Personal finance

Are you positioned for the opportunity set in global fixed income?

The Quick Take

- For the past decade, the options with which South African investors were able to diversify their portfolios offshore were skewed towards funds with growth asset exposure

- This was due to the unpalatably low yields available from global income-producing assets as a result of the lengthy period of zero or negative interest rates

- However, in 2022, we saw a dramatic resetting of interest rates, with nearly every segment of global fixed income markets selling off

- This has created an opportunity set that we believe investors should be positioning their portfolios for

South African investors understand the benefits of investing offshore. But for nearly a decade, the opportunity set with which to achieve global diversification within your overall portfolio was skewed in favour of funds that offered growth asset exposure. This was given the unpalatably low yields available on global fixed income assets.

With all of this having changed in 2022, and an opportunity set being created in global fixed income markets, here’s how we believe investors and fund allocators should be thinking about stepping up their allocation to global fixed income.

DIVERSIFYING INTO GLOBAL FIXED INCOME ON INVESTORS’ BEHALF

For many years our global multi-asset class portfolios (where we implement asset class views on behalf of investors) have maintained conservative allocations to global fixed income assets. This was informed by our view that developed market government bonds offered no value and that fixed income markets presented little in the way of return, while assuming a significant degree of risk. However, in the final quarter of 2022, our Coronation Global Capital Plus and Coronation Global Managed funds moved away from their conservative global fixed income allocations and started putting more capital to work, specifically in global investment-grade credit and global inflation-linked bond (ILB) positions, as the return potential started to increase.

AN ATTRACTIVE ALTERNATIVE TO TRADITIONAL GLOBAL FIXED INCOME BUILDING BLOCKS

Investors or fund selectors who are conducting their own asset allocation have typically been faced with choosing between single-asset class global bond or global cash funds. However, with this opportunity to step up allocations to global fixed income as yields have become more attractive, investors or allocators could do well to consider an actively managed global multi-asset class fixed income fund such as Coronation Global Strategic USD Income.

The Fund, which celebrates its 10-year track record later this year, aims to be an intelligent alternative to US dollar bank deposits. As at end March 2023, it offered an attractive yield of 5.7% (after fees for the retail class of this fund), which is ahead of USD (overnight cash). Furthermore, when compared to instruments that offer an equivalent yield, the fund’s risk profile is lower.

High-quality, shorter-dated debt exposure

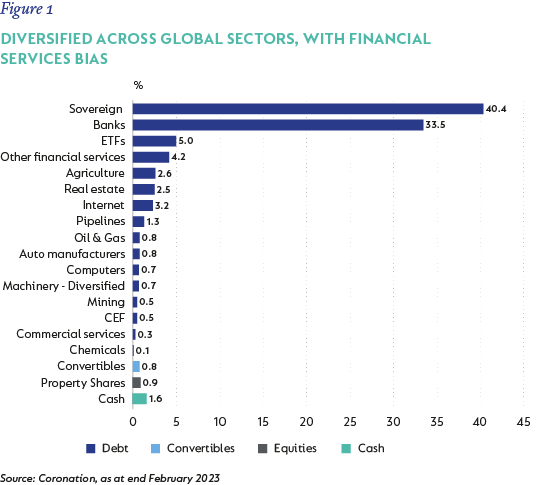

These attributes are possible thanks to the Fund’s diversified exposure across the global sectors (see table below). Today, over 70% of the portfolio is allocated to high-quality investment grade instruments. Its largest exposure is to financials, mostly senior paper, and focused on franchise leaders within regions or globally. Its allocation to property remains conservative in relation to the Fund’s risk budget, with duration of less than a year.

The diversified nature of the portfolio also proved its mettle in 2022, when during the worst year on record for global bonds (down 16% for the 12-month period in USD as measured by the Bloomberg Barclays Global Aggregate Bond [BBGBA] Index), the Fund return was -1.2%. Similarly, over three years to end-2022, while the BBGBA Index was down 4.5%, Global Strategic Income USD’s return was flat (also in USD after fees).

A UNIQUE SOLUTION FOR SOUTH AFRICAN INVESTORS

Having operated in a world of very low to negative interest rates for most of its lifespan, means that Coronation Global Strategic USD Income’s modest yield of 1.5% - 2% would have been unappealing to most fund selectors or investors doing their own asset allocation.

However, given South African investor’s preference for multi-asset portfolios and the shift in relative attractiveness of global fixed income assets in 2022, we believe a greater allocation to fixed income assets through a portfolio such as Coronation Global Strategic USD Income is warranted.

*The Coronation Global Strategic USD Income Fund was named Best (FSB-Approved) Global Fixed Interest Fund at the 2023 Raging Bulls Awards ceremony held on 28 February 2023. The full details and basis of the award are available on request.

Disclaimers

SA retail readers

South Africa - Personal

South Africa - Personal