Business & Industry views

Notes from my inbox

"Investing for the long term requires patience and dedication, but the rewards are worth the wait." – Quote by generative artificial intelligence engine GPT-3

Artificial intelligence (AI) assistant ChatGPT took the world by storm since public launch late last year. It is an example of generative AI, which is a technology that can adaptively solve new problems and may drastically change the way we approach content generation, whether it is text, images, audio, video, or code. Recently, the news broke that Microsoft is in talks to make an additional $10 billion investment into OpenAI, the company behind ChatGPT, with the likely intention to integrate this technology in its product suite. A lot of commentators are therefore concluding that the moment of mass-adoption of generative AI is upon us.

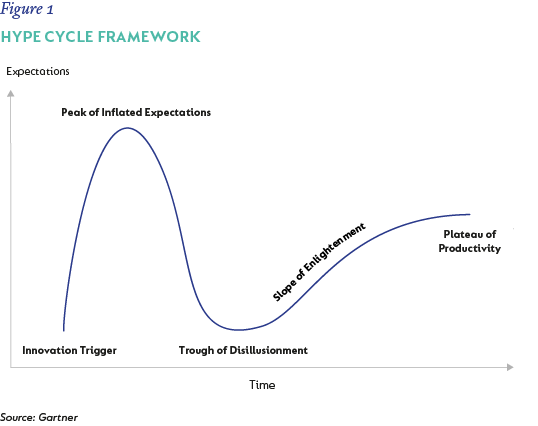

New technology always promises game-changing opportunities and exciting use cases. Research and consulting firm Gartner provides a way to assess the claims made by the proponents of innovation through its hype cycle framework (see Figure 1). This provides a useful reminder to separate the blue sky from reality. Autonomous vehicles are an example of a technology that significantly undershot initial expectations. In the early 2010s, promotors such as Google’s Sergei Brin and Tesla’s Elon Musk predicted that self-driving cars would be generally available before the end of the decade. In 2022, Gartner forecasted that we are still more than a decade away from achieving this goal.

Now, in early 2023, generative AI has clearly already reached its moment in the “Peak of Inflated Expectations” phase. This nascent technology still needs to overcome some serious challenges, which include copyright issues (the lawsuits brought by artists and image owners whose property is used to train the image-generating equivalents of ChatGPT have already started) and the lack of validation of output (responses may not be factually correct, which may lead to over-attribution errors and even more misinformation spread via social and other media). As the issues continue to emerge, the “Trough of Disillusionment” beckons.

This does not mean that the technology won’t become valuable in future. Take the example of computer vision (the ability for machines to see and understand visual information), which is now well advanced up the “Slope of Enlightenment”, with IBM estimating the market size at around $50 billion in 2022. It took some time to get there though. Intelligent machine vision became theoretically possible with the invention of optical character recognition in 1974, followed eventually by the first real-time face recognition applications in the early 2000s.

Long-time readers of Inbox will recognise that the hype cycle is just a variation of the more general cycle of expectations applicable to all investors. A year ago, the consensus was bullish, with the expectation that economies would recover strongly courtesy of post-Covid pent-up demand and that inflation would quickly be brought under control as supply chain bottlenecks were unclogged. What followed was a disastrous year of stubborn inflation, steep monetary tightening and deteriorating geopolitics, resulting in poor returns from growth and income assets. At the start of 2023, the mood is much more circumspect, yet growth asset valuations are low enough to make it much more likely that investors will achieve above-average returns over the next several years. While we know that it is rational to look forward when thinking about return prospects, it is difficult to overcome the way we feel in the present moment – whether it is the excitement and promise of something new that fuels optimism, or the urge to rather contemplate the scars we picked up in the most recent market crisis that fuels pessimism.

LATEST INSIGHTS

In this edition, economist Marie Antelme looks at the nature of 2022’s polycrisis and how it will continue to play out in 2023. Head of Fixed Income Nishan Maharaj points out that it is the Chinese Year of the Water Rabbit, signalling optimism and hope, and while the world is not out of the woods, there are some glimmers of light. As you can read in the fund commentaries for our multi-asset funds, we have used the decline in asset prices last year to increase exposure to global equity, as selected shares are now attractively priced despite the risks.

A recent addition to the global emerging markets investable universe is Saudi Arabia. Portfolio manager Suhail Suleman took a maiden trip to Riyadh, and found that outperforming Saudi is reforming for aggressive growth. Looking locally, portfolio manager Alistair Lea examines the attraction of the SA small cap universe, showing how, perhaps unexpectedly, it kept pace with globally exposed large cap powerhouses over the past decade.

And because the start of a new year invites us to take stock and develop healthier habits, read about the benefits of tax-free investing. If you aren’t already benefiting from a tax-free investment account, open one today.

As always, I invite you to contact us via clientservice@coronation.com if we have failed to live up to your expectations in any way.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal