Personal finance

Long-term investing

How to invest towards your long-term goals in a tax-efficient manner

Overview

People invest for the long term for different reasons. With the benefit of time on your side, you get to invest in funds that are managed to deliver maximum capital growth. And you might as well, do so in a product that enables you to invest tax-efficiently.

The impact of compounding maximum capital growth tax-efficiently is significant. This edition illustrates how pairing the most appropriate growth-oriented multi-asset class fund with a suitable tax-efficient product can help you to achieve just that.

WHY DO YOU INVEST FOR THE LONG TERM?

The most likely (and significant) reason why people invest for the long term is to build up capital for their retirement in what could be multiple decades from now.

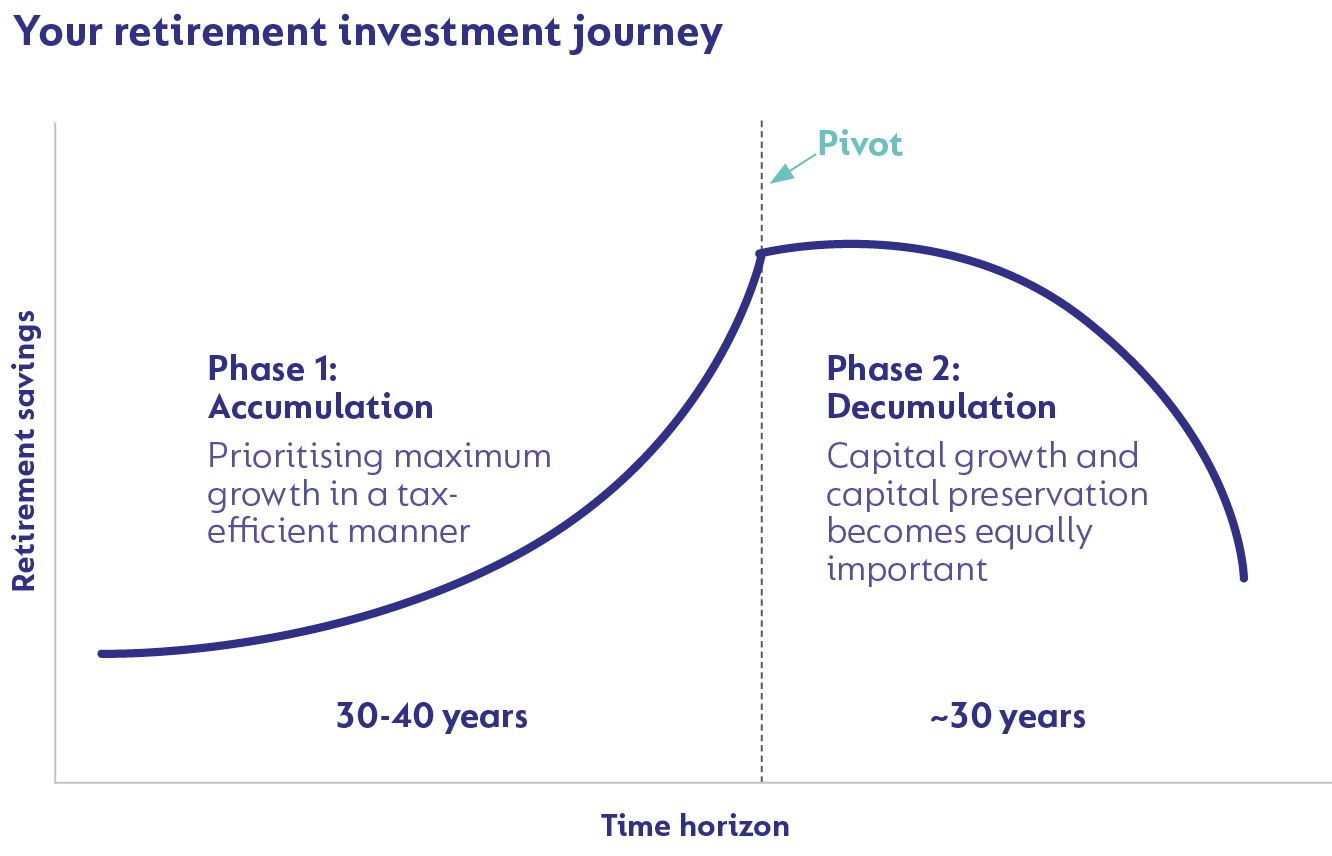

Read more about the second phase of your retirement journey in Corolab: Investing for income and growth.

Those who are fortunate enough to have access to discretionary savings (in other words, savings in excess of what you are already committing to your retirement pot) may be investing for an additional long-term goal, such as a child’s education or towards having greater financial freedom later in life.

Whatever significant long-term goal you aim to invest towards, it is worth remembering that you can achieve maximum capital growth in a tax-efficient manner.

In this quest for tax-efficient investing, your options include retirement annuities (RAs), tax-free investments (TFIs) and, for higher income individuals, endowments.

While each of these products fulfils a different function in an investor’s overall portfolio (it’s not a case of one being better than the other), this Corolab focuses on the most suitable combination of underlying investment fund and product with which to invest for your retirement or another discretionary long-term goal.

