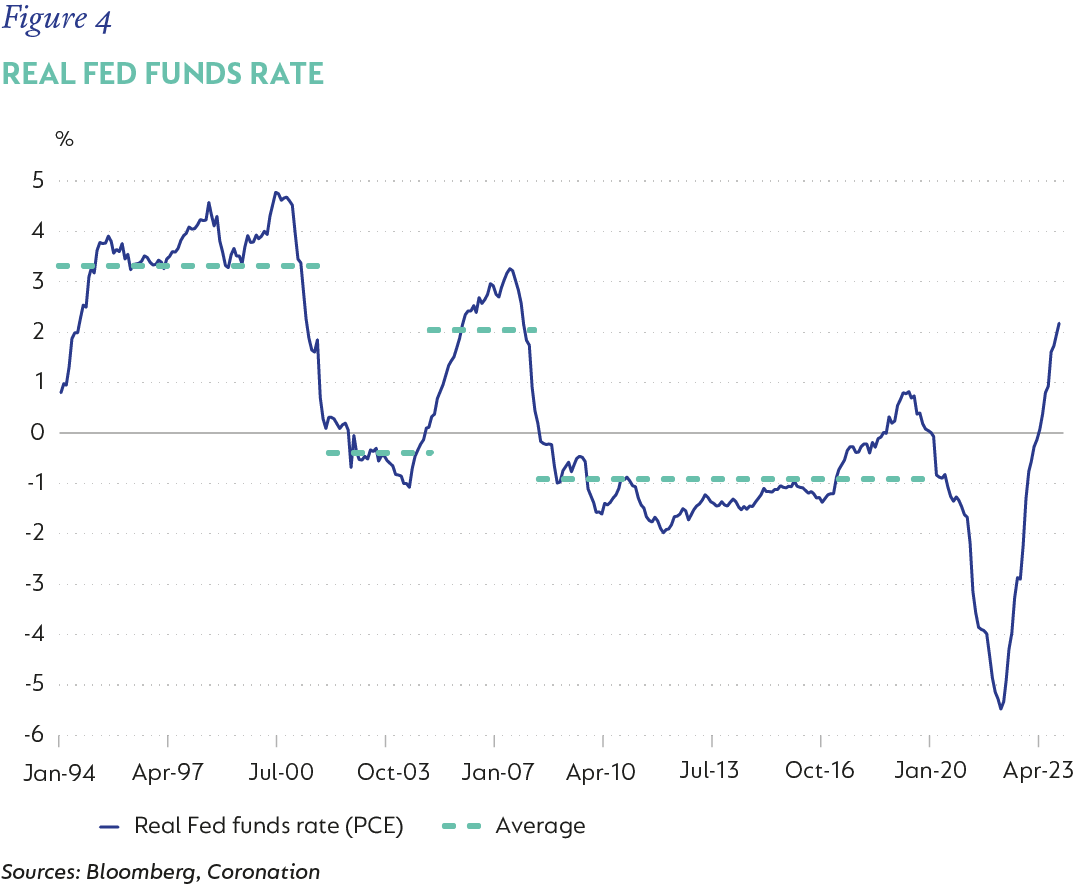

This might seem as if it’s an extreme change in pricing, but one has to contextualise what it means. Firstly, Figure 4 shows that, over the last 30 years, the real Fed funds policy rate (measured against the Fed’s preferred inflation measure, Personal Consumption Expenditures Price Index [PCE]), has been as high at 4.5% and as low as -5.5%. The average over extended cycles has been in the range of 3.4% to -1%, however during periods of high inflation (of which there have only been two in the last 30 years), it has been between 2% to 3.4%. US PCE was last close to current levels during the 2005-2007 period, in which the real policy rate averaged 2%. Therefore, given the current expected one-year policy rate, assuming a required real policy rate of 2%, suggests an expected PCE outcome of between 1.6% and 1.7%. Contrast this to current US PCE of 3.1% and market expectations of this measure only reaching 2% by end 2024, and it’s not a far stretch to conclude that current market pricing is slightly optimistic. Pricing probably needs to be pared back by around one to two rate cuts. However, this does not translate into significantly higher US bond yields. In June 2023, the market was still expecting the Fed to hike rates once or even twice more, whereas now the question is how much rates will come down versus if they will.

It is likely that some repricing of expectations will occur over the first quarter of this year, however, the global bond environment has definitely moved from being a headwind for emerging markets, as it was for most of 2023, to, at worst, being a more passive force. Short-end US treasury yields (2-year) peaked at close to 5.2% in mid-2023, a level only seen 20 years ago, and lured capital away from emerging markets. As yields continue their path lower with the realisation of Fed rate cuts, it is also likely that capital starts to flow towards the high yields of emerging markets. Emerging markets, including SA, stand to benefit from the flow of funds out of developed markets as policy rates shift lower. In SA’s case, this might provide much-needed funding for our large deficit, given the elevated levels of our bond yields.

SA ASSETS HAVE THEIR BACK TO THE WALL

Local credit markets have remained relatively subdued. Net issuance this year has been paltry, with most of it on the back of refinancing maturing bank (senior and subordinated) debt. Despite the poor fundamental backdrop in SA, credit spreads have continued to tighten this year as net supply has dwindled. Senior bank credit has compressed significantly, with the gap between 5-year and 7-year terms almost non-existent. The compression of term premiums in credit spreads indicates a market that is hungry for yield at any cost and not what one would expect in the poor economic environment. Subordinated bank credit (AT1 and AT2) has seen a similar compression, with AT2 spreads now just 30bps to 40bps above senior spreads. This compression is quite dramatic and, although banks remain well-capitalised and very far from failure, given the nature of the instruments, we feel current pricing to be too optimistic. Given their tight valuations, we consider current credit spreads unattractive and see better alternatives elsewhere. Current pricing of global interest rates and credit markets offers an attractive alternate risk-adjusted opportunity for investors, especially if one is able to capture the cross-currency interest rate differential, which enhances the yield and hence the risk buffer.

The last 18 months have seen aggressive rate-hiking campaigns across most developed and emerging markets. Inflation is easing, which should allow central banks to begin easing monetary policy. This monetary policy pivot should help support emerging markets as capital flows towards the higher yields on offer. SA, specifically, is in dire need of capital to fund its burgeoning deficits, as growth falters and inflation remains towards the upper end of targets. This reprieve will only prove temporary unless reform implementation is accelerated through increased private sector participation. For now, SA’s bond yields still provide an attractive alternative to cash given their high embedded risk premium, albeit some of this premium has reduced with the rally last quarter. We would advocate slightly overweight positions in bond portfolios, focused on maturities of less than 12 years, together with decent allocation to sub 8-year maturity ILBs.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal