Investment views

South African Bonds - The debt trap continues to beckon

Bloated merchant acquirers face disruption in the Brazilian market spac

- Policy implementation, SOEs and political manoeuvring continue to hamper recovery

- Valuation of longer-dated SAGBs offers a significant risk premium

- ILBs in the front end of the curve offer an attractive opportunity

- Listed credit valuations are still unattractive given underlying fundamentals

THE FIRST CASE of Covid-19 was detected in December 2019, but there was little to suggest how this little microbe would change human history. The world went into differing categories of lockdown to arrest the spread of the virus and allow time for the expansion of healthcare capacity. Ten months later, over 40 million people have been infected, just over a million souls have been laid to rest and the toll on the global economy is still uncertain. Many countries around the world eased lockdown measures as the levels of infection started to recede; however, there is now a rise in second waves of infection, which has heightened uncertainty.

The combination of accommodative monetary policy and fiscal stimulus, the likes of which have never been seen before, helped to soften the recessionary effects of lockdown and keep markets well buoyed. Levels of volatility will remain elevated, due to both the second wave of infections and upcoming geopolitical events (the finalisation of Brexit and the US presidential elections), which have placed big question marks on current valuations.

A PRECARIOUS POSITION

South Africa was precariously placed going into Covid-19, which meant the risk premium in local assets was already lofty. Despite South Africa’s early move into lockdown, the poor implementation of policy decisions has highlighted the country’s precarious financial situation. Risk premiums increased even further as foreign investors dumped South African assets at a ferocious pace. Local bonds were arguably the most vulnerable, since at the heart of South Africa’s problems lay large amounts of debt that needed to be serviced at double-digit yields, amidst very subdued growth.

The All Bond Index (ALBI) is up 3.6% over the last 12 months (1.5% over the last quarter), but is still running behind cash (+5.6% over the last year). This performance was due to the poor showing from bonds with a maturity of greater than seven years. Shorter dated bonds were anchored by the 300-basis point (bp) reduction in the repo rate over the last six months. Only inflation-linked bonds (ILBs) have delivered worse performance, down 2% over the last 12 months (up 1.2% over the last quarter). The total returns of South African bonds (both ILB and nominal) are even poorer when converted to US dollars (approximately -7% for the ALBI in US dollars) and compared to global bonds (6.8% World Government Bond Index return in US dollars), further emphasising how much local bonds have fallen out of favour.

South Africa’s fiscal problem is the culmination of many years of poor policy choices. On the expenditure side, the wages of government employees have enjoyed real growth of 3% per annum since 2009, while the economy has only averaged real growth of 1.2% over the same period. This has meant tax revenue has not kept pace, forcing expenditure to be reduced in other, more productive areas.

State-owned enterprises (SOEs) have further crowded out productive expenditure due to their continuous demand for government support, and Eskom remains the biggest risk to the economy. Years of mismanagement have resulted in an unsustainable debt load and unreliable energy supply that place added pressure on the fiscus and reduce the long-term growth potential of the local economy.

Covid-19 has placed a further burden on government finances, as tax revenue will drop by c.R300 billion, which will force hard decisions to be made about further expenditure cuts and other reforms. Interest service costs will skyrocket to around 25% of tax revenue over the next three years, which will place South Africa on the precipice of a debt trap.

Markets have lost faith in policymakers’ ability to right the situation. We need to see tangible steps put in place that detail how the bloated wage bill will be reduced, how Eskom will be set on a path to operational and financial stability, and how growth can be reaccelerated. Further disappointments include government’s attachment to the beleaguered South African Airways and the scale of misappropriation of government tenders during the Covid-19 crisis.

SOME RAYS OF HOPE

In the past month, there has been some good news. The National Energy Regulator of South Africa has approved a plan to tender almost 12 gigawatts of power generation capacity, predominantly from renewables, and there seems to be consensus on a plan between labour, government and business that will address some of Eskom’s problems. In addition, the Independent Communications Authority of South Africa has finally announced that high-demand spectrum will be auctioned this fiscal year, which will introduce between R8 billion and R12 billion of revenue. Another encouraging sign is that there have been some high-profile arrests on the back of the ongoing graft investigations.

South Africa faces yet another watershed budget at the end of October when Finance Minister Tito Mboweni will provide details on how he plans to enact R230 billion worth of savings over the next three years to take South Africa to a primary surplus and pull us back from the brink of a debt trap.

LOCAL BOND OUTLOOK

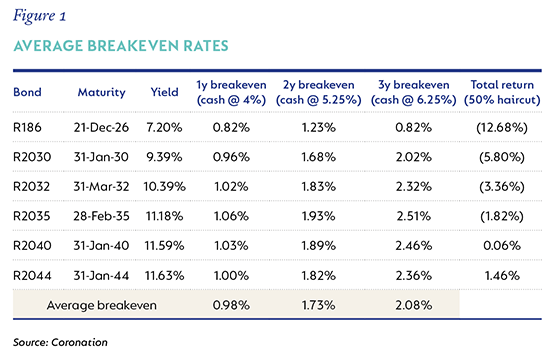

Despite the poor fundamental overhang, the valuation of South African bonds has adjusted to embed a significant risk premium. In previous publications, we have gone into detail regarding the risk premium embedded in South African government bonds (SAGBs) relative to their emerging market peers, both from a pickup relative to developed market bond yields and an implied real rate perspective. Figure 1 shows the amount bond yields can move before they break even relative to cash. At 100bps to 200bps breakeven, these are extremely attractive. In addition, bonds with a maturity of greater than 10 years offer the most value from this perspective.

In almost all cases where a country falls into a debt trap, the restructuring of debt through a haircut is the first avenue pursued, and these haircuts can vary between 15% and 60%. In the last column in the table, we take a scenario where, after four years, South African debt is haircut by 50%, and we show the total return of the various bonds, including the haircut, up until that point. Due to the higher yields and low cash prices on offer in the long end of the bond curve, once again bonds with a maturity of greater than 10 years outperform, providing further support to keeping duration allocations focused in this area of the curve.

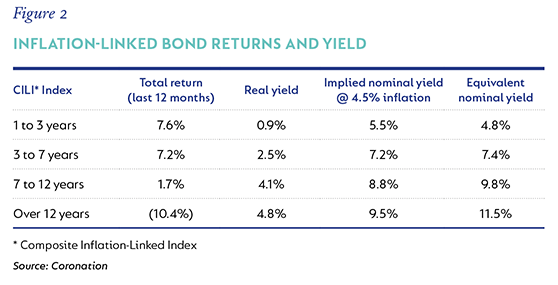

ILBs have been a poor performer as an asset class, but as with the ALBI, the ILB bond curve is weighted heavily towards longer dated bonds. As is evident in Figure 2, over the last 12 months, ILBs out to seven years have produced decent returns relative to cash, offer an attractive pickup to their nominal bond counterparts and still provide inherent protection against higher inflation. Furthermore, the one-year forward real policy rate (the difference between the repo rate and one-year forward inflation) sits at -1%, which acts as a very strong anchor for short-dated real yields. The risk, which we believe to be negligible at this point, is that the South African Reserve Bank (SARB) moves the real policy rate into a marginally positive area.

LISTED CREDIT VALUATIONS SEEM EXTENDED

The listed credit market was not spared during the Covid-19 sell-off; however, the recovery in listed credit spreads has far exceeded the quality of the underlying fundamentals. Once again, the listed corporate market is suffering from a supply/ demand imbalance and the primary credit markets have dried up for most of the issuers in the market. Since the SARB relaxed prudential capital buffer ratios for banks, they can now afford to refinance upcoming debt maturities for corporates without forcing them to go to debt capital markets. At the same time, the risk/return characteristics of other asset classes have turned less favourable, making listed credit, with its reduced return volatility, a seemingly attractive opportunity set. Unlike investing in an equity, where one can double or triple one’s initial investment, when one invests in a credit, the best one can hope for is to receive one’s coupon payments on time and one’s capital back at the end. The return profile is therefore discreet; that is, one continues to earn a steady interest rate (coupon) until maturity or default.

Even though underlying fundamentals might be deteriorating, the return of the South African corporate credit market has remained steady, predominantly due to there being large holders of individual issues, hence limiting secondary market activity and price discovery. This reduced volatility hides the underlying risk within the sector currently. In addition, the inclusion of structured products in a portfolio can also be used to reduce the volatility of returns of the underlying credit exposures due to inefficiencies in the mark-to-market process for structured products.

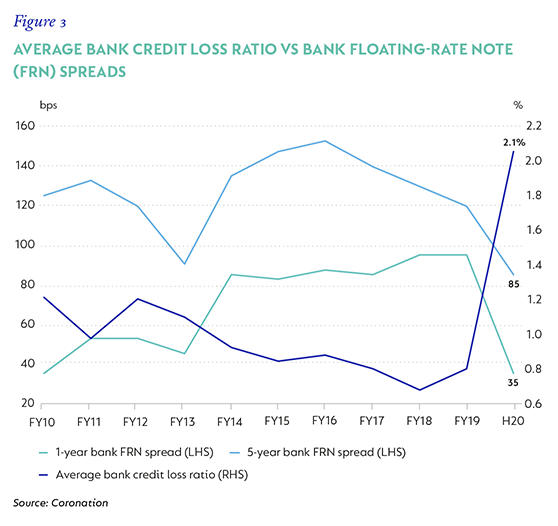

Figure 3 highlights why we believe underlying fundamentals are not being reflected in credit spreads. Bank credit loss ratios have increased dramatically following Covid-19 and are set to remain elevated for at least the next 12 to 18 months as the second-round effects of the crisis make its way through the economy. However, banks pay less for funding now than they did before the crisis or at any point during the last 10 years, despite credit loss ratios (a reflection of the condition of their lending book) being higher now than they were during the Global Financial Crisis, a situation we believe is not sustainable.

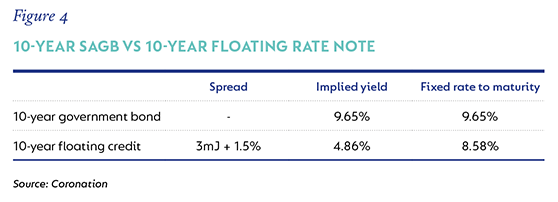

The margin of safety in the valuation of listed credit is not very encouraging either. In Figure 4 we list the yield coming off the SAGB 10-year bond, the yield on a floating credit (spread over three-month Jibar) and the equivalent fixed rate of the 10-year credit to maturity.

As is evident, government bonds offer a much more attractive yield versus the underlying credit. The credit’s fixed rate to maturity materialises at a much lower yield due to the low level of cash rates and the ability of banks to borrow money at a cheaper rate than government. As an aside, it is cheaper for the average South African to borrow money than the government, given prime is at 7%, highlighting how much risk premium is embedded in SAGB yields. Given current prevailing levels of credit spreads in the listed market and the underlying fundamentals, we believe credit to be an unattractive allocation option within a bond or multi-asset fixed income fund.

BONDS IN YOUR PORTFOLIO

In summary, South Africa is on the brink of a debt trap due to years of poor policy choices that have been exacerbated by the effects of the Covid-19 crisis. At the heart of the country’s problems lies a large debt load that is being financed at exceptionally high levels of interest and ailing SOEs, key among them Eskom.

Policy choices are moving in the right direction; however, the political will to implement appears sluggish.

However, the valuation of SAGBs does embed a significant amount of risk premium, commensurate with the underlying risk, if not more. This valuation is specifically attractive in the longer end of the bond curve due to high yields and low cash prices. ILBs in the front end of the curve (greater than seven years) offer an attractive pickup relative to their nominal counterparts with inherent inflation protection, while listed credit is unattractive given expensive valuations.

We believe bond portfolios should have a neutral to overweight position to SAGBs in the longer end of the curve, an allocation to ILBs in the short end of the curve and low (if any) allocation to listed credit.

Disclaimer

South Africa - Personal

South Africa - Personal