Investing for retirement by way of a retirement annuity (RA)

Saving towards retirement could take up most of your working life (30-40 years). If you stay the course and invest sufficiently in a fund with a strong track record of delivering inflation-beating returns, history tells us that few risks could derail this long-term goal. The only additional outcome that you need to concern yourself with is achieving maximum capital growth tax-efficiently as you build your nest egg during this accumulation phase of your retirement journey.

ACHIEVING TAX EFFICIENCY WITH AN RA

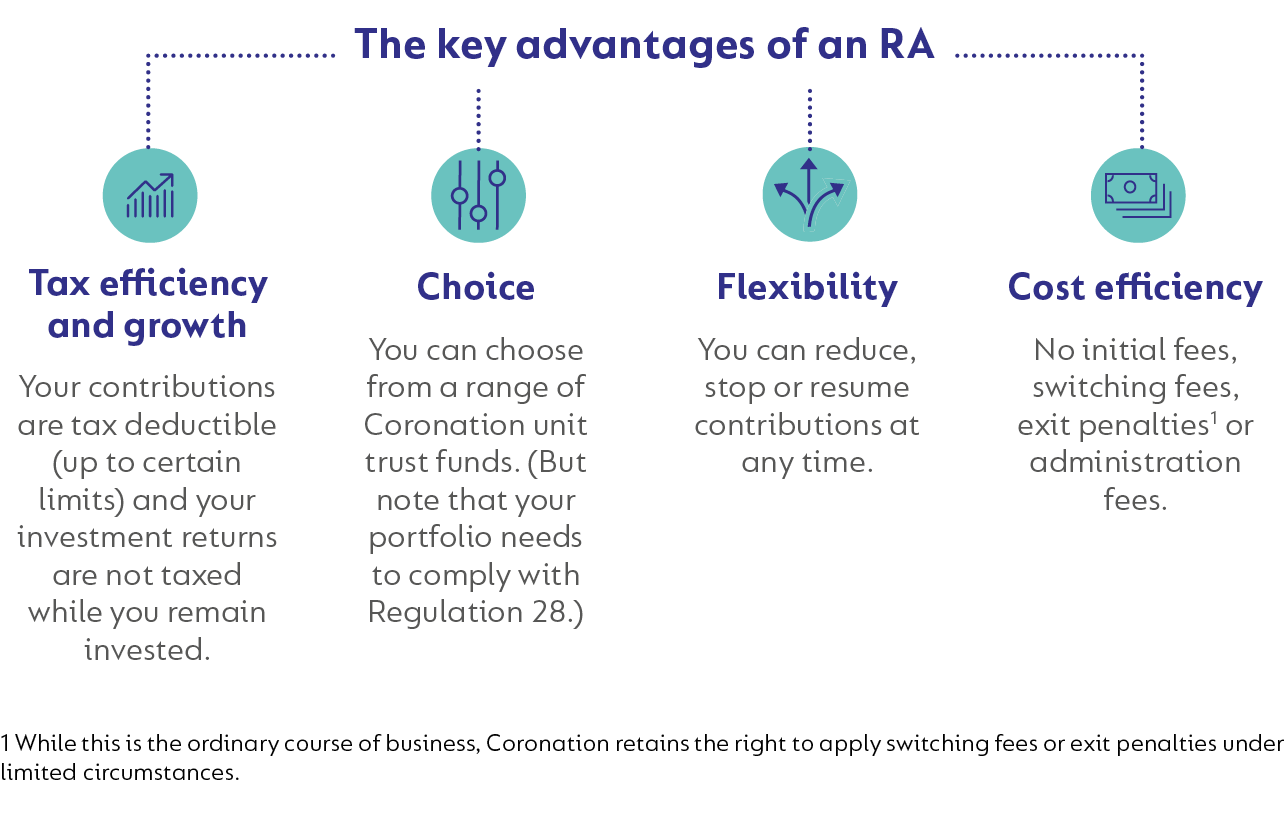

The Coronation Retirement Annuity Fund is a personal retirement plan that enables you to save tax-efficiently for retirement and is an ideal vehicle for allocating a portion of your non-retirement funding income to.

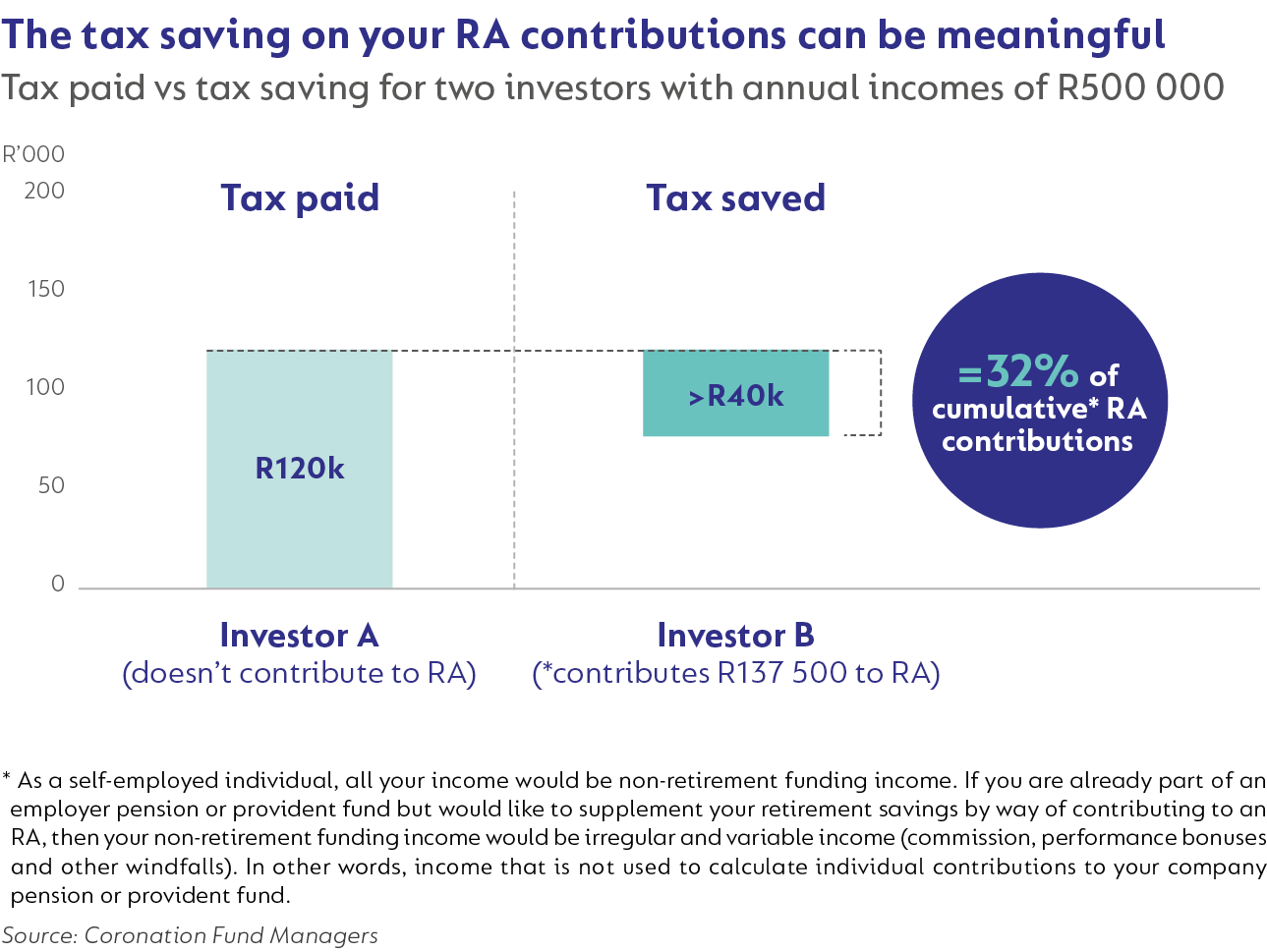

The following example best illustrates the tax saving enabled by contributing towards an RA. Investor A earns non-retirement funding income* of R500 000 a year but doesn’t contribute to an RA. As a result, Investor A pays roughly R120 000 in tax on that amount of income. Investor B earns the same amount of non-retirement funding income a year but contributes 27.5% (or R137 500) to an RA. Because Investor B’s contributions are tax deductible (up to certain limits), this results in a tax saving of more than R40 000 – essentially discounting his annual retirement contributions by a third.

MAXIMISING CAPITAL GROWTH WITH CORONATION BALANCED PLUS

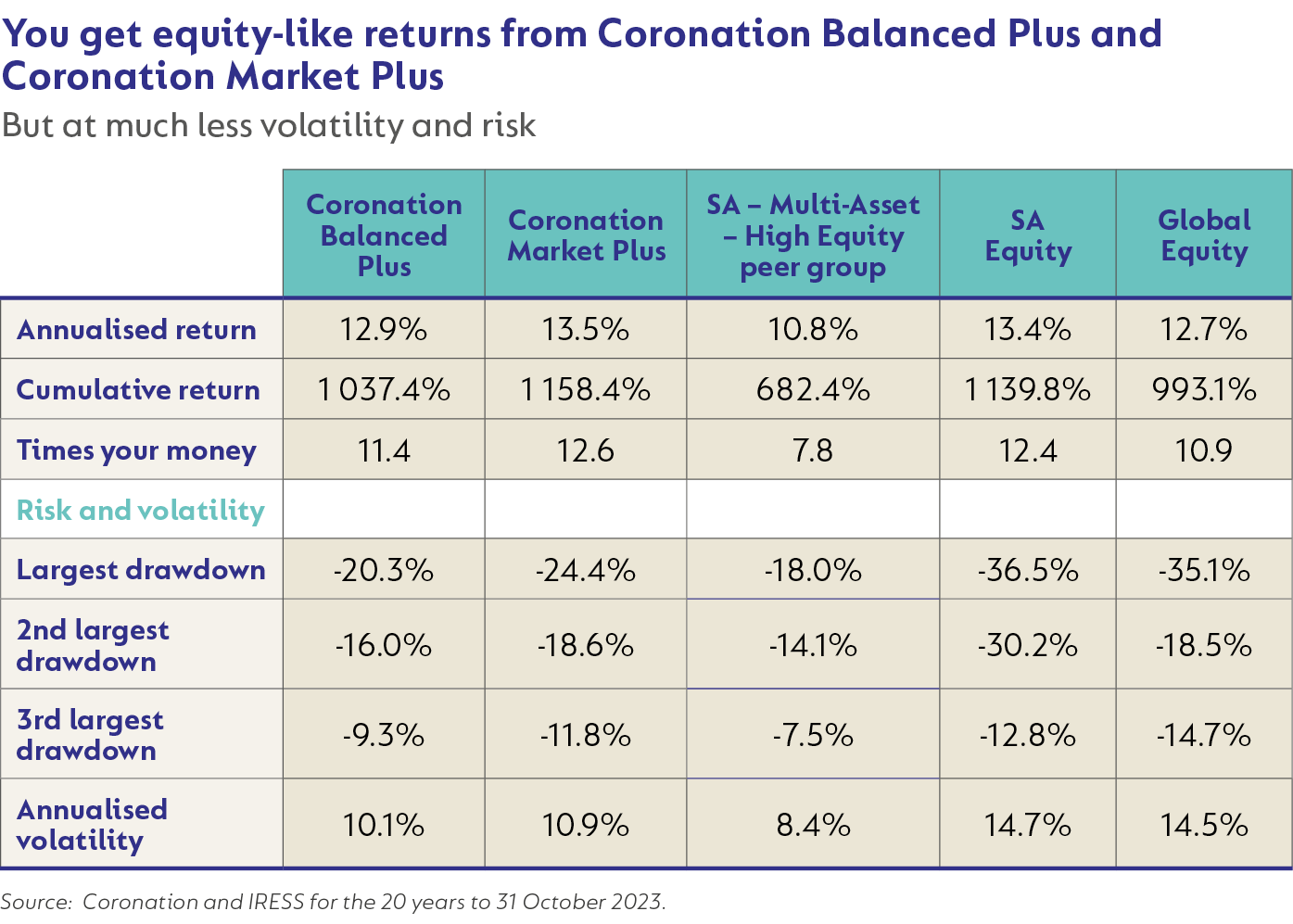

If you are saving for retirement in the Coronation Retirement Annuity, we believe that Coronation Balanced Plus, our flagship pre-retirement fund, is the most suitable option from which investors’ retirement savings stand to benefit. This is because the fund offers investors the highest exposure to growth assets and offshore exposure within Regulation 28 limits, allowing investors to maximise capital growth.

THE BENEFIT OF PRESERVATION

Coronation Balanced Plus is also a suitable option for those changing jobs and wanting to preserve the tax benefits of contributions made to a previous employer’s pension or provident fund by way of the Coronation Preservation Pension Fund or Coronation Preservation Provident Fund.

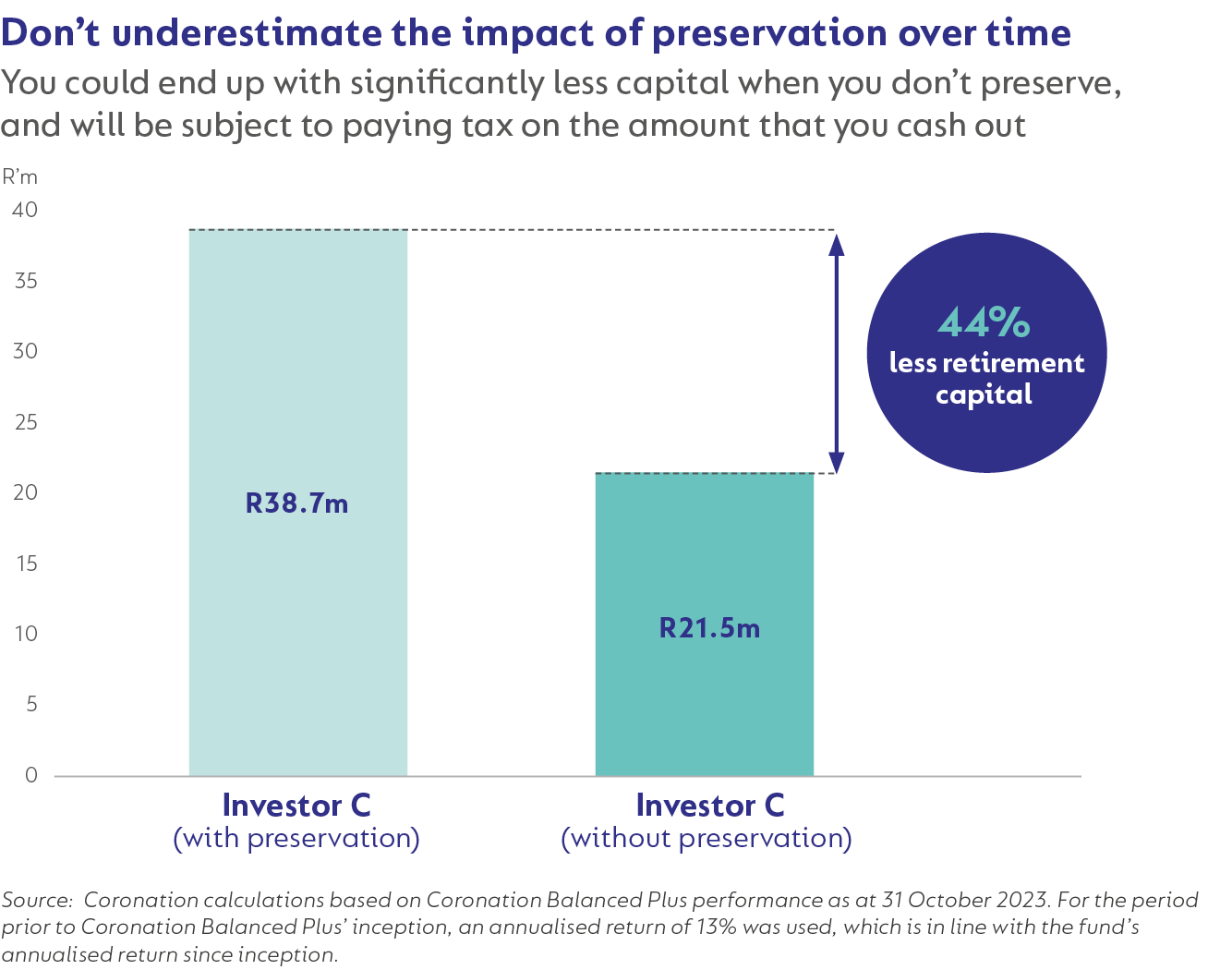

To demonstrate the value of preserving your retirement contributions versus cashing out to meet a short-term need, consider the following simple example. Investor C earned a pensionable salary of R100 000 a year (adjusted for inflation annually) over 40 years and contributed 12% to her company pension plan that invested in Coronation Balanced Plus. After ten years of working full-time, Investor C left her job to move to another company, where she continued working for another 30 years until retirement. Here, too, her salary is adjusted annually to account for inflation. Upon resignation, she preserved her accumulated savings in a preservation provident fund, with Coronation Balanced Plus, as her underlying fund choice, she continued to contribute 12% to her company pension fund that invested in Coronation Balanced Plus. Had she not preserved her accumulated savings at the point of changing jobs, her total retirement savings would have been 44% less today, as per the visual below.

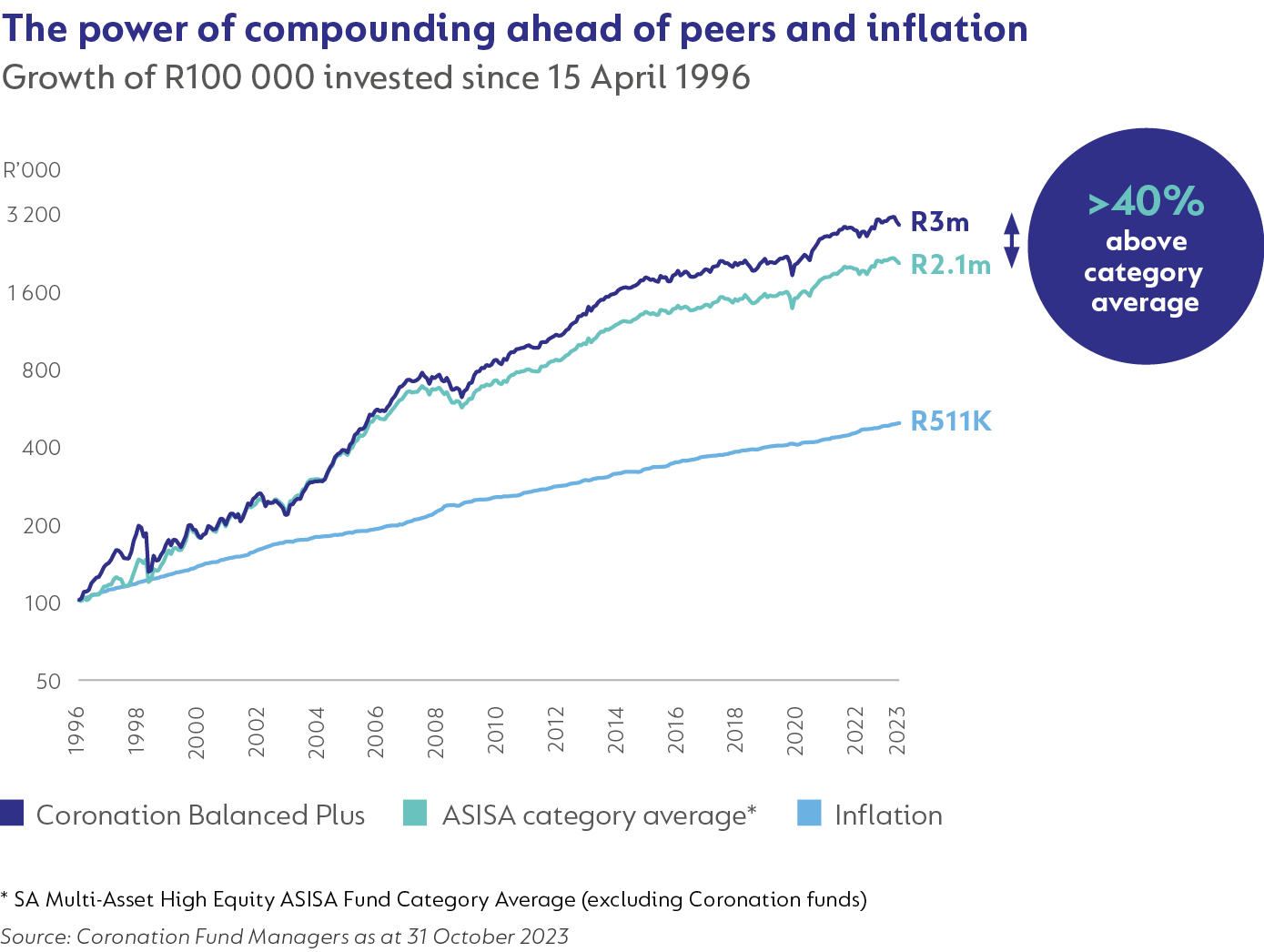

Coronation Balanced Plus has a 27-year track record of beating inflation by more than 5% per annum and its benchmark (ASISA category average) by 1.5% per year over this multi-decade period. It also managed to outperform the local equity market with significantly less exposure to equities. This level of outperformance compounded over time, it can add significantly to your investment outcome. If you consider the added benefits of tax-deductible contributions and the fact that your investment returns are not taxed while you remain invested, the outcome becomes even greater. As is clear from the graph below, an investment in the average high equity balanced fund more than 27 years ago would have grown your capital by 21 times (in nominal terms) as at the end October 2023, whereas a similar investment in the Coronation Balanced Plus Fund, which has outperformed the category average by 1.5% p.a. after fees (a seemingly small number), would have grown your capital by close to 31 times over this same period.

Investing for a long-term goal with discretionary savings

If you are investing for a long-term goal with discretionary savings, your options with which to achieve maximum capital growth are wide. Depending on the purpose of your investment, your investment fund doesn’t need to comply with Regulation 28 and could include anything from a domestic equity-only fund (such as Coronation Equity or Coronation Top 20) or a global fund available to South African investors. (Read more about our range of global funds in Corolab: Corolab - Investing Offshore).

ACHIEVING TAX EFFICIENCY WITH A TFI

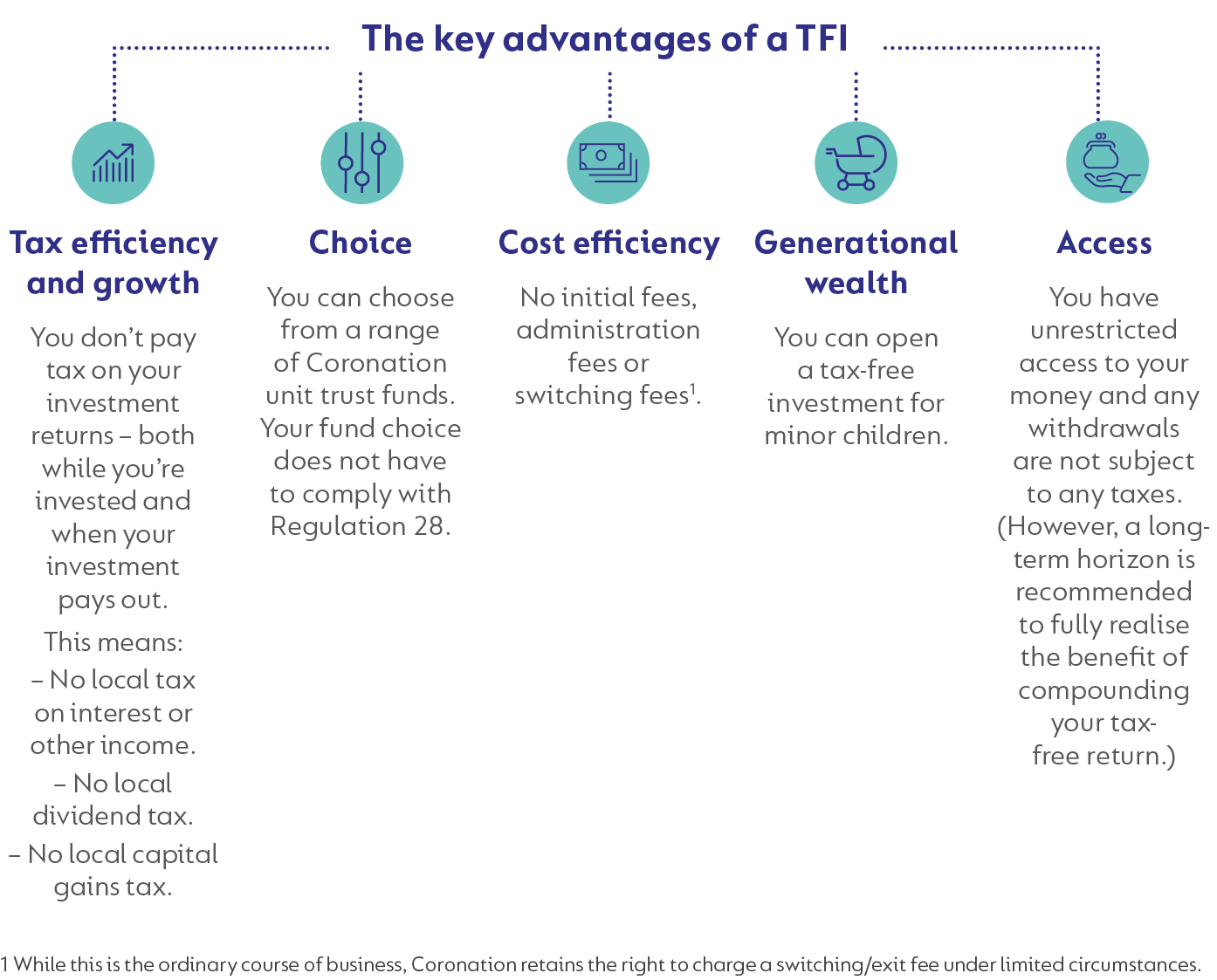

If you want to make your discretionary long-term investment work a little harder, you could consider housing your chosen underlying investment fund in a tax-free investment (TFI), such as the Coronation Tax-Free Investment.

When you invest in a TFI, you don’t pay local tax on your investment returns – both while you’re invested and when your investment pays out. The taxes you save remain invested to grow, which can make a significant difference over the long term.

MAXIMISING CAPITAL GROWTH WITH CORONATION MARKET PLUS

Unlike retirement funds, TFIs are not bound by Regulation 28. As a result, you are free to invest in a fund that can express views beyond those constraints – and rightly expect such a solution to outperform a traditional balanced fund. If managed well, such a fund can even provide a return close to, or in line with, the market. However, taking on reasonable levels of risk and the added benefit of diversification results in a less volatile experience than a pure equity fund. This attribute helps investors to stay the course.

Since its inception in 2001, Coronation Market Plus has met the needs of somewhat aggressive investors aiming to build long-term capital outside their retirement portfolios. With the ability to invest more than 75% in equities (the regulatory limit under Regulation 28), Coronation Market Plus has delivered an annualised return of 13.9% since inception, well ahead of its inflation plus 5% target and the average balanced fund return of 10.7%. What is particularly pleasing is that, over this period, despite never being fully invested in equities, Coronation Market Plus has also managed to outperform the JSE All Share Index’s performance of 13%. With an objective to grow real capital over time, the fund delivered an annualised real return of 7.7% p.a. (All performance figures quoted are as at 31 October 2023.)

THE BENEFITS OF STAYING THE COURSE

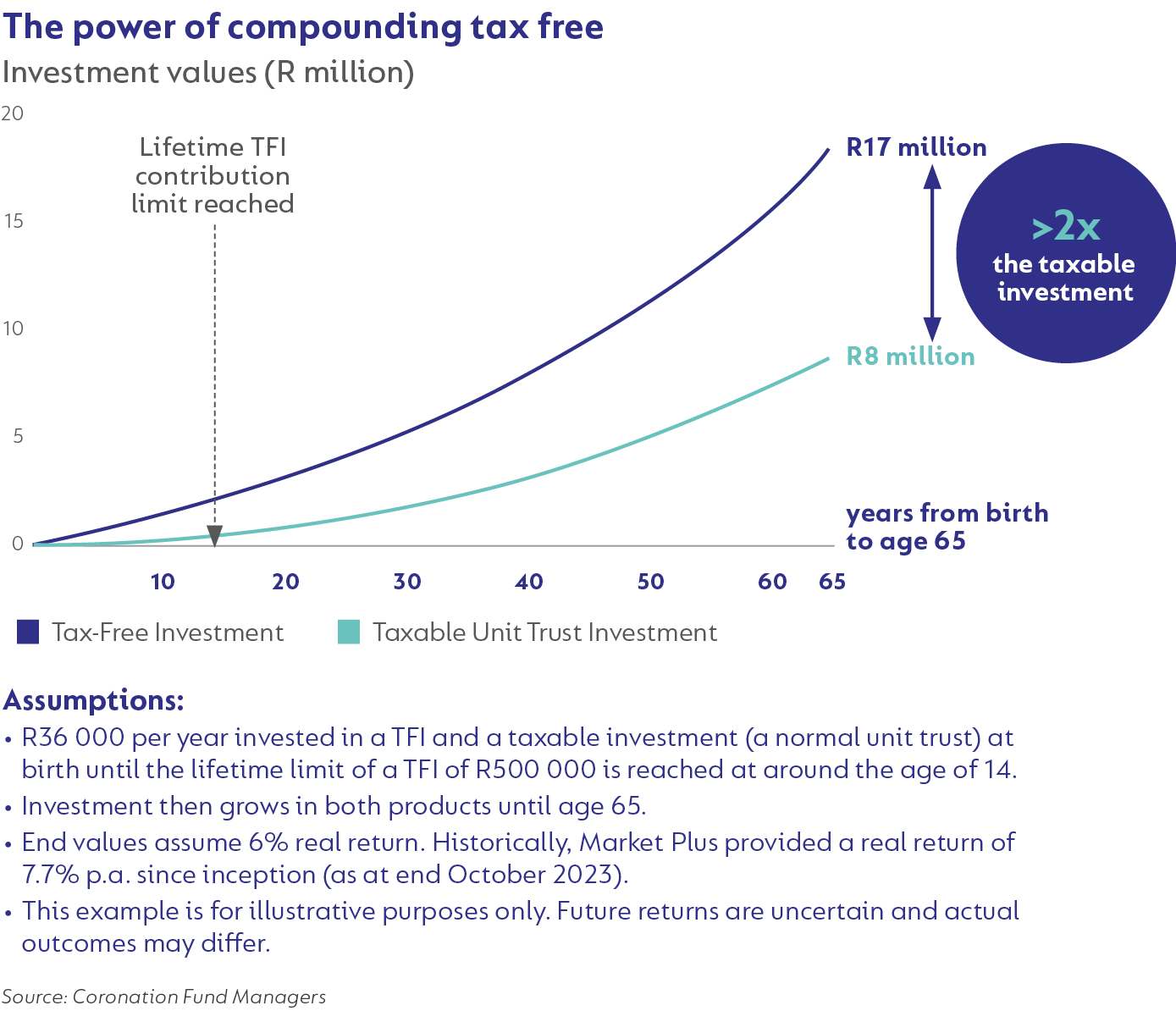

The following illustrative example highlights the long-term benefits of staying the course in a fund such as Coronation Market Plus. Imagine that you invest the maximum annual amount (R36 000) in a tax-free investment for your child from birth. If you continue doing so, you will reach the lifetime limit of R500 000 before your child turns 14. The longer you decide to keep the money invested, the more the benefits of compounding and the greater the extent to which your tax-free fund outperforms the same taxable fund.

Our analysis, based on certain assumptions, shows that if you keep the money in the fund until your child turns 18, the value of the tax-free investment will be 22% greater than the equivalent taxable investment. By age 30, this difference widens to 42% and by age 65, the investment would be double the value of the same taxable investment.

These results show that by resisting the temptation to disinvest from the fund, the nest egg is built up would keep your child in good stead by either financing tertiary education, buying a first home or ideally investing in their retirement, depending on when your child decides to disinvest. This theoretical exercise also shows the incredible power of compounding over long periods. Investing R500 000 spread out over 14 years and then doing nothing for 41 years results in an investment worth R17 million in today’s money by the age of 65. That is enough to fund a retirement income for life of more than R80 000 a month, again in today’s money. Our hypothetical (very patient) tax-free investment beneficiary would, therefore, never have to contribute to retirement while working, effectively freeing up 10% to 15% of annual income that would typically have been required to fund retirement income if you start contributing in your early 20s.

MAXIMISING CAPITAL GROWTH IN INTERNATIONAL MARKETS

Investors seeking to utilise their discretionary savings in a fund that predominantly invests in offshore asset classes, can consider one of Coronation’s global long-term growth-oriented multi-asset funds. The Coronation Global Optimum Growth Fund is an aggressive allocation fund suited to investors with a very long time horizon (10 years plus).

A HIGHER-INCOME OPTION

High-income individuals who have already hit the investment ceiling in their TFI should consider an endowment as another tax-efficient investment option.

The appeal of endowments lies in the flat tax rates that apply to income and capital gains. Income is taxed at 30% (compared with a marginal individual tax rate that can be as high as 45%), while capital gains are taxed at 12% (compared with an effective rate of 18% for individuals in the highest income tax bracket). Investors’ underlying fund options are not restricted by any regulation. As such, you can choose to invest in any of our long-term growth-oriented funds.

All roads lead to multi-asset funds

Long-term investors, especially those who are investing with discretionary savings, could consider funds that are fully invested in equities – the asset class that provides the highest expected return over time.

However, being fully invested in equities (domestic or global equities, or a combination of both) comes with higher short-term volatility. While the longer you remain invested in equities, the lower this variability becomes, most investors may prefer a less volatile experience that allows them to stay the course.

ACHIEVING A SMOOTHER RETURN PATH THROUGH DIVERSIFICATION AND ACTIVE ASSET ALLOCATION

Both Coronation Balanced Plus and Coronation Market Plus have strong asset allocation track records. By making considered yet decisive asset allocation decisions, informed by our proprietary long-term work, these funds have enhanced the long-term savings of their investors through the various changing market and regulatory environments without exposing their investors to the volatility inherent in a pure equity fund.

EASIER SAID THAN DONE

However, asset allocation across all geographies and asset classes through the cycle is a capability that very few managers have. This is because it requires an integrated approach that is anchored in a granular understanding of every single security’s risk and return dynamics and then to construct and manage a portfolio based on that deep knowledge and ongoing monitoring.

Good asset allocation also requires active decision-making, as has been required in response to the many unimaginable events of the last 15 years (including 9/11, the Global Financial Crisis, negative interest rates, the Covid pandemic, Russia’s invasion of Ukraine, etc). As we are likely to see more of these events in the fractious world, we are living in, investors need to consider investing with good asset allocators with a demonstrable track record in taking bold and decisive action when it is required.

ADDING ANOTHER LAYER OF TAX EFFICIENCY

Choosing to house your long-term investment in a multi-asset fund has the added benefit that active asset allocation adjustments are made on your behalf within the fund and, as such, do not trigger a capital gains event (as would be the case with a DIY portfolio).

Within a multi-asset fund, the managers can buy or sell underlying assets without showing an actual gain or loss for the investors, which would be subject to capital gains tax (CGT) in the hands of an individual. CGT is, therefore, deferred until you decide to divest.

Conclusion

The conclusion is as simple as it is compelling: Invest for your long-term goals in funds managed by good asset allocators with solid track records in delivering inflation-beating returns over long periods.

When you pair these track records with a tax-efficient product, the power of compounding will most likely do extraordinary things for you. Choosing a multi-asset fund such as Coronation Balanced Plus (for savers who need to adhere to retirement limits within the context of an RA) or Coronation Market Plus (for discretionary savers who can seek more flexibility in terms of equity exposure than a Regulation 28-compliant fund) are most likely to help you achieve the best outcomes while enabling you to stay the course.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal